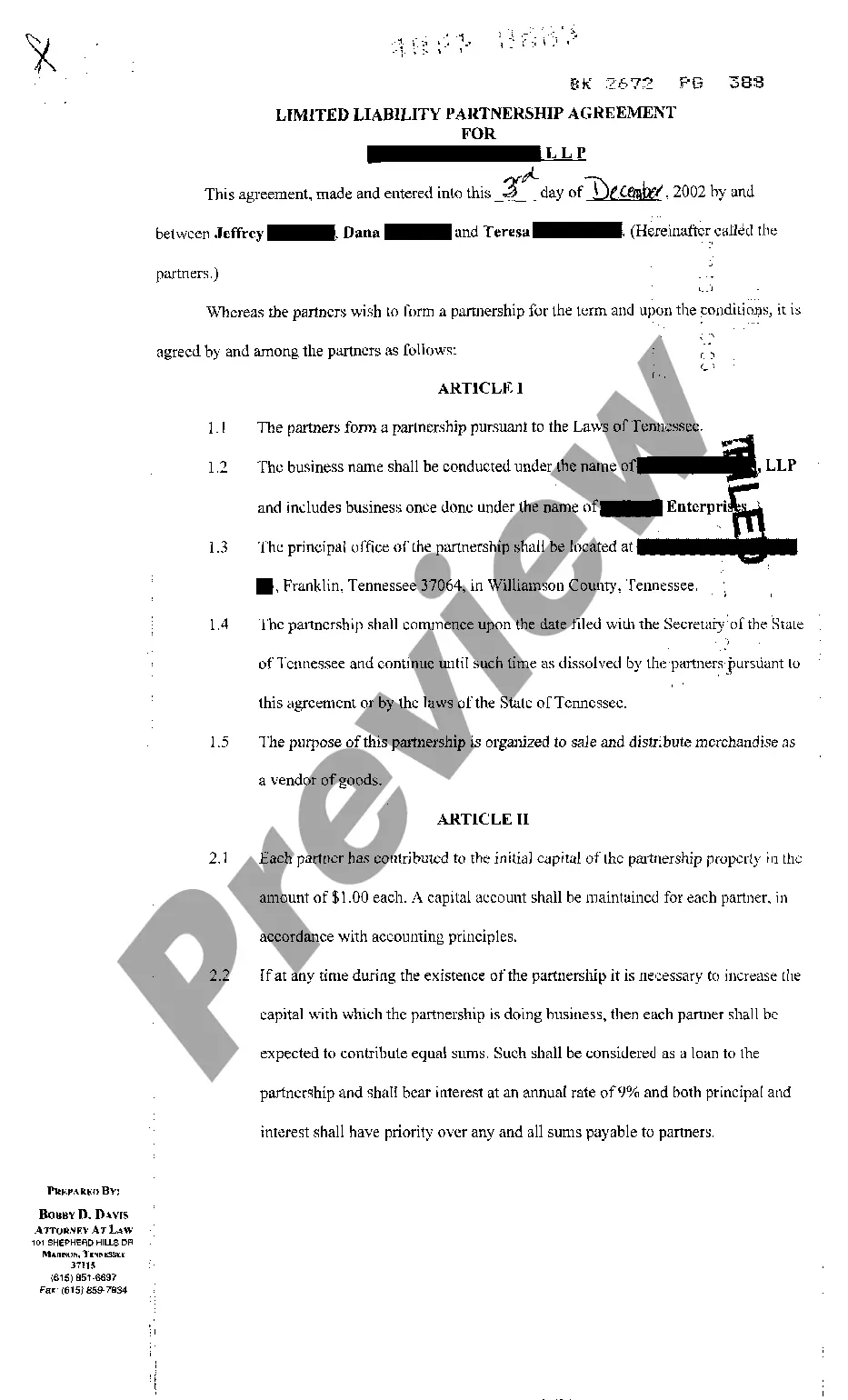

Tennessee LLP Agreement

Description

How to fill out Tennessee LLP Agreement?

Get access to top quality Tennessee LLP Agreement forms online with US Legal Forms. Prevent hours of misused time browsing the internet and dropped money on forms that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Get more than 85,000 state-specific legal and tax samples that you could download and fill out in clicks within the Forms library.

To get the example, log in to your account and click on Download button. The document will be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide listed below to make getting started easier:

- See if the Tennessee LLP Agreement you’re looking at is suitable for your state.

- Look at the sample using the Preview option and read its description.

- Go to the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to register.

- Pay by card or PayPal to finish creating an account.

- Pick a preferred file format to save the document (.pdf or .docx).

Now you can open up the Tennessee LLP Agreement sample and fill it out online or print it and get it done yourself. Consider giving the papers to your legal counsel to make sure all things are completed correctly. If you make a mistake, print and fill application once again (once you’ve created an account every document you save is reusable). Create your US Legal Forms account now and get access to a lot more forms.

Form popularity

FAQ

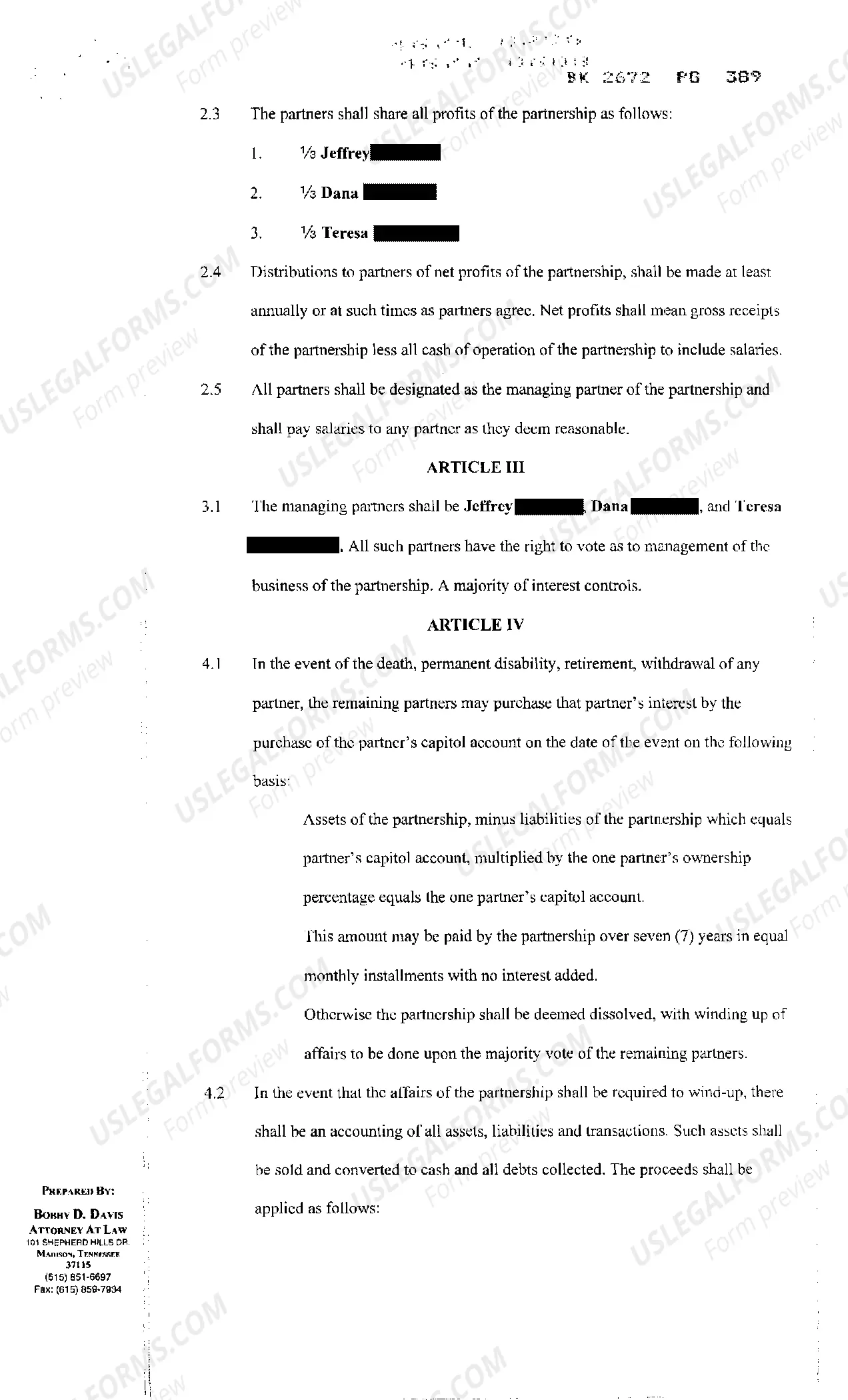

An LLP protects each partner from debts against the partnership arising from professional malpractice lawsuits against another partner.

LLP agreement must be filed in form 3 online on MCA Portal. Form 3 for the LLP agreement has to be filed within 30 days of the date of incorporation. The LLP Agreement has to be printed on Stamp Paper.

Similar to the LLC, the LLP is a hybrid of both the corporation and partnership, to give the greatest advantages for taxation and liability protection. The LLP is not a separate entity for income tax purposes and profits and losses are passed through to the partners.

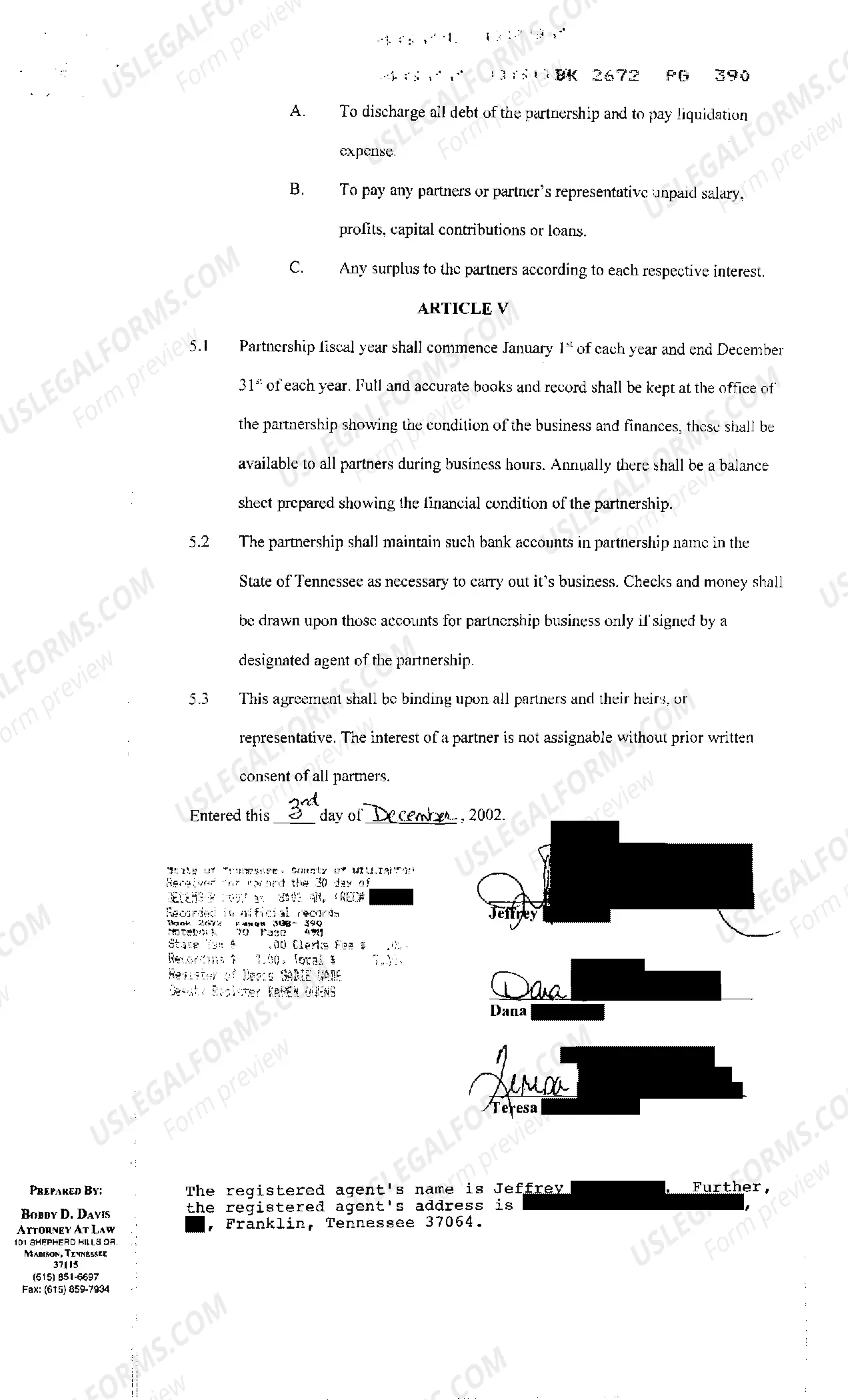

LLP Agreement is a written contract between the partners of the LLP or between the LLP and its designated partners. It establishes the rights and a duty of the designated partners toward each other as well toward the LLP.

The primary advantage for an LLP is that it establishes a separate legal entity from that of the general partners. As such, an LLP may own property as well as sue and be sued in a legal arena. By far the most beneficial aspect of separate legal status is the limited liability protection it provides.

The limited liability feature protects the partner's personal assets from the risk of being seized to satisfy creditor claims in the event of the company's or partnership's insolvency while the general partner's personal property would remain at risk.

Limited liability partnerships (LLPs) allow for a partnership structure where each partner's liabilities is limited to the amount they put into the business. Having business partners means spreading the risk, leveraging individual skills and expertise, and establishing a division of labor.

LLPs have the same tax advantages of LLCs. They cannot, however, have corporations as owners. Perhaps the most significant difference between LLCs and LLPs is that LLPs must have at least one managing partner who bears liability for the partnership's actions.

Convenient. No minimum capital requirement. No limit on owners of business. Lower Registration Cost. No requirement of compulsory Audit. Savings from lower compliance burden. Taxation Aspect on LLP. (DDT) not applicable.