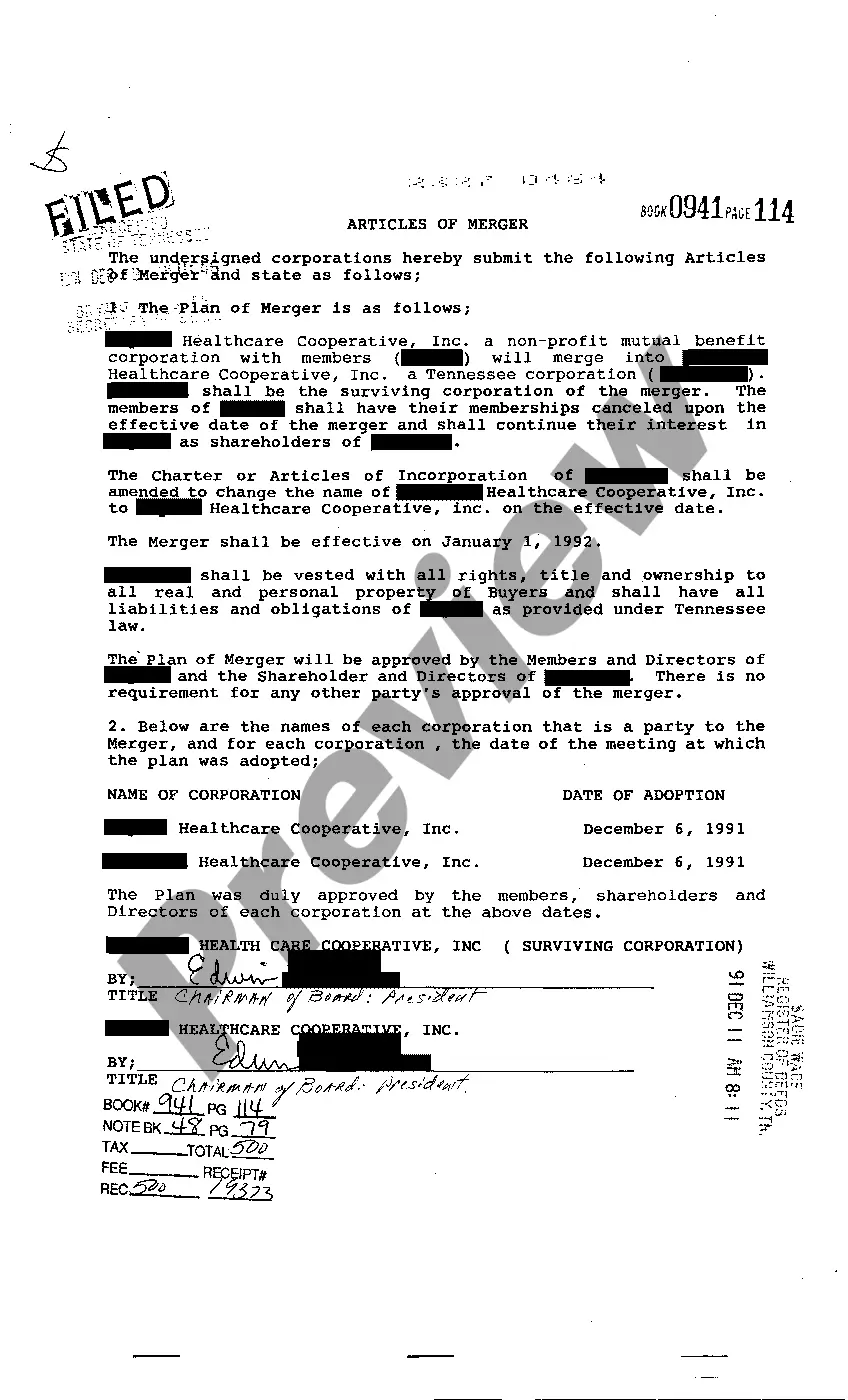

Tennessee Articles of Merger

Description

How to fill out Tennessee Articles Of Merger?

Get access to high quality Tennessee Articles of Merger templates online with US Legal Forms. Steer clear of days of lost time browsing the internet and lost money on files that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Find around 85,000 state-specific authorized and tax templates you can save and fill out in clicks within the Forms library.

To find the sample, log in to your account and click on Download button. The file is going to be stored in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, take a look at our how-guide listed below to make getting started easier:

- Find out if the Tennessee Articles of Merger you’re considering is suitable for your state.

- Look at the form utilizing the Preview function and read its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to go on to register.

- Pay out by card or PayPal to complete making an account.

- Pick a preferred format to download the document (.pdf or .docx).

Now you can open the Tennessee Articles of Merger sample and fill it out online or print it out and do it by hand. Think about sending the papers to your legal counsel to ensure all things are filled out correctly. If you make a error, print out and fill sample again (once you’ve registered an account all documents you download is reusable). Make your US Legal Forms account now and access much more forms.

Form popularity

FAQ

The name of the LLC. The names of the members and managers of the LLC. The address of the LLC's principal place of business.

How much does it cost to form an LLC in Tennessee? The Tennessee Secretary of State charges $50 per LLC member included in the filing, with a minimum total fee of $300. The filing fee cannot exceed $3,000 for the Articles of Organization.

Option 1: Access the Tennessee Secretary of State's online services. Option 2: Download and mail in the Articles of Organization PDF to the Tennessee Secretary of State or submit it in-person. State Filing Cost: $50 per member, with a minimum of $300 and a maximum of $3000.

Choose a Name for Your Series LLC. Get a Domain Name. Designate a Registered Agent. Prepare and File the Articles of Organization. Acquire an EIN. Create a Series LLC Operating Agreement. Create a Financial Infrastructure. Obtain Licenses and Permits.

Articles of Merger means those Articles or Certificates of Merger with respect to the Merger substantially in the forms attached as Annex I hereto or with such other changes therein as may be required by applicable state laws.

Do the Articles of Organization need to be notarized? Some states require that you have your Articles of Organization documents notarized. For your state's notarization requirements, choose your state from the drop-down list above.

Visit Tennessee's Secretary of State website. Select Corporations from the drop-down menu of the Business Services tab.

Tennessee, however, is different: it does not recognize the federal S election, and instead treats S corporations like traditional corporations, including requiring them to pay the same taxes as traditional corporations.In addition, individual shareholders who receive dividends will owe tax to the state.

Choose a corporate name. File your Articles of Incorporation. Appoint a registered agent. Start a corporate records book. Prepare corporate bylaws. Appoint initial directors. Hold first Board of Directors meeting. Issue stock to shareholders.