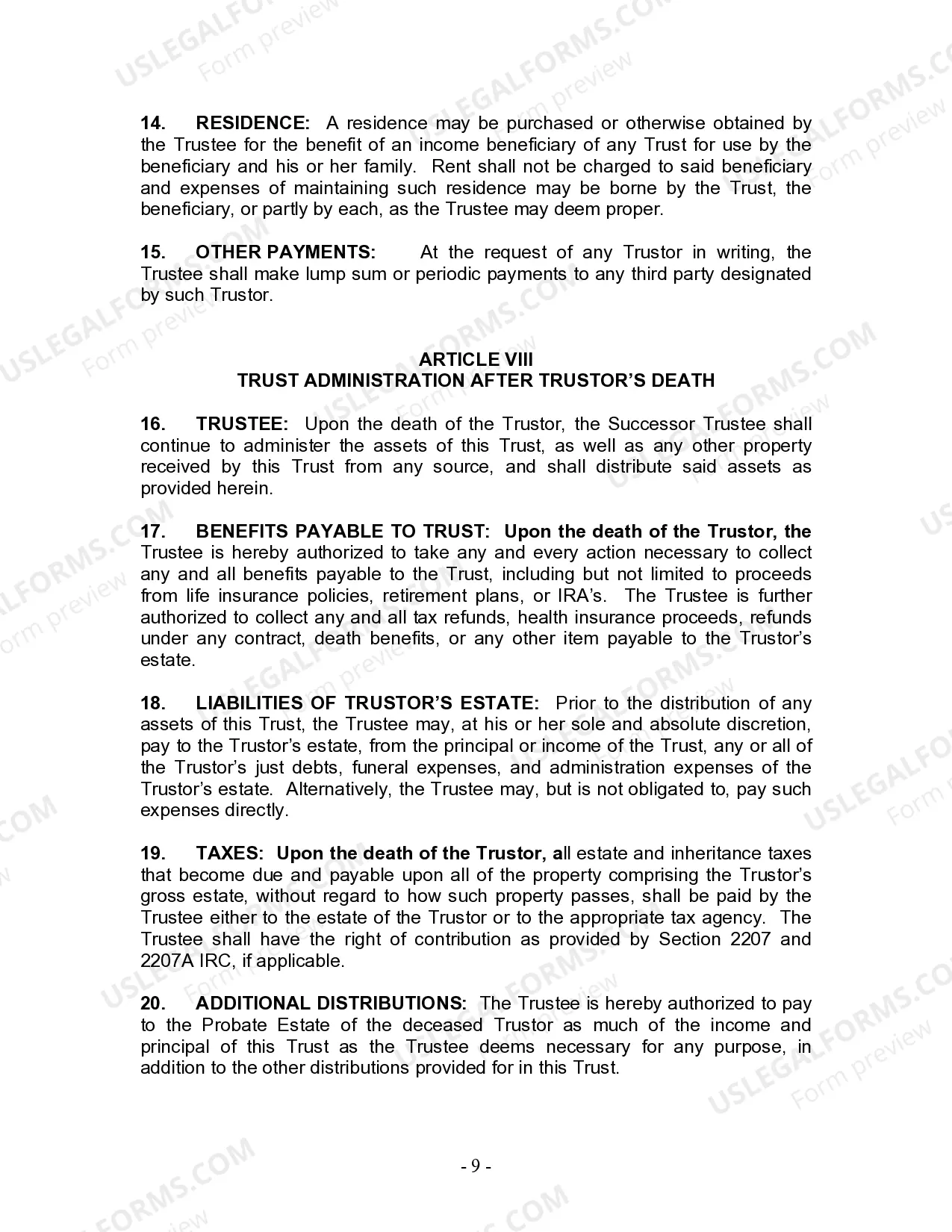

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Tennessee Living Trust for Husband and Wife with No Children

Description

How to fill out Tennessee Living Trust For Husband And Wife With No Children?

Access to top quality Tennessee Living Trust for Husband and Wife with No Children samples online with US Legal Forms. Prevent hours of lost time searching the internet and dropped money on forms that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Get around 85,000 state-specific legal and tax forms that you could download and fill out in clicks within the Forms library.

To get the sample, log in to your account and then click Download. The document is going to be stored in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide below to make getting started simpler:

- Check if the Tennessee Living Trust for Husband and Wife with No Children you’re looking at is appropriate for your state.

- View the sample using the Preview option and browse its description.

- Visit the subscription page by simply clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay by card or PayPal to finish making an account.

- Pick a preferred file format to save the file (.pdf or .docx).

Now you can open up the Tennessee Living Trust for Husband and Wife with No Children example and fill it out online or print it out and get it done by hand. Consider giving the document to your legal counsel to make sure all things are filled out properly. If you make a error, print out and fill application again (once you’ve registered an account all documents you save is reusable). Make your US Legal Forms account now and get more samples.

Form popularity

FAQ

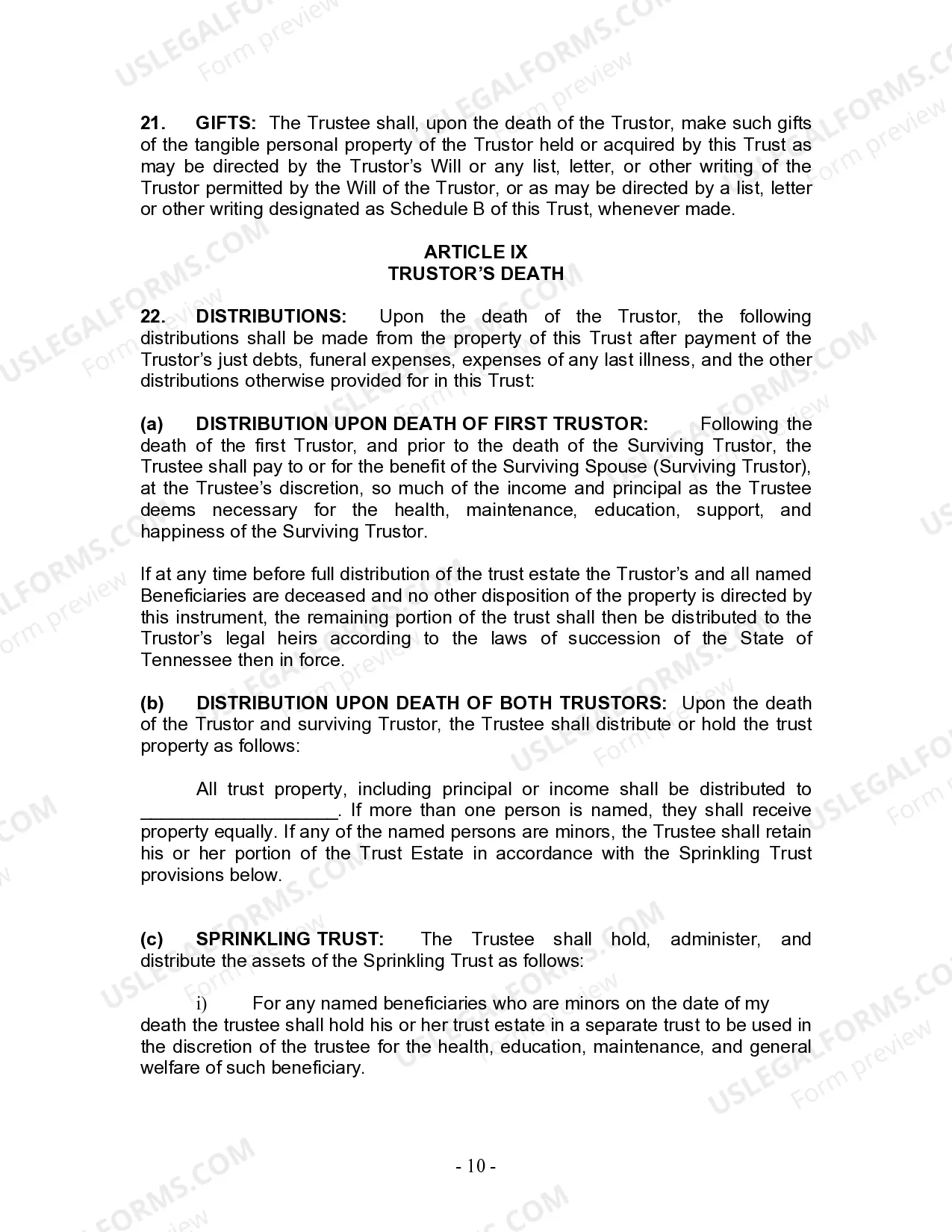

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

If you die intestate and you do not have either a spouse or descendants, the State of Tennessee dictates that the subsequent relative to inherit your estate is any surviving parents. If your parents survive you, your estate is distributed to them in equal parts.

This law states that no matter what your will says, your spouse has a right to inherit one-third or one-half (depending on the state and sometimes depending on the length of the marriage) of your total estate. To exercise this right, your spouse has to petition the probate court to enforce the law.

The term usually means your nearest blood relative. In the case of a married couple or a civil partnership it usually means their husband or wife. Next of kin is a title that can be given, by you, to anyone from your partner to blood relatives and even friends.

Federal law prohibits enforcement of a due on sale clause in certain cases, such as where the transfer is to a relative upon the borrower's death. Even if your name was not on the mortgage, once you receive title to the property and obtain lender consent, you may assume the existing loan.

Tennessee inheritance laws protect the inheritance rights of any children who were conceived prior to their parent's death, but were born following it. However, that child must have lived for at least 120 hours and been born in the 10-month window that comes after the parent's death.

How Is Next of Kin Determined? To determine next of kin in California, go down the list until someone exists in the category listed.For example, if decedent had no surviving spouse or registered domestic partner, but was survived by adult children, then the adult children would be next of kin.

If a person dies intestate without any children, the spouse recovers the entire estate. If the person left a spouse and children, the surviving spouse will receive either one-third of the entire estate or a child's share of the estate, whichever is greater.

Community Property in California Inheritance LawsCalifornia is a community property state, which is a policy that only applies to spouses and domestic partners.The only property that doesn't become community property automatically are gifts and inheritances that one spouse receives.