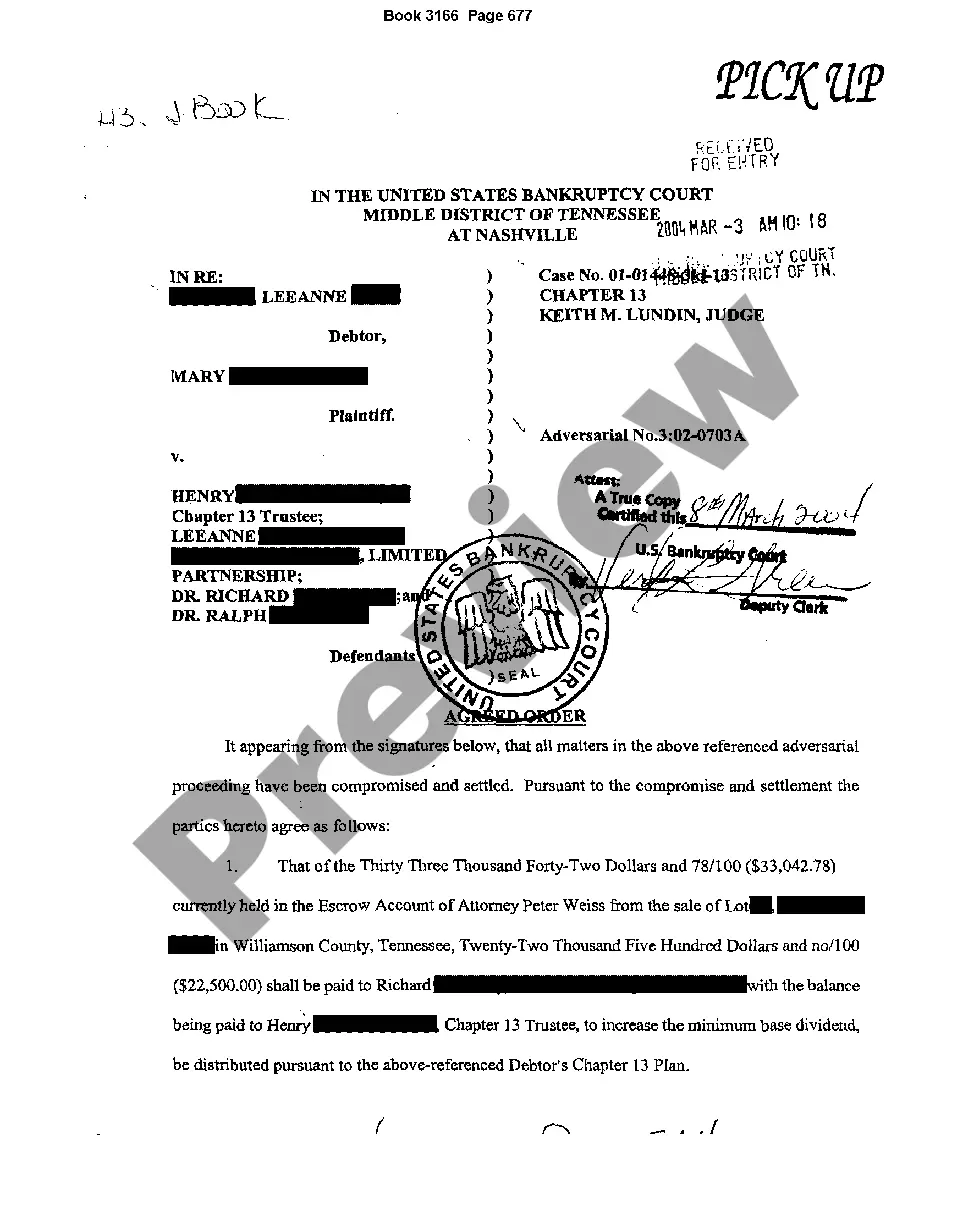

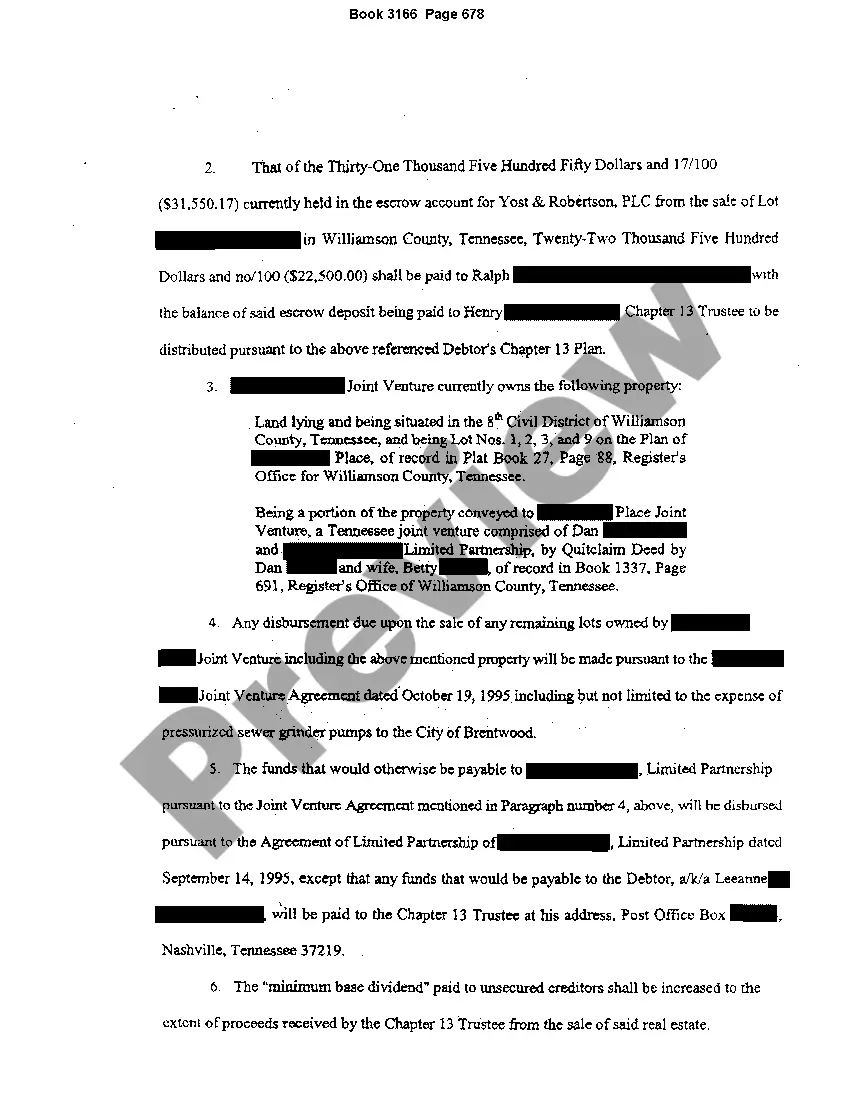

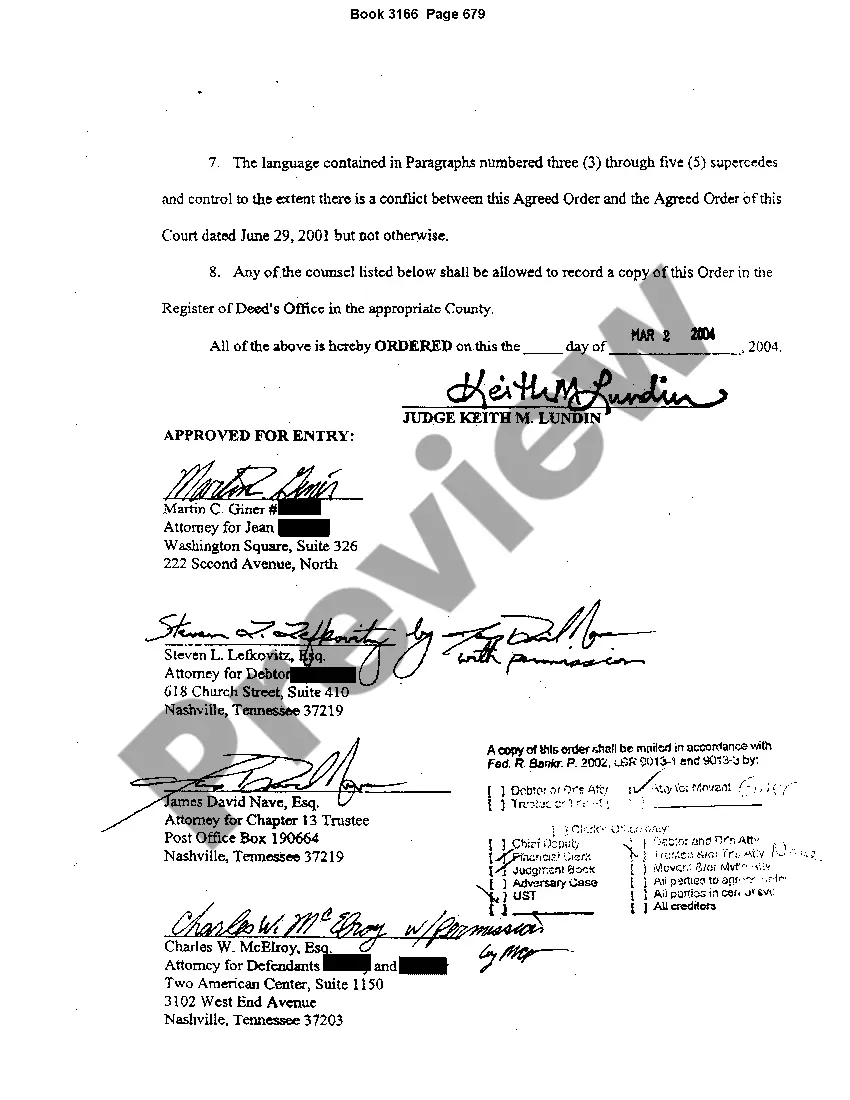

Tennessee Agreed Order for Chapter 13 Settlement with claimants

Description

How to fill out Tennessee Agreed Order For Chapter 13 Settlement With Claimants?

Access to quality Tennessee Agreed Order for Chapter 13 Settlement with claimants forms online with US Legal Forms. Avoid hours of lost time searching the internet and lost money on files that aren’t updated. US Legal Forms provides you with a solution to exactly that. Get around 85,000 state-specific authorized and tax templates you can save and fill out in clicks within the Forms library.

To get the sample, log in to your account and click on Download button. The file will be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide below to make getting started easier:

- See if the Tennessee Agreed Order for Chapter 13 Settlement with claimants you’re considering is appropriate for your state.

- View the sample utilizing the Preview option and browse its description.

- Go to the subscription page by simply clicking Buy Now.

- Select the subscription plan to go on to register.

- Pay out by card or PayPal to complete making an account.

- Choose a preferred file format to download the document (.pdf or .docx).

Now you can open the Tennessee Agreed Order for Chapter 13 Settlement with claimants template and fill it out online or print it out and get it done by hand. Consider mailing the papers to your legal counsel to be certain things are completed correctly. If you make a error, print out and complete sample once again (once you’ve registered an account all documents you download is reusable). Create your US Legal Forms account now and get a lot more templates.

Form popularity

FAQ

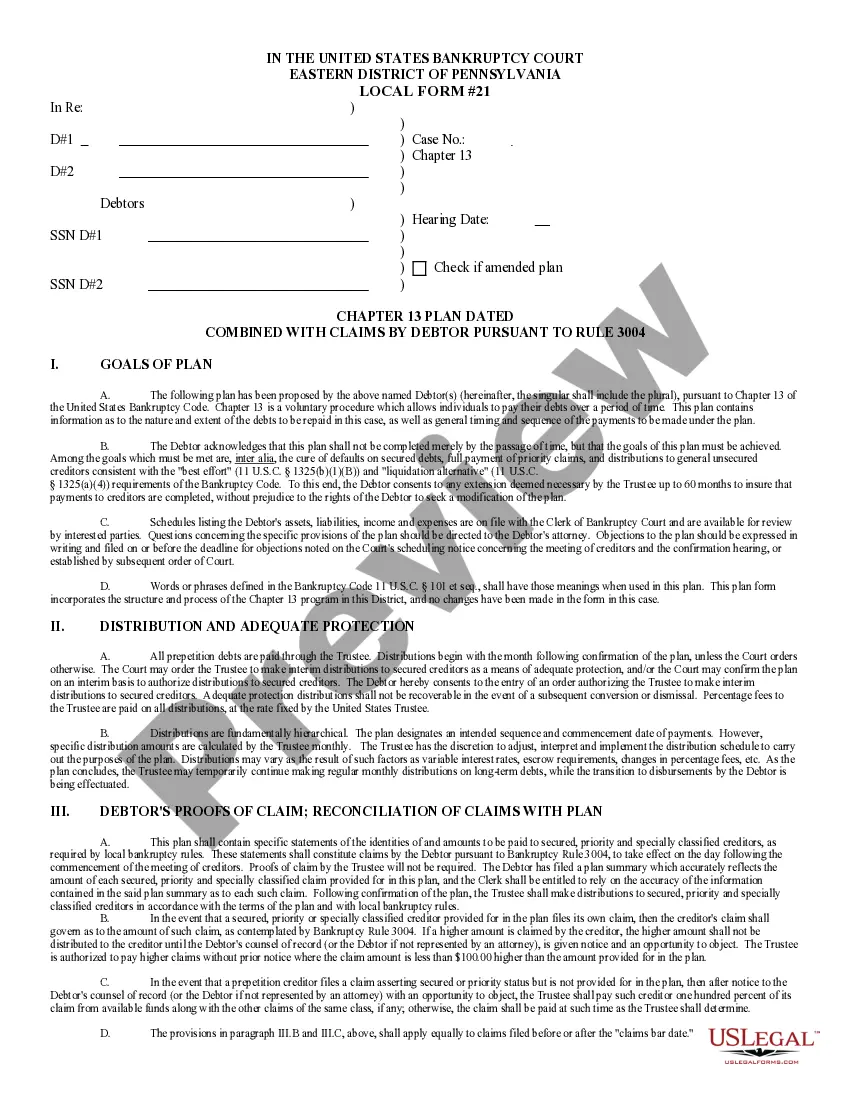

The Overall Chapter 13 Average Payment. The average payment for a Chapter 13 case overall is probably about $500 to $600 per month. This information, however, may not be very helpful for your particular situation.

A bankruptcy filing won't stop a divorce proceeding. Similarly, the bankruptcy court won't get involved in a family court's determination regarding the amount of alimony or child support someone should pay. However, a Chapter 13 bankruptcy can wipe out a property division settlement.

If a debtor fails to keep up with payments under their repayment plan in a Chapter 13 bankruptcy, the bankruptcy trustee may file a motion to dismiss their case. This means that their debts would not be discharged because the case would be considered unsuccessful.

Debts You Must Pay in Full Through Your Plan. Add up the following debts and divide by the number of months your plan will last. Secured Debt Payments on Property You Want to Keep. Unsecured Debts. Length of Your Repayment Plan.

Priority claims are those granted special status by the bankruptcy law, such as most taxes and the costs of bankruptcy proceeding. (3) Secured claims are those for which the creditor has the right take back certain property (i.e., the collateral) if the debtor does not pay the underlying debt.

A discharge is a win! The bankruptcy discharge order wipes out your personal legal liability to pay a debt. A dismissal is usually a loss. It means the bankruptcy case was closed before a discharge was entered.

If the Chapter 13 plan is dismissed, creditors may immediately initiate or continue with state court litigation pursuant to applicable state law to foreclose on the petitioner's property or garnish their income. If a bankruptcy case is dismissed, the legal affect is that the bankruptcy is deemed void.

Chapter 13 typically lasts for 3 to 5 years and involves a repayment plan, where you pay some or all of the money owed to your creditors over the length of the plan. Written by Attorney Eva Bacevice. A Chapter 13 bankruptcy case will typically take between three and five years to complete.

You take and complete a credit counseling course. You'll prepare the bankruptcy petition and the proposed Chapter 13 plan. You file your bankruptcy petition, proposed plan, and other required documents. The court appoints a bankruptcy trustee to administer your case. The automatic stay takes effect.