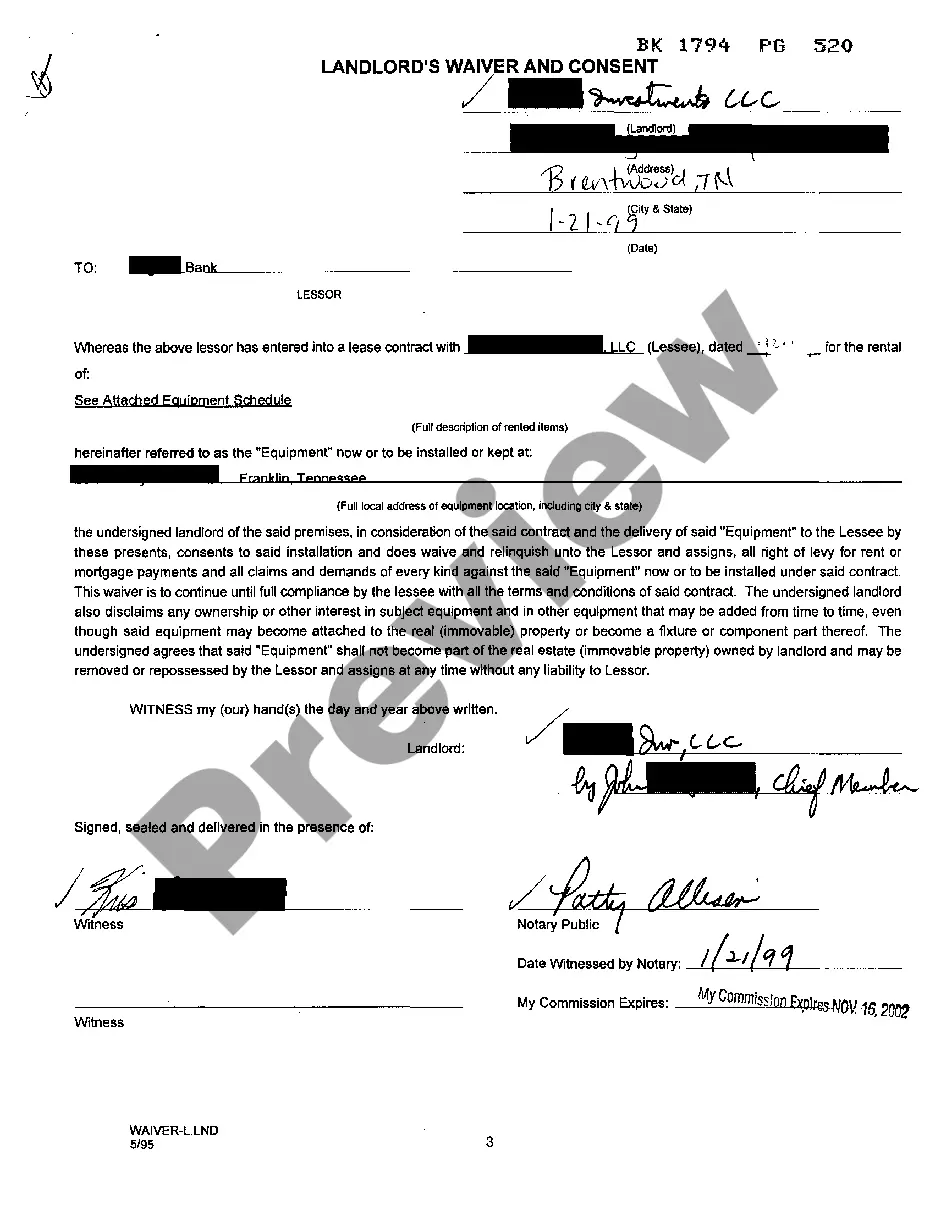

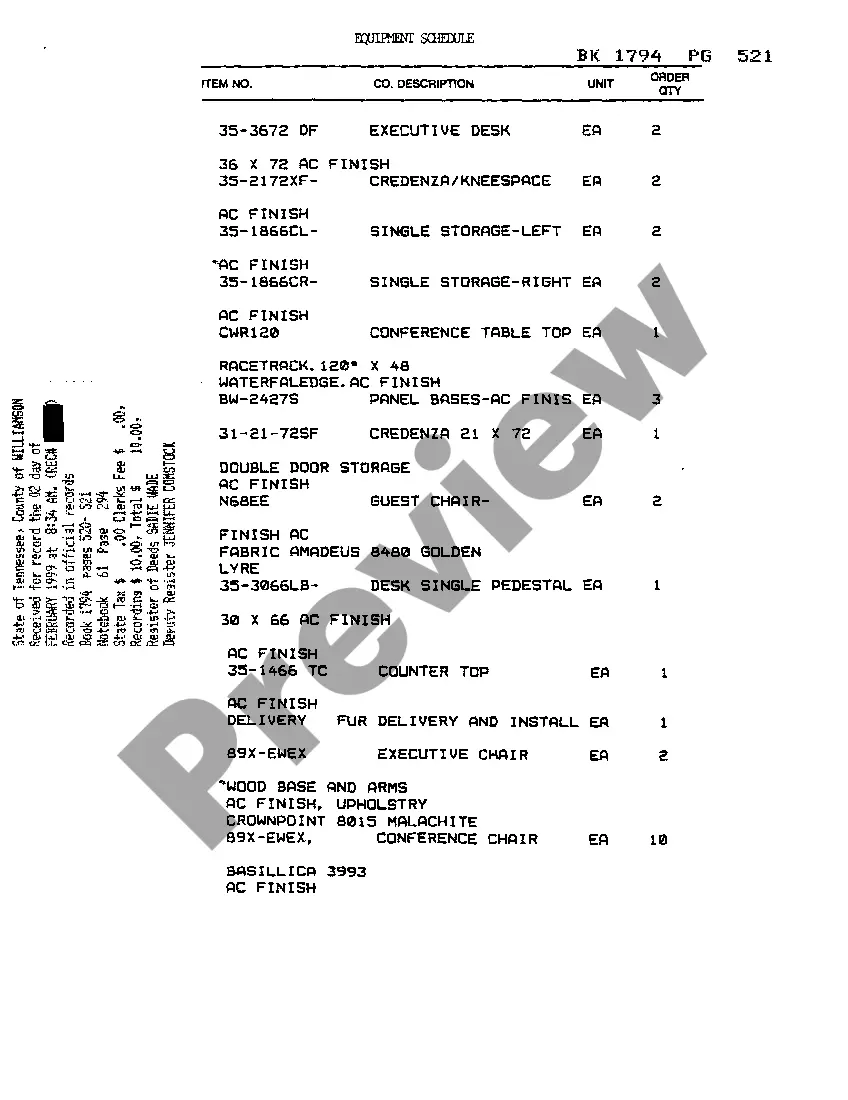

Tennessee Landlords Waiver And Consent to Installation of Equipment on Leased Premises

Description What Is A Landlord Waiver And Consent

How to fill out Tennessee Landlords Waiver And Consent To Installation Of Equipment On Leased Premises?

Access to top quality Tennessee Landlords Waiver And Consent to Installation of Equipment on Leased Premises templates online with US Legal Forms. Prevent days of wasted time searching the internet and lost money on files that aren’t up-to-date. US Legal Forms gives you a solution to just that. Get over 85,000 state-specific legal and tax samples that you can download and fill out in clicks in the Forms library.

To receive the example, log in to your account and click Download. The document is going to be stored in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, take a look at our how-guide below to make getting started easier:

- See if the Tennessee Landlords Waiver And Consent to Installation of Equipment on Leased Premises you’re considering is suitable for your state.

- Look at the form using the Preview option and read its description.

- Check out the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to register.

- Pay out by credit card or PayPal to complete making an account.

- Select a favored format to save the file (.pdf or .docx).

Now you can open up the Tennessee Landlords Waiver And Consent to Installation of Equipment on Leased Premises template and fill it out online or print it and get it done by hand. Think about mailing the document to your legal counsel to be certain all things are filled out properly. If you make a mistake, print out and fill sample once again (once you’ve registered an account every document you download is reusable). Create your US Legal Forms account now and access much more forms.

Form popularity

FAQ

Can a tenant claim for improvements made during the lease? The position differs in the case of immovable and movable property. Tenant can claim for:The claim arises only once the lease is terminated and lessee vacated the property.

As a landlord, you have many rights that allow you to manage your rental property effectively and efficiently.Collecting rent deposits and payments, as well as any deposits or payments associated with pets, parking, and/or added amenities. Entering the tenant's unit with notice or due to an emergency. Evicting tenants.

Often, landlords will provide a 'leasehold improvement allowance' for their tenants which is merely a set amount they agree to pay for. If the improvements you want cost more than the allowance, you will be responsible for those extra costs.

In cases like this, landlords are entitled to deduct the remaining tax basis in capitalized leasehold improvements made for a particular tenant upon termination of the lease if such improvements are irrevocably disposed of or abandoned and won't be used by a subsequent tenant.

Landlord's Waivers are intercreditor agreements for the benefit of the tenant's lender or equipment lessor, stipulating the landlord's and the lender's respective rights in certain property owned by the tenant.

Leasehold improvements are any changes made to a rental property in order to customize it for the particular needs of a tenant. These can include alterations such as painting, installing partitions, changing the flooring, or putting in customized light fixtures.

Waiver is defined as follows: When the landlord knows that the tenant is breaching the lease, yet conducts the landlord-tenant relationship in the normal course (for example, accepts rent and otherwise does nothing to object to the violation of the lease), then the court may infer that the owner has waived, or forgiven

If the tenant pays for leasehold improvements, the capital expenditure is recorded as an asset on the tenant's balance sheet. Then the expense is recorded on income statements as amortization over either the life of the lease or the useful life of the asset, whichever is shorter.

The rule of subrogation known as the Sutton Rule states that a tenant and landlord are automatically considered co-insureds under a fire insurance policy as a matter of law and, therefore, the insurer of the landlord who pays for the fire damage caused by the negligence of a tenant may not sue the tenant in