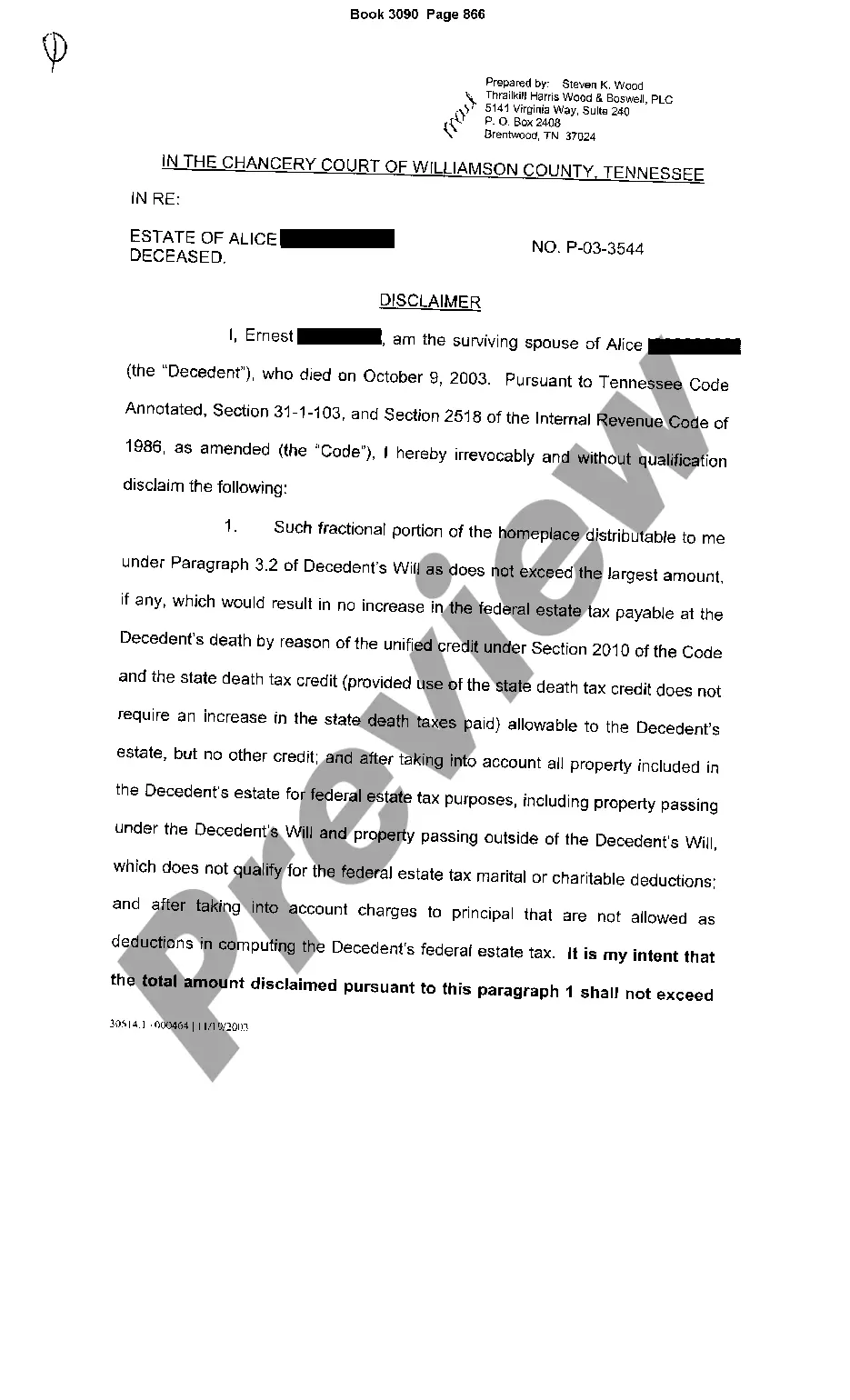

Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property

Description

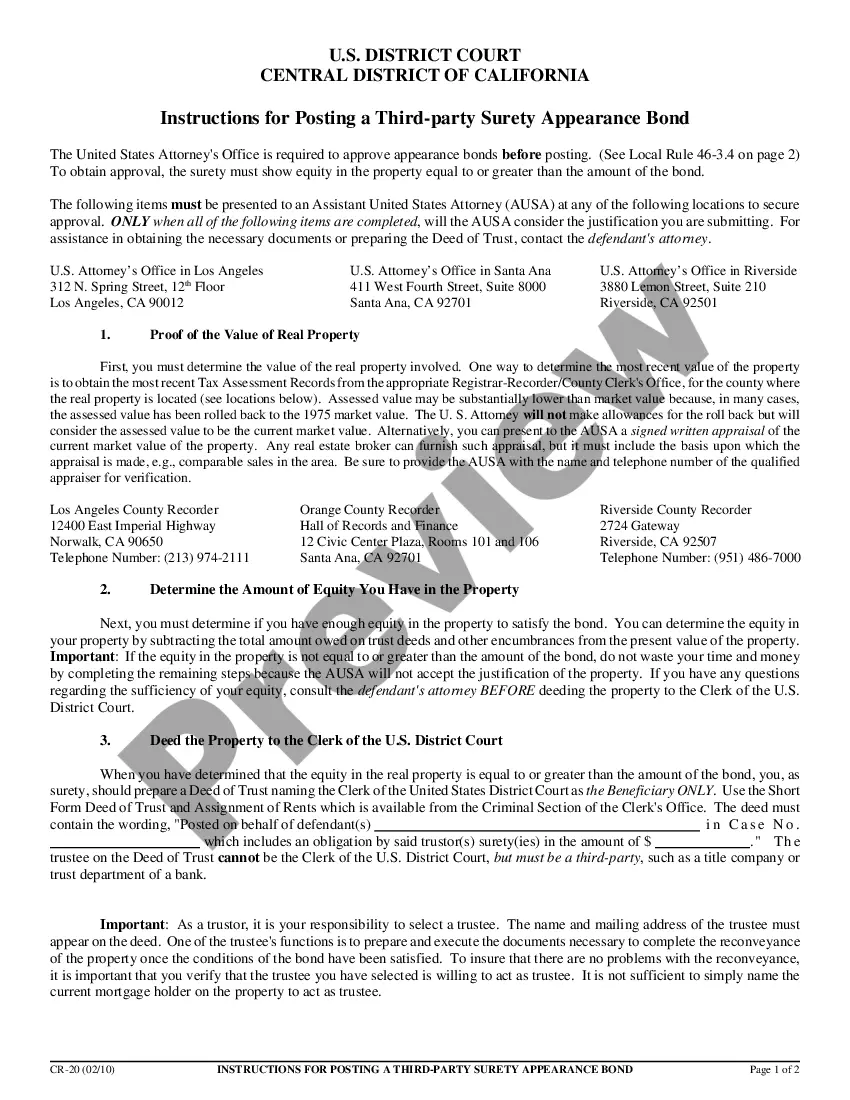

How to fill out Tennessee Disclaimer By Surviving Spouse To Portion Of Decedent's Real Property?

Get access to top quality Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property samples online with US Legal Forms. Prevent hours of misused time browsing the internet and dropped money on files that aren’t up-to-date. US Legal Forms offers you a solution to just that. Find more than 85,000 state-specific legal and tax samples that you can save and fill out in clicks in the Forms library.

To receive the sample, log in to your account and click on Download button. The file is going to be saved in two places: on the device and in the My Forms folder.

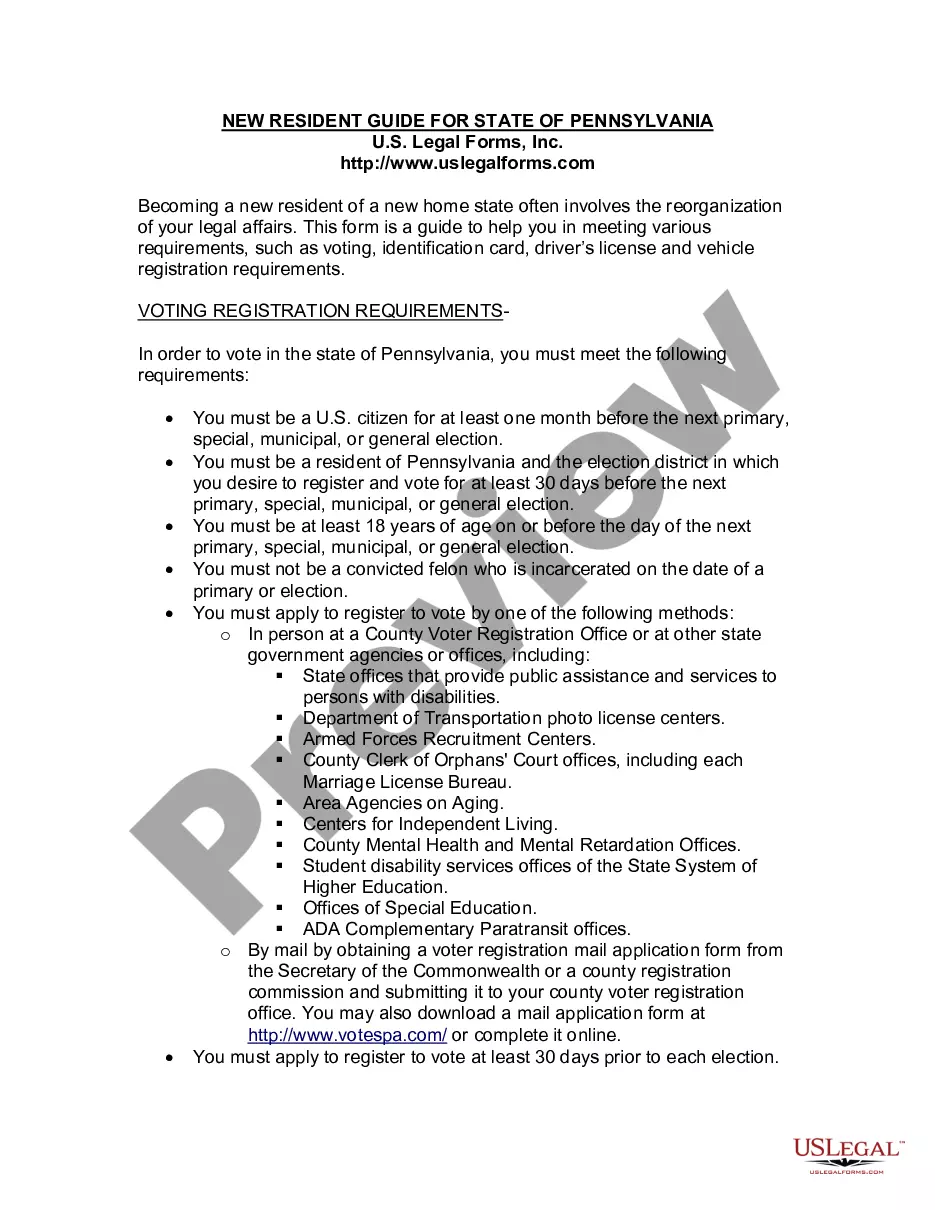

For those who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

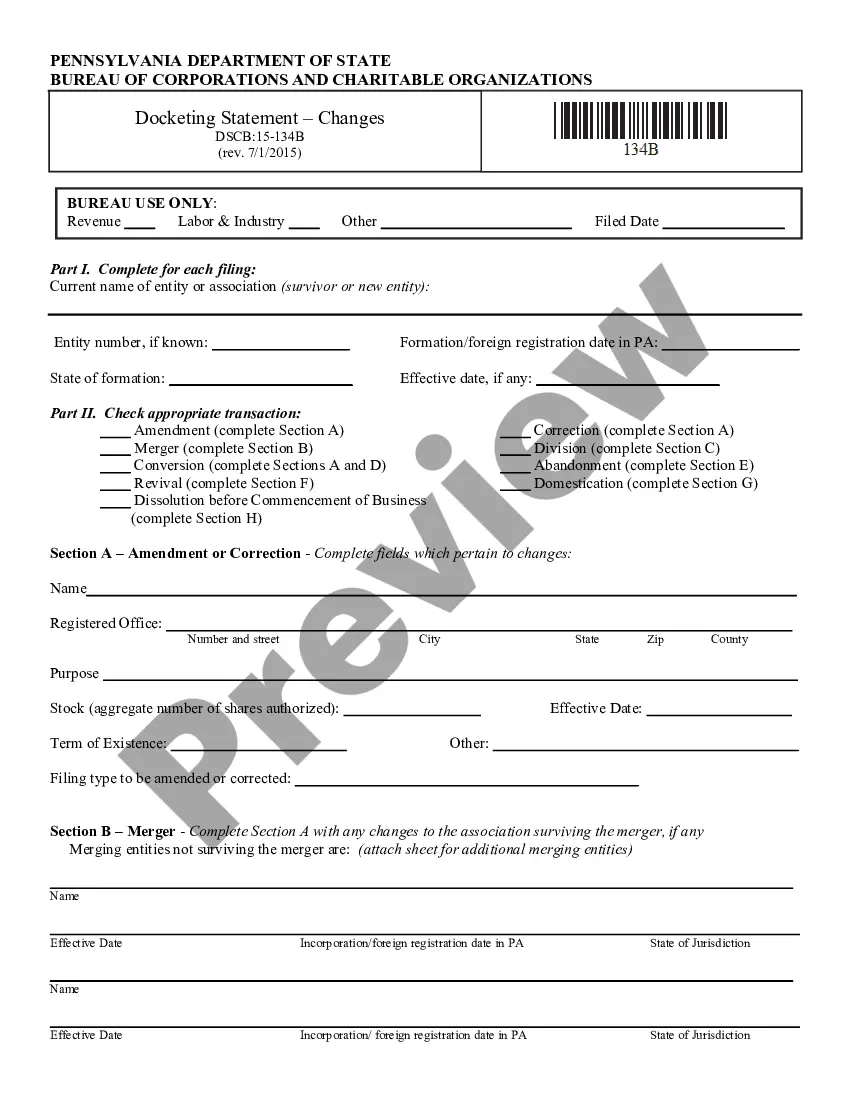

- Find out if the Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property you’re looking at is appropriate for your state.

- Look at the sample using the Preview function and read its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to keep on to register.

- Pay by credit card or PayPal to complete making an account.

- Select a favored file format to save the file (.pdf or .docx).

You can now open up the Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property sample and fill it out online or print it out and do it by hand. Think about sending the file to your legal counsel to be certain all things are completed properly. If you make a mistake, print and complete sample again (once you’ve registered an account all documents you download is reusable). Create your US Legal Forms account now and get a lot more forms.

Form popularity

FAQ

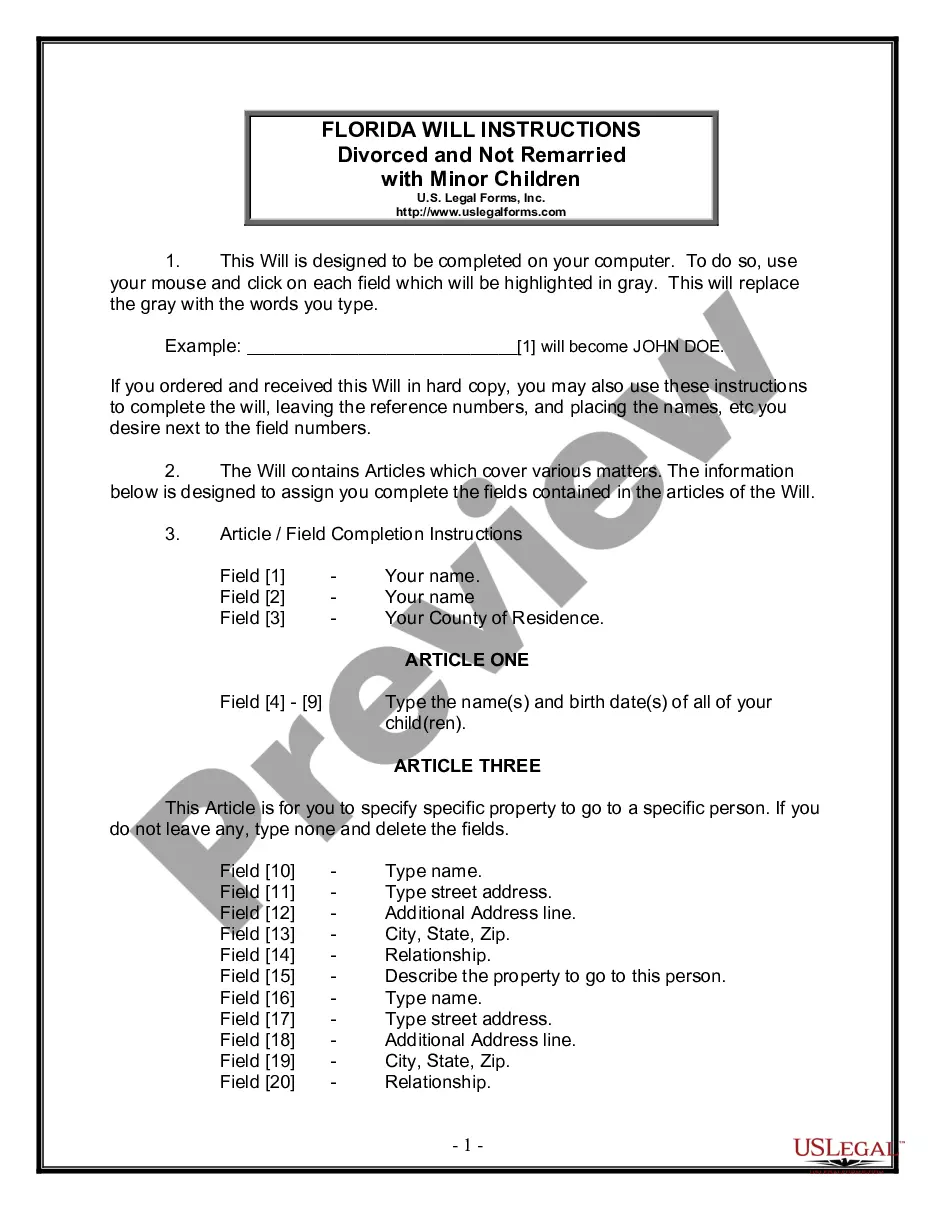

A disclaimer trust is a clause typically included in a person's will that establishes a trust upon their death, subject to certain specifications. This allows certain assets to be moved into the trust by the surviving spouse without being subject to taxation.

Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Setting up a joint tenancy is easy, and it doesn't cost a penny.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

A qualified disclaimer is a refusal to accept property that meets the provisions set forth in the Internal Revenue Code (IRC) Tax Reform Act of 1976, allowing for the property or interest in property to be treated as an entity that has never been received.

Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest. Silence or otherwise passive behaviour will not suffice.

The beneficiary can avoid receiving the trust assets through a disclaimer. A disclaimer is a legal act where the beneficiary instructs the trustee to disregard the beneficiary as though he was dead, as though he predeceased the trust's intended end.

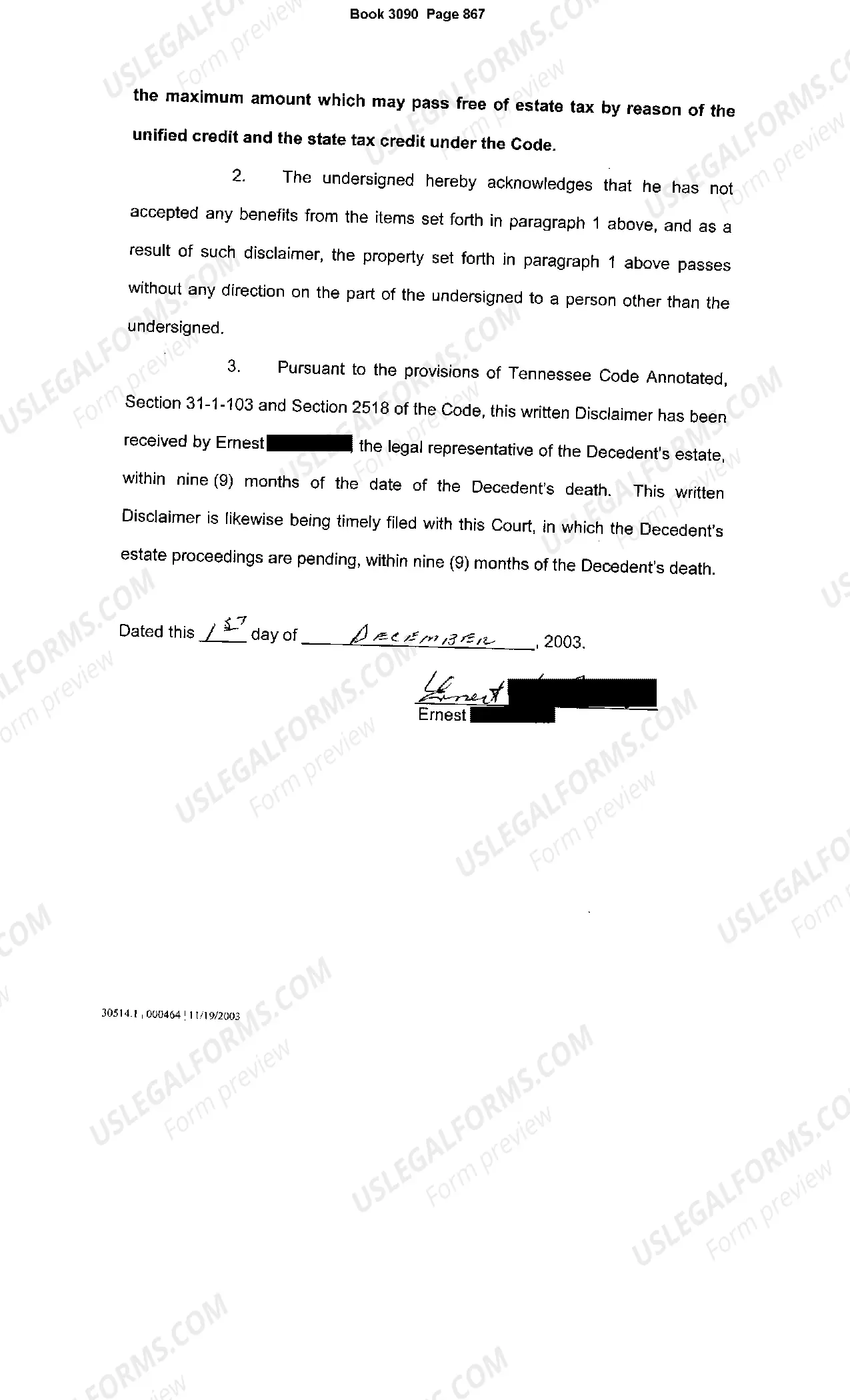

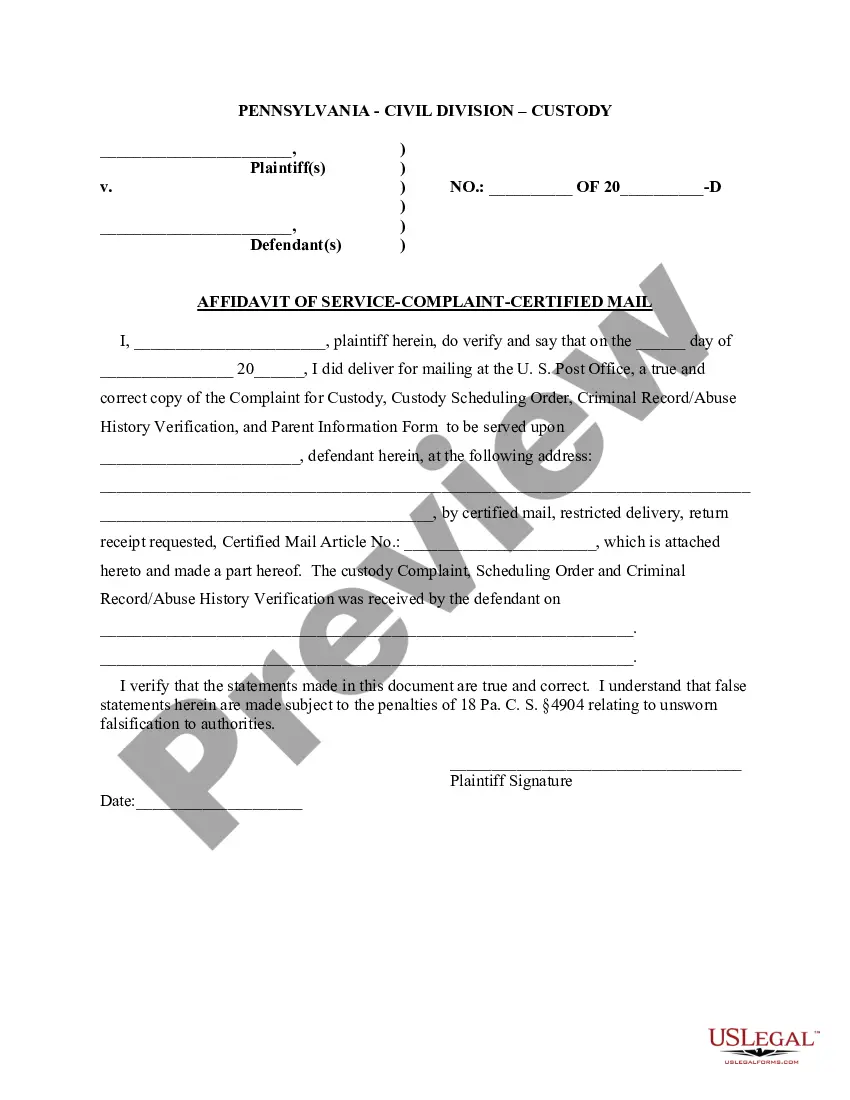

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.

The surviving spouse can serve as the sole trustee, but cannot have any power to direct the beneficial enjoyment of the disclaimed property unless the power is limited by an "ascertainable standard." This is necessary both to qualify the disclaimer and to avoid any taxable general power of appointment.

Jointly owned property is treated as consisting of a both present and a future interest in the jointly owned property. Thus, a surviving spouse may disclaim the future interest in jointly owned property on the death of their spouse, including assets that were held by the spouses as tenants by the entirety.