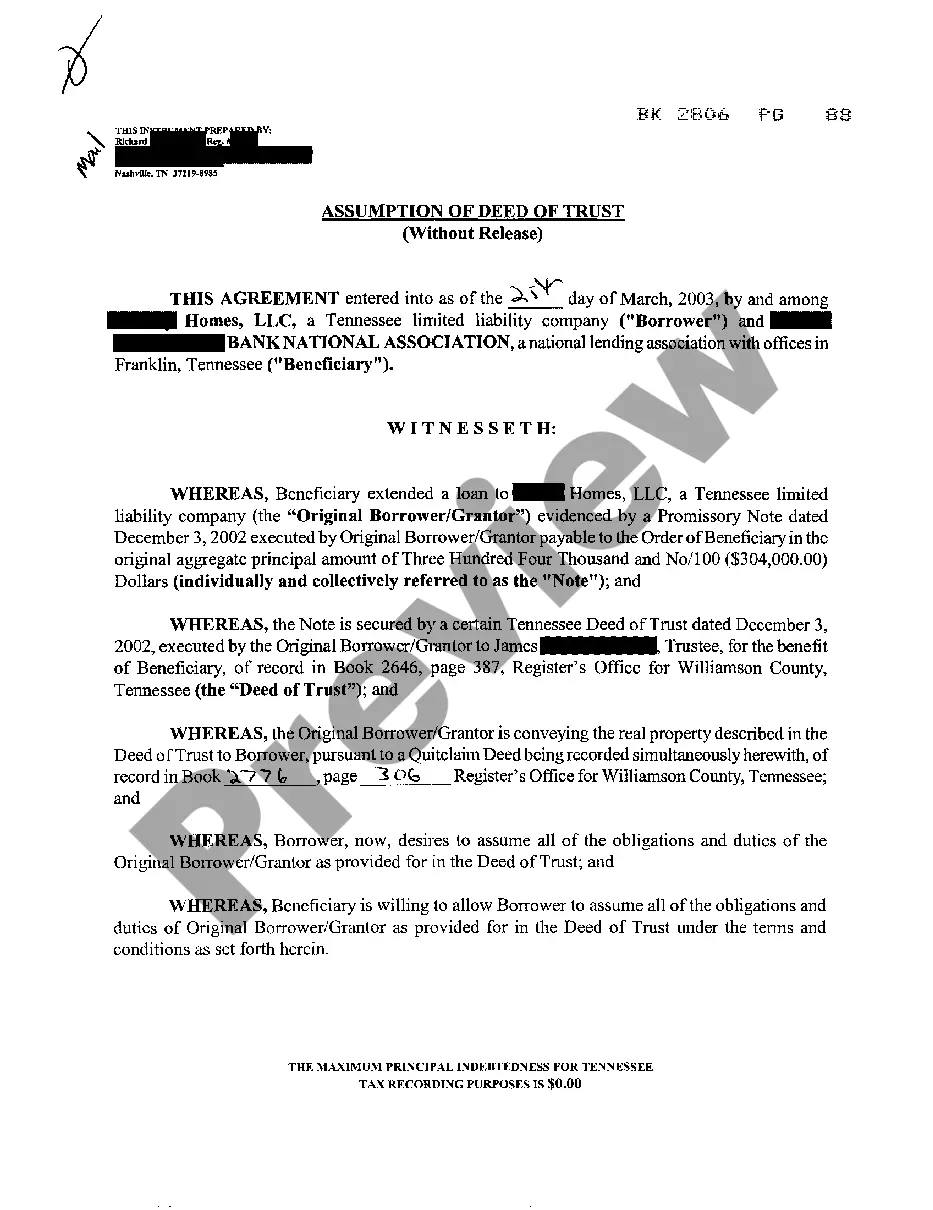

Tennessee Assumption of Deed of Trust

Description

How to fill out Tennessee Assumption Of Deed Of Trust?

Get access to quality Tennessee Assumption of Deed of Trust templates online with US Legal Forms. Steer clear of days of wasted time searching the internet and dropped money on documents that aren’t updated. US Legal Forms offers you a solution to just that. Get over 85,000 state-specific legal and tax templates that you can save and complete in clicks in the Forms library.

To find the example, log in to your account and then click Download. The document will be saved in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide below to make getting started simpler:

- See if the Tennessee Assumption of Deed of Trust you’re considering is appropriate for your state.

- View the form using the Preview option and read its description.

- Check out the subscription page by simply clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay out by card or PayPal to complete making an account.

- Select a favored file format to download the document (.pdf or .docx).

You can now open up the Tennessee Assumption of Deed of Trust sample and fill it out online or print it and do it yourself. Think about mailing the file to your legal counsel to make sure things are filled out properly. If you make a error, print out and fill application once again (once you’ve registered an account every document you save is reusable). Create your US Legal Forms account now and get access to more templates.

Form popularity

FAQ

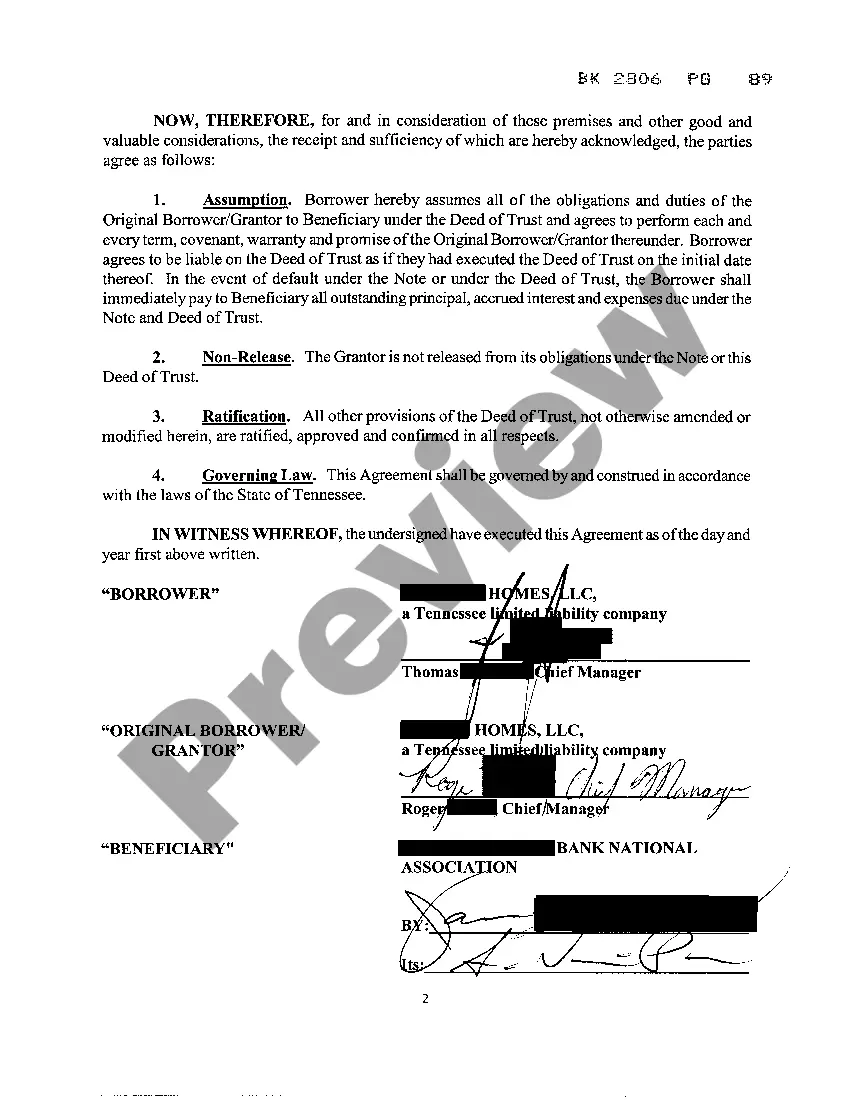

In order to convey any real property or an interest in property in Tennessee, the deed must be in writing, acknowledged by the grantor, and registered in the county where the property is located. The Annotated Code of Tennessee allows for the transfer of real property through the usage of a variety of deeds.

Tennessee deed forms convey interest in property from one party (the Grantor) to another (the Grantee). The documents can be prepared by anyone as long as the required information is written in the deed as outlined in § 66-5-103.

When it comes to property division during divorce, Tennessee is considered an equitable distribution state. Essentially, this means that marital property is divided fairly and reasonably, not necessarily 50-50.

Everyone who is on the title of the property is required to sign the deed of trust.In a "purchase money mortgage" transaction in which only one spouse owns the property, the other spouse is not required to sign the deed of trust.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

The deed must be signed by the party or parties making the conveyance or grant; and 7.

A deed of trust (DOT), is a document that conveys title to real property to a trustee as security for a loan until the grantor (borrower) repays the lender according to terms defined in an attached promissory note.In Tennessee, a Deed of Trust is the most commonly used instrument to secure a loan.

The deed of trust is currently used in Alabama, Alaska, Arkansas, Arizona, California, Colorado, District of Columbia, Georgia, Hawaii, Idaho, Iowa, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, North Carolina, Oklahoma, Oregon, Rhode Island, South Dakota, Tennessee, Texas, Utah, Virginia,

If you are married and your name is not on the title deed, you may have relinquished your ownership right.