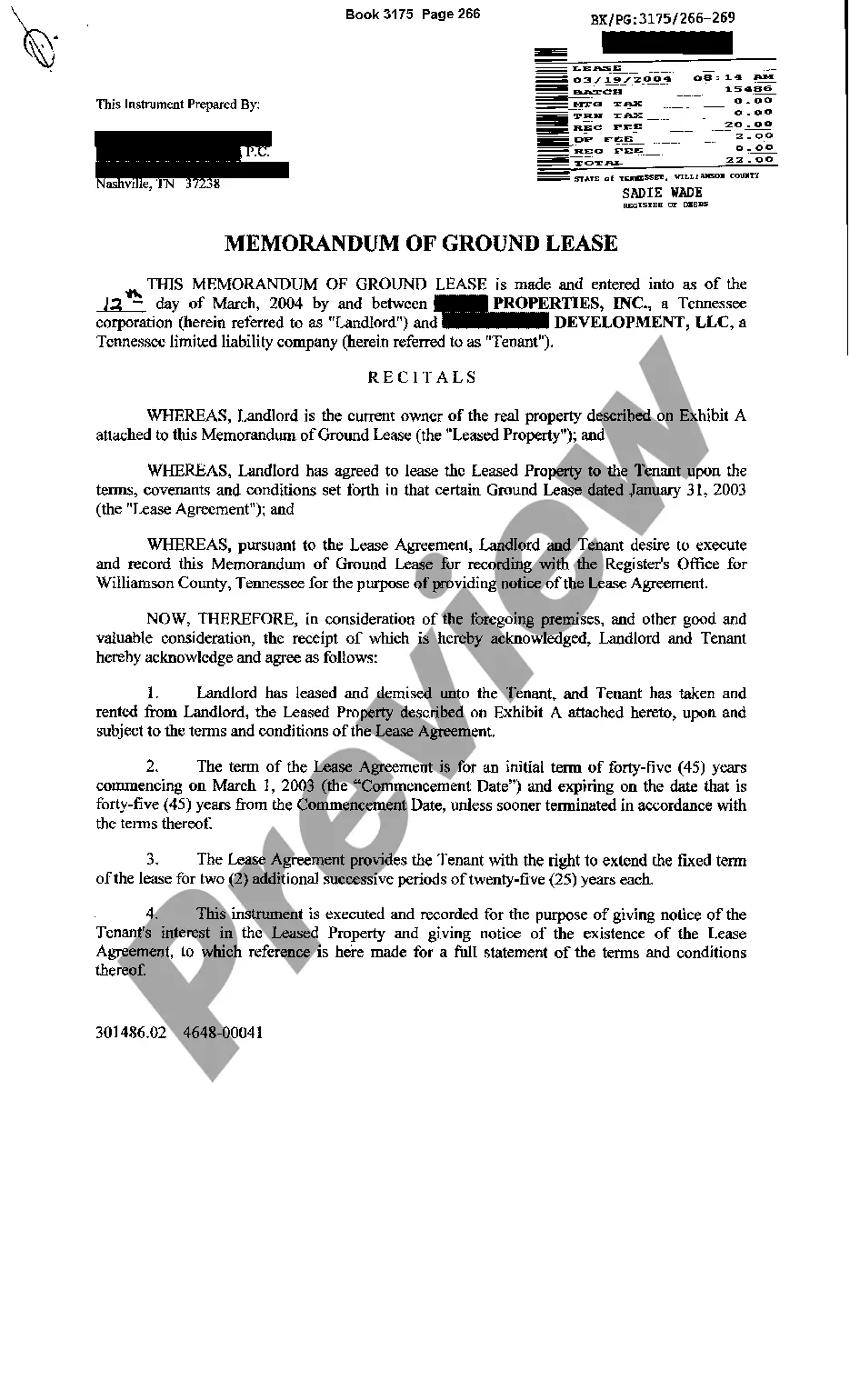

Tennessee Ground Lease

Description Ground Lease Pricing

How to fill out Tennessee Ground Lease?

Get access to quality Tennessee Ground Lease forms online with US Legal Forms. Steer clear of hours of lost time browsing the internet and dropped money on forms that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Find around 85,000 state-specific authorized and tax forms that you could save and complete in clicks within the Forms library.

To receive the example, log in to your account and then click Download. The file is going to be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, check out our how-guide listed below to make getting started easier:

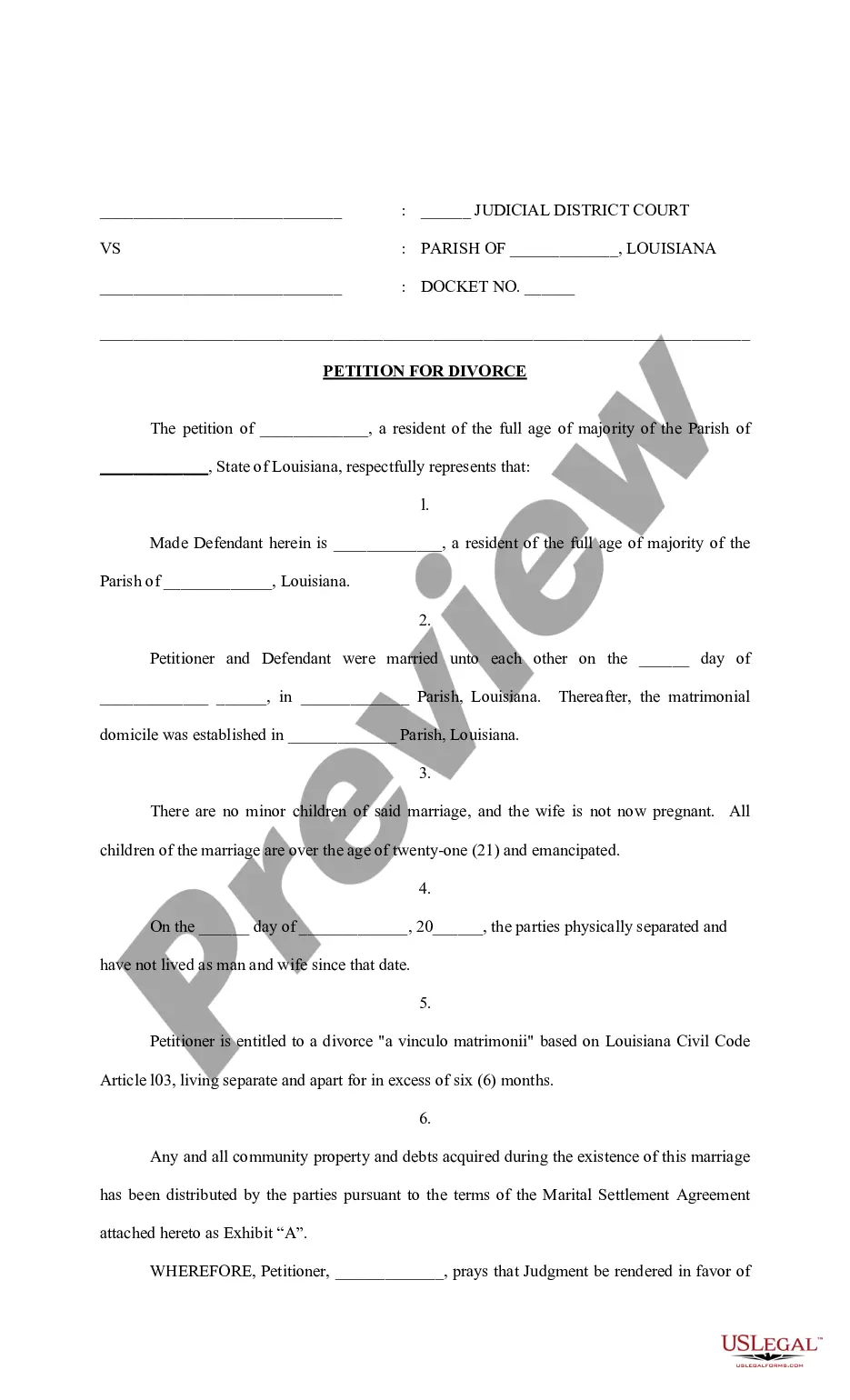

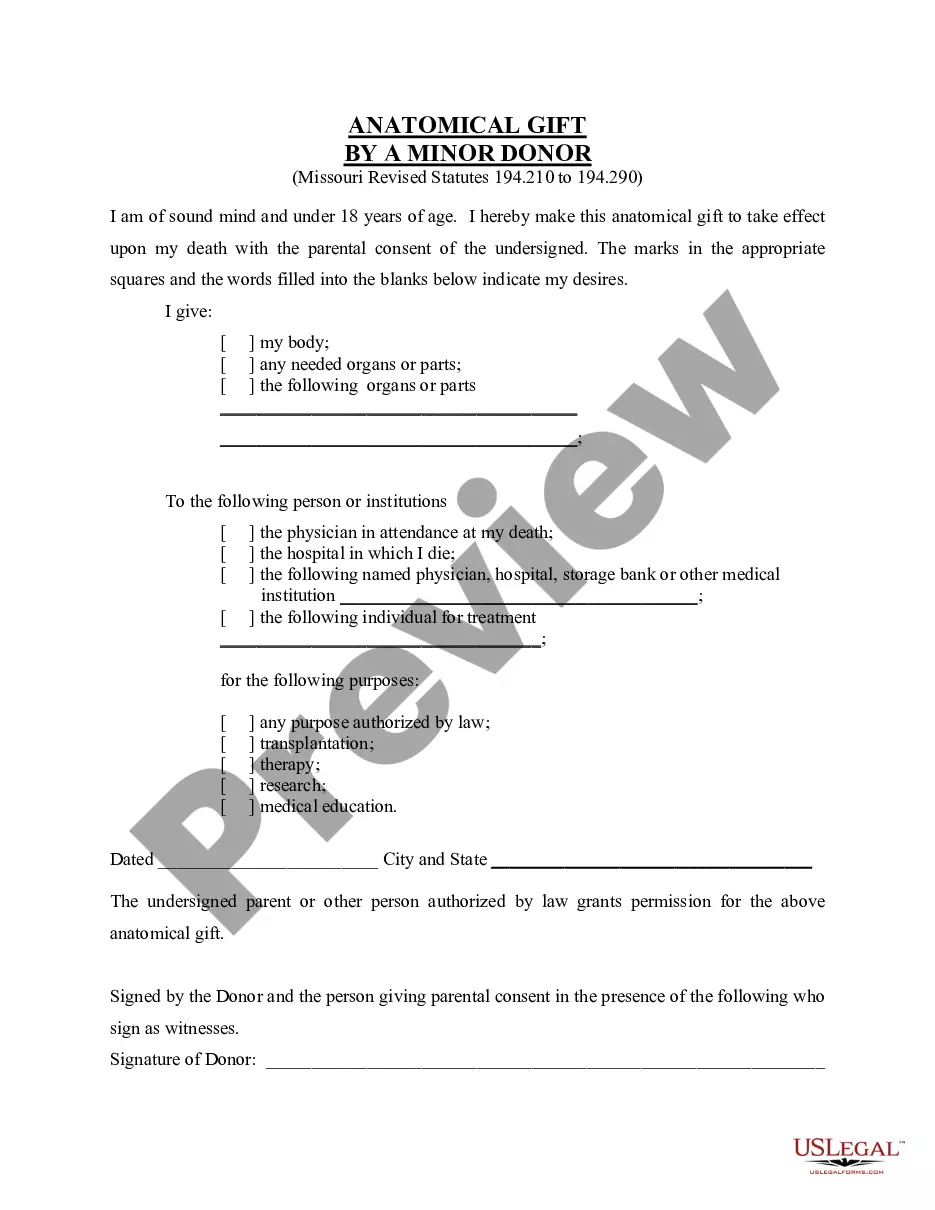

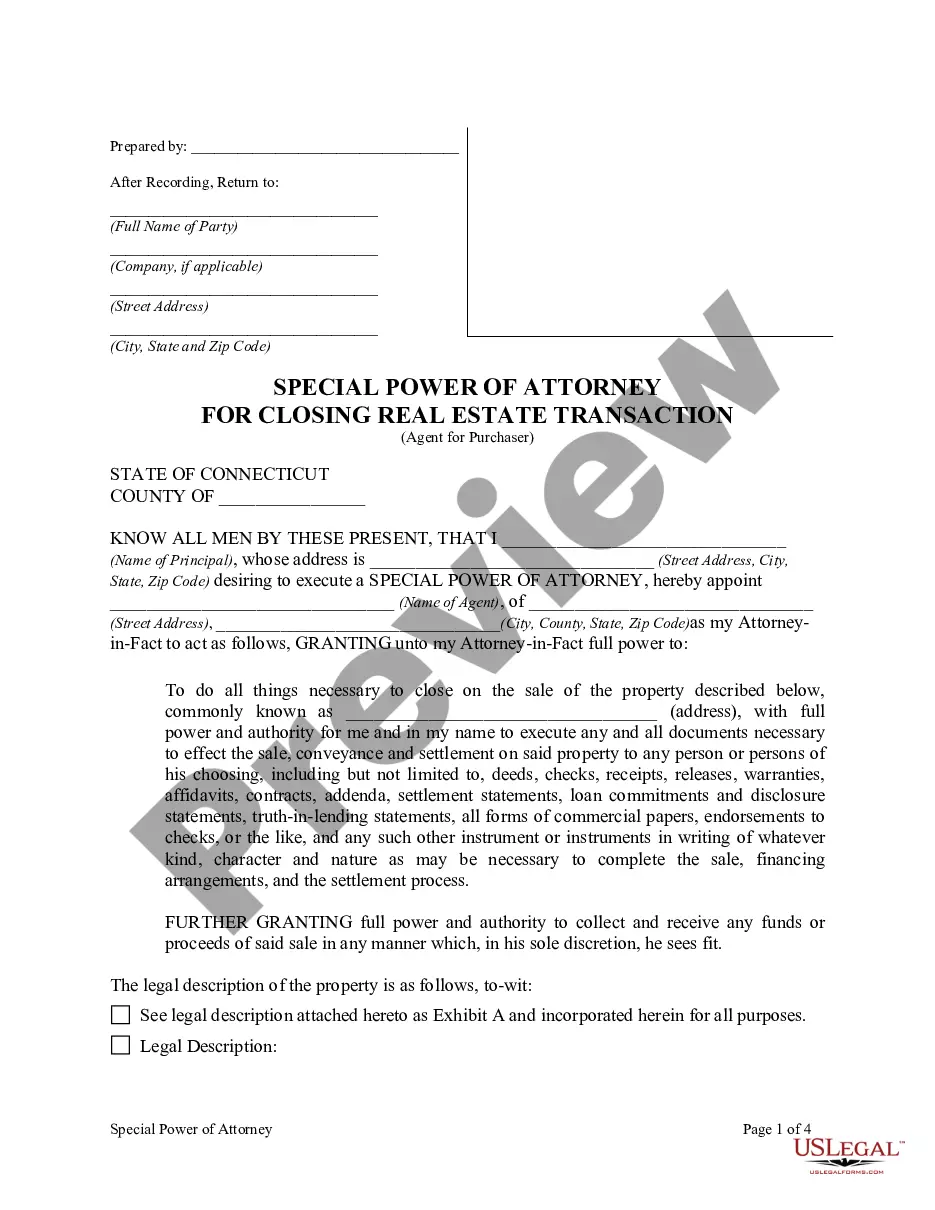

- Verify that the Tennessee Ground Lease you’re looking at is suitable for your state.

- View the form using the Preview function and browse its description.

- Go to the subscription page by clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay by credit card or PayPal to complete making an account.

- Select a preferred format to download the file (.pdf or .docx).

You can now open the Tennessee Ground Lease example and fill it out online or print it out and get it done by hand. Take into account giving the file to your legal counsel to make certain all things are completed appropriately. If you make a mistake, print out and fill sample once again (once you’ve made an account all documents you save is reusable). Create your US Legal Forms account now and get access to more forms.

Form popularity

FAQ

Ground Lease PV Valuation To calculate the value of the ground lease, we take the present value of all ground lease payments plus the reversion value of the ground lease at maturity. Discount Rate The discount rate at which to calculate the present value of the ground lease cash flows.

The lease calculator shows you the monthly lease payments and the total interest amount in seconds. You may use the mathematical formula to calculate the monthly lease payments. PMT = PV FV / (1+i)^n / (1 (1 / (1+i)^n / i) For example, the cost of the leased asset is Rs 2,00,000. The residual value is Rs 50,000.

Ground leases can provide great investment opportunities for people who want to deploy capital in real estate while never having to think about property management.The value of the rental stream and the landlord's position will typically end up well below half the value of the land and building as a whole.

A ground lease is an agreement between a landowner and a tenant, in which the tenant leases land for a new build. The lessee is the owner of the building only, and is responsible for all the expenses and costs associated to constructing and maintaining a business location on a leased piece of land.

Names of all tenants. Limits on occupancy. Term of the tenancy. Rent. Deposits and fees. Repairs and maintenance. Entry to rental property. Restrictions on tenant illegal activity.

Inspect the Property and Record Any Current Damages. Know What's Included in the Rent. Can You Make Adjustments and Customizations? Clearly Understand the Terms Within the Agreement and Anticipate Problems. Communicate with Your Landlord About Your Expectations.

Like an ordinary lease, under a ground lease a tenant or lessee pays rent to a landlord or lessor and receives in return a right to possession and use of the property for the time period covered by the rent. Like an ordinary lease, ground leases generally call for rent to be paid on a periodic basis, typically monthly.

Multiply the set amount per square foot times your square footage to calculate the ground rent. For instance, if the lot is 15,000 square feet and your set amount is 1 cent per square foot, multiply 0.01 by 15,000 to get a yearly ground rent of $150.

NSW DPI state that although there is no prescriptive method, but generally lease values are reasonably stable between 59% of land value. For example, if land is valued at $2,500/ha and the agreed rate is 6% of the land value, the rental payment would be $150/ha.