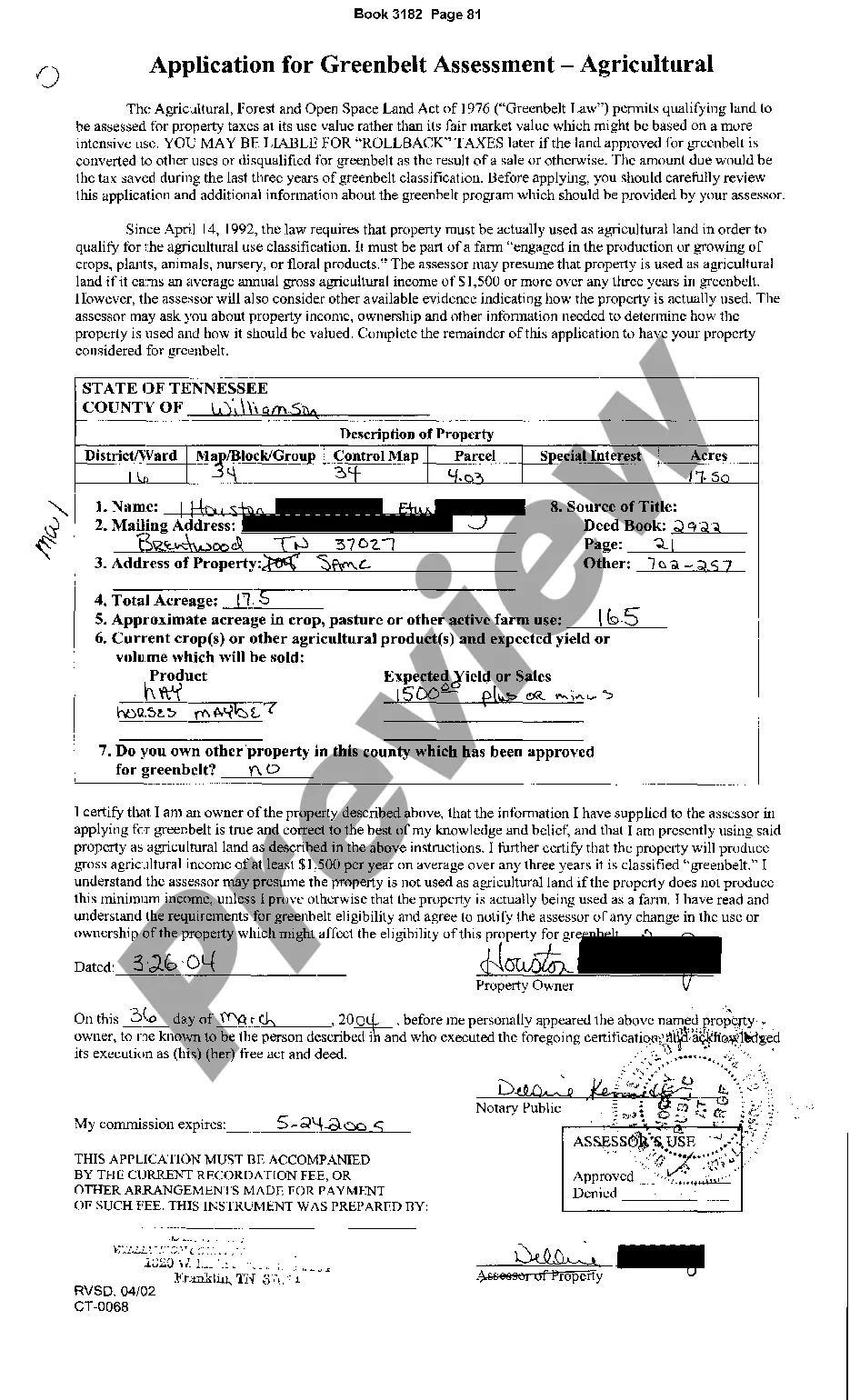

Tennessee Greenbelt Assessment

Description Tennessee Greenbelt Rules

How to fill out Greenbelt Property?

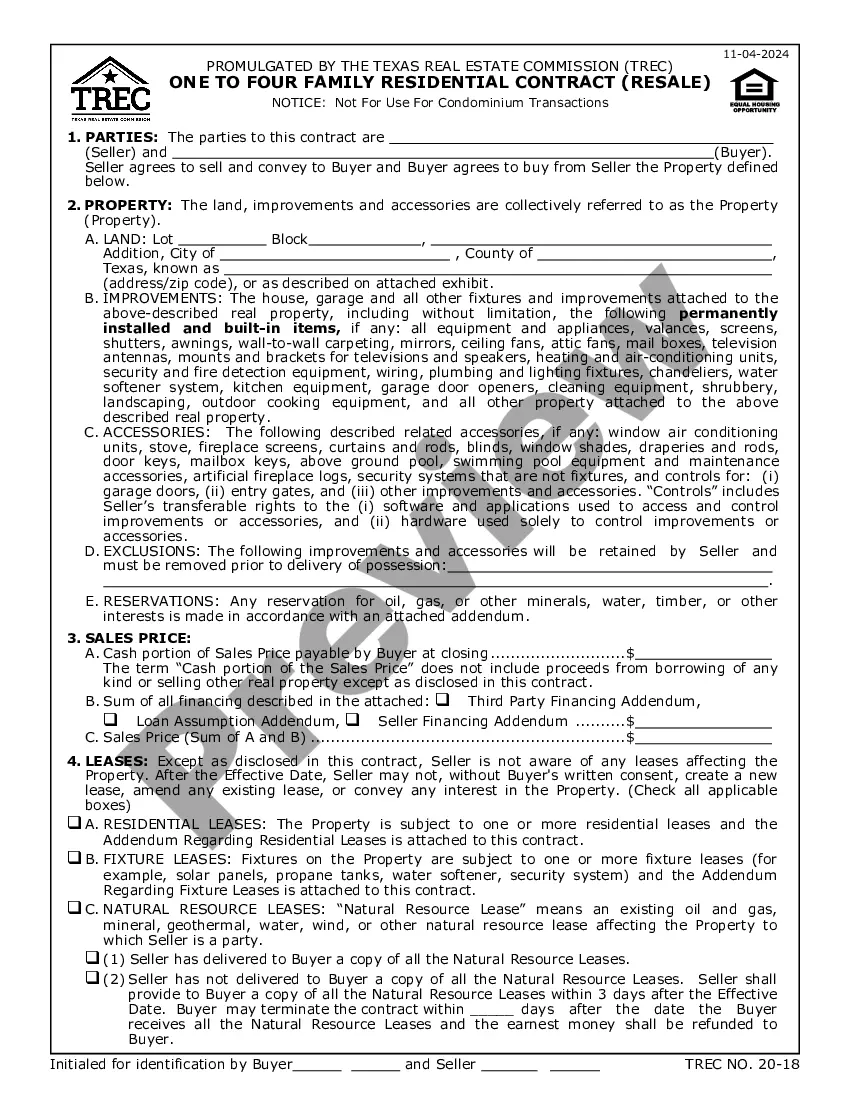

Access to quality Tennessee Greenbelt Assessment templates online with US Legal Forms. Avoid days of lost time searching the internet and dropped money on files that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Find around 85,000 state-specific authorized and tax templates you can save and submit in clicks in the Forms library.

To get the example, log in to your account and then click Download. The document is going to be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Check if the Tennessee Greenbelt Assessment you’re considering is appropriate for your state.

- Look at the sample using the Preview option and browse its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay by card or PayPal to finish making an account.

- Pick a favored format to download the document (.pdf or .docx).

You can now open the Tennessee Greenbelt Assessment sample and fill it out online or print it out and do it by hand. Consider sending the document to your legal counsel to make sure all things are filled in appropriately. If you make a error, print and complete sample once again (once you’ve registered an account all documents you save is reusable). Make your US Legal Forms account now and get a lot more templates.

Green Belt Land Rules Form popularity

Greenbelt Application Tn Other Form Names

Green Belt Examples FAQ

No. Greenbelt only applies to the farm or forest land. A one acre home site will not be covered under the Greenbelt. The homesite escluded from Greenbelt may be more than one acre if more than one acre is used for the home and yard.

1. The area of the land is more than 5 contiguous acres and is used to produce field crops, is in a crop rotation, raises and/or grazes stock for a for-profit venture.Land used for the grazing of horses that are primarily used for personal use or pleasure will not qualify.

A copy of the Tennessee Department of Revenue Agricultural Sales and Use Tax Certificate of Exemption. A copy of the wallet-sized exemption card also provided by the Department of Revenue, or.

The Agricultural, Forest and Open Space Land Act of 1976, better known as the Greenbelt Law, allows certain land to be taxed on its present use instead of market value. Provide relief from urban sprawl and provide green spaces for enjoyment of people who would not normally have access to such areas.

You cannot buy a green belt land as you are a non agriculturist. In order to buy green belt land, you must satisfy the criteria laid down in the land r act of that state.

A green belt is a policy and land use zone designation used in land use planning to retain areas of largely undeveloped, wild, or agricultural land surrounding or neighboring urban areas.

A green belt is a policy and land use zone designation used in land use planning to retain areas of largely undeveloped, wild, or agricultural land surrounding or neighboring urban areas. Similar concepts are greenways or green wedges which have a linear character and may run through an urban area instead of around it.

To receive an Agricultural Sales and Use Tax Certificate of Exemption, persons who qualify for the exemption must apply to the Tennessee Department of Revenue using the farmer, logger and nursery operator's application for exemption.

The Agricultural, Forest and Open Space Land Act of 1976 (Greenbelt Law) permits qualifying tracts of land that are: equal to or. Page 1. The Agricultural, Forest and Open Space Land Act of 1976 (Greenbelt Law) permits qualifying tracts of.