Tennessee Garnishment and Execution Instructions

Description

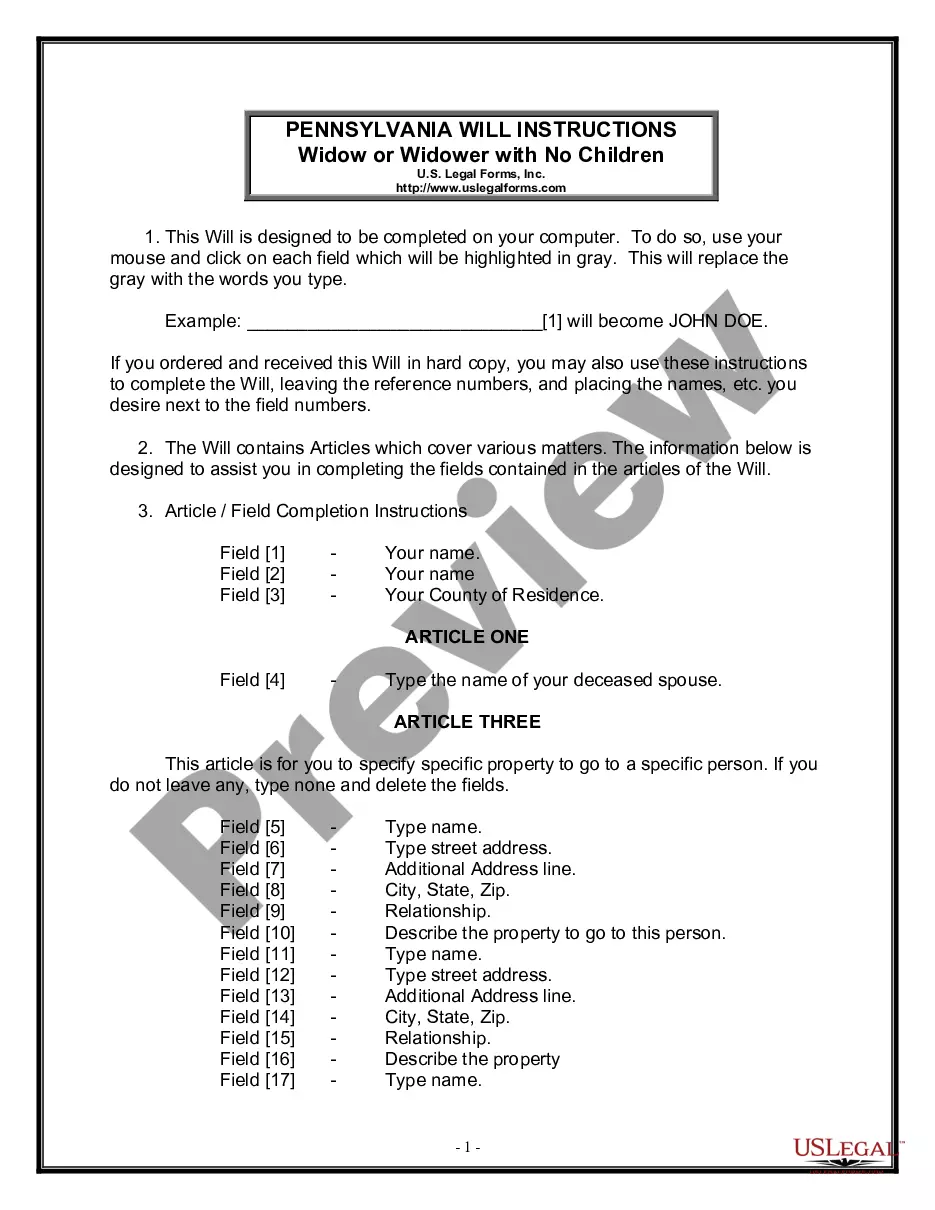

How to fill out Tennessee Garnishment And Execution Instructions?

If you’re searching for a way to properly prepare the Tennessee Garnishment and Execution Instructions without hiring a legal professional, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every individual and business situation. Every piece of documentation you find on our online service is designed in accordance with nationwide and state regulations, so you can be certain that your documents are in order.

Follow these straightforward instructions on how to get the ready-to-use Tennessee Garnishment and Execution Instructions:

- Make sure the document you see on the page corresponds with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the document title in the Search tab on the top of the page and select your state from the list to locate an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to get your Tennessee Garnishment and Execution Instructions and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Within ten days of service, the garnishee shall file a written answer with the court accounting for any property of the judgment debtor held by the garnishee. Within thirty days of service, the garnishee shall file with the court any money or wages (minus statutory exemptions) otherwise payable to the judgment debtor.

An income execution (also known as a garnishment) is another manner of collecting a money judgment. When a money judgment is rendered in favor of one party and the judgment debtor fails to pay voluntarily, the judgment creditor may enforce his judgment with an income execution against a source of the debtor's income.

You may apply to the court at the clerk's office shown below within twenty (20) days from any improper withholding of your wages for a motion to stop the garnishment. The court clerk identified below shall provide you with a form for making such a motion, or may have supplied a form motion on the back of this notice.

Both Tennessee law and federal wage garnishment law limit the amount that can be garnished from a week's pay to the lesser of: 25% of your weekly disposable income.The amount of your weekly disposable income that is left over after you are paid 30 times the federal minimum wage.

Wage garnishment, the most common type of garnishment, is the process of deducting money from an employee's monetary compensation (including salary), usually as a result of a court order.

You can stop a garnishment by: Paying off the debt in full. Filing an objection to the garnishment with the court if you have legal basis, such debt was a result of fraud or identity theft. Filing for court protection and debt resolution through Chapter 13 or Chapter 7 bankruptcy.

A garnishment is an order directing a third party to seize assets, usually wages from employment or money in a bank account, to settle an unpaid debt. The IRS may garnish wages without a court order.

A garnishment merely freezes the debtor's property in the hands of the garnishee, but an execution requires the person holding the debtor's property to release it to the creditor.