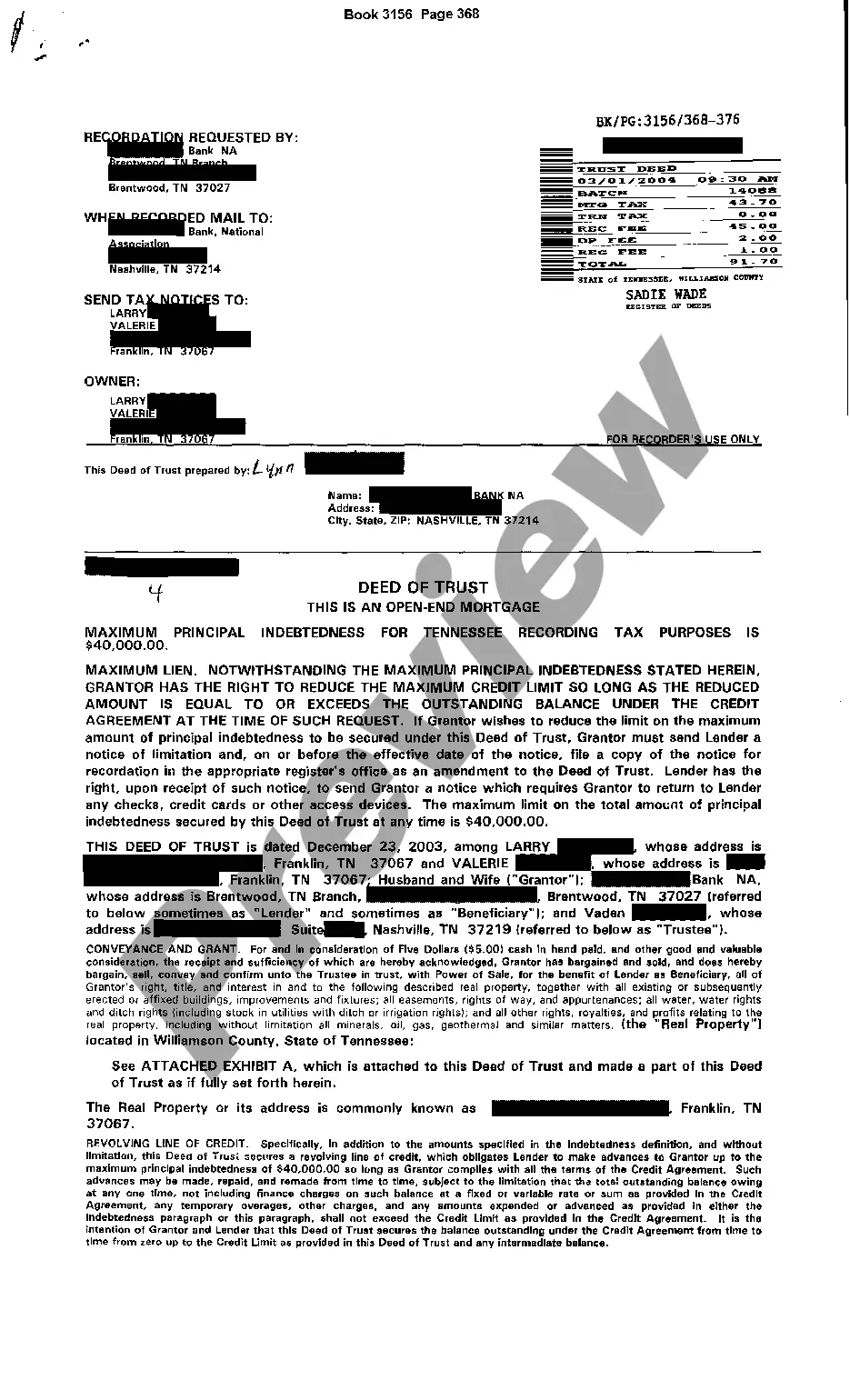

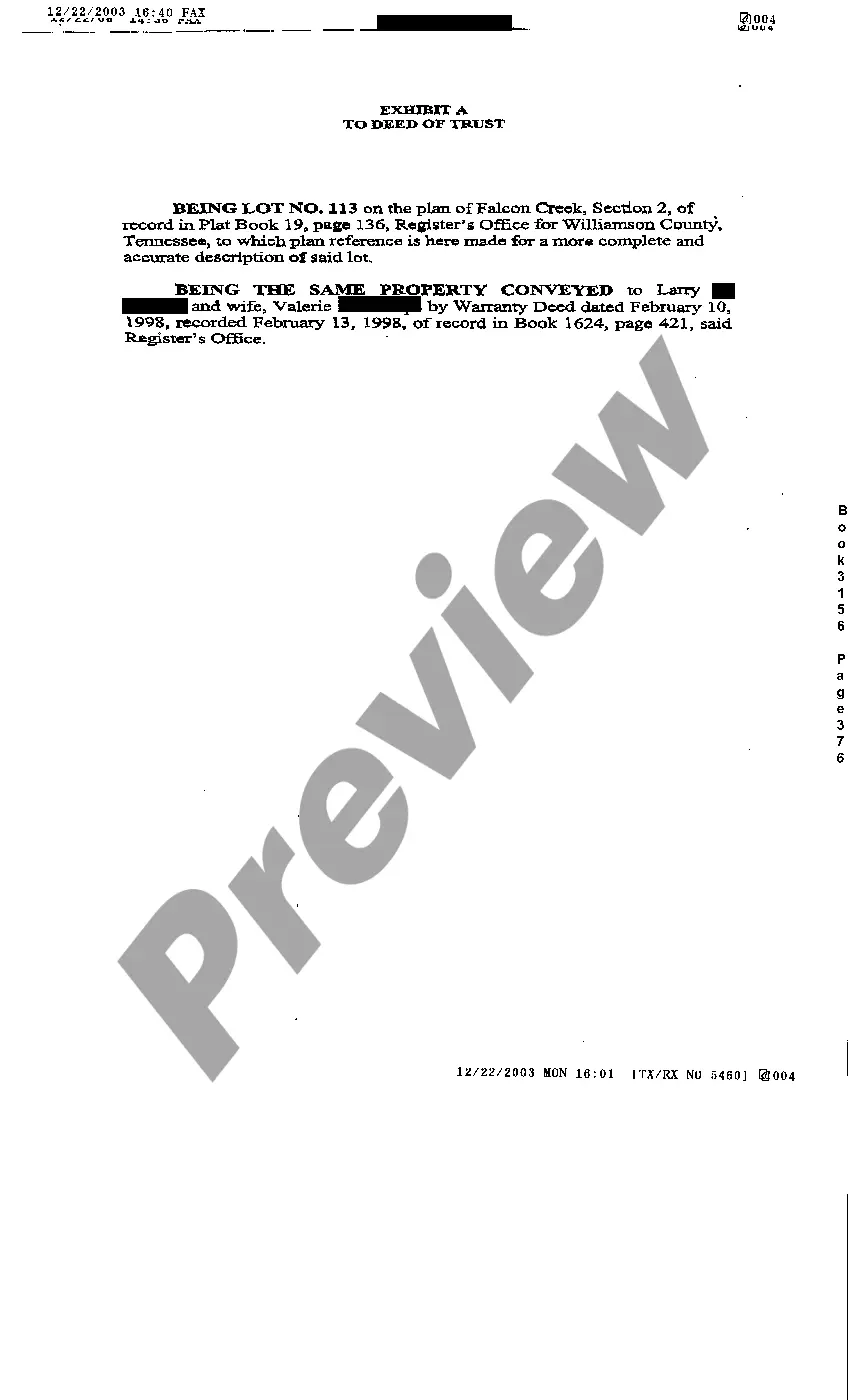

Tennessee Deed of Trust Open End Mortgage

Description

How to fill out Tennessee Deed Of Trust Open End Mortgage?

Get access to top quality Tennessee Deed of Trust Open End Mortgage templates online with US Legal Forms. Steer clear of days of wasted time searching the internet and lost money on files that aren’t up-to-date. US Legal Forms gives you a solution to just that. Find more than 85,000 state-specific authorized and tax templates that you can download and complete in clicks within the Forms library.

To get the sample, log in to your account and click Download. The file is going to be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide listed below to make getting started simpler:

- See if the Tennessee Deed of Trust Open End Mortgage you’re considering is suitable for your state.

- Look at the sample making use of the Preview option and browse its description.

- Go to the subscription page by clicking Buy Now.

- Choose the subscription plan to continue on to register.

- Pay by credit card or PayPal to complete creating an account.

- Pick a preferred format to save the document (.pdf or .docx).

Now you can open up the Tennessee Deed of Trust Open End Mortgage sample and fill it out online or print it and get it done yourself. Consider giving the papers to your legal counsel to make sure everything is filled out appropriately. If you make a mistake, print out and complete sample again (once you’ve made an account all documents you download is reusable). Make your US Legal Forms account now and get access to a lot more samples.

Form popularity

FAQ

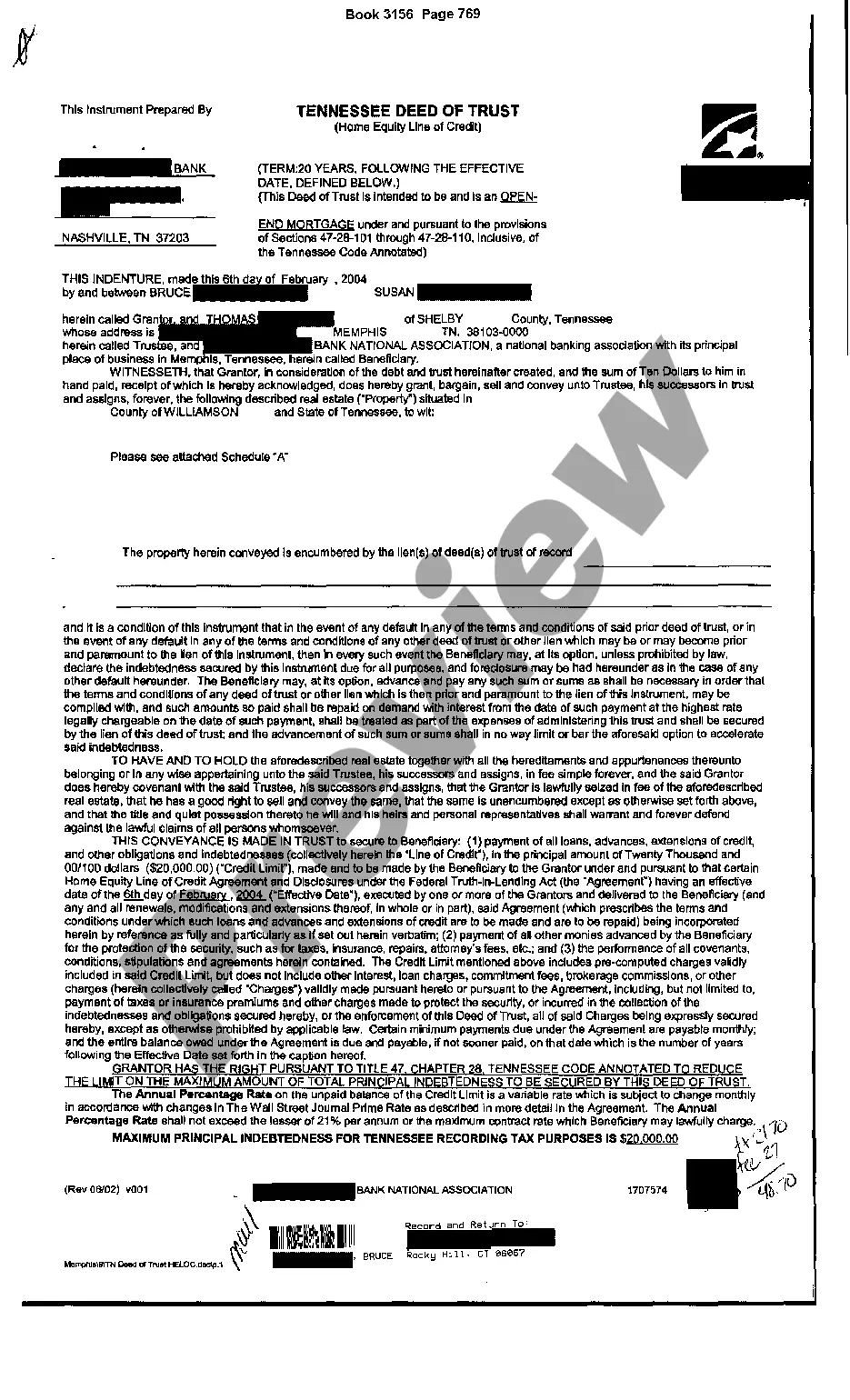

While a mortgage involves two parties, a deed of trust involves three: the trustor (the borrower) the lender (sometimes called a "beneficiary"), and. the trustee.

The basic difference between the mortgage as a security instrument and a Deed of Trust is that in a Deed of Trust there are three parties involved, the borrower, the lender, and a trustee, whereas in a mortgage document there are only two parties involved, the borrower and the lender.

An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time. Open-end mortgages permit the borrower to go back to the lender and borrow more money. There is usually a set dollar limit on the additional amount that can be borrowed.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

Open-end credit is a pre-approved loan, granted by a financial institution to a borrower, that can be used repeatedly. With open-end loans, like credit cards, once the borrower has started to pay back the balance, they can choose to take out the funds againmeaning it is a revolving loan.

A deed of trust is a method of securing a real estate transaction that includes three parties: a lender, borrower and a third-party trustee.

A mortgage deed is a legal document that shows the transfer of real estate. In the case of a mortgage deed, it shows that the person who owns the home transfers the ownership to the lender as security for a loan, or mortgage.

Open-end loans are set for a fixed amount, like the credit limit on a credit card.As a contrast to open-end credit, closed-end loans are taken out for a specific reason, like a car loan or mortgage. For example, if you want to buy a car, the loan can only be used for that car.

A traditional mortgage provides you with a single lump sum. Ordinarily, all of this money is used to purchase the home. An open-end mortgage provides you with a lump sum that is used to purchase the home. But the open-end mortgage is for more than the purchase amount.