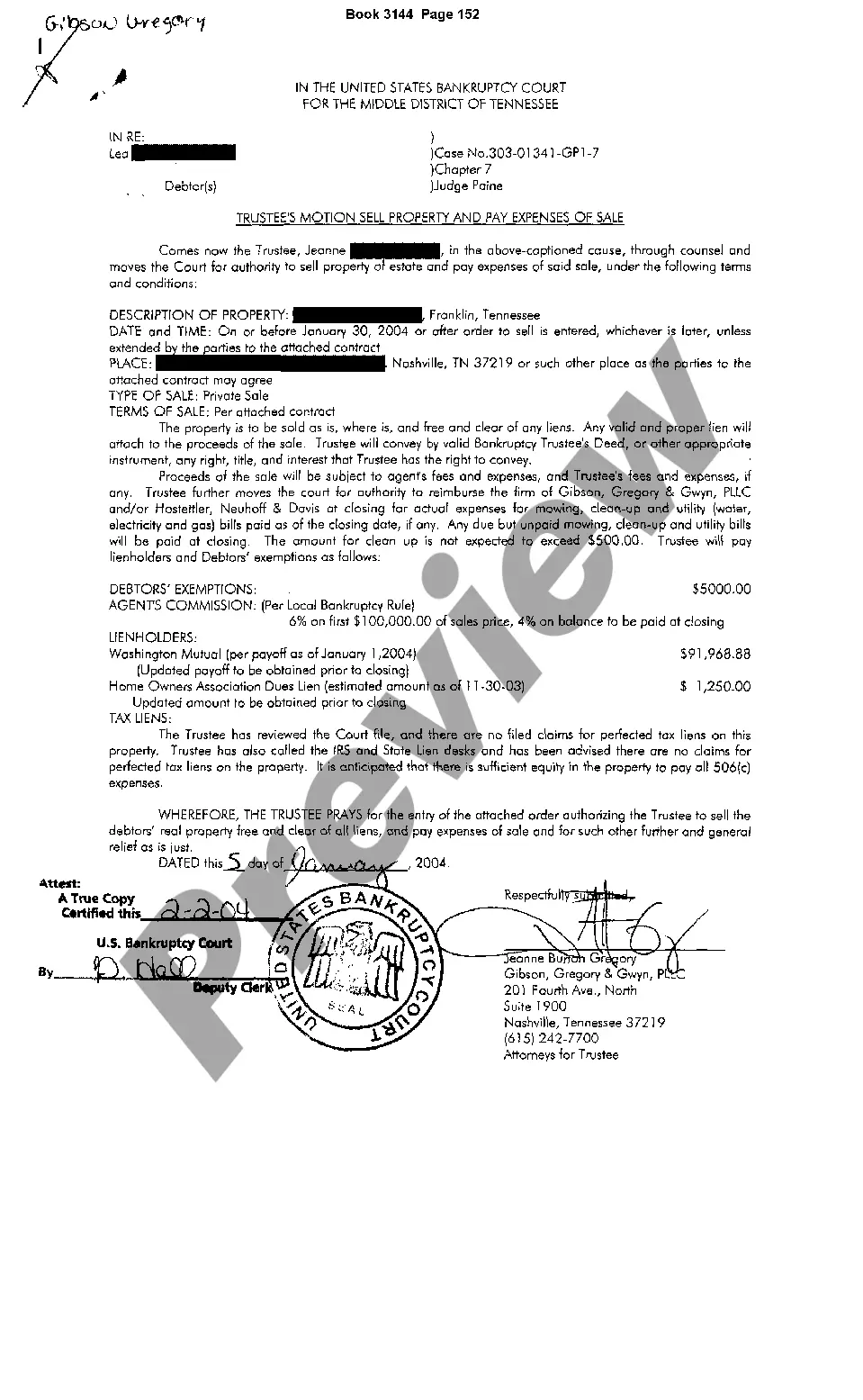

Tennessee Trustee's Notice Sell Property and Pay Expenses of Sale

Description

How to fill out Tennessee Trustee's Notice Sell Property And Pay Expenses Of Sale?

Access to quality Tennessee Trustee's Notice Sell Property and Pay Expenses of Sale templates online with US Legal Forms. Avoid hours of misused time looking the internet and lost money on documents that aren’t up-to-date. US Legal Forms gives you a solution to just that. Find above 85,000 state-specific legal and tax samples that you could download and submit in clicks within the Forms library.

To get the sample, log in to your account and click on Download button. The file will be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- See if the Tennessee Trustee's Notice Sell Property and Pay Expenses of Sale you’re looking at is appropriate for your state.

- Look at the form using the Preview option and browse its description.

- Check out the subscription page by clicking on Buy Now button.

- Select the subscription plan to go on to register.

- Pay out by card or PayPal to complete creating an account.

- Select a favored format to download the file (.pdf or .docx).

You can now open up the Tennessee Trustee's Notice Sell Property and Pay Expenses of Sale template and fill it out online or print it out and get it done by hand. Consider sending the file to your legal counsel to be certain things are completed correctly. If you make a error, print out and fill sample again (once you’ve made an account all documents you download is reusable). Create your US Legal Forms account now and get a lot more samples.

Form popularity

FAQ

It depends, under certain circumstances a party's payment of property taxes can create a rebuttable presumption that the party has title, or ownership, to the property in question. These requirements are addressed in Tennessee Code Annotated ? 28-2-109 & 110. T.C.A.

When a lender institutes foreclosure proceedings, most states give the borrower a period of time to pay off the entire amount owed and thus recover the property. In Tennessee, this period is two years after foreclosure. However, many Tennessee borrowers sign a deed of trust that waives this right to redemption.

After a tax sale happens, the homeowner might be able to redeem the property. "Redemption" is the right of the property owner to reclaim the property by paying the entire sale price, plus certain additional costs and interest, after the sale so long as it is within the time period allowed by statute.

The buyer should pay the real estate taxes due after closing. This way, the buyer and seller only pay the real estate taxes that accrued during the time they actually owned the property.

Tennessee is a redeemable tax deed state. In a redeemable tax deed state the actual property is sold after tax foreclosure and then the former owner has one last opportunity to redeem the property (pay the delinquent taxes).

Code Ann. § 28-2-101). A person can also establish this type of presumptive ownership under color of title after having paid the taxes on a piece of property for 20 years or more without the original owner, or the government, objecting. (See Tenn.

Generally, the redemption period is one year. However, this time frame may be reduced under some circumstances, like if the taxes are more than five years overdue or if the home is vacant and abandoned. (Tenn.

Capital gains tax (CGT) is payable when you sell an asset that has increased in value since you bought it. The rate varies based on a number of factors, such as your income and size of gain. For residential property it may be 18% or 28% of the gain (not the total sale price).