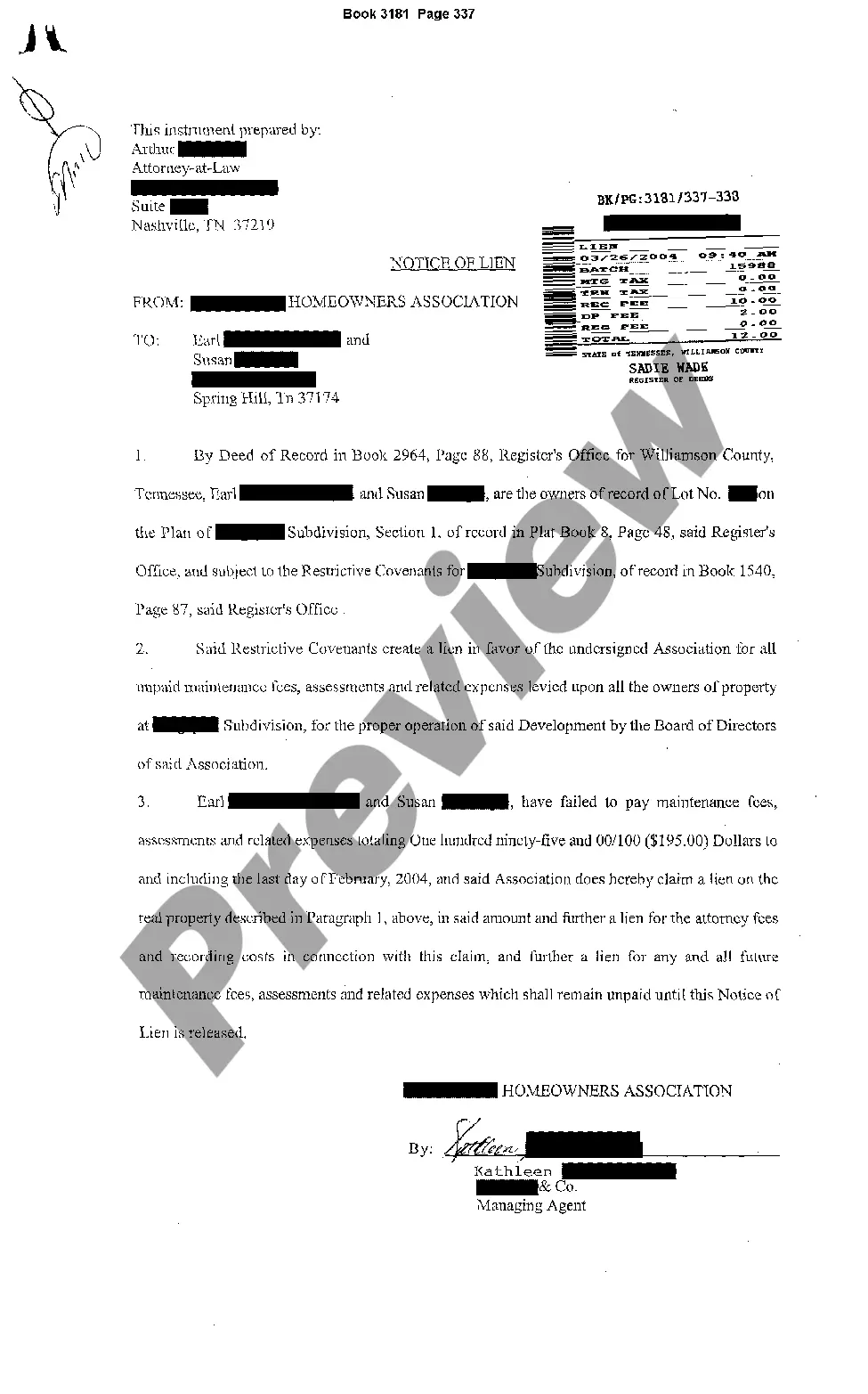

Tennessee Notice of Lien regarding homeowners association fees

Description Hoa 10 00

How to fill out Hoa Put A Lien On My House?

Get access to quality Tennessee Notice of Lien regarding homeowners association fees forms online with US Legal Forms. Avoid days of wasted time looking the internet and lost money on forms that aren’t up-to-date. US Legal Forms offers you a solution to just that. Get above 85,000 state-specific legal and tax templates that you could download and submit in clicks in the Forms library.

To get the example, log in to your account and then click Download. The document will be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, check out our how-guide below to make getting started easier:

- Verify that the Tennessee Notice of Lien regarding homeowners association fees you’re considering is appropriate for your state.

- View the form making use of the Preview option and read its description.

- Visit the subscription page by simply clicking Buy Now.

- Select the subscription plan to go on to sign up.

- Pay out by card or PayPal to complete making an account.

- Pick a preferred format to save the document (.pdf or .docx).

Now you can open up the Tennessee Notice of Lien regarding homeowners association fees example and fill it out online or print it out and do it by hand. Think about mailing the document to your legal counsel to be certain all things are filled in properly. If you make a error, print and fill sample once again (once you’ve created an account every document you download is reusable). Create your US Legal Forms account now and get access to more samples.

What Happens If An Hoa Put A Lien On Your House Form popularity

Hoa Lien Other Form Names

Homeowners Association Complaint Form FAQ

Majority of Members Must Consent to Dissolution of HOA Because an HOA technically consists of two parts, the legal entity plus its membership, one part usually needs the consent and approval of the other in order to take an extreme action like dissolution.

To remove a lien on a property, homeowners must first satisfy the debt owed to the homeowners association. To pay off an HOA lien, the homeowner must make payment to the association in the amount of the delinquent assessments, plus interest and any applicable fees.

If a homeowner doesn't pay the required assessments, the HOA may choose to try to collect those dues through normal collection processes (like by making collection calls and sending demand letters), by filing a civil suit to obtain a personal judgment against the homeowner, or by initiating a foreclosure.

If an HOA has a lien on a homeowner's property, it may forecloseeven if the home already has a mortgage on itas permitted by the CC&Rs and state law. The HOA can foreclose either through judicial foreclosure or a nonjudicial foreclosure, depending on state law and the terms in the CC&Rs.

HOA Super Liens, Though, Are Senior to First Mortgages If an HOA forecloses a super lien, it can potentially eliminate the first mortgage and any other junior mortgages on the property. Keep in mind, though, that even if a mortgage lien is eliminated, you're not off the hook for the debt.

HOA fees are separate from the mortgage. The mortgage only secures the money loaned to purchase the property. HOA fees are akin to recurring costs of maintaining the presort year such as utilities. There may be a structure where the mortgage, HOA and property taxes are paid out of an escrow fund.

What is a super lien? There are nearly 20 states that allow homeowners' associations to file a lien for overdue assessments. In most of these states, a HOA lien is subordinate to a first and second mortgage regardless of when the HOA filed their line. In many cases, the HOA lien is treated like a mortgage.

HOAs are funded by dues from homeowner members, but when those members are delinquent on their payments, HOAs can take certain actions, such as placing liens on members' homes. These liens result from court-ordered money judgments and can lead to HOA foreclosure.