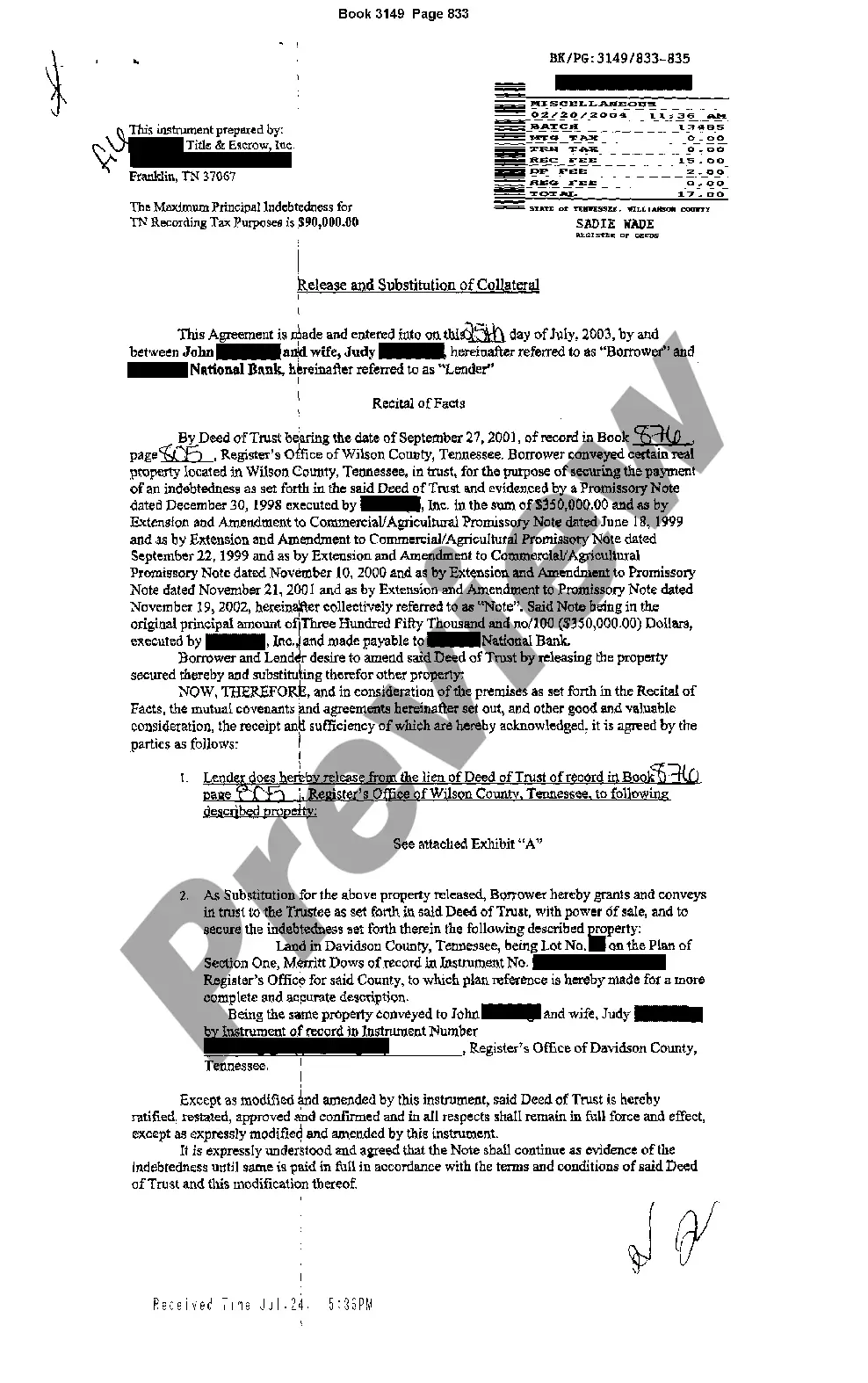

Tennessee Release and Substitution of Collateral

Description Substitution Of Collateral

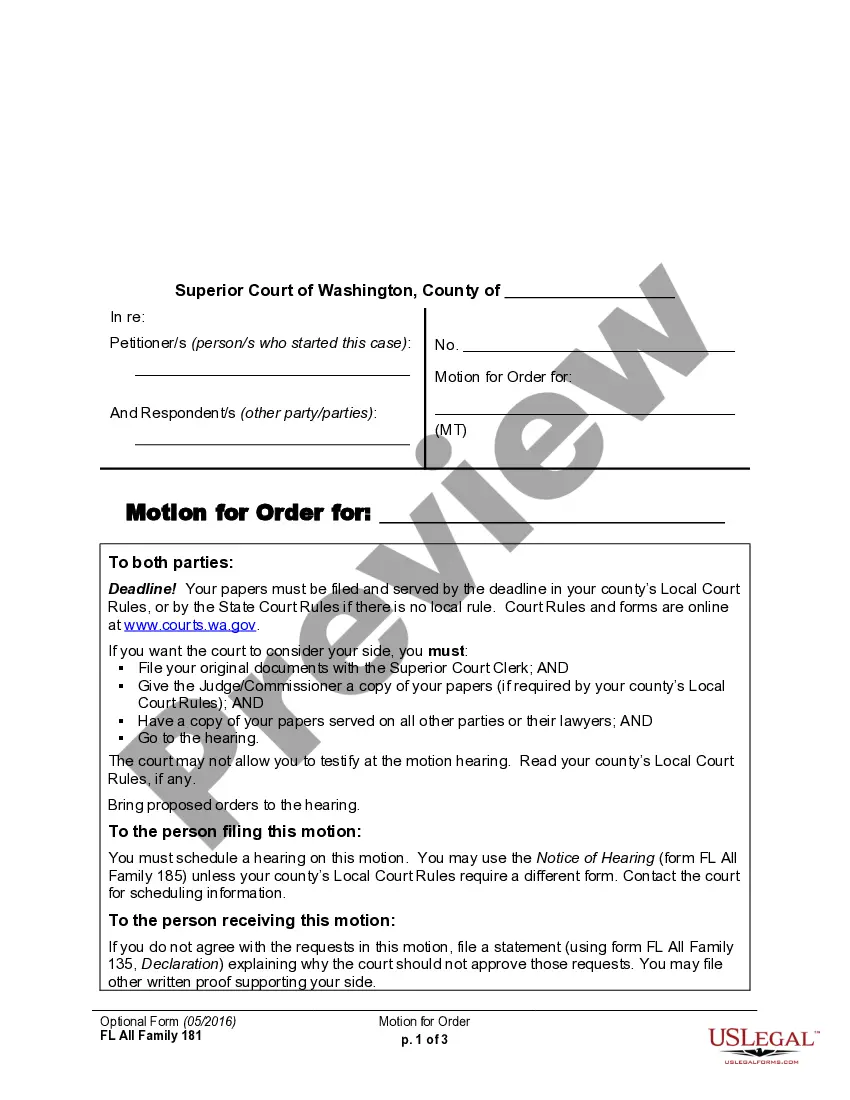

How to fill out Tennessee Release And Substitution Of Collateral?

Access to quality Tennessee Release and Substitution of Collateral samples online with US Legal Forms. Prevent hours of wasted time searching the internet and lost money on files that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Get over 85,000 state-specific authorized and tax templates that you could download and submit in clicks in the Forms library.

To get the sample, log in to your account and click on Download button. The document will be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, have a look at our how-guide listed below to make getting started easier:

- Verify that the Tennessee Release and Substitution of Collateral you’re looking at is appropriate for your state.

- Look at the form making use of the Preview option and browse its description.

- Check out the subscription page by clicking on Buy Now button.

- Choose the subscription plan to go on to sign up.

- Pay by card or PayPal to finish making an account.

- Choose a preferred file format to save the file (.pdf or .docx).

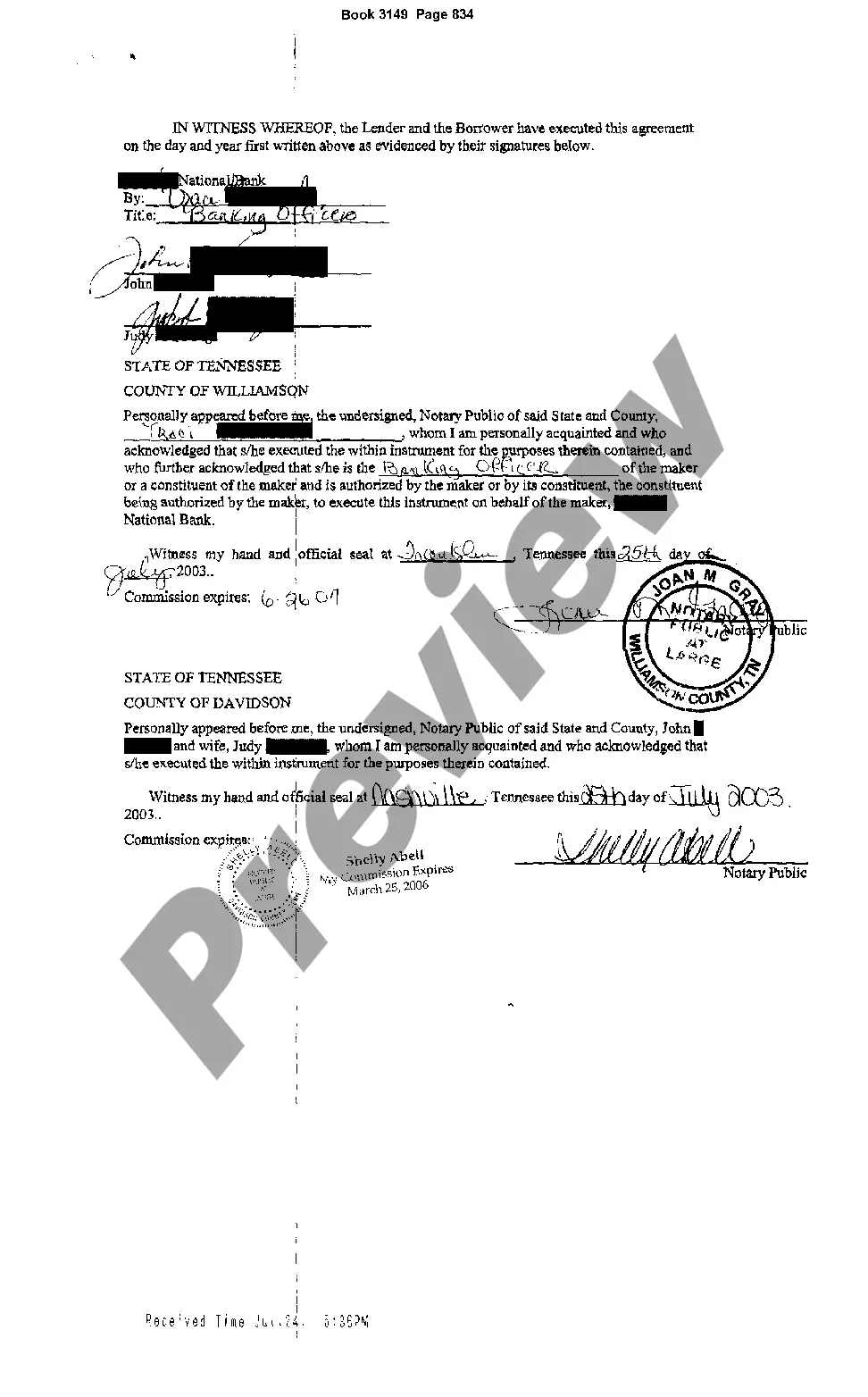

You can now open the Tennessee Release and Substitution of Collateral sample and fill it out online or print it and do it by hand. Consider sending the document to your legal counsel to be certain things are filled in correctly. If you make a error, print and complete sample again (once you’ve made an account all documents you download is reusable). Create your US Legal Forms account now and access far more forms.

Substitution Of Collateral Real Estate Form popularity

Substitution Of Collateral Agreement Form Other Form Names

FAQ

Subordinate or Substitute. Subordination occurs when a lender who holds a mortgage (or deed of trust) on a piece of property agrees to make their lien subordinate to another lien. A mortgage or deed of trust is a lien placed on a property as collateral for a loan.

The term collateral refers to an asset that a lender accepts as security for a loan. Collateral may take the form of real estate or other kinds of assets, depending on the purpose of the loan. The collateral acts as a form of protection for the lender.

Substitution of collateral is when a lender allows the borrower to transfer the mortgage that the borrower signed to another property that the borrower has that is of equal or greater value.A clause must be in purchase agreement stating the seller allows you to substitute collateral at any time during your agreement.

These include checking accounts, savings accounts, mortgages, debit cards, credit cards, and personal loans., he may use his car or the title of a piece of property as collateral. If he fails to repay the loan, the collateral may be seized by the bank, based on the two parties' agreement.

Consider a "Substitution of Collateral." Essentially, a Substitution of Collateral is where your car lender will agree to move the lien that they have on the old (wrecked) car to a new (substitute) car. Basically, the new car becomes the security for the old loan.