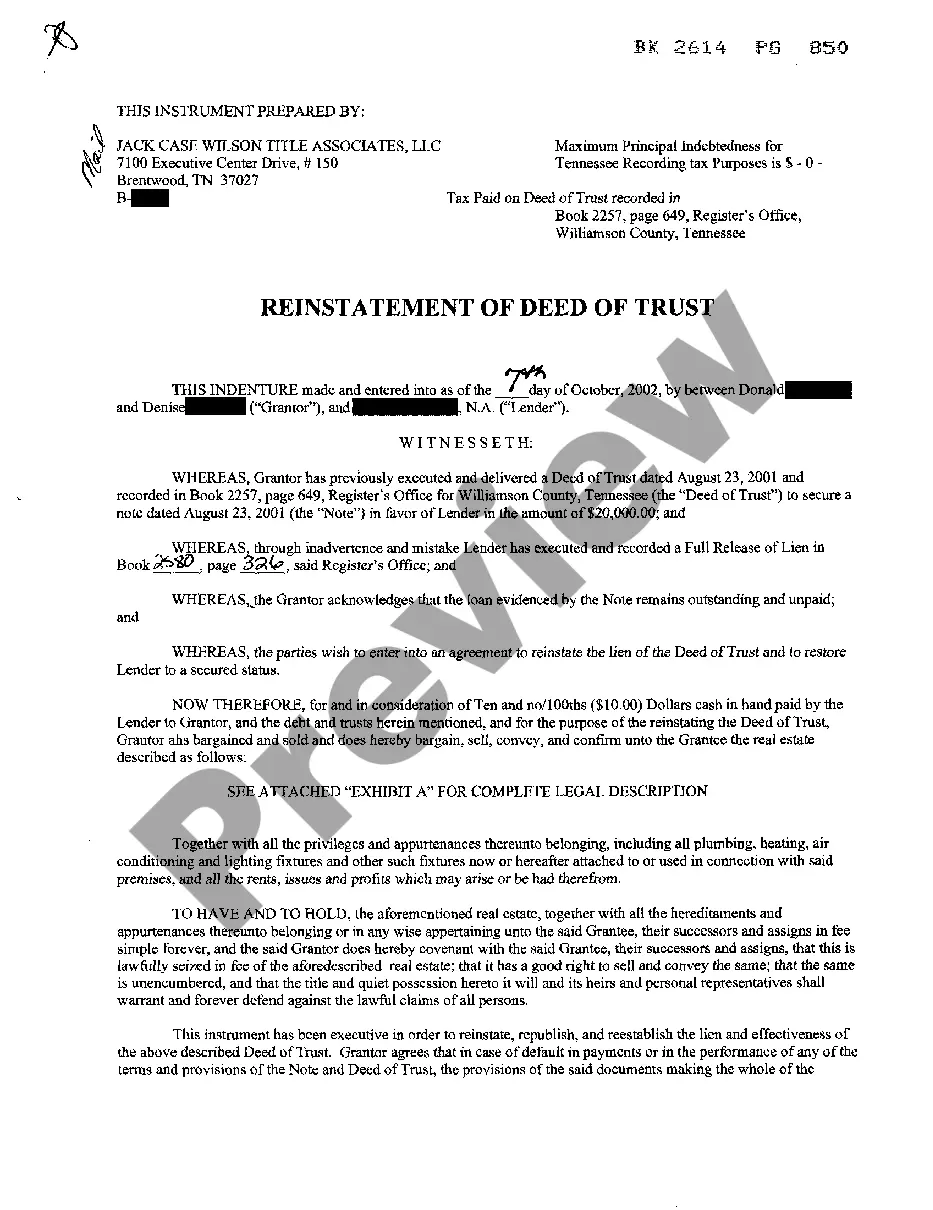

Tennessee Reinstatement of Deed of Trust

Description

How to fill out Tennessee Reinstatement Of Deed Of Trust?

Access to quality Tennessee Reinstatement of Deed of Trust forms online with US Legal Forms. Steer clear of hours of lost time searching the internet and dropped money on forms that aren’t updated. US Legal Forms provides you with a solution to just that. Find around 85,000 state-specific authorized and tax templates that you could download and submit in clicks in the Forms library.

To get the example, log in to your account and click on Download button. The document will be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide listed below to make getting started simpler:

- Find out if the Tennessee Reinstatement of Deed of Trust you’re looking at is suitable for your state.

- Look at the sample using the Preview option and read its description.

- Go to the subscription page by simply clicking Buy Now.

- Select the subscription plan to go on to sign up.

- Pay out by card or PayPal to finish making an account.

- Pick a preferred file format to save the document (.pdf or .docx).

You can now open up the Tennessee Reinstatement of Deed of Trust template and fill it out online or print it and get it done yourself. Think about sending the papers to your legal counsel to make certain everything is filled out correctly. If you make a error, print out and complete sample again (once you’ve created an account all documents you download is reusable). Make your US Legal Forms account now and get access to far more forms.

Form popularity

FAQ

Property cannot be conveyed to a grantee who does not exist. Thus, a deed to a grantee who is dead at the time of delivery is void. For example, a deed recorded by the grantor is presumed to have been delivered.For example, a deed is voidable if it was obtained by fraud in the inducement.

A deed of trust (DOT), is a document that conveys title to real property to a trustee as security for a loan until the grantor (borrower) repays the lender according to terms defined in an attached promissory note.In Tennessee, a Deed of Trust is the most commonly used instrument to secure a loan.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.

A deed of trust expires can and will expire based upon one of two specific timelines. The deed can either expire at a designated point follow the maturity date or, in the absence of this information, exactly 35 years after the date on which the deed had been recorded.

Re-recording of the original document. With corrections made in the body of the original document. A cover sheet detailing the changes. Must be re-signed and re-acknowledged. Correction Deed. A new deed reflecting the corrections/changes. Must meet all recording requirements of a deed.

When you are ready to sign a deed of trust, the parties will need to sign in the presence of a notary public.The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.