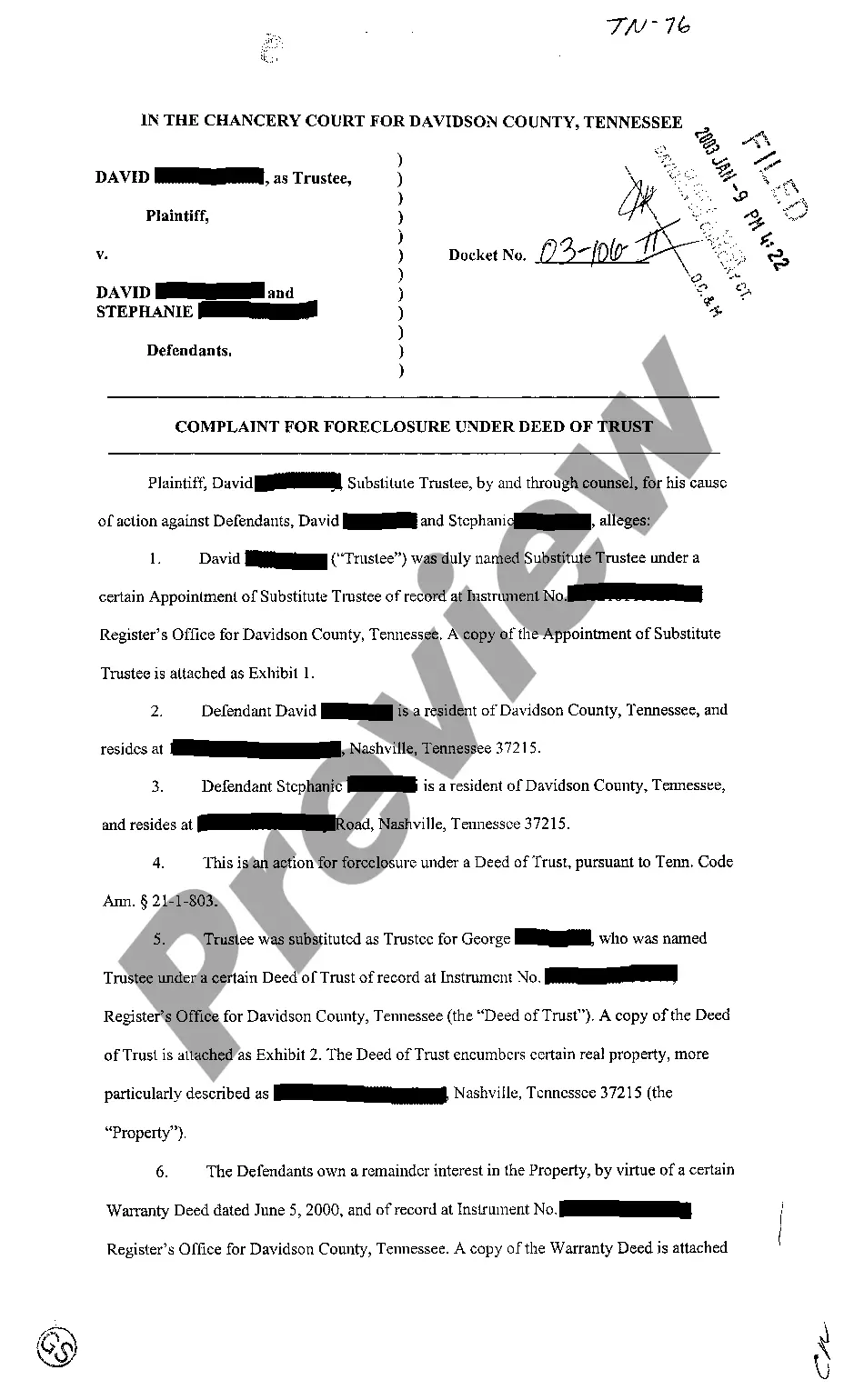

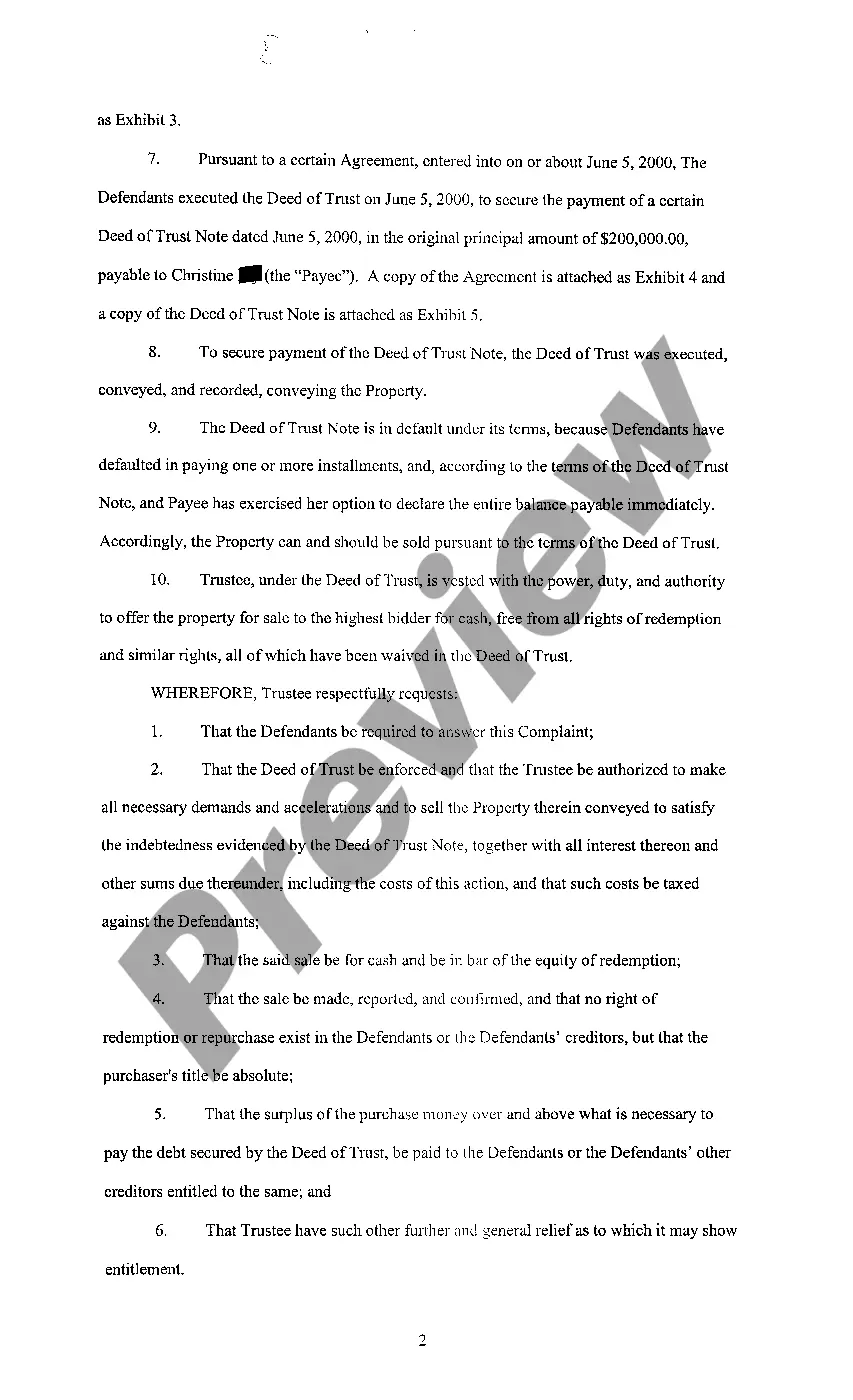

Tennessee Complaint For Foreclosure Under Deed of Trust

Description

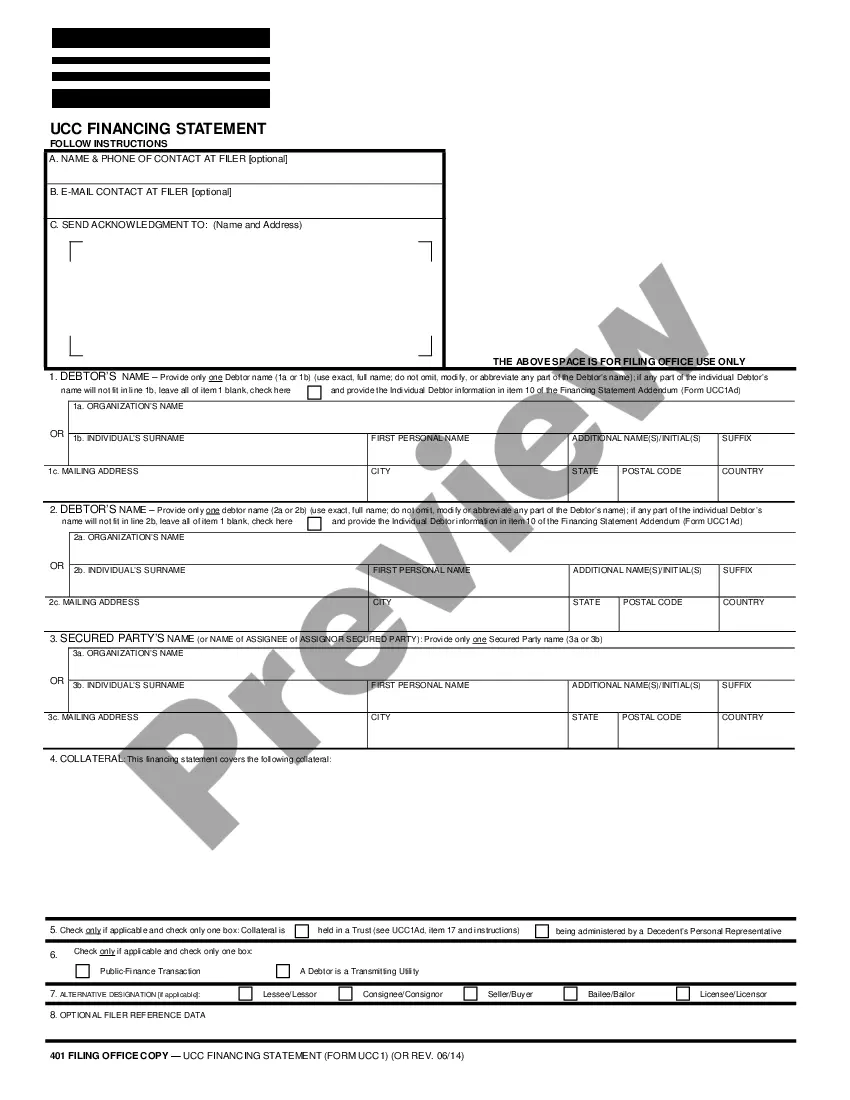

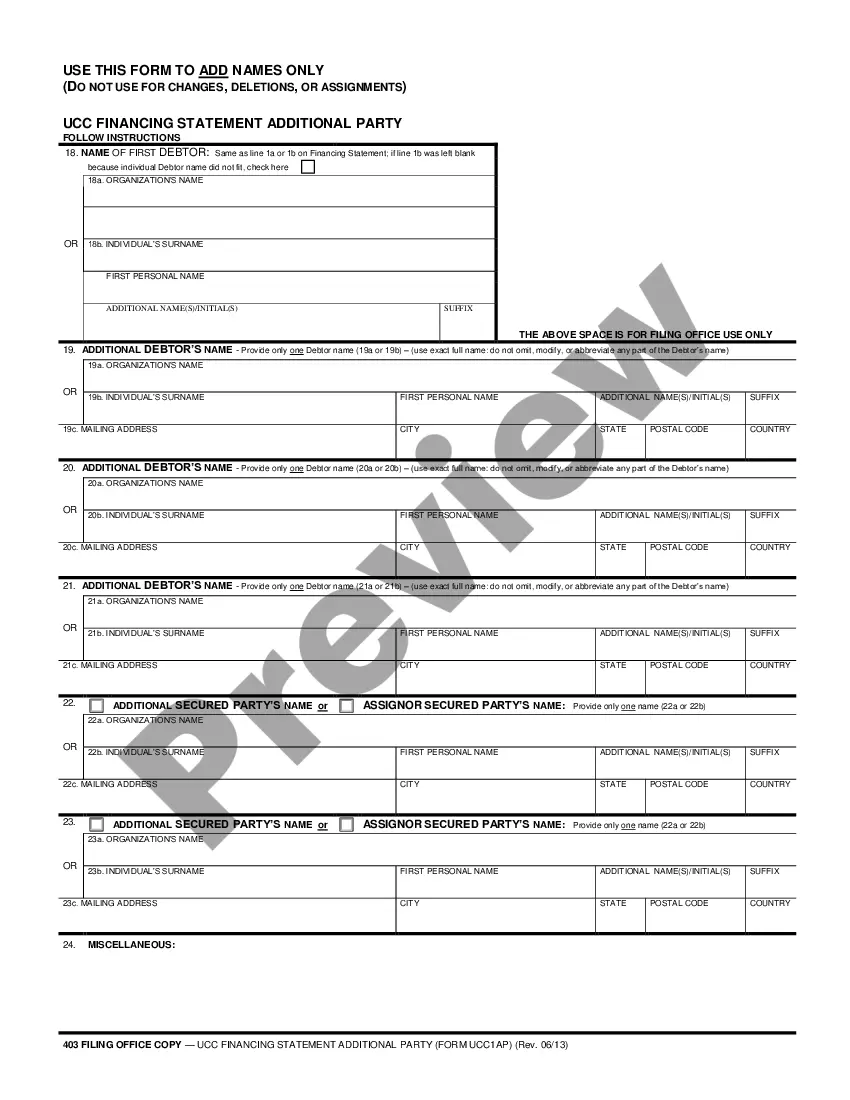

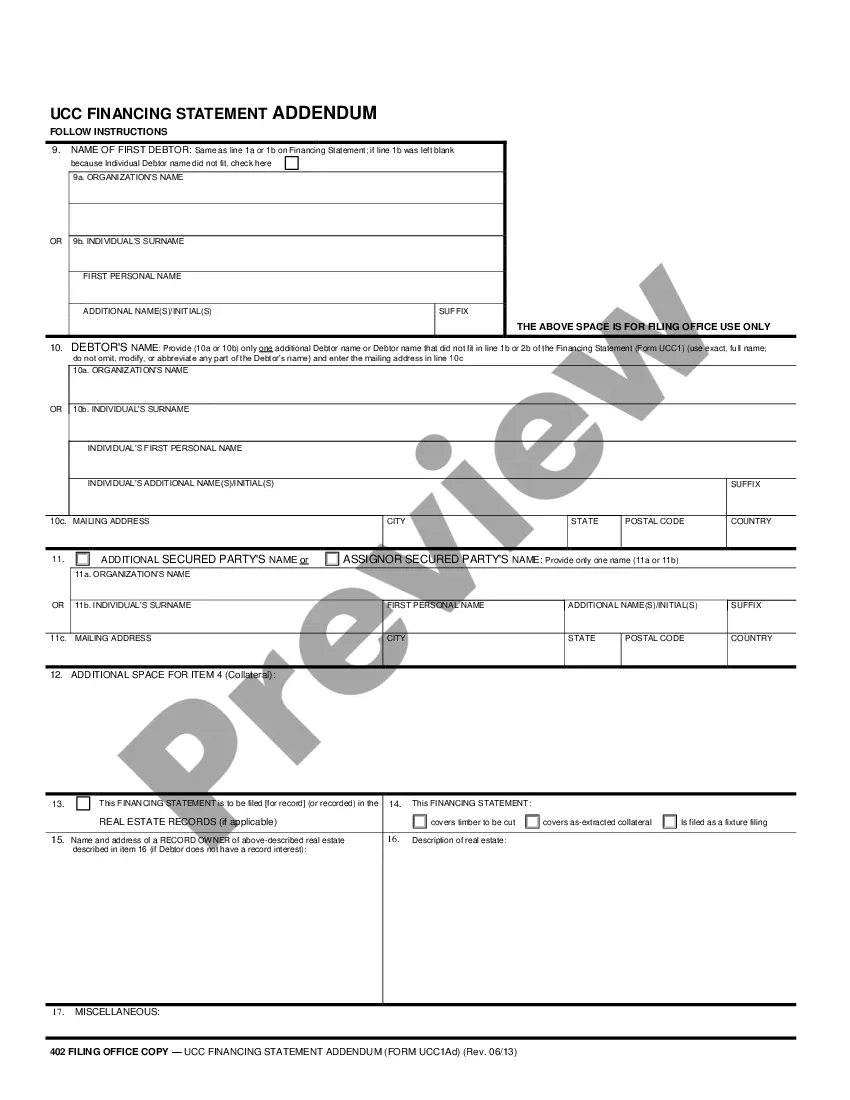

How to fill out Tennessee Complaint For Foreclosure Under Deed Of Trust?

Access to high quality Tennessee Complaint For Foreclosure Under Deed of Trust forms online with US Legal Forms. Steer clear of days of wasted time browsing the internet and lost money on forms that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Get over 85,000 state-specific legal and tax forms you can save and submit in clicks within the Forms library.

To receive the example, log in to your account and click on Download button. The file will be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, take a look at our how-guide listed below to make getting started simpler:

- Verify that the Tennessee Complaint For Foreclosure Under Deed of Trust you’re considering is appropriate for your state.

- View the form utilizing the Preview option and read its description.

- Check out the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay by credit card or PayPal to finish creating an account.

- Select a preferred file format to download the document (.pdf or .docx).

You can now open up the Tennessee Complaint For Foreclosure Under Deed of Trust example and fill it out online or print it and do it by hand. Consider sending the file to your legal counsel to make certain things are filled out properly. If you make a error, print out and fill sample again (once you’ve made an account every document you save is reusable). Make your US Legal Forms account now and access a lot more templates.

Form popularity

FAQ

When a deed of trust is foreclosed by court sale, the action: Would allow the trustor a redemption period; A trustee has legally begun the process to sell property secured by a trust deed.

Step 1 Notice of Default. Record a Notice of Default with the county recorder. Step 2 Notice of Sale. If the borrower does not pay the balance stated in the Notice of Default within the deadline, the lender can go ahead with recording a Notice of Sale. Step 3 Auction. Step 4 Obtain Possession of Property.

When you have a deed of trust, the bank can foreclose on your home without going to court.The process that the bank must go through to take your house back is generally called foreclosure.

Proving Wrongful Foreclosure If you wish to sue the bank for wrongful foreclosure, you must prove the following: The lender owed you, the borrower, a legal duty. The lender breached that duty. The breach of duty caused your injury or loss (damages)

When a mortgage is the security instrument, the lender usually has to go through a court action to foreclose. This is called a judicial foreclosure. Unlike a mortgage, a trust deed (aka deed of trust) involves three parties the borrower (trustor), the lender (beneficiary), and the trustee.

A Trustee's Deed Upon Sale, also known as a Trustee's Deed Under Sale or a Trustee's Deed is a deed of foreclosure. This deed is prepared after a property's foreclosure sale and recorded in the county were the property is located.The property may be in default on taxes, have mechanic's liens and/or other encumbrances.

If the borrower defaults on the loan, the trustee has the power to foreclose on the property on behalf of the beneficiary. In most U.S. states, a deed of trust (but not a mortgage) can contain a special "power of sale" clause that permits the trustee to exercise these powers.