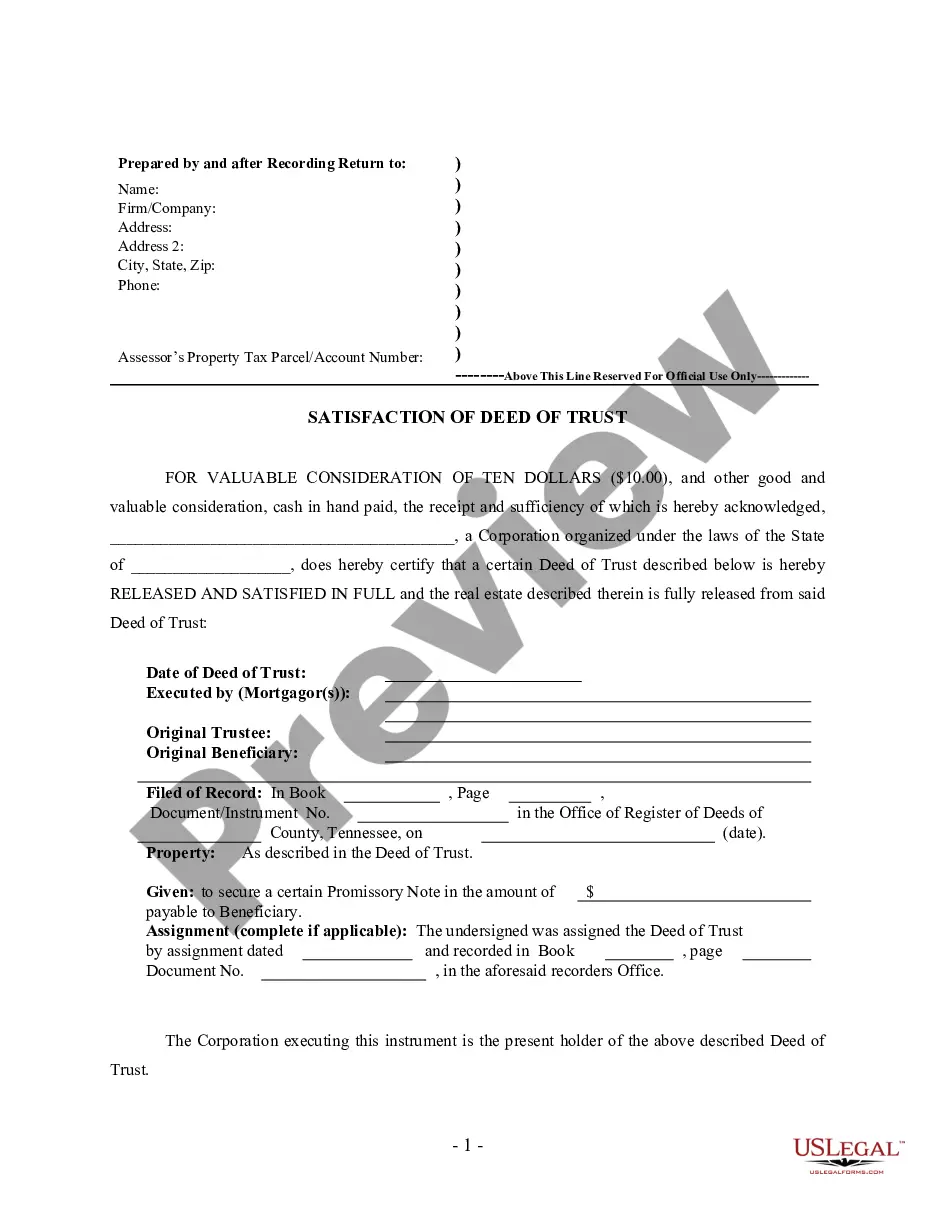

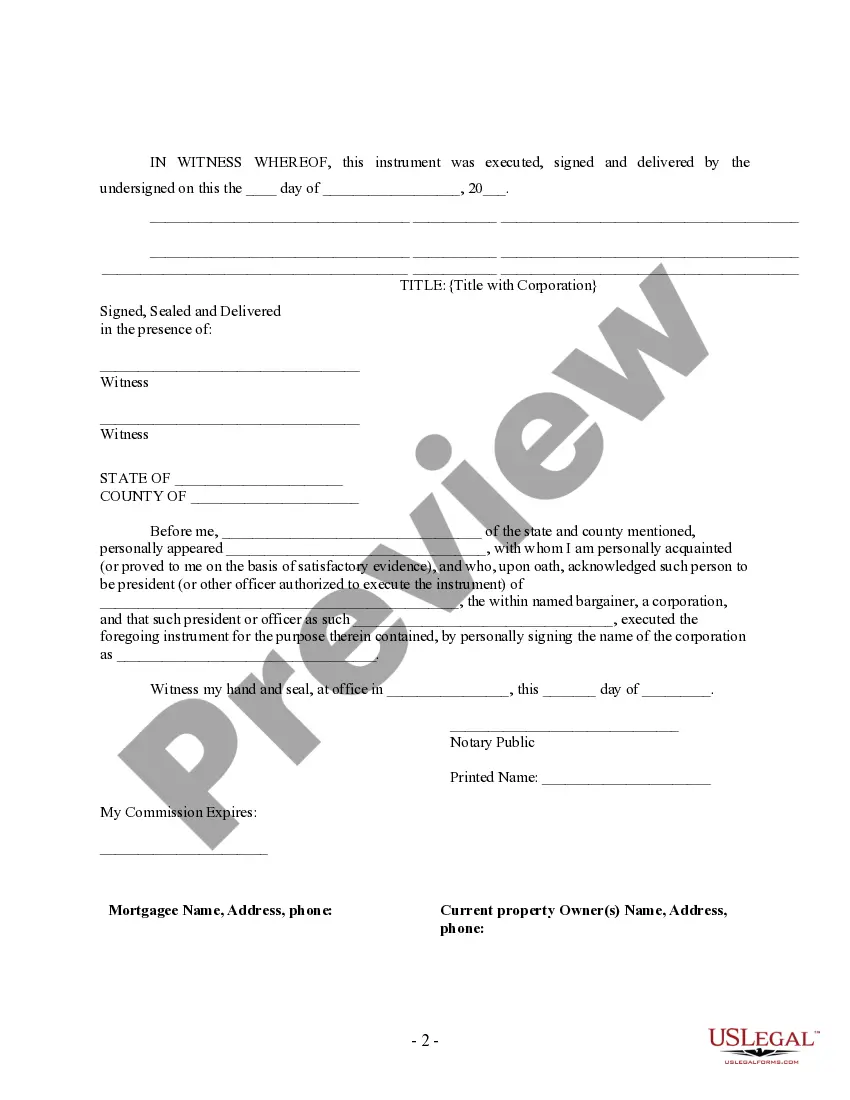

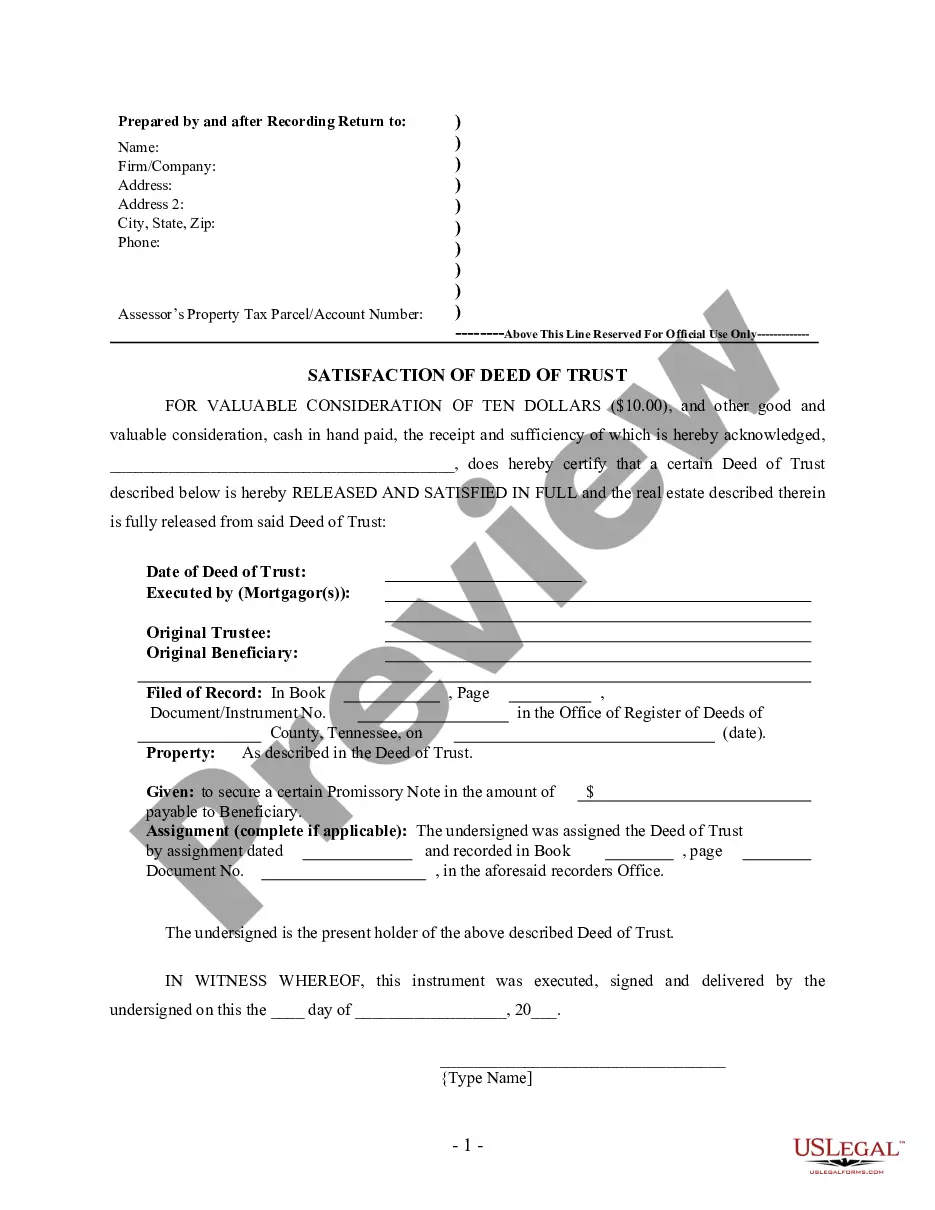

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Tennessee by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender

Description Tennessee Trust Online

How to fill out Cancellation Trust?

Access to quality Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender templates online with US Legal Forms. Steer clear of days of lost time looking the internet and lost money on files that aren’t updated. US Legal Forms provides you with a solution to just that. Find around 85,000 state-specific authorized and tax templates that you could download and fill out in clicks within the Forms library.

To find the example, log in to your account and click on Download button. The document will be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- See if the Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender you’re considering is suitable for your state.

- View the sample using the Preview option and browse its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to go on to sign up.

- Pay by card or PayPal to finish making an account.

- Choose a favored format to save the file (.pdf or .docx).

Now you can open up the Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender sample and fill it out online or print it out and do it by hand. Consider giving the papers to your legal counsel to ensure things are completed properly. If you make a mistake, print and fill sample again (once you’ve made an account every document you save is reusable). Create your US Legal Forms account now and access a lot more templates.

Deed Trust Form Form popularity

Satisfied Mortgagee Parcel Other Form Names

Release Lender Form FAQ

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.

In order to reconvey a deed of trust, the full reconveyance must be recorded within 21 days of receipt of the documents from the Beneficiary. The deed of reconveyance must be recorded in the county where the property is located. Locate the name of the Trustee in the recorded Deed of Trust.

A deed of trust expires can and will expire based upon one of two specific timelines. The deed can either expire at a designated point follow the maturity date or, in the absence of this information, exactly 35 years after the date on which the deed had been recorded.

Once you've paid off your outstanding mortgage debt, the lender must prepare and issue a release of mortgage. This document officially discharges you from the debt obligation and removes the lien against the property.

The property's title remains in the trust until the loan is paid off, or satisfied, then it is released from the trust. To complete the release, the lender prepares a deed of reconveyance. This document states that the conditions of the loan have been met and you have no further financial obligations to the lender.

The deed can be re-written to reflect changes, but it needs the consent of both parties. If you want to make substantial changes to the deed, it's typically best to get a new one written. If changes are only minor, you can enter a deed of variation.

In real estate parlance, the party conveying property is called the grantor. The party receiving the property is the grantee. Either party can be an individual, a business entity, or a partnership. The contract between the grantor and grantee establishes the terms of transfer between the parties.

With a deed of trust, you temporarily give control of the title to your property to the lender for security purposes. Once you pay off the debt, the lender conveys that temporary control back to you.