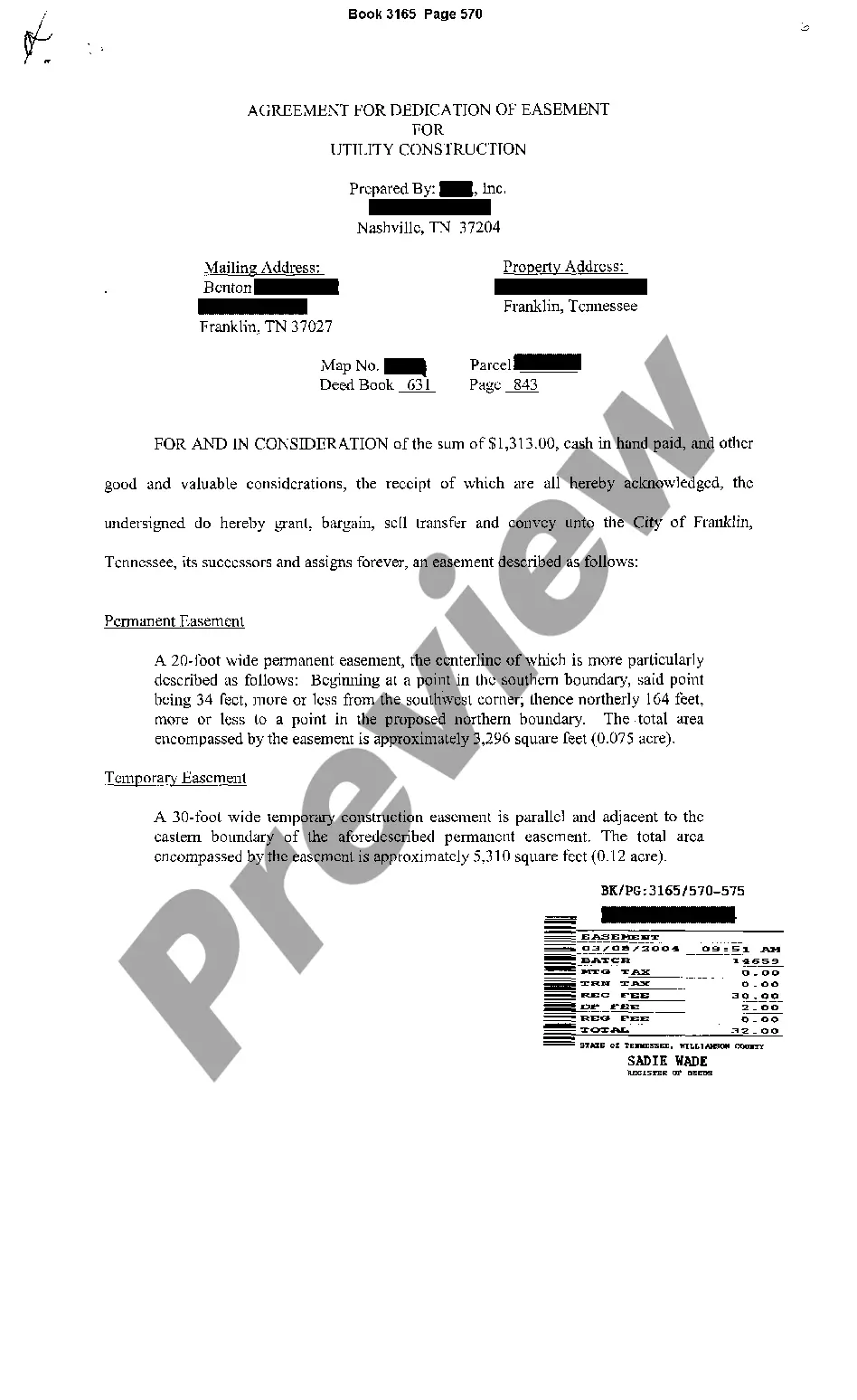

Tennessee Claim of Mineral Interest

Description

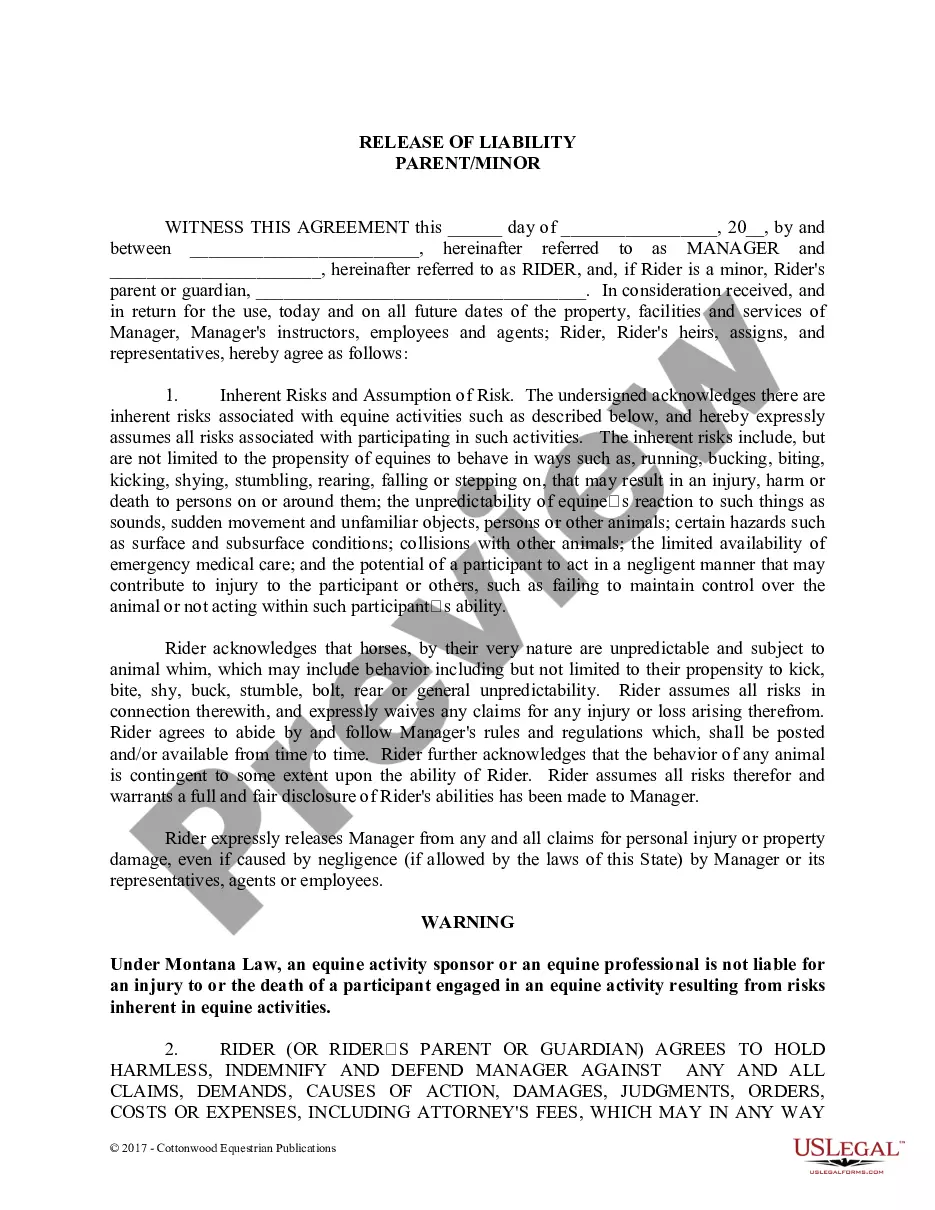

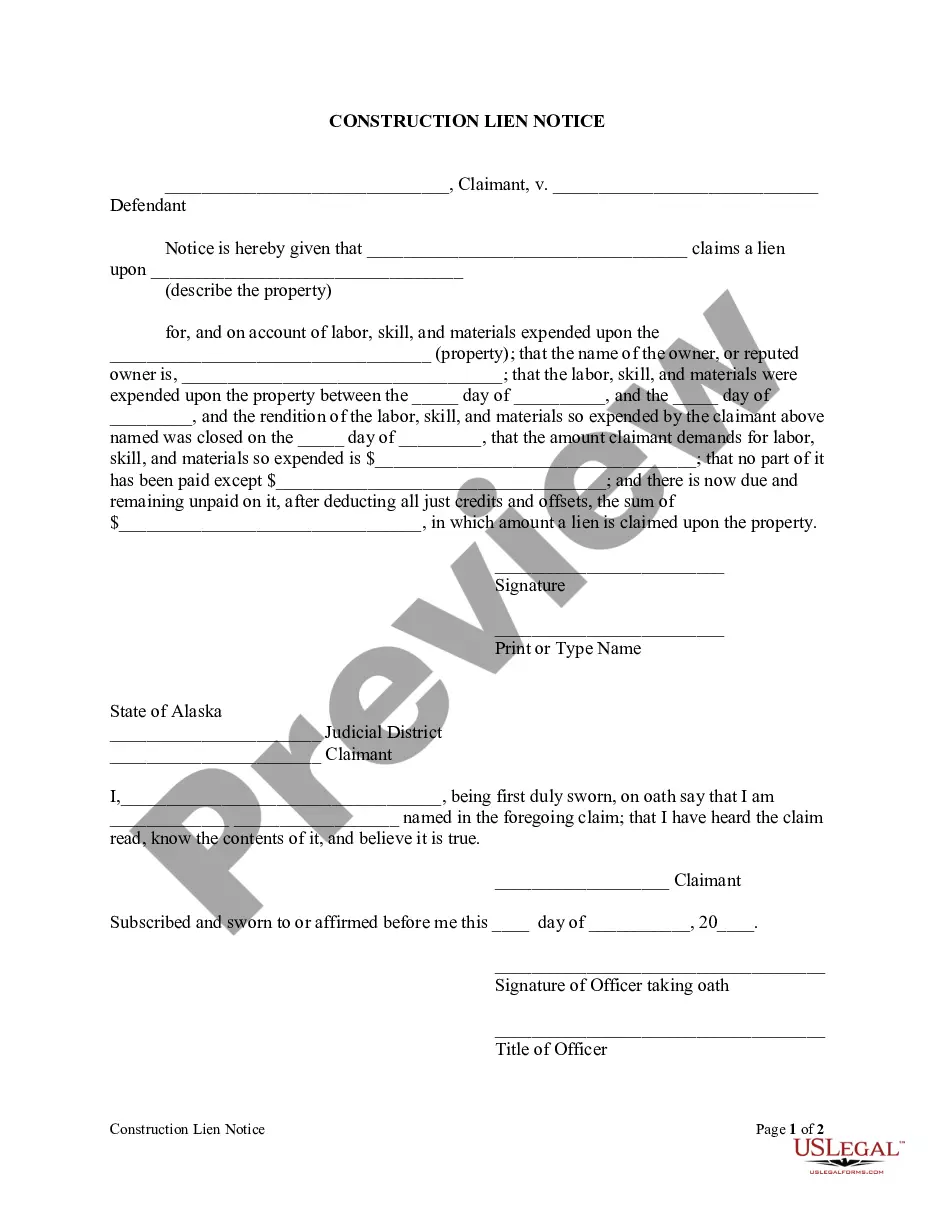

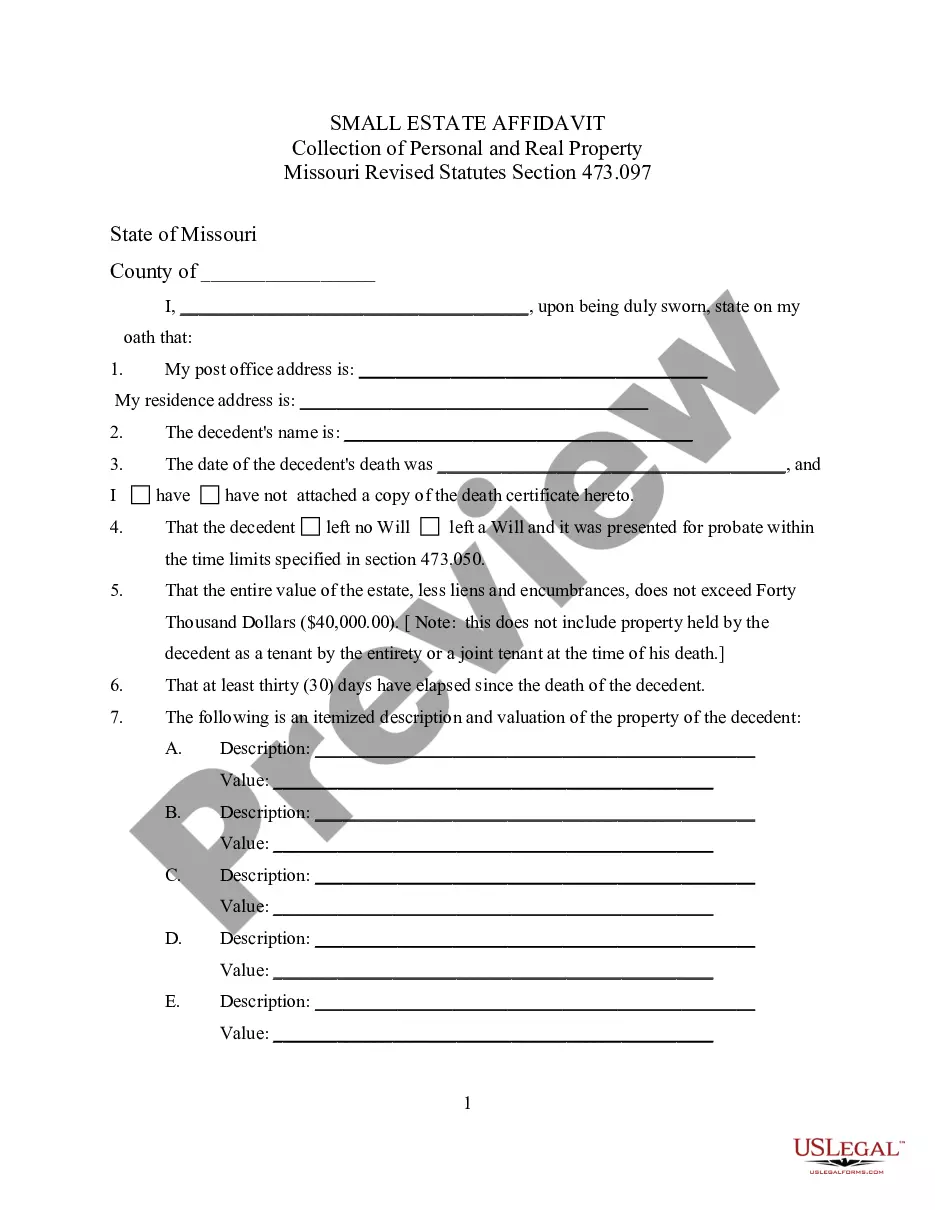

How to fill out Tennessee Claim Of Mineral Interest?

Access to high quality Tennessee Claim of Mineral Interest samples online with US Legal Forms. Prevent hours of misused time looking the internet and lost money on forms that aren’t updated. US Legal Forms provides you with a solution to just that. Get around 85,000 state-specific legal and tax forms that you can save and complete in clicks within the Forms library.

To receive the sample, log in to your account and click on Download button. The document will be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide below to make getting started easier:

- Find out if the Tennessee Claim of Mineral Interest you’re considering is appropriate for your state.

- Look at the sample making use of the Preview function and read its description.

- Check out the subscription page by clicking on Buy Now button.

- Select the subscription plan to continue on to register.

- Pay by card or PayPal to complete creating an account.

- Choose a preferred file format to download the file (.pdf or .docx).

Now you can open the Tennessee Claim of Mineral Interest template and fill it out online or print it out and get it done yourself. Think about giving the papers to your legal counsel to make sure all things are completed appropriately. If you make a mistake, print and fill sample once again (once you’ve created an account all documents you download is reusable). Create your US Legal Forms account now and get access to a lot more forms.

Form popularity

FAQ

One important factor you must keep in mind is that if real estate contains mineral rights, simply buying the property doesn't make you the owner of them. Since mineral rights can be sold separately from the land itself, even if you own the land, someone else may hold ownership of what's below it.

Conclusion. If you are ready to list or purchase mineral rights, the best mineral rights value rule of thumb to use is the current market price. Today, your mineral rights may sell for $2,000 an acre, but if the developers drill a few dry wells tomorrow, that value could plummet.

Nationally, mineral rights owners can expect anywhere from $100 to $5,000 per acre for their mineral rights lease. The most valuable mineral rights leases are on producing parcels of land that are still expected to hold many more precious minerals.

Mineral rights don't come into effect until you begin to dig below the surface of the property. But the bottom line is: if you do not have the mineral rights to a parcel of land, then you do not have the legal ability to explore, extract, or sell the naturally occurring deposits below.

In the United Kingdom, the ownership of oil, gas, gold and silver is held by the Crown Estate. Exploitation of these resources is overseen and run by the Crown Estate. The ownership and licensing of unworked coal and coal mines in the United Kingdom is managed by the Coal Authority.

Mineral rights can be complex. By law, property falls into two categories real or personal. Real property includes land and whatever is permanently attached to land, found on it either by nature, (water, trees, or minerals) or by man (buildings, fences, bridges, roads).

Mineral rights are often sold separately from the land they are on. You may have title to the mineral rights on a property you own, or a previous owner may have sold or leased them in which case, they may not be yours to sell. But there is no need to abandon the idea of monetizing your mineral reserves!

Common ways to research mineral rights include: Reviewing County Records and Tax Assessor's Documents By performing a title deed search at the county records office, you can see the ownership history of any particular property over time.