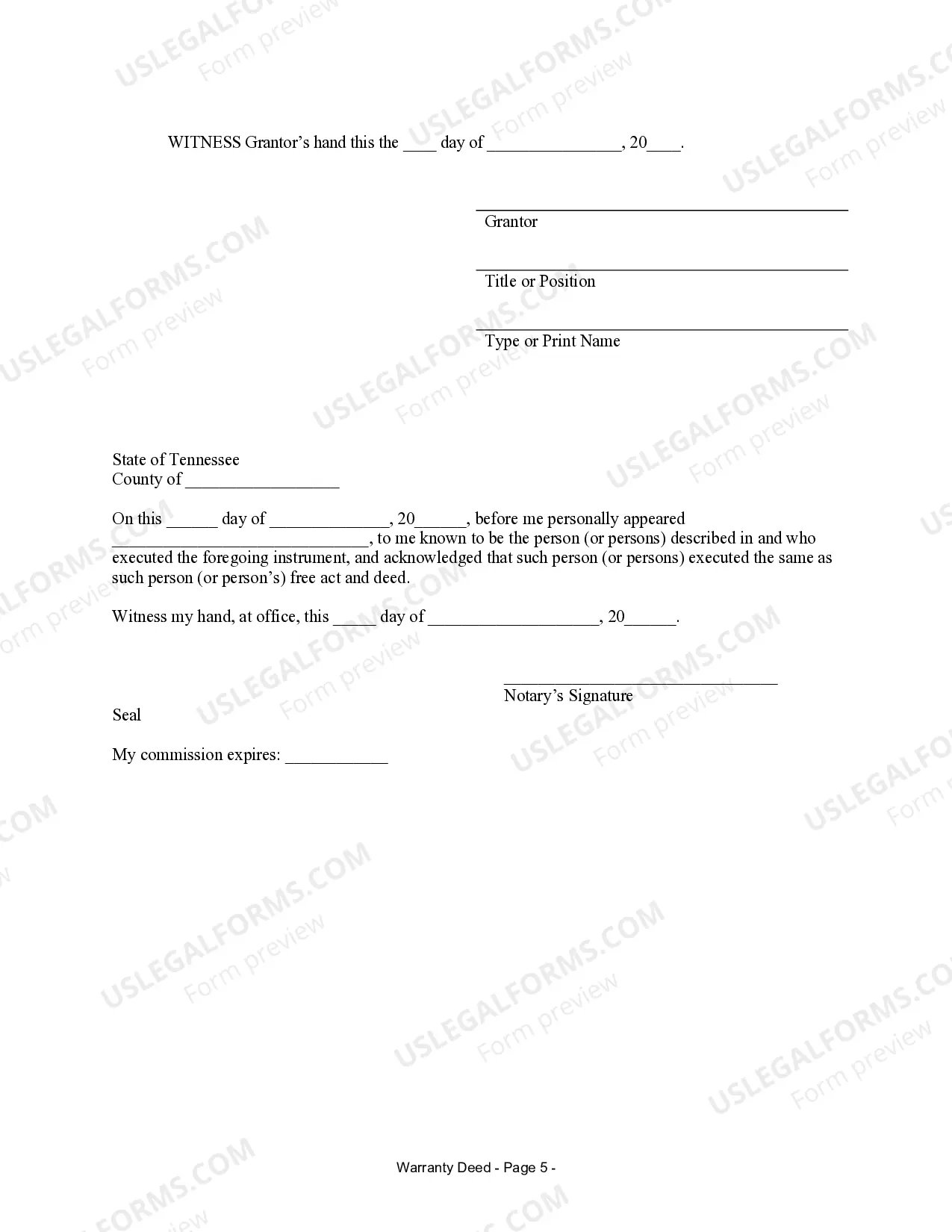

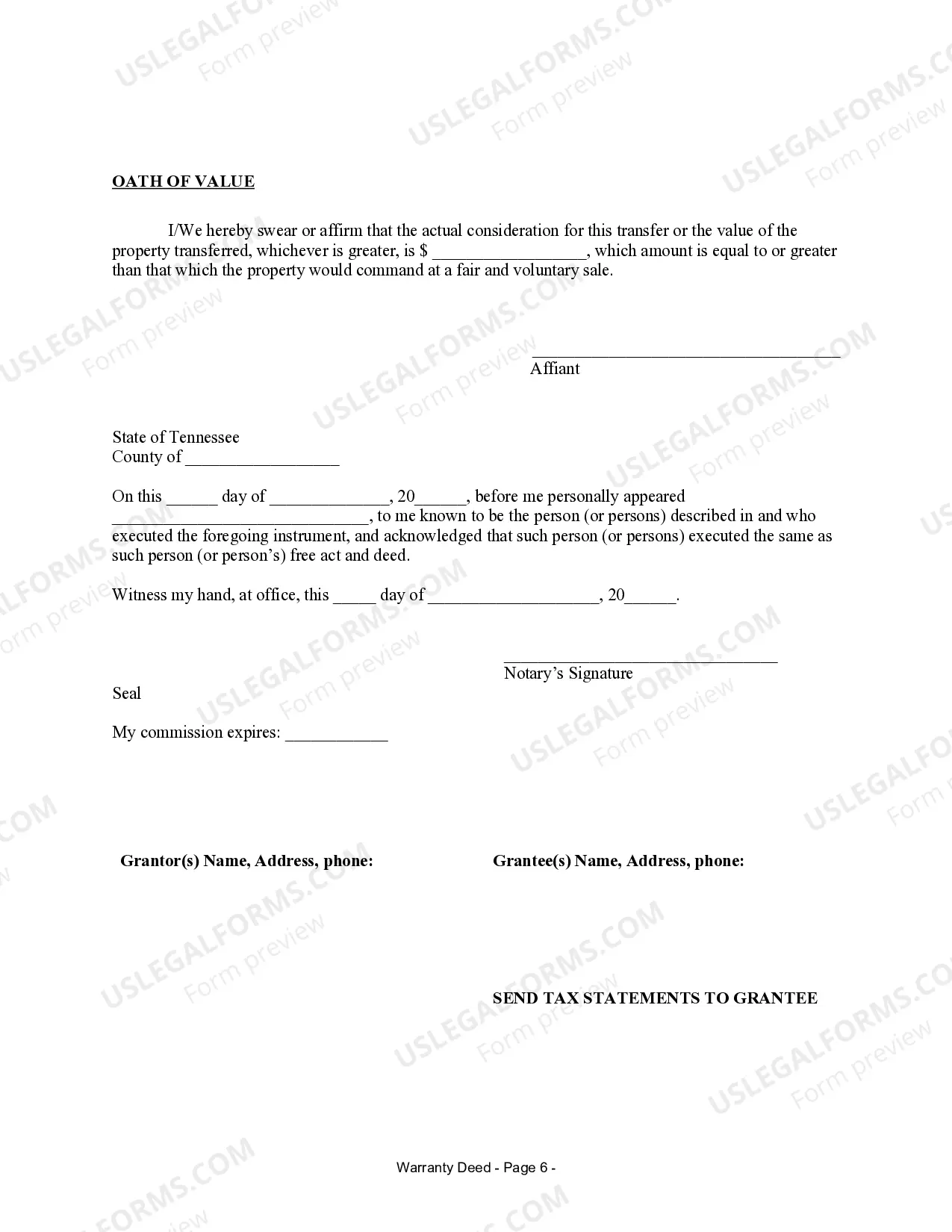

This form is a Warranty Deed where the grantor is a trust and the grantee is a trust.

Tennessee Warranty Deed for Trust to Trust

Description Tennessee Grantor Grantee

How to fill out Tennessee Warranty Deed For Trust To Trust?

Access to quality Tennessee Warranty Deed for Trust to Trust samples online with US Legal Forms. Avoid days of misused time seeking the internet and lost money on files that aren’t up-to-date. US Legal Forms offers you a solution to just that. Get over 85,000 state-specific legal and tax templates that you can download and submit in clicks within the Forms library.

To find the example, log in to your account and click Download. The document will be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide below to make getting started easier:

- Find out if the Tennessee Warranty Deed for Trust to Trust you’re looking at is appropriate for your state.

- See the form utilizing the Preview option and read its description.

- Go to the subscription page by clicking on Buy Now button.

- Select the subscription plan to go on to sign up.

- Pay out by credit card or PayPal to finish creating an account.

- Pick a preferred file format to download the document (.pdf or .docx).

Now you can open the Tennessee Warranty Deed for Trust to Trust template and fill it out online or print it and do it yourself. Take into account mailing the document to your legal counsel to ensure things are filled out properly. If you make a mistake, print out and fill sample once again (once you’ve made an account all documents you download is reusable). Make your US Legal Forms account now and get access to a lot more samples.

Warranty Deed Grantor Form popularity

Deed Grantor Grantee Other Form Names

FAQ

A deed of trust (DOT), is a document that conveys title to real property to a trustee as security for a loan until the grantor (borrower) repays the lender according to terms defined in an attached promissory note.In Tennessee, a Deed of Trust is the most commonly used instrument to secure a loan.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

A trustee deed offers no such warranties about the title.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

When recorded, a special warranty deed conveys an interest in real property to the named grantee with limited warranties of title. In Tennessee, special warranty deeds are statutory.This means that the deed will not protect the grantee against title issues that arose prior to the time the grantor acquired title.

A special warranty deed to real estate offers protection to the buyer through the seller's guarantee that the title has been free and clear of encumbrances during their ownership of the property. It does not guarantee clear title beyond their ownership.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

The deed of trust is currently used in Alabama, Alaska, Arkansas, Arizona, California, Colorado, District of Columbia, Georgia, Hawaii, Idaho, Iowa, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, North Carolina, Oklahoma, Oregon, Rhode Island, South Dakota, Tennessee, Texas, Utah, Virginia,