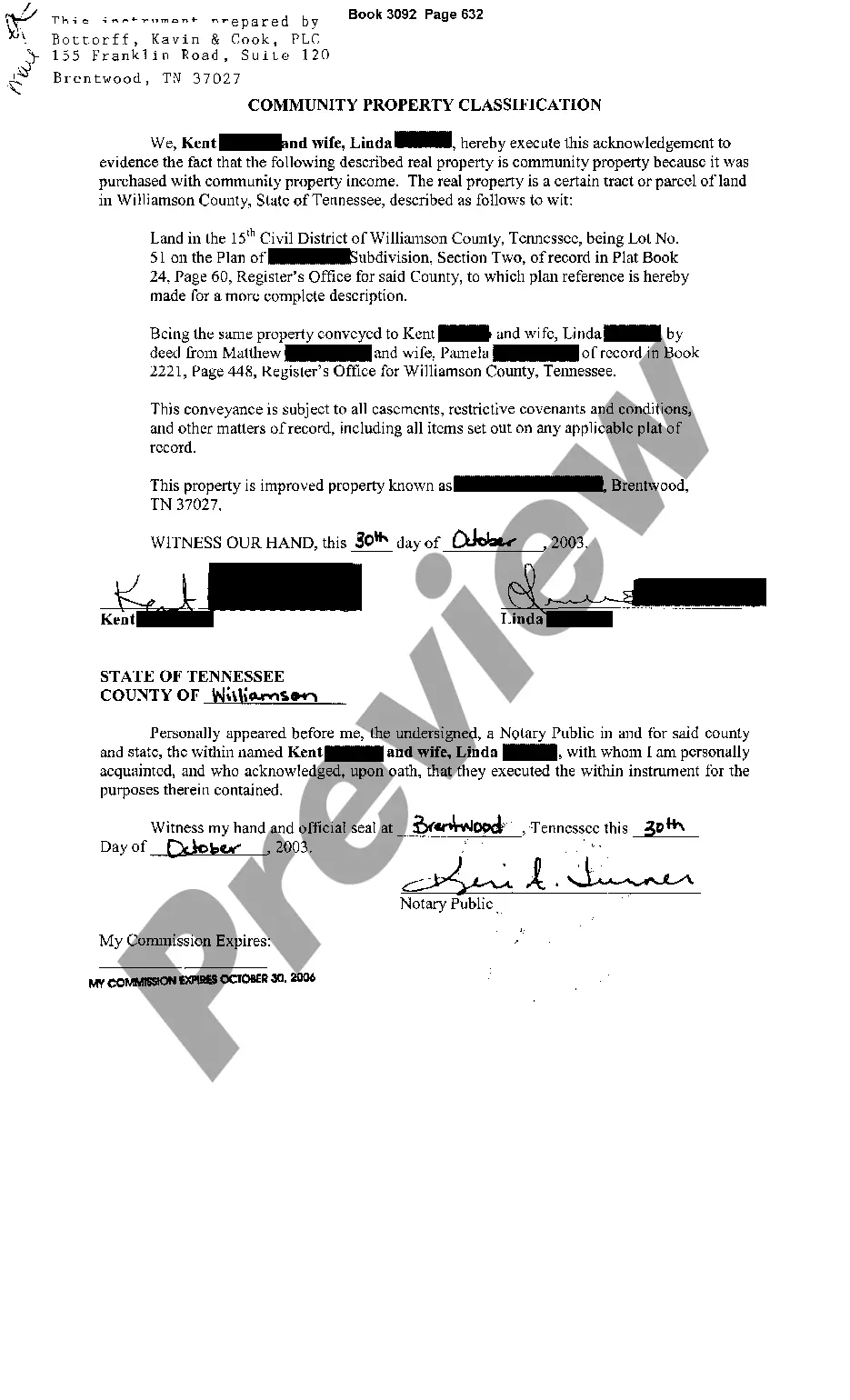

Tennessee Community Property Classification

Description

How to fill out Tennessee Community Property Classification?

Get access to high quality Tennessee Community Property Classification forms online with US Legal Forms. Avoid hours of wasted time looking the internet and dropped money on files that aren’t updated. US Legal Forms offers you a solution to exactly that. Get above 85,000 state-specific legal and tax samples that you could save and submit in clicks in the Forms library.

To get the example, log in to your account and then click Download. The file is going to be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- Verify that the Tennessee Community Property Classification you’re looking at is appropriate for your state.

- See the sample using the Preview function and read its description.

- Visit the subscription page by simply clicking Buy Now.

- Select the subscription plan to keep on to register.

- Pay by card or PayPal to finish creating an account.

- Choose a preferred format to save the document (.pdf or .docx).

Now you can open up the Tennessee Community Property Classification example and fill it out online or print it and get it done yourself. Take into account giving the file to your legal counsel to make certain everything is filled in properly. If you make a mistake, print out and complete application once again (once you’ve made an account all documents you download is reusable). Create your US Legal Forms account now and access far more templates.

Form popularity

FAQ

Under Tennessee law, only marital property is subject to equitable division upon divorce. Specifically, marital property is defined as any assets or property acquired by either you or your spouse while you are married.

Property distribution upon death or separation: When one spouse passes away, his or her half of the community property passes to the surviving spouse. Their separate property can be devised to whomever they wish according to their will, or via probate without a will.

Community property states are Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

Thus, we have the Moore/Marsden calculation, which is as follows: Add together the dollar-for-dollar reimbursement and the pro tanto share and you get the community interest in the property. Multiply this by this equation: Numerator = Community property payments of principal.

The court determines the spouses' contributions to increase to determined value. Everything else is separate property, and is awarded to the spouse whose property it is.Tennessee is not a community property state, like California or New York. Tennessee is an equitable division state.

Thus, we have the Moore/Marsden calculation, which is as follows: Add together the dollar-for-dollar reimbursement and the pro tanto share and you get the community interest in the property. Multiply this by this equation: Numerator = Community property payments of principal.

At divorce, community property is generally divided equally between the spouses, while each spouse keeps his or her separate property. Equitable distribution. In all other states, assets and earnings accumulated during marriage are divided equitably (fairly), but not necessarily equally.

Marital property refers to property that belongs to the marriage, as opposed to separate property, which is separately owned by one spouse or the other. Marital property includes all real and personal property, whether tangible or intangible, acquired by either or both spouses during the course of the marriage.

In California, each spouse or partner owns one-half of the community property. And, each spouse or partner is responsible for one-half of the debt. Community property and community debts are usually divided equally.If the debt was incurred during your marriage or domestic partnership, it belongs to you too.