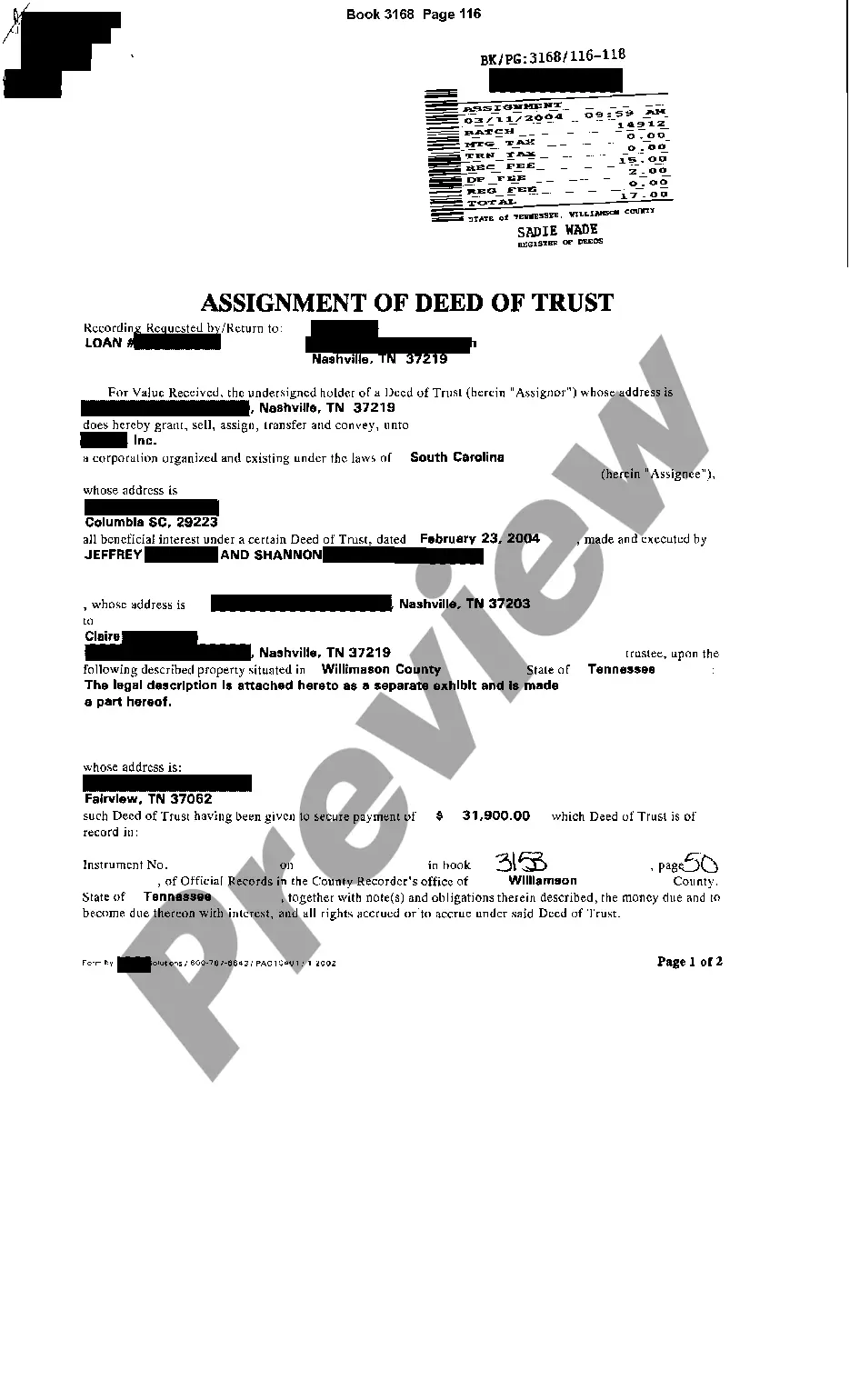

Tennessee Assignment of Deed of Trust

Description

How to fill out Tennessee Assignment Of Deed Of Trust?

Get access to high quality Tennessee Assignment of Deed of Trust templates online with US Legal Forms. Avoid days of misused time looking the internet and lost money on documents that aren’t updated. US Legal Forms gives you a solution to just that. Get above 85,000 state-specific authorized and tax samples that you can download and fill out in clicks within the Forms library.

To find the sample, log in to your account and then click Download. The file will be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Check if the Tennessee Assignment of Deed of Trust you’re considering is appropriate for your state.

- See the sample using the Preview function and read its description.

- Check out the subscription page by clicking on Buy Now button.

- Choose the subscription plan to continue on to sign up.

- Pay by card or PayPal to finish making an account.

- Pick a favored file format to save the file (.pdf or .docx).

Now you can open the Tennessee Assignment of Deed of Trust example and fill it out online or print it and do it yourself. Consider sending the file to your legal counsel to make sure everything is completed appropriately. If you make a mistake, print out and fill sample again (once you’ve created an account all documents you download is reusable). Create your US Legal Forms account now and access far more forms.

Form popularity

FAQ

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

A deed of trust (DOT), also known as a trust deed, is a document that conveys title to real property to a trustee as security for a loan until the grantor (borrower) repays the lender according to terms defined in an attached promissory note.

Parties need a deed of release to bring a dispute or agreement to an end.Alternatively, if you are an employer, you may want a departing employee to sign a deed of release to agree that they won't make any employment claims against you once they have gone.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

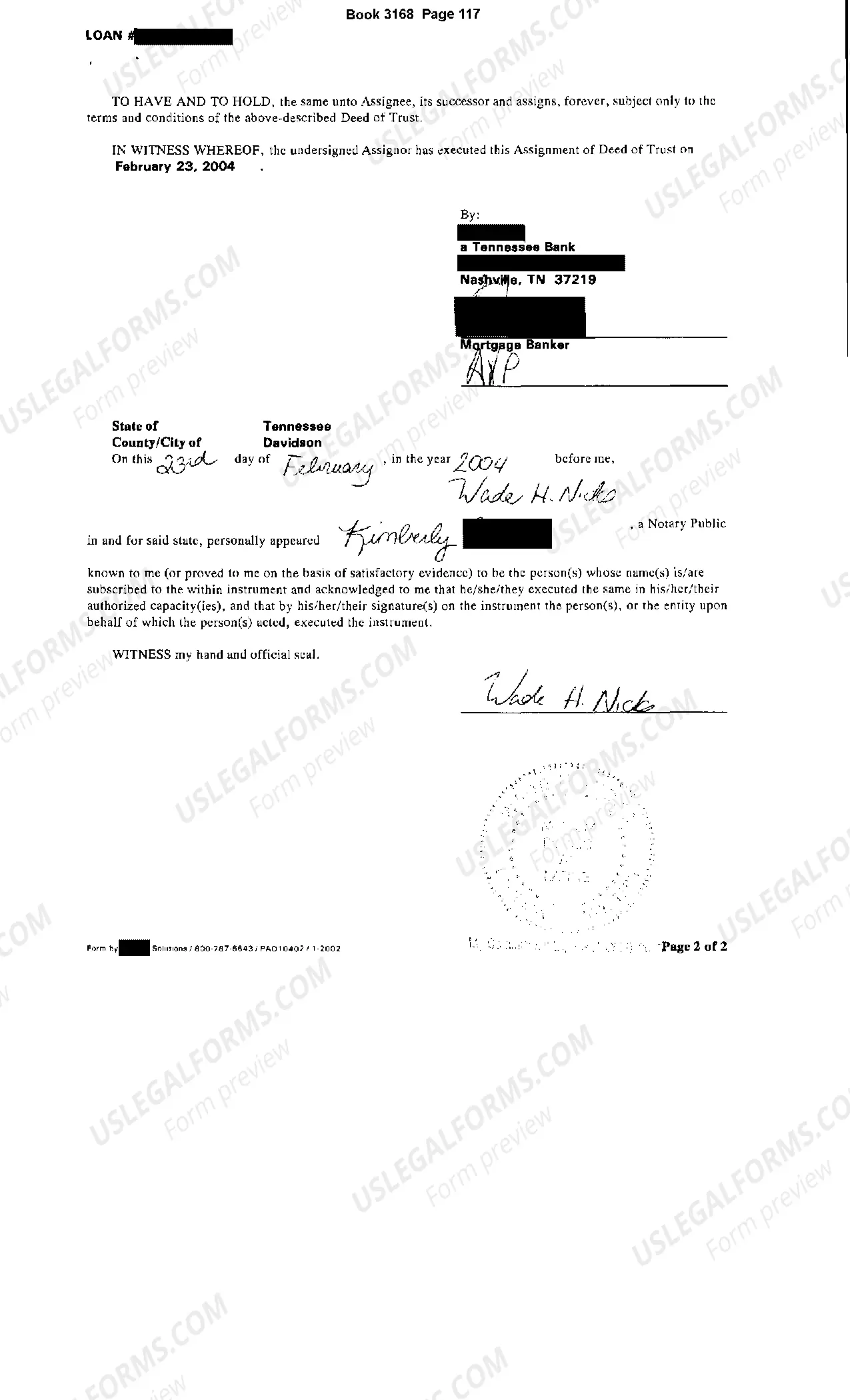

The deed must be signed by the party or parties making the conveyance or grant; and 7.

A deed of release or release deed is a legal document that removes the claim of a person from an immovable property and transfers his/her share to the co-owner. The release deed procedure is executed in the sub-registrars office and both the parties are required to be present for signing it.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

Only until the debt is paid off by the borrower can a deed of reconveyance then be used to clear the deed of trust from the title to the property. The document is signed by the trustee, whose signature must be notarized.

A deed of trust is a method of securing a real estate transaction that includes three parties: a lender, borrower and a third-party trustee.