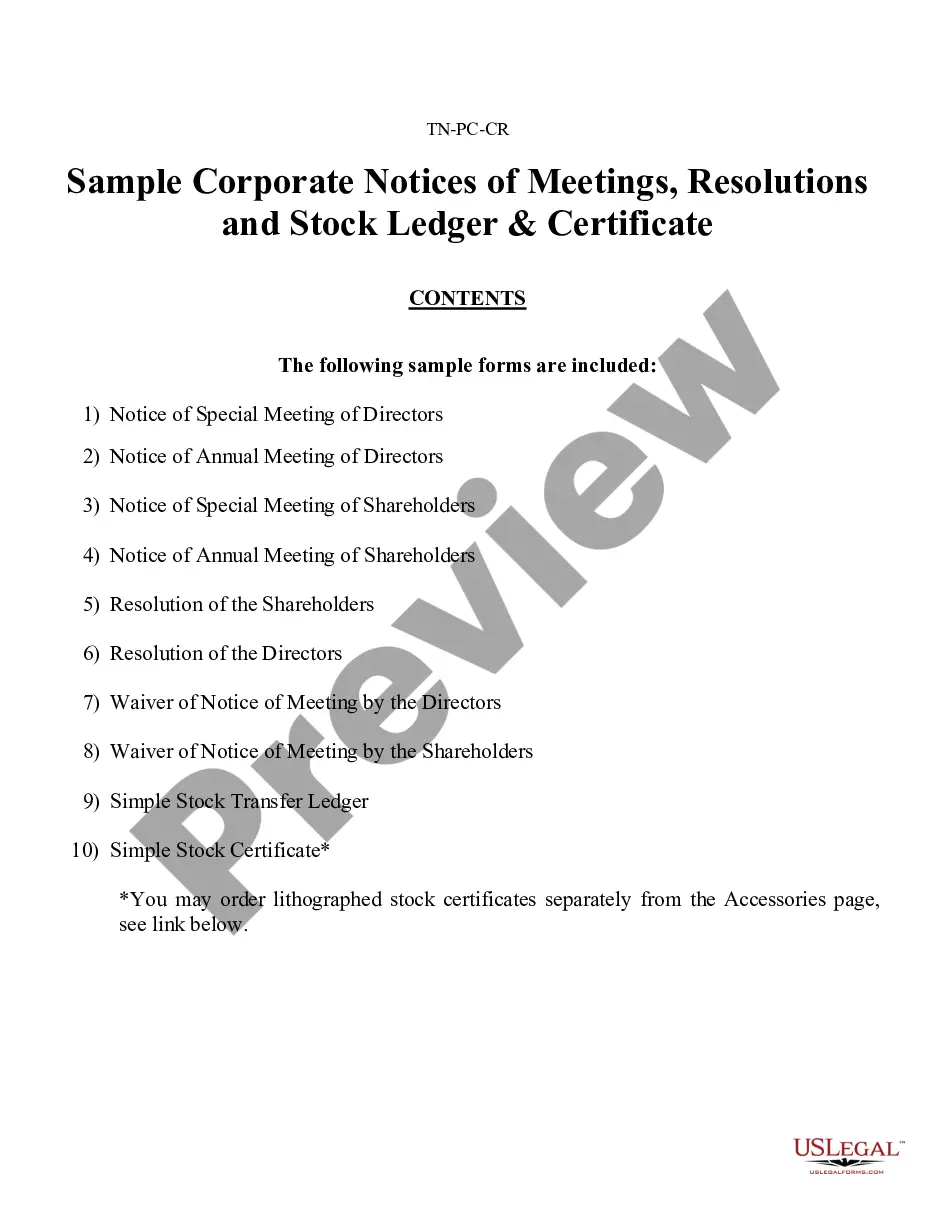

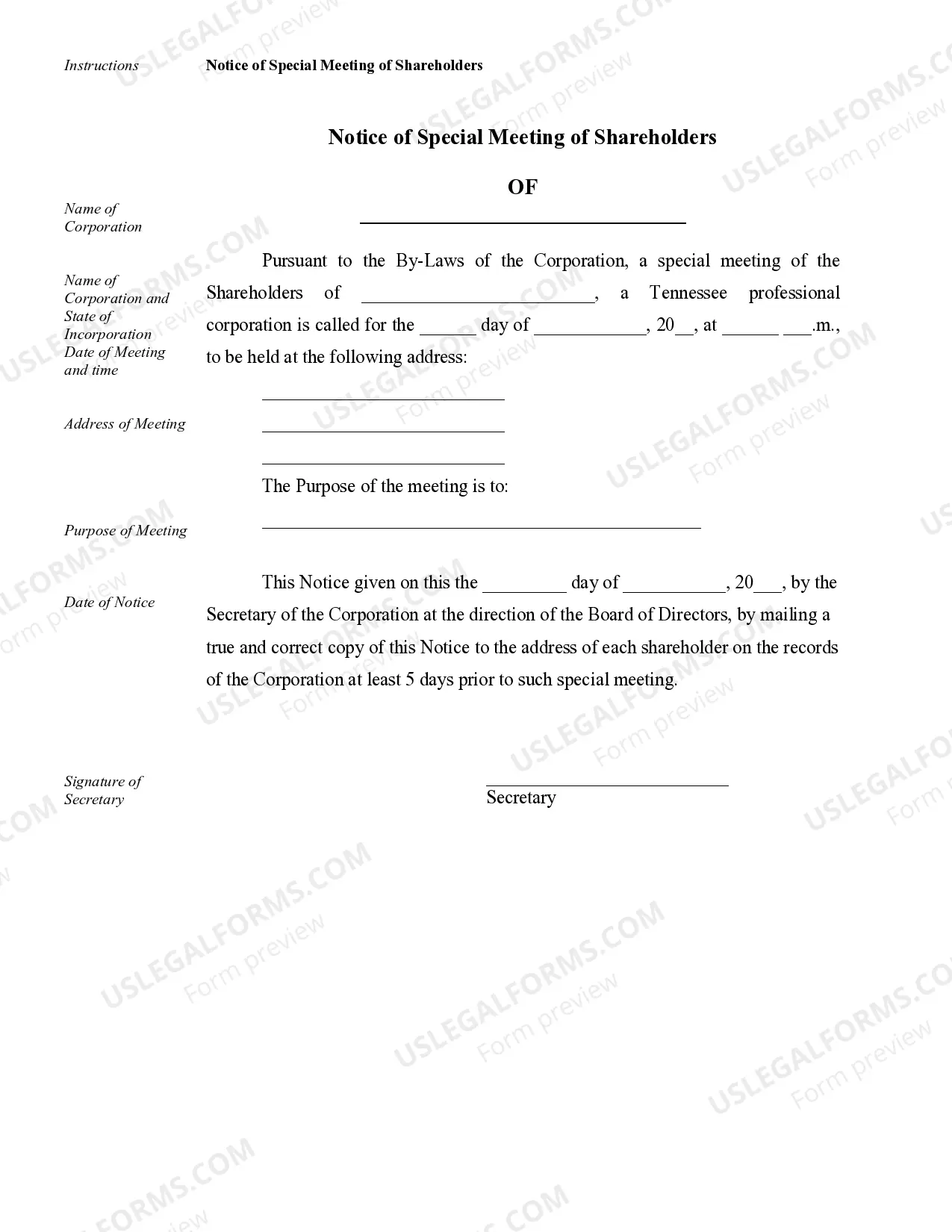

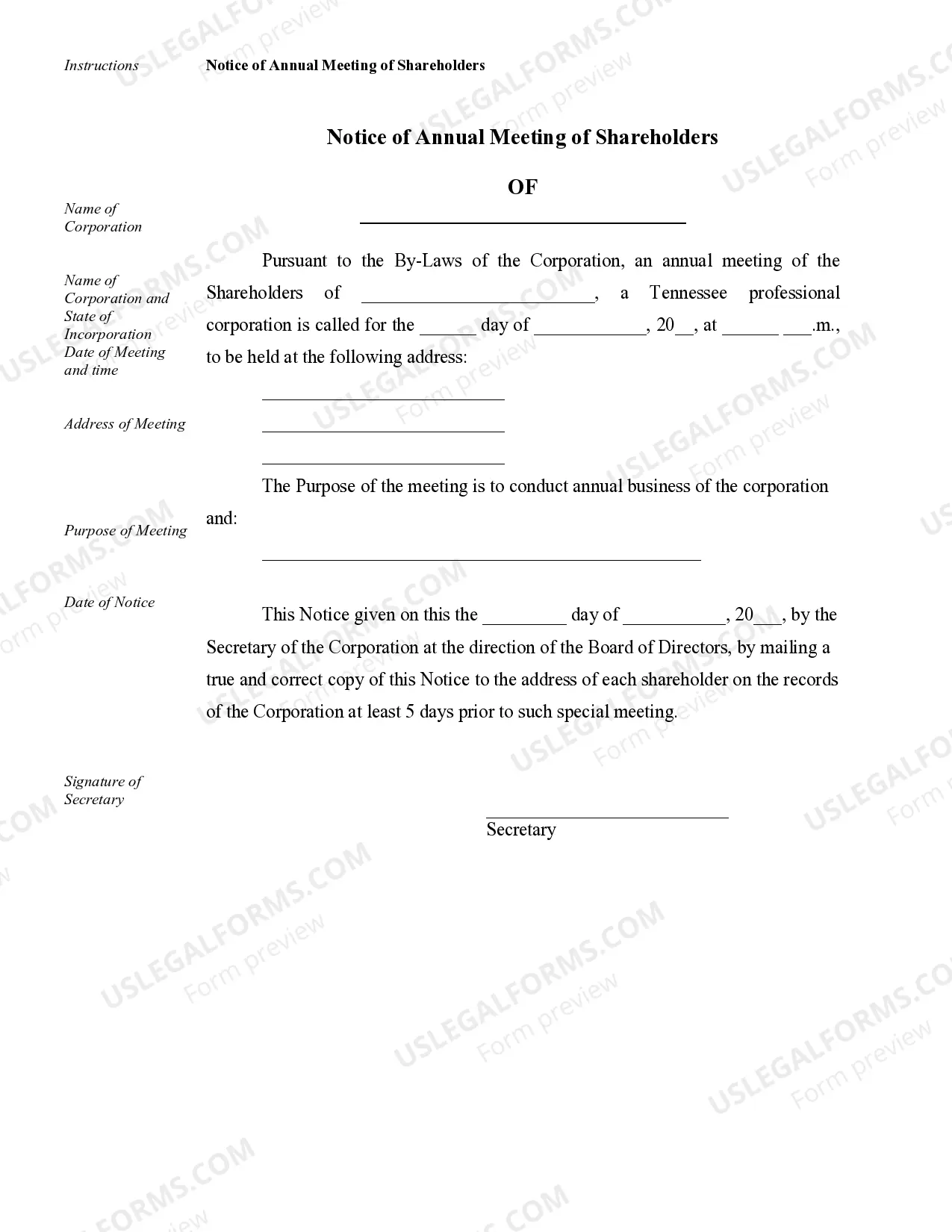

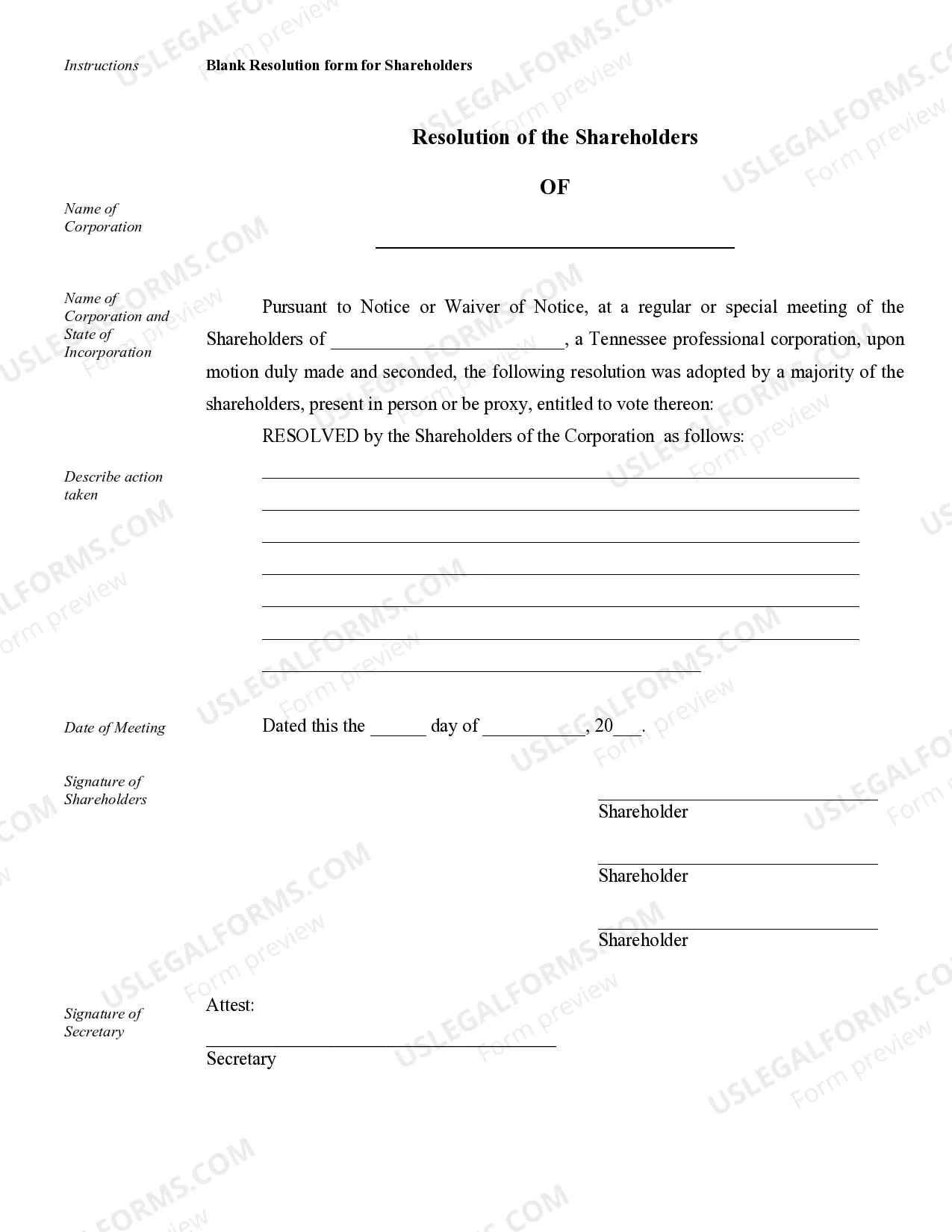

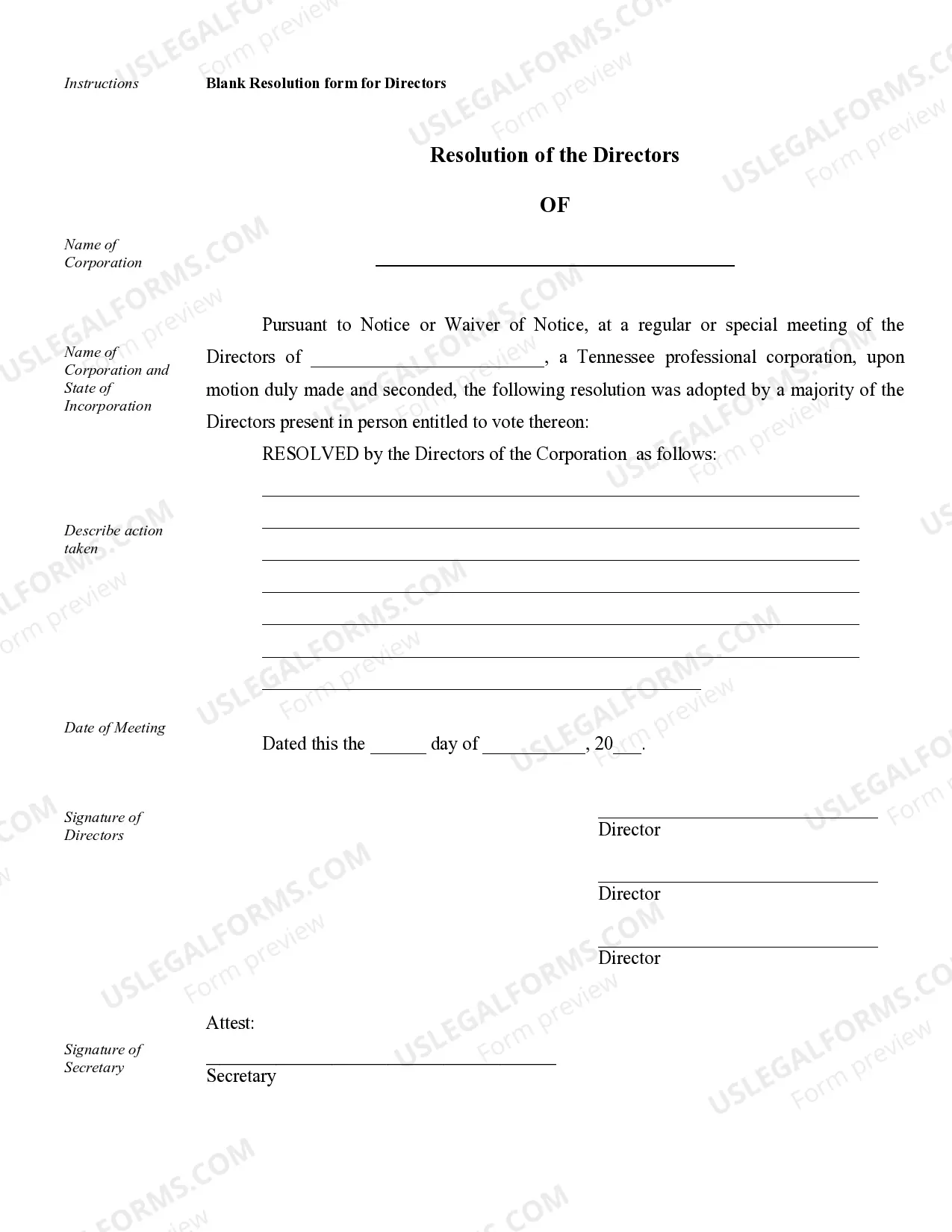

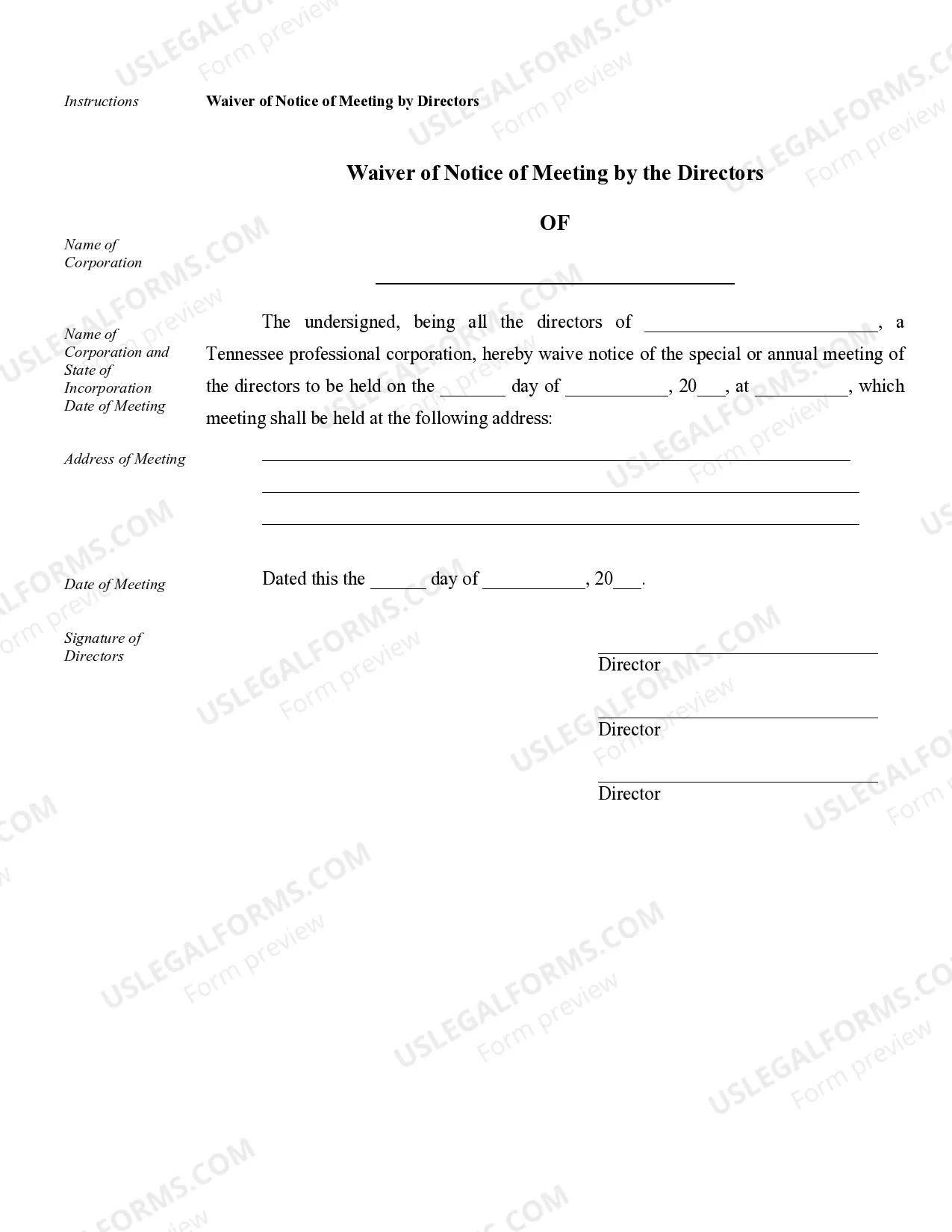

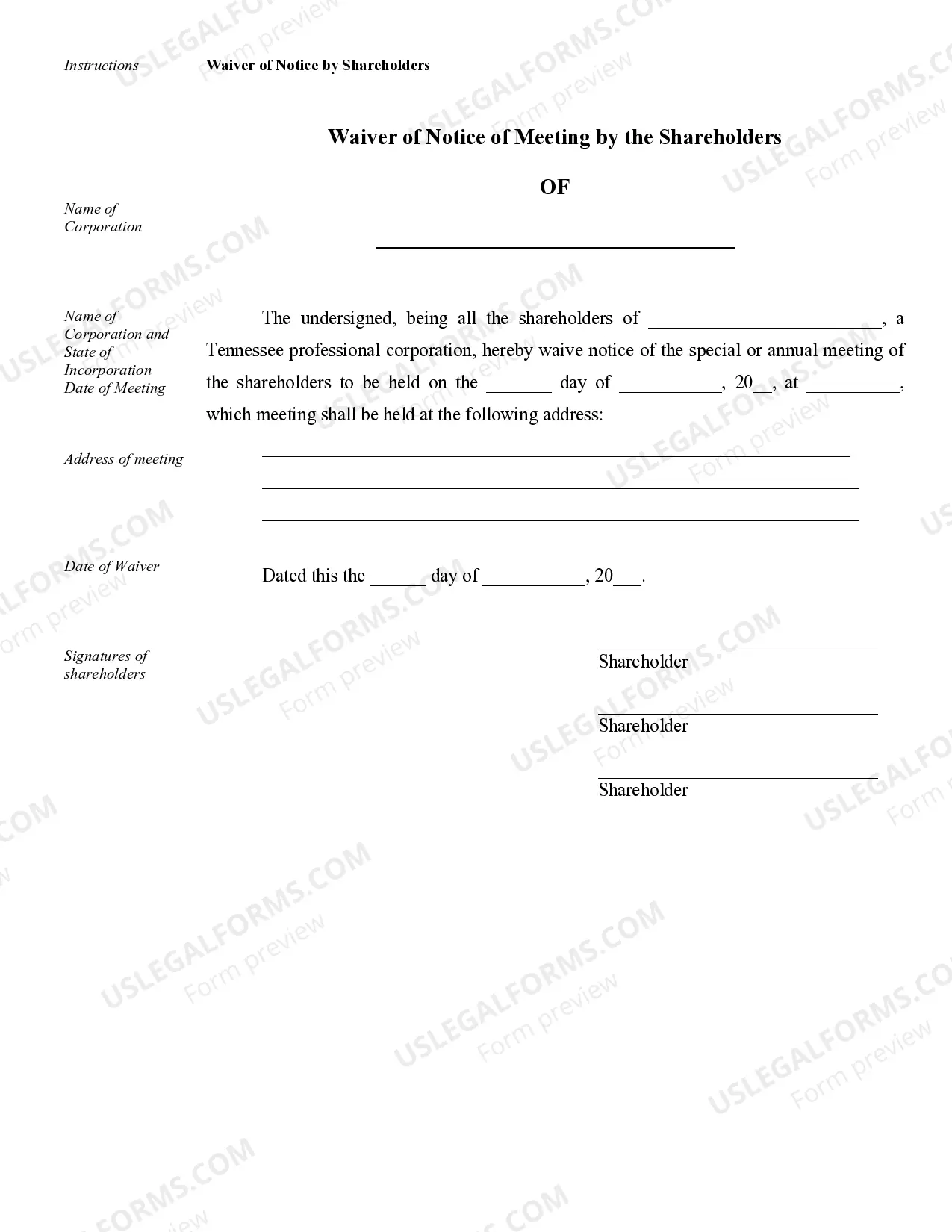

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

Sample Corporate Records for a Tennessee Professional Corporation

Description

How to fill out Sample Corporate Records For A Tennessee Professional Corporation?

Access to quality Sample Corporate Records for a Tennessee Professional Corporation forms online with US Legal Forms. Avoid hours of lost time seeking the internet and dropped money on documents that aren’t updated. US Legal Forms provides you with a solution to exactly that. Find more than 85,000 state-specific authorized and tax samples that you could save and submit in clicks in the Forms library.

To receive the example, log in to your account and click Download. The document is going to be saved in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, look at our how-guide listed below to make getting started easier:

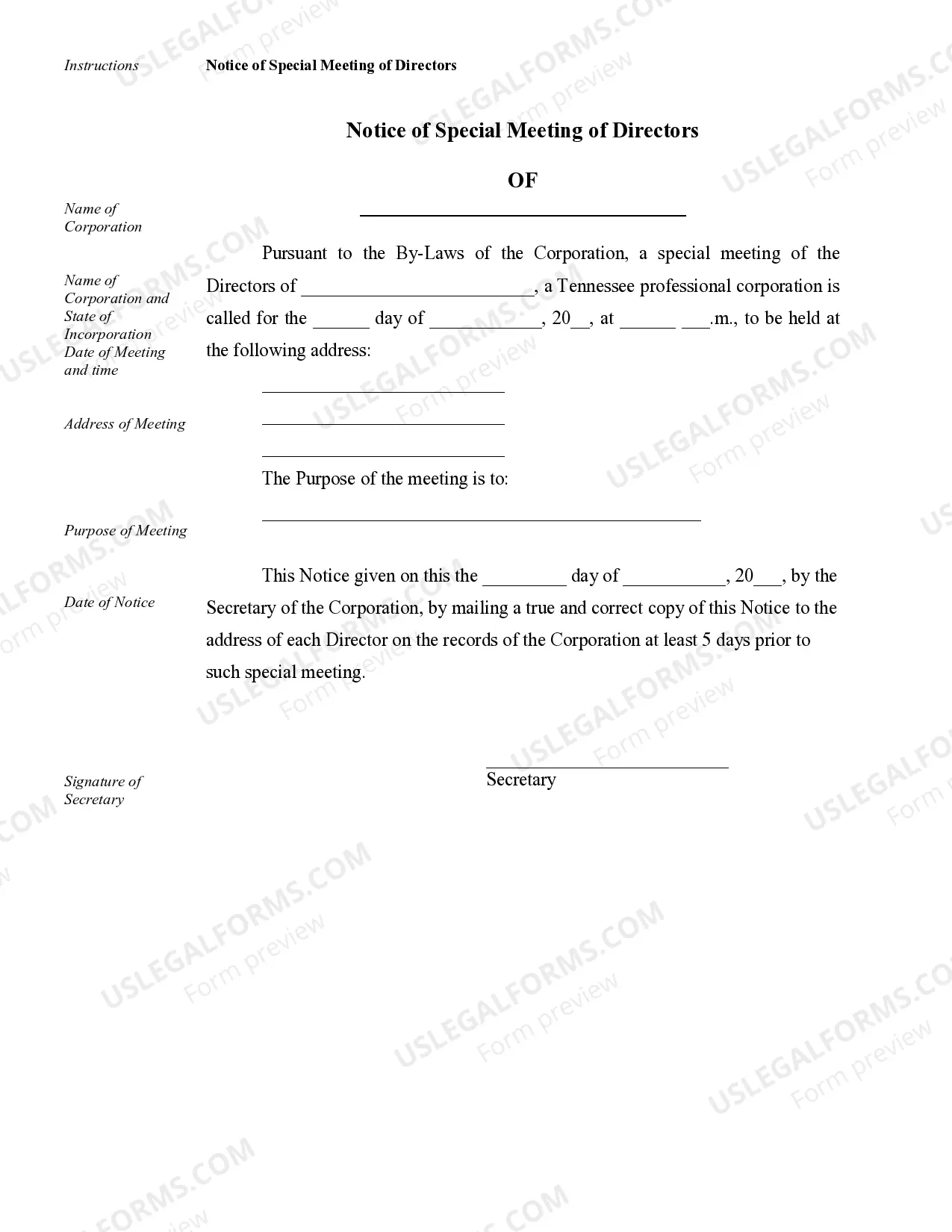

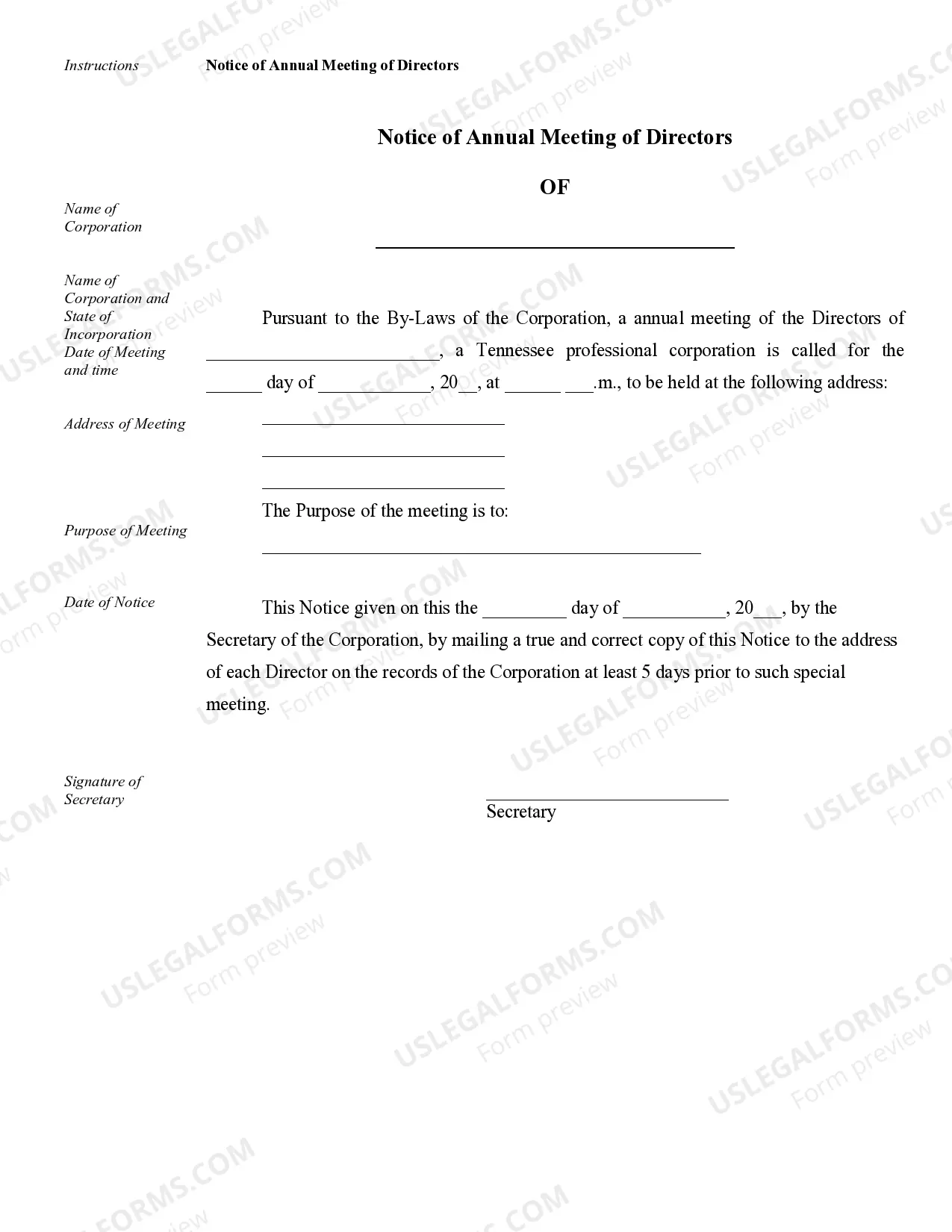

- Check if the Sample Corporate Records for a Tennessee Professional Corporation you’re considering is appropriate for your state.

- See the sample using the Preview option and read its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to go on to sign up.

- Pay by credit card or PayPal to complete creating an account.

- Choose a favored file format to save the file (.pdf or .docx).

Now you can open the Sample Corporate Records for a Tennessee Professional Corporation template and fill it out online or print it and get it done by hand. Think about giving the file to your legal counsel to make sure everything is filled in appropriately. If you make a mistake, print out and complete sample again (once you’ve created an account all documents you save is reusable). Create your US Legal Forms account now and access far more forms.

Form popularity

FAQ

(1) It is an artificial being; (2) Created by operation of law; (3) With right of succession; (4) Has the powers, attributes, and properties as expressly authorized by law or incident to its existence.

The IRS categorizes professional corporations as C corporations. They are considered taxpayers and must pay income taxes at the corporate rate. In some states, physicians are not allowed to form professional corporations and must instead establish professional associations.

Professional corporations or professional service corporation (abbreviated as PC or PSC) are those corporate entities for which many corporation statutes make special provision, regulating the use of the corporate form by licensed professionals such as attorneys, architects, engineers, public accountants and physicians

A corporation is a legal entity, meaning it is a separate entity from its owners who are called stockholders. A corporation is treated as a person with most of the rights and obligations of a real person. A corporation is not allowed to hold public office or vote, but it does pay income taxes.

Great companies are focused on one goal and don't get distracted from it. They're strategic.Great people who create a culture of accountability and those who aren't afraid to make decisions for the good of their team and the company. Great companies take risks, which often means they fail.

A professional corporation is one that only performs services in one, single profession. It is a specific type of corporation for professionals like doctors, lawyers, accountants, etc. The professional is able to form a corporation, but the professional remains liable for his or her own actions.

The different types of corporations and business structures. When it comes to types of corporations, there are typically four that are brought up: S corps, C corps, non-profit corporations, and LLCs.

Choose a Corporate Name. File a Corporate Charter. Appoint a Registered Agent. Prepare Corporate Bylaws. Appoint Initial Directors and Hold First Board Meeting. File Annual Report. Obtain an EIN.

Advantages of a corporation include personal liability protection, business security and continuity, and easier access to capital. Disadvantages of a corporation include it being time-consuming and subject to double taxation, as well as having rigid formalities and protocols to follow.