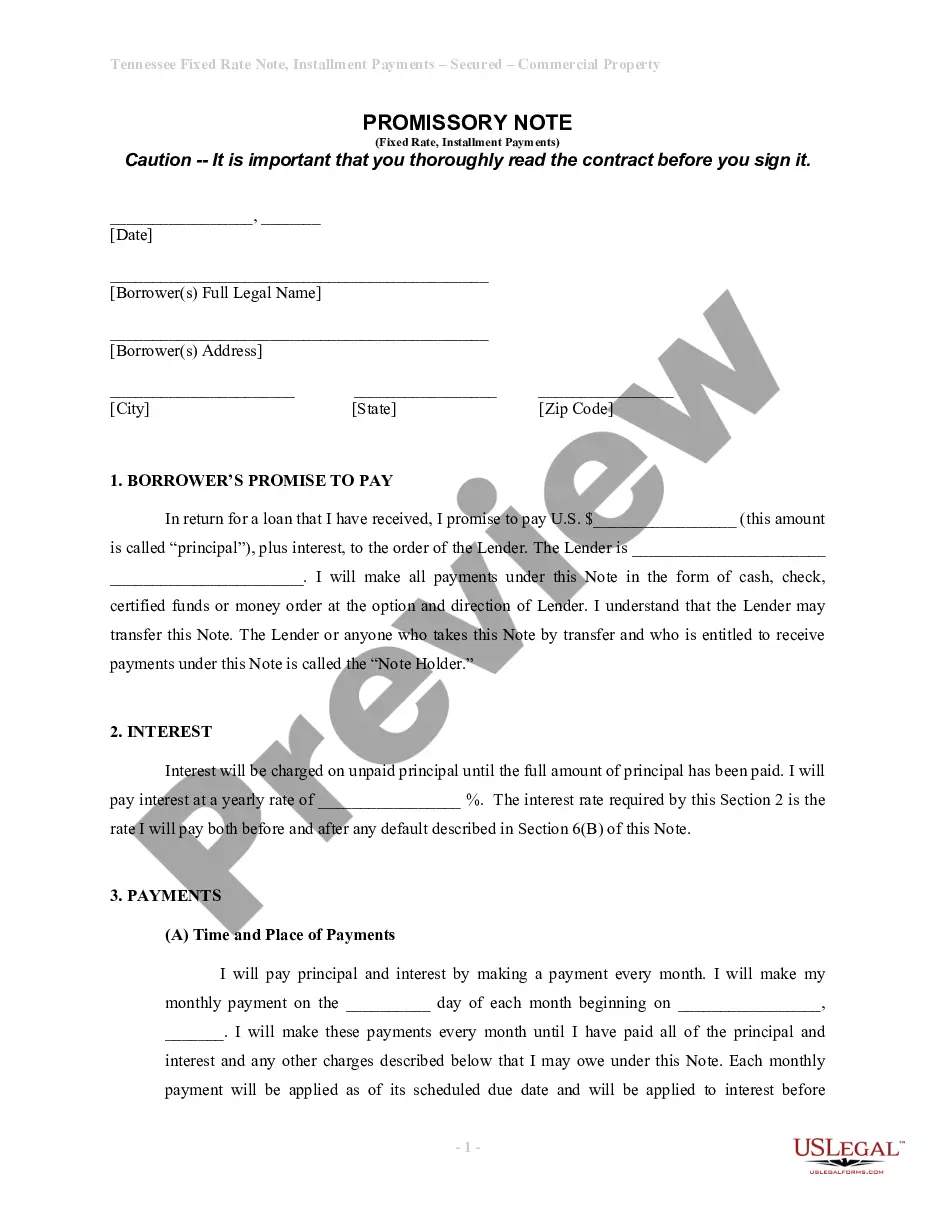

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Tennessee Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Tennessee Installments Fixed Rate Promissory Note Secured By Personal Property?

Get access to top quality Tennessee Installments Fixed Rate Promissory Note Secured by Personal Property templates online with US Legal Forms. Steer clear of days of lost time browsing the internet and lost money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Find over 85,000 state-specific legal and tax forms that you can save and complete in clicks in the Forms library.

To receive the example, log in to your account and click Download. The document will be saved in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide below to make getting started easier:

- Find out if the Tennessee Installments Fixed Rate Promissory Note Secured by Personal Property you’re considering is appropriate for your state.

- Look at the sample using the Preview option and browse its description.

- Check out the subscription page by simply clicking Buy Now.

- Select the subscription plan to continue on to register.

- Pay out by credit card or PayPal to complete making an account.

- Select a favored file format to save the file (.pdf or .docx).

Now you can open up the Tennessee Installments Fixed Rate Promissory Note Secured by Personal Property sample and fill it out online or print it out and do it yourself. Think about mailing the document to your legal counsel to make sure everything is filled out correctly. If you make a error, print out and complete sample once again (once you’ve created an account all documents you download is reusable). Make your US Legal Forms account now and get access to more samples.

Form popularity

FAQ

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

Types of Property that can be used as collateral. Speak to them in person. Draft a Demand / Notice Letter. Write and send a Follow Up Letter. Enlisting a Professional Collection Agency. Filing a petition or complaint in court. Selling the Promissory Note. Final Tips.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

No. California promissory notes do not need to be notarized or witnessed for validity.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.