Tennessee Garnishment Answer is a legal process that allows creditors to collect money owed to them from a debtor's wages. It is a type of debt collection that is used when a debtor has failed to make payments towards an outstanding debt and the creditor wishes to collect on that debt. There are three types of Tennessee Garnishment Answer: Wage Garnishment, Bank Garnishment, and Property Garnishment. Wage Garnishment is when a creditor takes a percentage of the debtor's wages directly from their employer. Bank Garnishment is when a creditor takes money directly from the debtor's bank account. Property Garnishment is when a creditor takes possession of personal property owned by the debtor.

Tennessee Garnishment Answer

Description

How to fill out Tennessee Garnishment Answer?

How much time and resources do you typically spend on composing formal documentation? There’s a greater opportunity to get such forms than hiring legal specialists or wasting hours searching the web for a proper blank. US Legal Forms is the premier online library that provides professionally drafted and verified state-specific legal documents for any purpose, like the Tennessee Garnishment Answer.

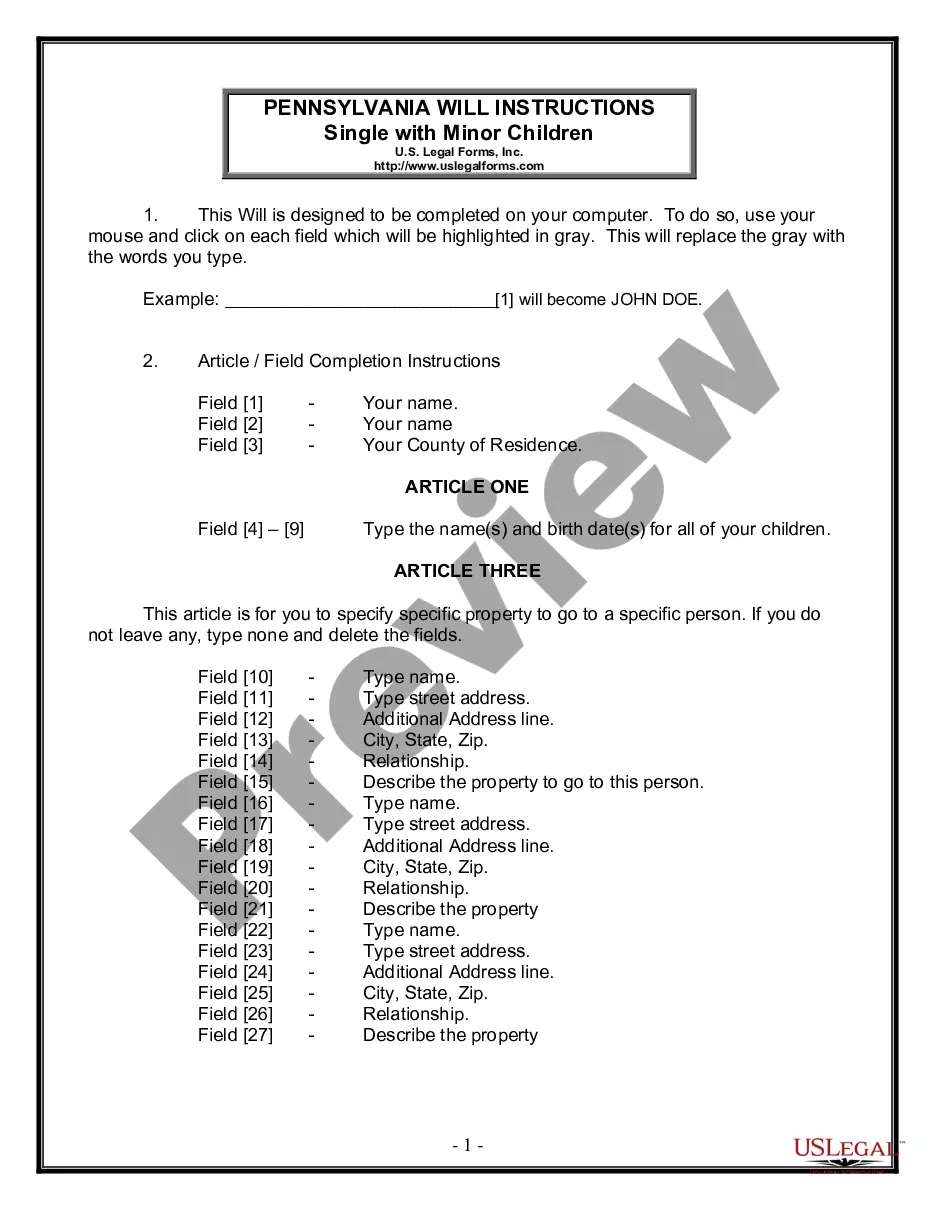

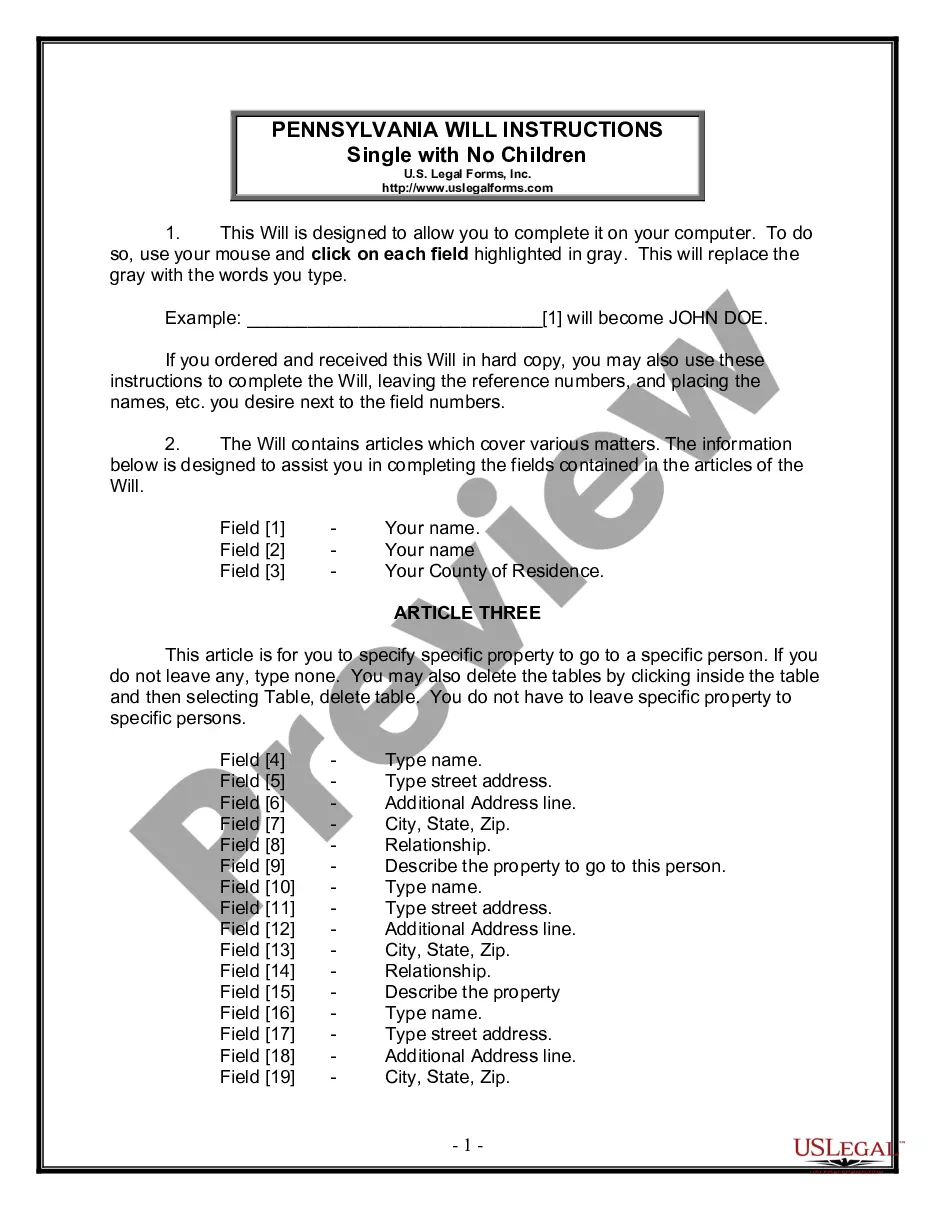

To obtain and prepare an appropriate Tennessee Garnishment Answer blank, follow these simple steps:

- Examine the form content to ensure it complies with your state laws. To do so, read the form description or utilize the Preview option.

- In case your legal template doesn’t satisfy your needs, locate a different one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Tennessee Garnishment Answer. Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Opt for the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally reliable for that.

- Download your Tennessee Garnishment Answer on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously purchased documents that you securely store in your profile in the My Forms tab. Get them anytime and re-complete your paperwork as often as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most trustworthy web solutions. Sign up for us now!

Form popularity

FAQ

Both Tennessee law and federal wage garnishment law limit the amount that can be garnished from a week's pay to the lesser of: 25% of your weekly disposable income.The amount of your weekly disposable income that is left over after you are paid 30 times the federal minimum wage.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. (15 U.S.C. § 1673).

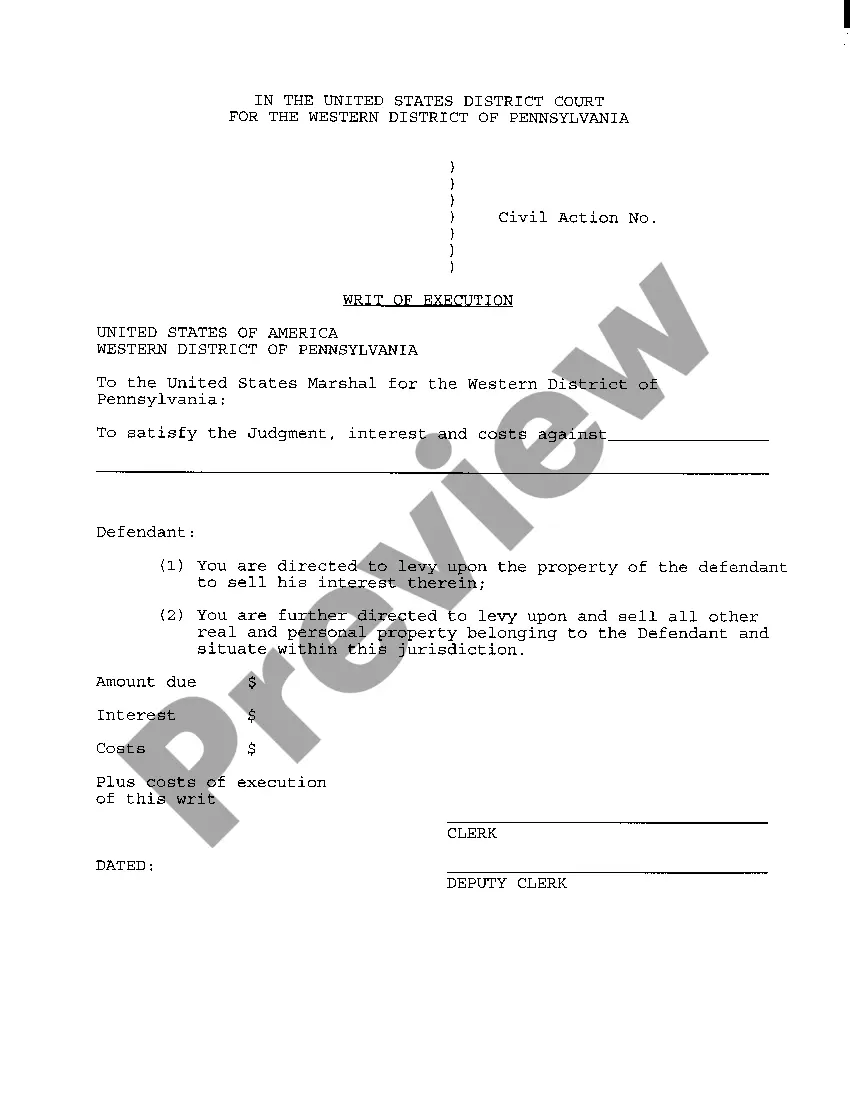

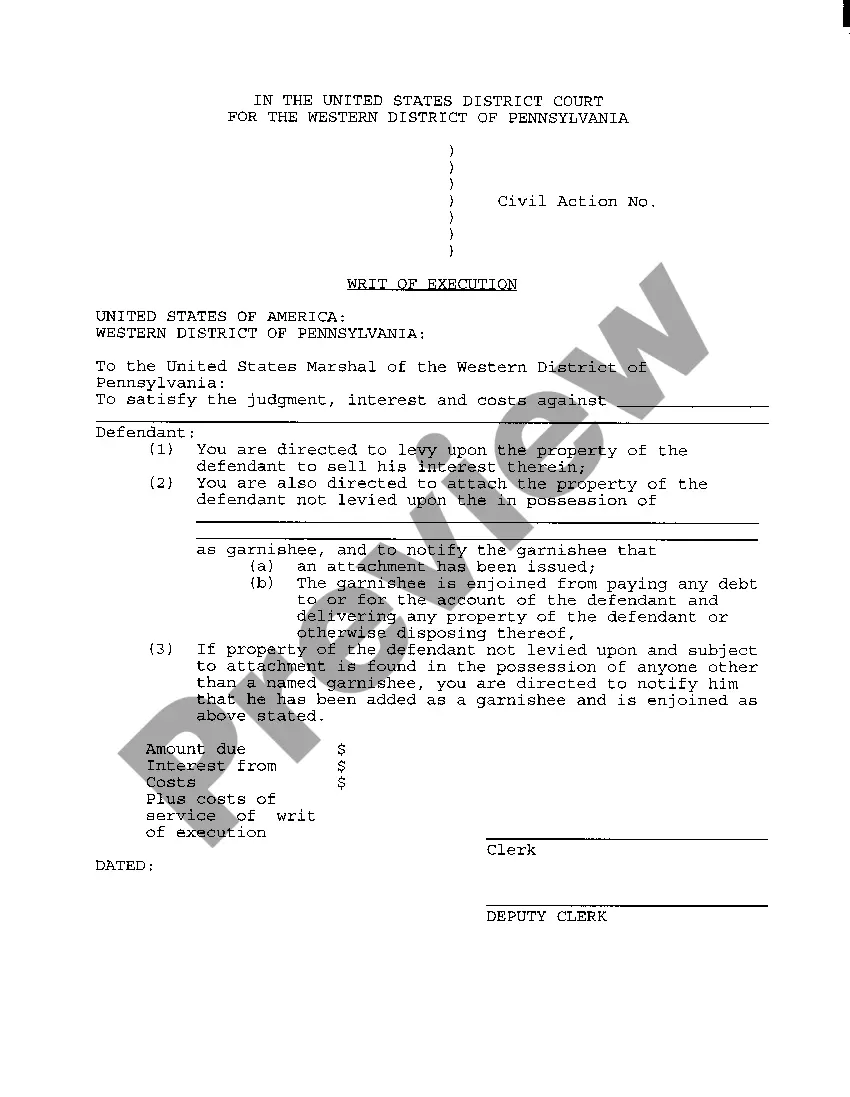

Execution.? every process or writ whereby the judgments and decrees of Courts are enforced.? (an Encyclopedia of Tennessee Law) says: ?An execution issues, as a matter of course, upon a judgment for a specific sum of money, without any order awarding or directing its issuance in express terms.?

Within ten days of service, the garnishee shall file a written answer with the court accounting for any property of the judgment debtor held by the garnishee. Within thirty days of service, the garnishee shall file with the court any money or wages (minus statutory exemptions) otherwise payable to the judgment debtor.

Both state and federal laws limit the amount of money that may be withheld from your weekly pay. The state and federal exemptions are nearly identical. Both Tennessee law and federal wage garnishment law limit the amount that can be garnished from a week's pay to the lesser of: 25% of your weekly disposable income.

Specifically, Rule 69.04 of the Tennessee Rules of Civil Procedure provides that: Within ten years from the entry of a judgment, the creditor whose judgment remains unsatisfied may file a motion to extend the judgment for another ten years.

You may apply to the court at the clerk's office shown below within twenty (20) days from any improper withholding of your wages for a motion to stop the garnishment. The court clerk identified below shall provide you with a form for making such a motion, or may have supplied a form motion on the back of this notice.

You may apply to the court at the clerk's office shown below within twenty (20) days from any improper withholding of your wages for a motion to stop the garnishment. The court clerk identified below shall provide you with a form for making such a motion, or may have supplied a form motion on the back of this notice.