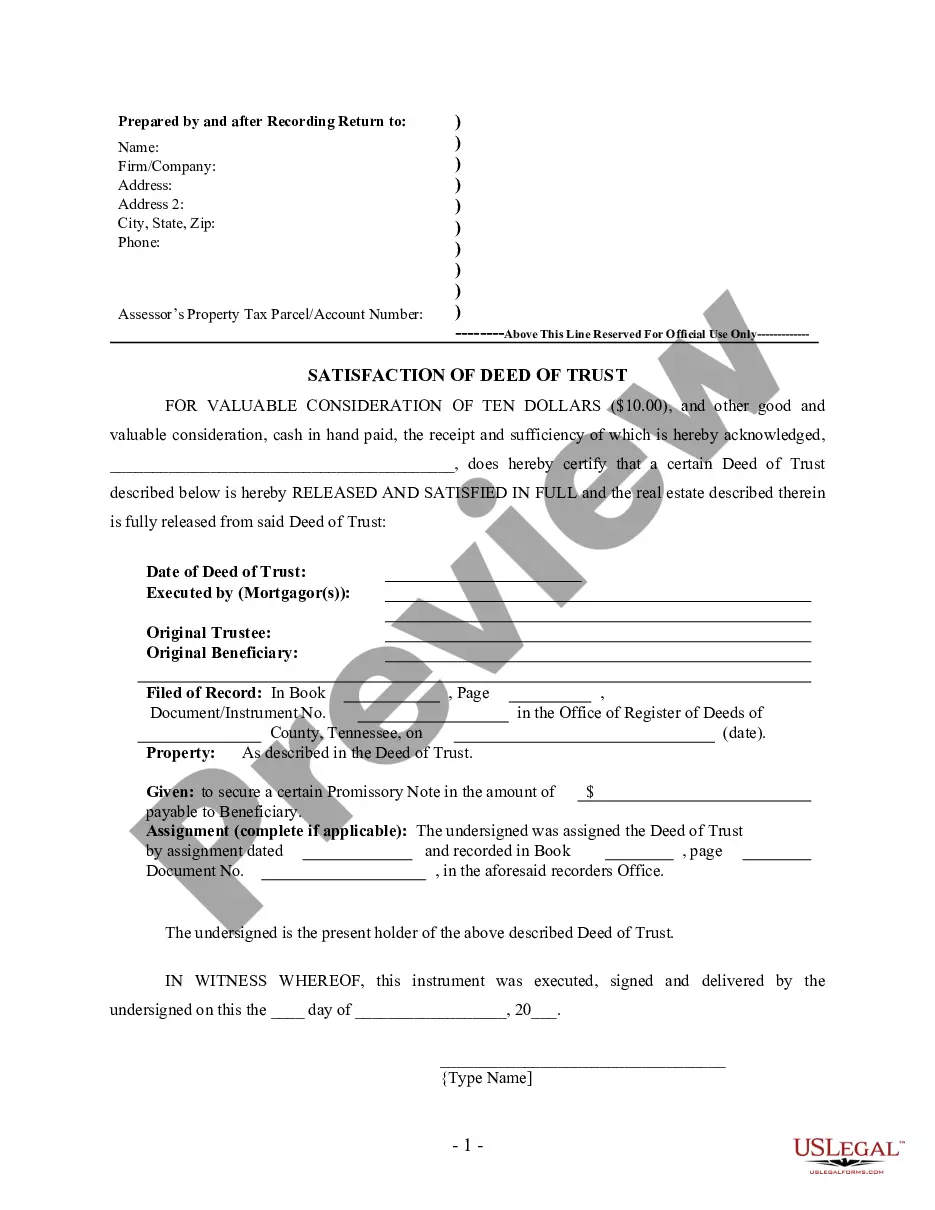

This form is for the satisfaction or release of a deed of trust for the state of Tennnessee by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Tennessee Release - Satisfaction - Cancellation of Deed of Trust - Individual Lender or Holder

Description Trust Deed

Understanding Release, Satisfaction, Cancellation of Deed

Release: The act of freeing someone from a duty or obligation.

Satisfaction: The fulfillment or discharge of a debt or claim.

Cancellation: The act of declaring something void and terminating its legal force.

Deed: A legal document that is signed and delivered, especially one regarding the ownership of property or legal rights.

Step-by-Step Guide to Process a Cancellation of Deed

- Determine the Need for Cancellation: Verify the reasons and legal basis for the cancellation of the deed.

- Obtain Consent from Relevant Parties: Secure agreement from all parties involved in the original deed.

- Prepare Cancellation Documents: Draft the cancellation document reflecting the consent and reasons for the deed's cancellation.

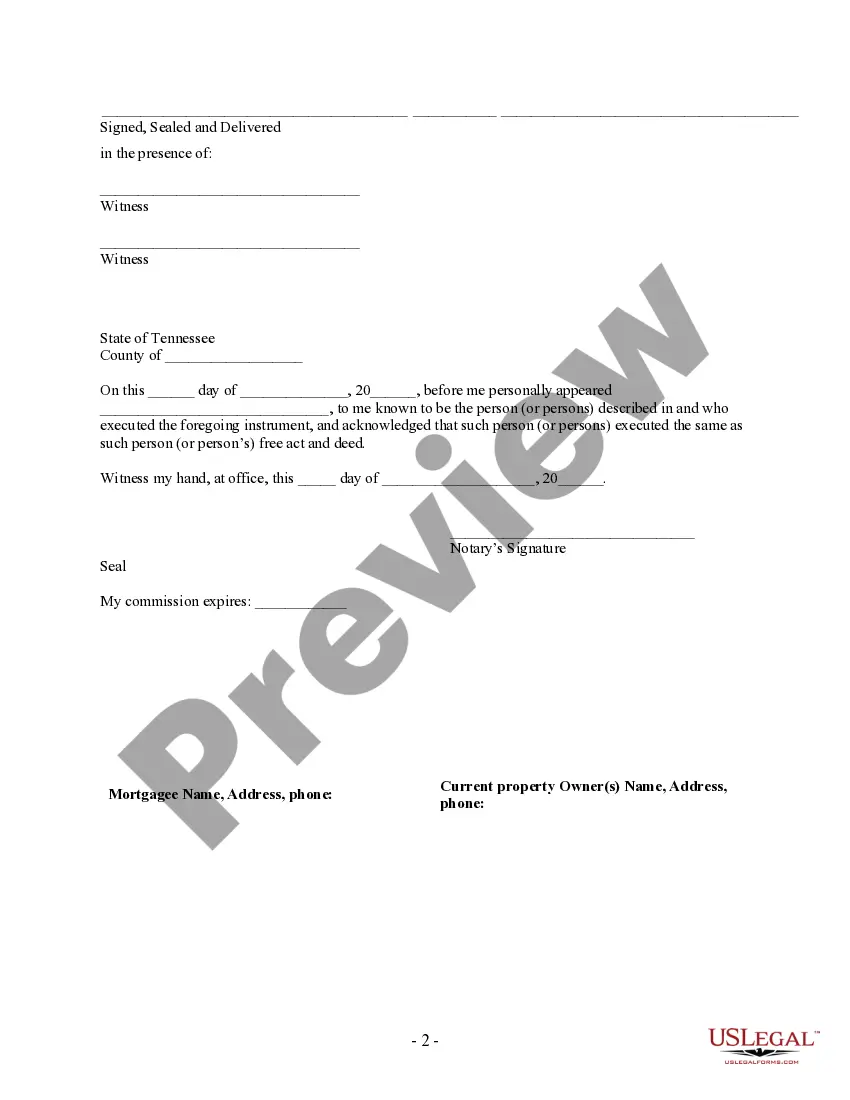

- Sign and Notarize: Have the document signed by all parties involved and notarized to ensure its validity.

- Record the Cancellation: File the cancellation document with the appropriate local or state registry to formally complete the process.

Risks Involved in Cancelling a Deed

- Legal Consequences: Incorrect handling can lead to disputes or lawsuits.

- Financial Impact: There may be financial implications such as loss of deposits or fees paid.

- Impact on Credit: Mishandling can affect the credit ratings of the involved parties.

Comparative Analysis: Cancellation vs. Amendment of Deed

| Aspect | Cancellation of Deed | Amendment of Deed |

|---|---|---|

| Purpose | Terminates the deed entirely | Modifies specific terms while keeping the deed active |

| Complexity | High, as it nullifies previous legal agreements | Medium, requires precision but maintains framework |

| Risk Level | High, potential for disputes | Lower, typically agreed upon adjustments |

Best Practices for Deed Cancellation

- Comprehensive Review: Thoroughly review legal implications and conditions tied to the deed before proceeding.

- Professional Advice: Consult with legal experts to ensure all aspects are properly handled.

- Clear Documentation: Maintain detailed and clear records of all communications and official documents.

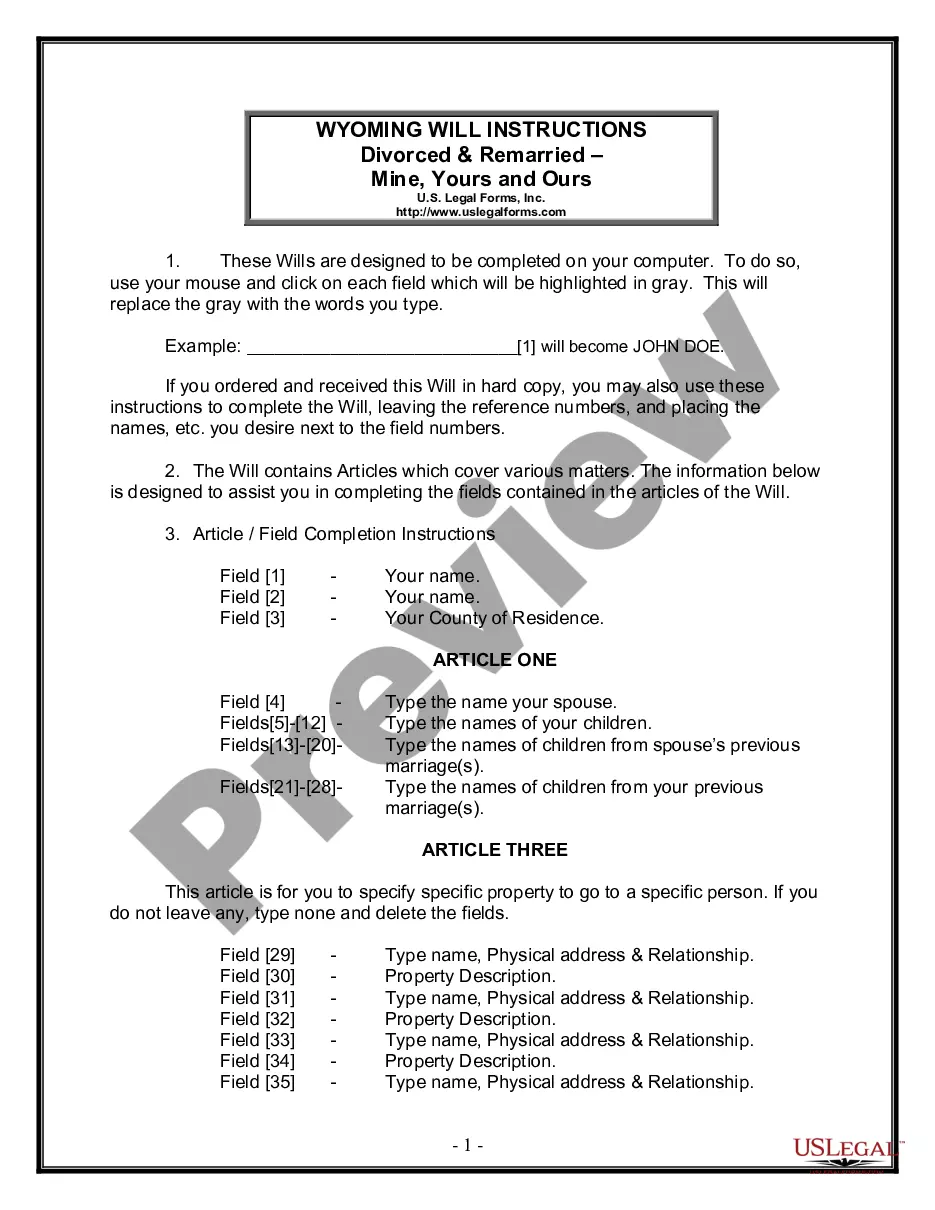

How to fill out Deed Of Release?

Get access to top quality Tennessee Release - Satisfaction - Cancellation of Deed of Trust - Individual Lender or Holder forms online with US Legal Forms. Avoid days of wasted time browsing the internet and dropped money on files that aren’t updated. US Legal Forms offers you a solution to exactly that. Get around 85,000 state-specific legal and tax samples you can save and complete in clicks within the Forms library.

To receive the example, log in to your account and click on Download button. The file will be stored in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide listed below to make getting started easier:

- Find out if the Tennessee Release - Satisfaction - Cancellation of Deed of Trust - Individual Lender or Holder you’re looking at is suitable for your state.

- See the sample making use of the Preview function and browse its description.

- Go to the subscription page by simply clicking Buy Now.

- Choose the subscription plan to go on to register.

- Pay out by card or PayPal to complete making an account.

- Pick a favored format to save the file (.pdf or .docx).

You can now open the Tennessee Release - Satisfaction - Cancellation of Deed of Trust - Individual Lender or Holder example and fill it out online or print it out and get it done by hand. Consider giving the papers to your legal counsel to ensure everything is completed properly. If you make a error, print and complete application again (once you’ve created an account all documents you save is reusable). Make your US Legal Forms account now and access more templates.

What Does A Deed Of Trust Look Like Form popularity

Release Of Deed Other Form Names

What Is A Deed Of Trust In Tennessee FAQ

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

Pay off your debt. Fill out a release-of-lien form and have the lien holder sign it. Run out the statute of limitations. Get a court order. Make a claim with your title insurance company. Learn more:

If you have cleared a debt, a mortgage satisfaction document will give you clear title to real property. In other words, mortgage satisfaction is a document that results in release or discharge of a mortgage lien, and indicates that a borrower has cleared his/her debt.

In order to reconvey a deed of trust, the full reconveyance must be recorded within 21 days of receipt of the documents from the Beneficiary. The deed of reconveyance must be recorded in the county where the property is located. Locate the name of the Trustee in the recorded Deed of Trust.

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

The lender will also notify the Department of Motor Vehicles (DMV) that the loan has been paid in full. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied. This request can be made through the DMV or directly to the lender.

Depending on state laws, paper titles are generally mailed and electronic titles and/or liens are released to the motor vehicle agency approximately 10 business days after the payoff is received. Allow 15-30 days for receipt of your title based on mail time and/or motor vehicle agency process.

If you can't find out which company took over, call the Federal Deposit Insurance Corporation's (FDIC) lien release number at (888) 206-4662 (toll free) or visit the Closed Banks and Asset Sales section on the FDIC's "Contact Us" page.