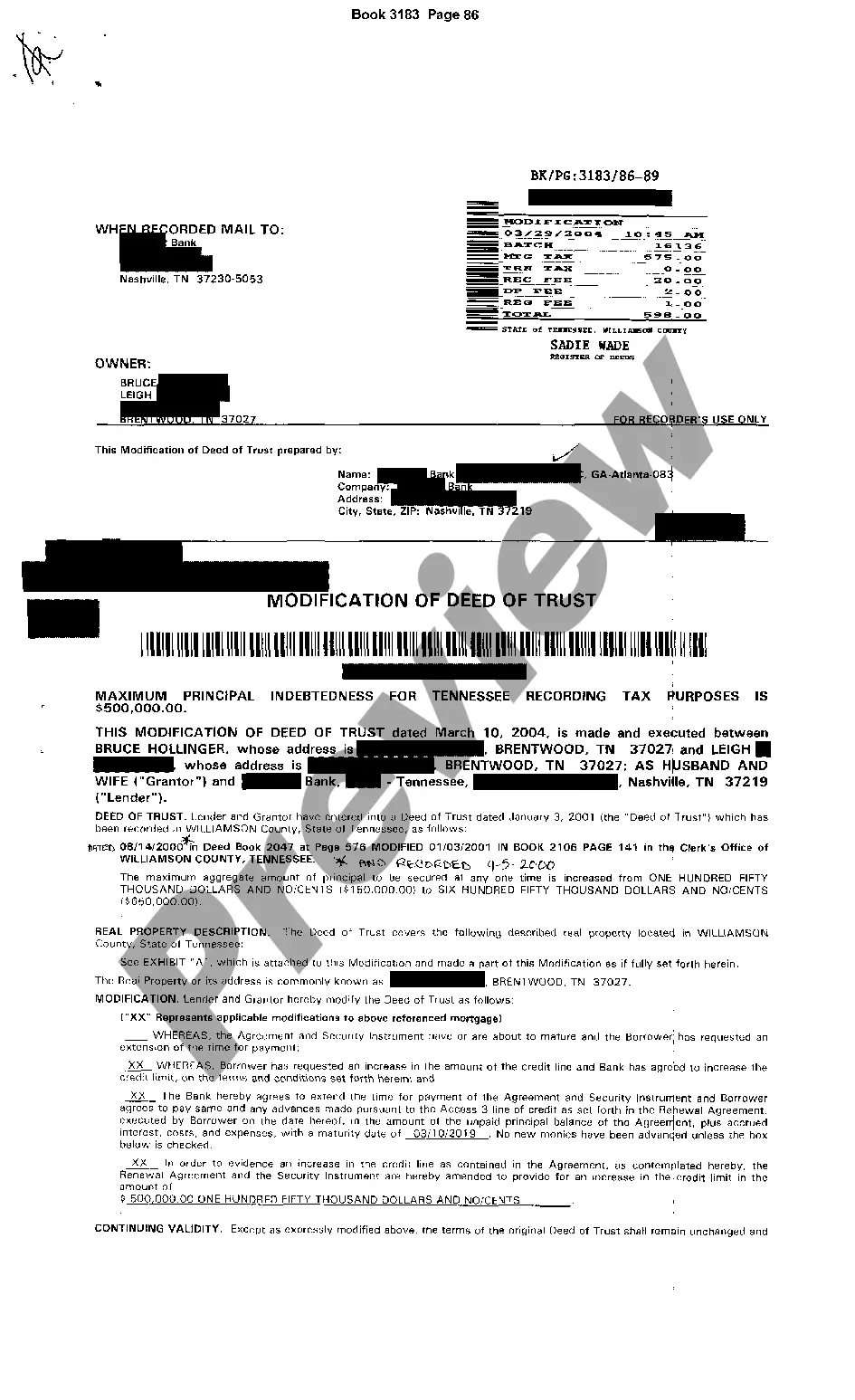

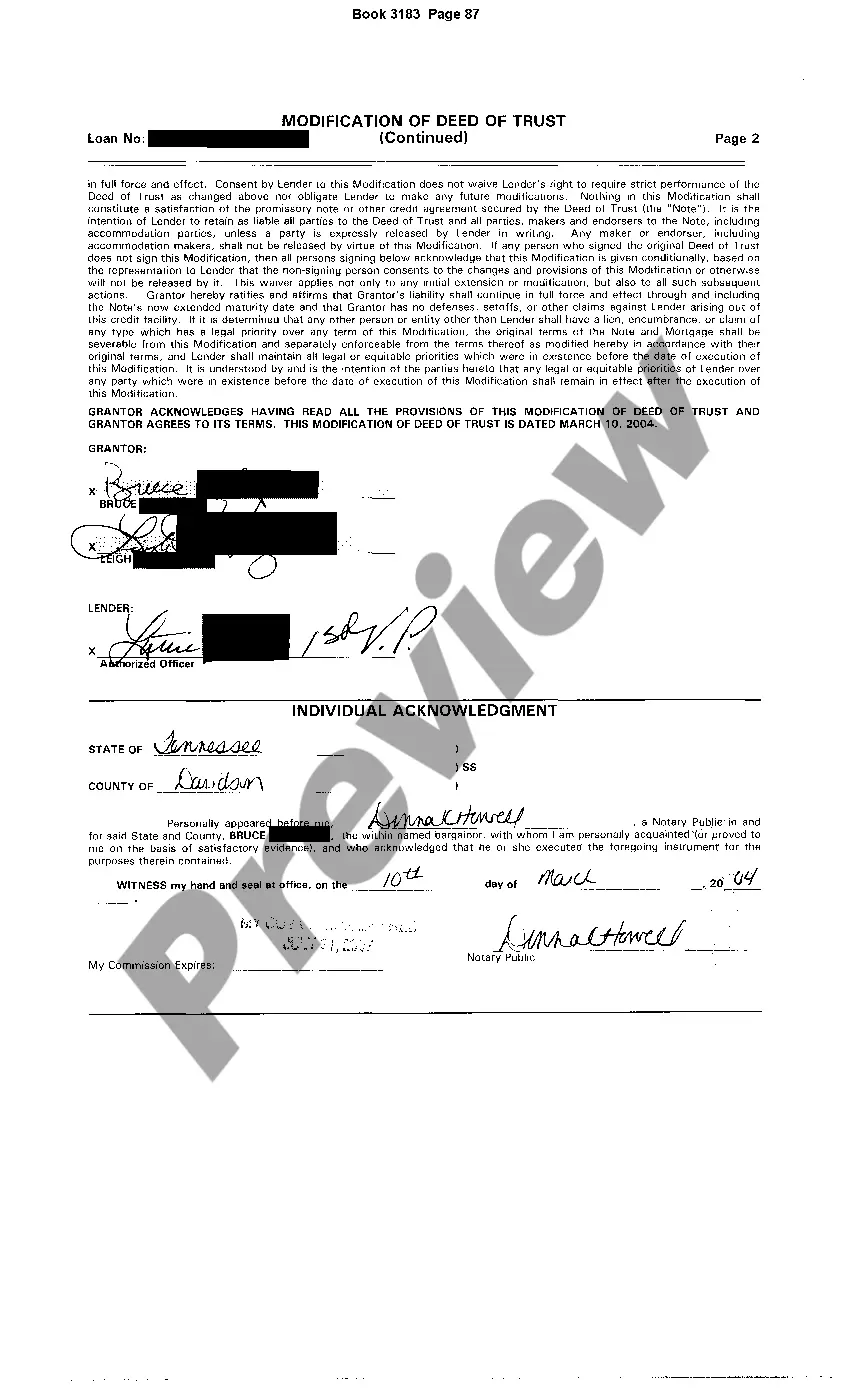

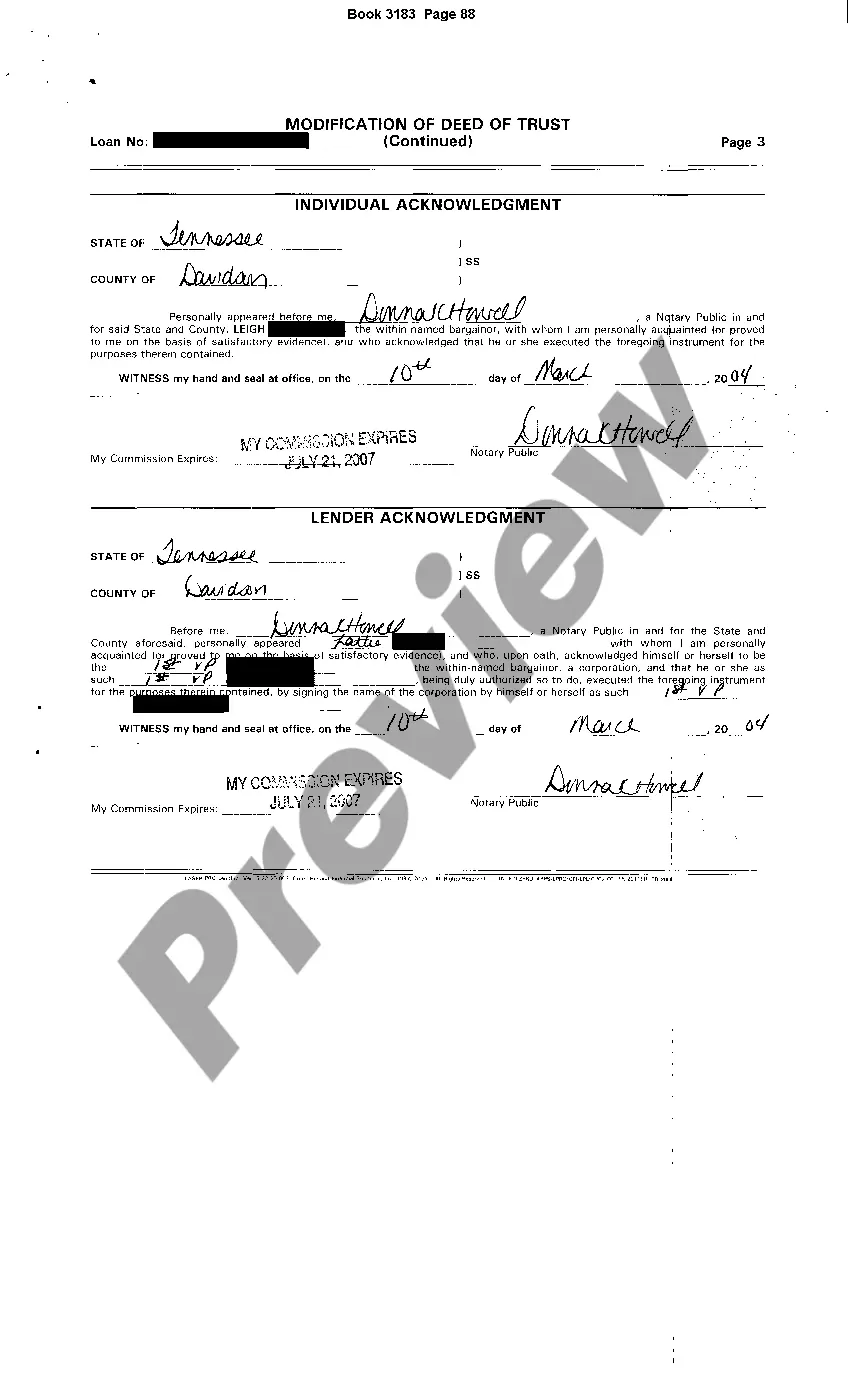

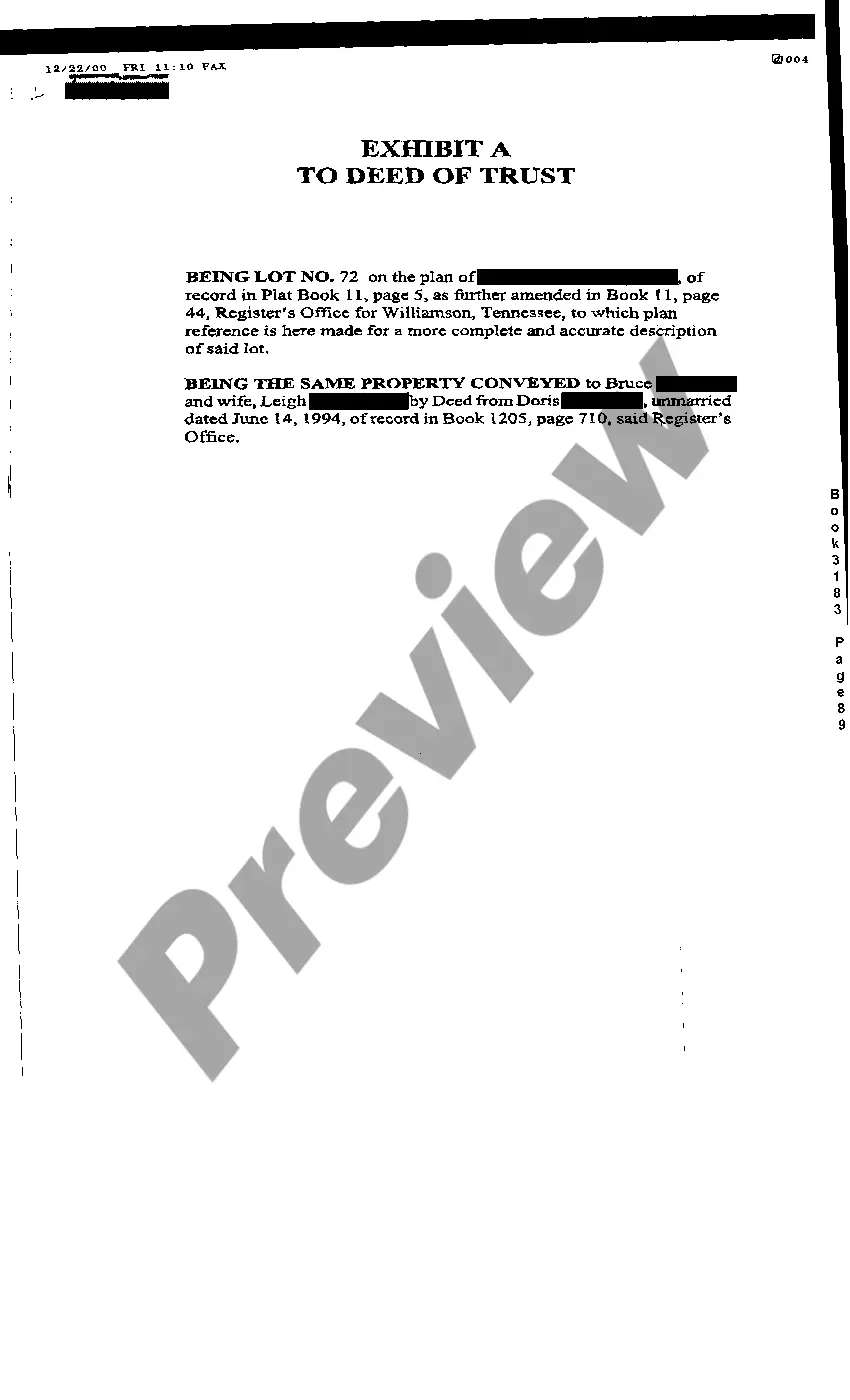

Tennessee Change or Modification of Deed of Trust to Increase Credit Line

Description Deed Of Trust Modification Form

How to fill out Tennessee Change Or Modification Of Deed Of Trust To Increase Credit Line?

Get access to high quality Tennessee Change or Modification of Deed of Trust to Increase Credit Line samples online with US Legal Forms. Avoid hours of wasted time seeking the internet and lost money on forms that aren’t updated. US Legal Forms gives you a solution to just that. Get more than 85,000 state-specific authorized and tax samples that you could download and submit in clicks within the Forms library.

To find the example, log in to your account and click Download. The document is going to be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

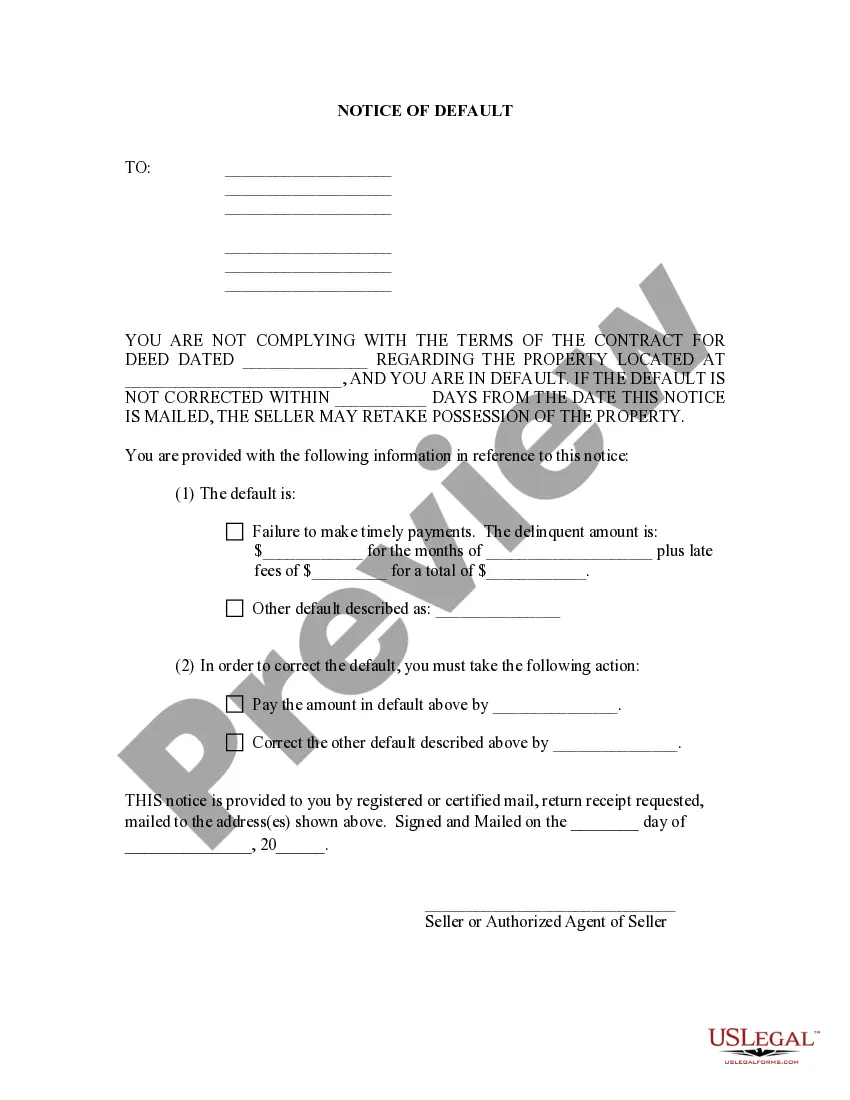

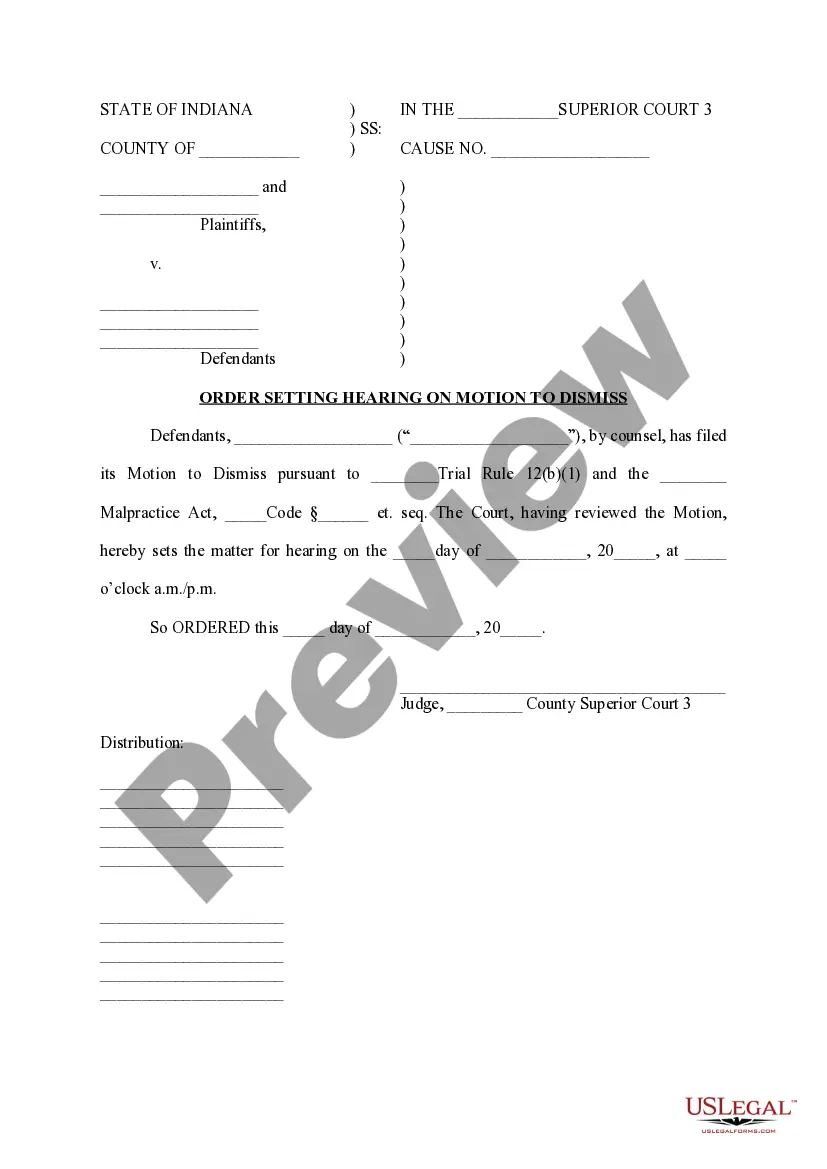

- See if the Tennessee Change or Modification of Deed of Trust to Increase Credit Line you’re considering is appropriate for your state.

- Look at the form utilizing the Preview function and browse its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to register.

- Pay by credit card or PayPal to complete making an account.

- Choose a preferred format to download the document (.pdf or .docx).

Now you can open the Tennessee Change or Modification of Deed of Trust to Increase Credit Line example and fill it out online or print it out and do it by hand. Consider giving the document to your legal counsel to be certain everything is completed correctly. If you make a error, print out and complete sample again (once you’ve created an account every document you download is reusable). Make your US Legal Forms account now and access a lot more forms.

Tennessee Deed Of Trust Expiration Form popularity

Tn Deed Of Trust How To Convert From Open End To Closed End Other Form Names

FAQ

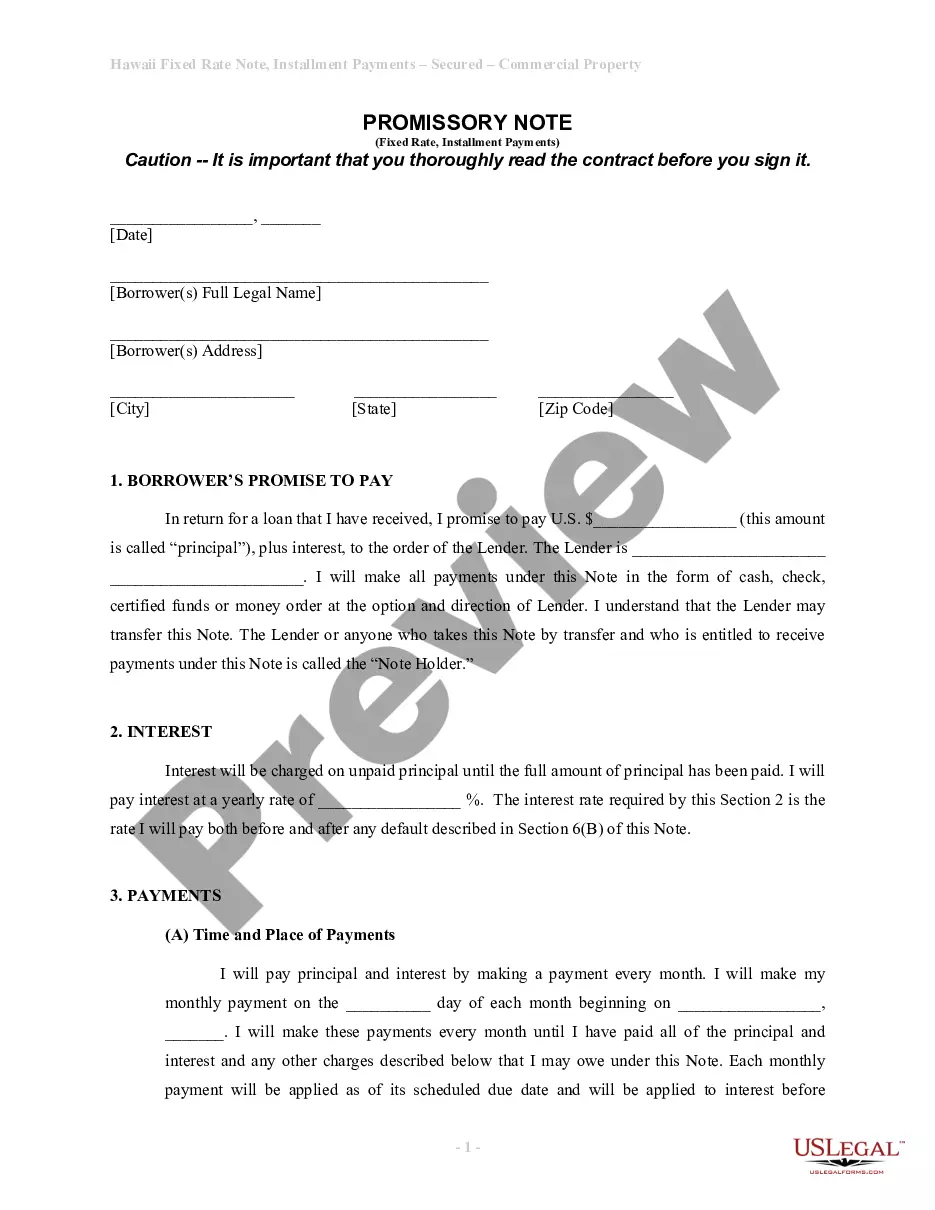

With a deed of trust, you temporarily give control of the title to your property to the lender for security purposes. Once you pay off the debt, the lender conveys that temporary control back to you.

In order to reconvey a deed of trust, the full reconveyance must be recorded within 21 days of receipt of the documents from the Beneficiary. The deed of reconveyance must be recorded in the county where the property is located. Locate the name of the Trustee in the recorded Deed of Trust.

When intentions are clear, there's less room for anyone to go back on the agreement. In fact, it can be difficult to challenge a declaration of trust in court the only cases which tend to be represented are on the grounds of fraud or misrepresentation.

A deed of trust expires can and will expire based upon one of two specific timelines. The deed can either expire at a designated point follow the maturity date or, in the absence of this information, exactly 35 years after the date on which the deed had been recorded.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.

In a deed of trust, the borrower is called the trustor and the lender is the beneficiary. The trustee holds title to the property until the trustor has fully repaid the loan to the beneficiary, at which time the lender notifies the trustee, who then transfers full title of the property to the trustor.

Can a declaration of trust be overturned? Generally the point in the document is so you cannot change your minds. However, you can update the document with the consent of both parties. If it is a big change, you should write a new deed.

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.

The deed can be re-written to reflect changes, but it needs the consent of both parties. If you want to make substantial changes to the deed, it's typically best to get a new one written. If changes are only minor, you can enter a deed of variation.