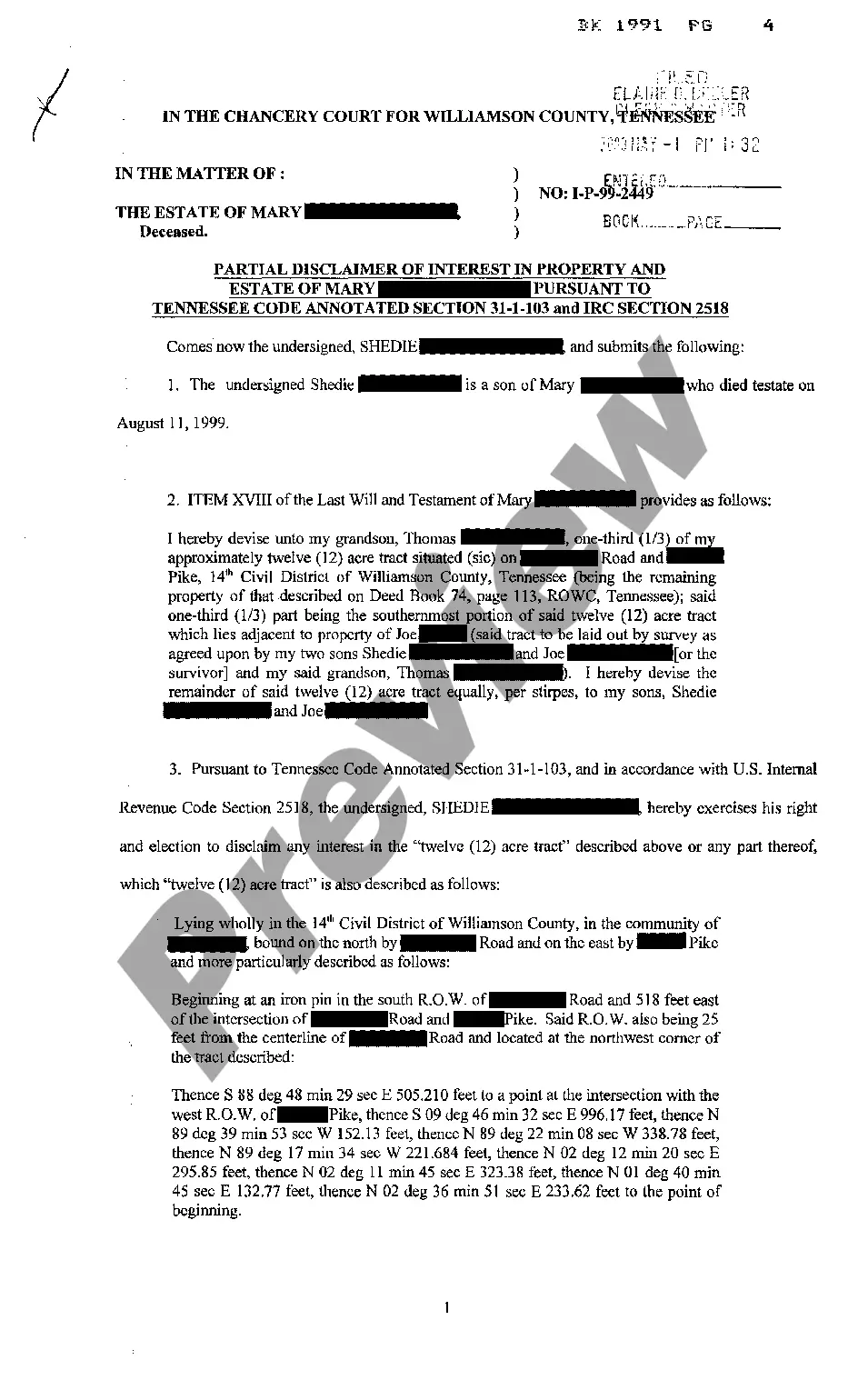

Tennessee Partial Disclaimer of Interest

Description Disclaimer Of Interest Template

How to fill out Tennessee Partial Disclaimer Of Interest?

Get access to quality Tennessee Partial Disclaimer of Interest forms online with US Legal Forms. Prevent hours of wasted time looking the internet and dropped money on forms that aren’t updated. US Legal Forms provides you with a solution to exactly that. Find around 85,000 state-specific authorized and tax forms that you can download and complete in clicks within the Forms library.

To get the sample, log in to your account and then click Download. The file is going to be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- Check if the Tennessee Partial Disclaimer of Interest you’re looking at is appropriate for your state.

- Look at the form making use of the Preview option and read its description.

- Check out the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to register.

- Pay out by credit card or PayPal to finish creating an account.

- Select a favored format to download the document (.pdf or .docx).

You can now open up the Tennessee Partial Disclaimer of Interest sample and fill it out online or print it and do it by hand. Consider giving the document to your legal counsel to be certain everything is filled in properly. If you make a error, print and complete application again (once you’ve registered an account every document you download is reusable). Create your US Legal Forms account now and get access to far more templates.

Form popularity

FAQ

By filing a properly drafted petition with the circuit court, which includes the consent of the trustee and the trust beneficiaries, an Order can be obtained directing the collapse of the ILIT and the distribution of its assets in any way the parties agree.

Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Setting up a joint tenancy is easy, and it doesn't cost a penny.

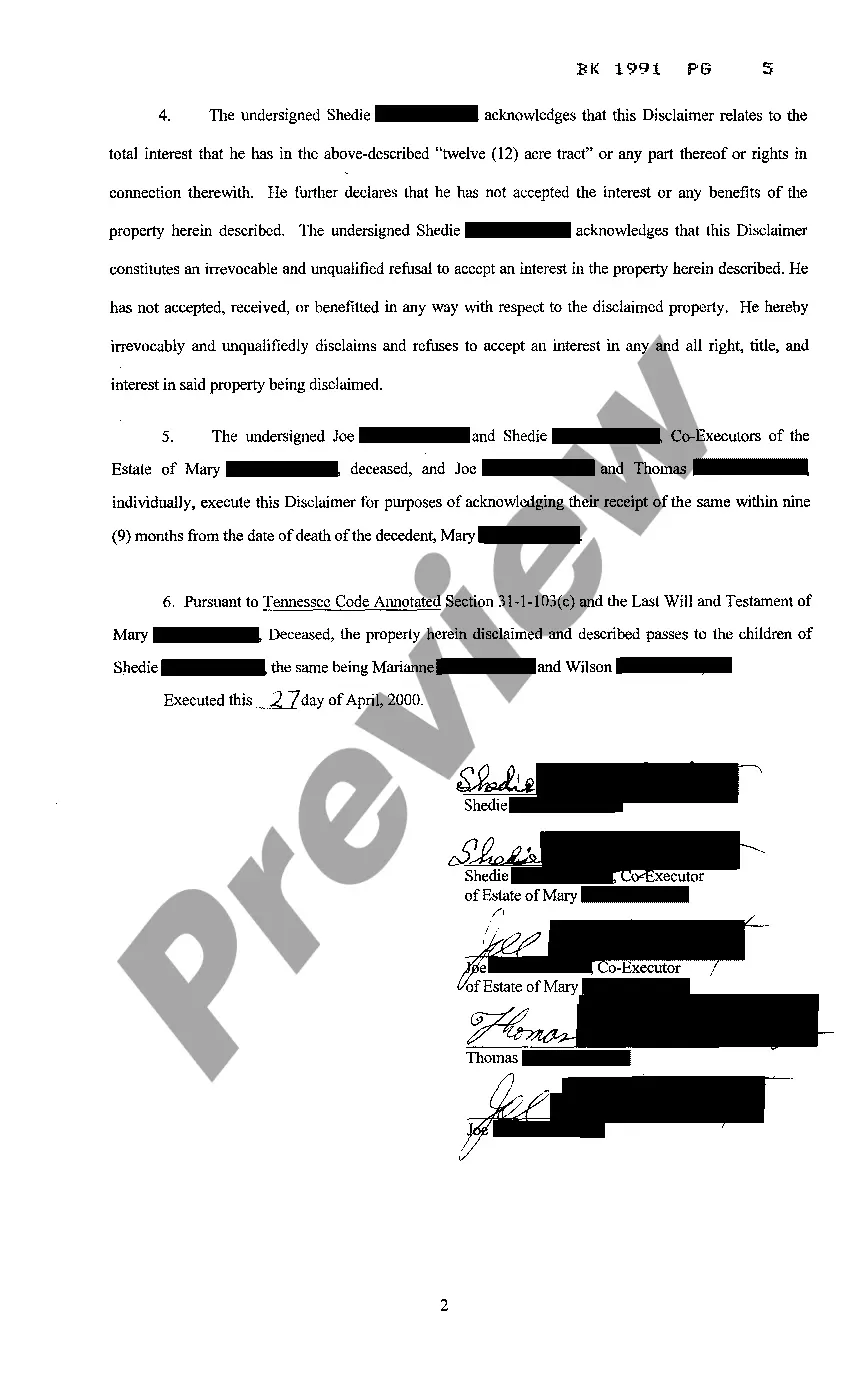

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

The Will must be filed with the probate court in the county where the decedent lived. A Petition for Probate must be filed with the probate court as well. This requests the appointment of an executor.

Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest. Silence or otherwise passive behaviour will not suffice.

Jointly owned property is treated as consisting of a both present and a future interest in the jointly owned property. Thus, a surviving spouse may disclaim the future interest in jointly owned property on the death of their spouse, including assets that were held by the spouses as tenants by the entirety.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

A marital disclaimer trust has provisions (usually contained in a will) that allow a surviving spouse to put assets in a trust by disclaiming ownership of a portion of the estate that they would have inherited after the death of the first spouse.