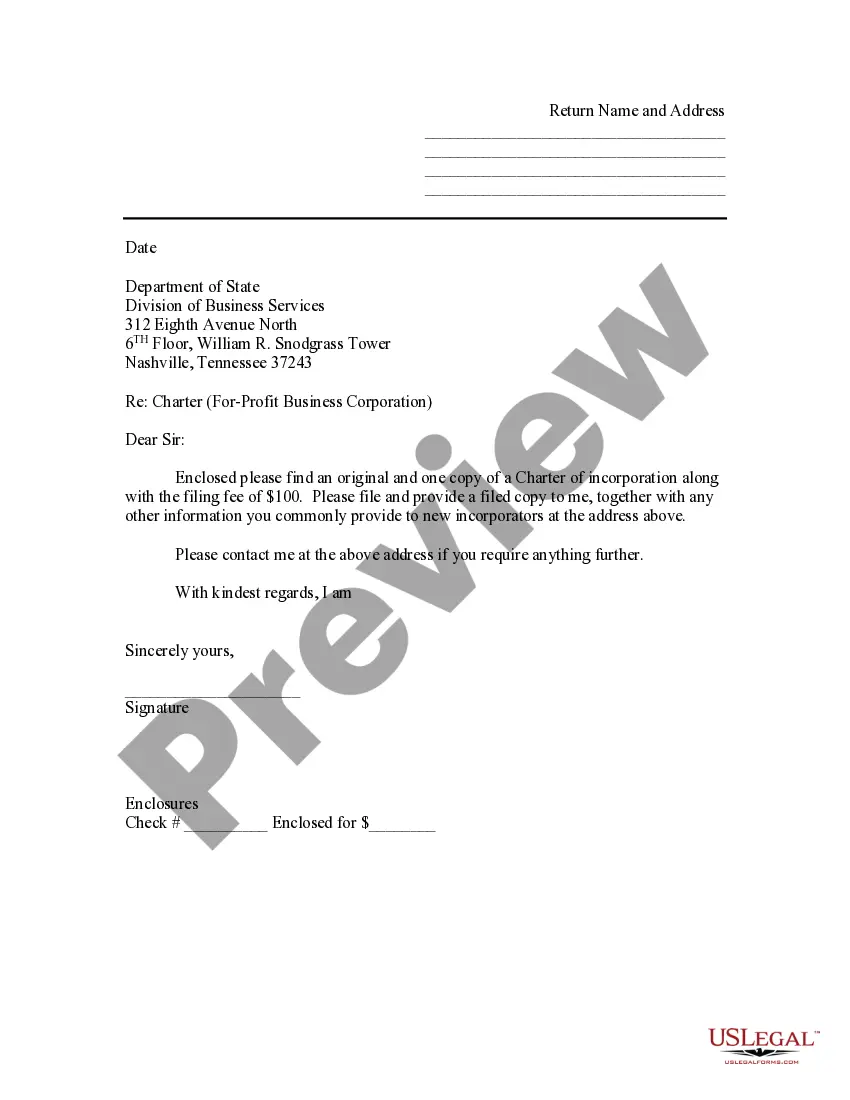

Use this sample letter as a cover sheet to accompany the Articles of Incorporation for filing with the Secretary of State's Office.

Tennessee Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation

Description

How to fill out Tennessee Sample Transmittal Letter To Secretary Of State's Office To File Articles Of Incorporation?

Access to quality Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - Tennessee forms online with US Legal Forms. Steer clear of days of misused time looking the internet and dropped money on files that aren’t updated. US Legal Forms provides you with a solution to exactly that. Get around 85,000 state-specific authorized and tax templates that you could save and complete in clicks in the Forms library.

To find the example, log in to your account and click on Download button. The document will be stored in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- Verify that the Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - Tennessee you’re considering is appropriate for your state.

- View the sample utilizing the Preview option and browse its description.

- Go to the subscription page by simply clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay out by card or PayPal to finish creating an account.

- Select a favored format to save the document (.pdf or .docx).

You can now open the Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - Tennessee example and fill it out online or print it out and do it yourself. Consider giving the document to your legal counsel to be certain things are completed correctly. If you make a error, print and complete sample once again (once you’ve registered an account all documents you save is reusable). Create your US Legal Forms account now and access a lot more templates.

Form popularity

FAQ

Do the Articles of Organization need to be notarized? Some states require that you have your Articles of Organization documents notarized. For your state's notarization requirements, choose your state from the drop-down list above.

Option 1: File Online With the Tennessee Secretary of State. Option 2: File the Application for Registration of Assumed Name by Mail. Cost: $20 Filing Fee. Mailing Address: Corporate Filings. 312 Rosa L. Parks Ave. 6th Floor, William R. Snodgrass Tower. Nashville, TN 37243.

Overview. Generally, if you conduct business within any county and/or incorporated municipality in Tennessee, then you should register for and remit business tax. Business tax consists of two separate taxes: the state business tax and the city business tax.

Business tax can be filed and paid online using the Tennessee Taxpayer Access Point (TNTAP). A TNTAP logon should be created to file this tax. Click here for help creating your logon.

For assistance with your annual report submission, or if you do not want to submit online, please contact Business Services at (615) 741-2286 or TNSOS.CORPINFO@tn.gov.

The name of the LLC. The names of the members and managers of the LLC. The address of the LLC's principal place of business.

How much does it cost to form an LLC in Tennessee? The Tennessee Secretary of State charges $50 per LLC member included in the filing, with a minimum total fee of $300. The filing fee cannot exceed $3,000 for the Articles of Organization.

Option 1: Access the Tennessee Secretary of State's online services. Option 2: Download and mail in the Articles of Organization PDF to the Tennessee Secretary of State or submit it in-person. State Filing Cost: $50 per member, with a minimum of $300 and a maximum of $3000.

Visit Tennessee's Secretary of State website. Select Corporations from the drop-down menu of the Business Services tab.