Tennessee Statistical Sheet Form

Description

How to fill out Tennessee Statistical Sheet Form?

US Legal Forms is the most easy and cost-effective way to locate suitable formal templates. It’s the most extensive web-based library of business and personal legal documentation drafted and checked by attorneys. Here, you can find printable and fillable templates that comply with federal and local laws - just like your Tennessee Statistical Sheet Form.

Obtaining your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted Tennessee Statistical Sheet Form if you are using US Legal Forms for the first time:

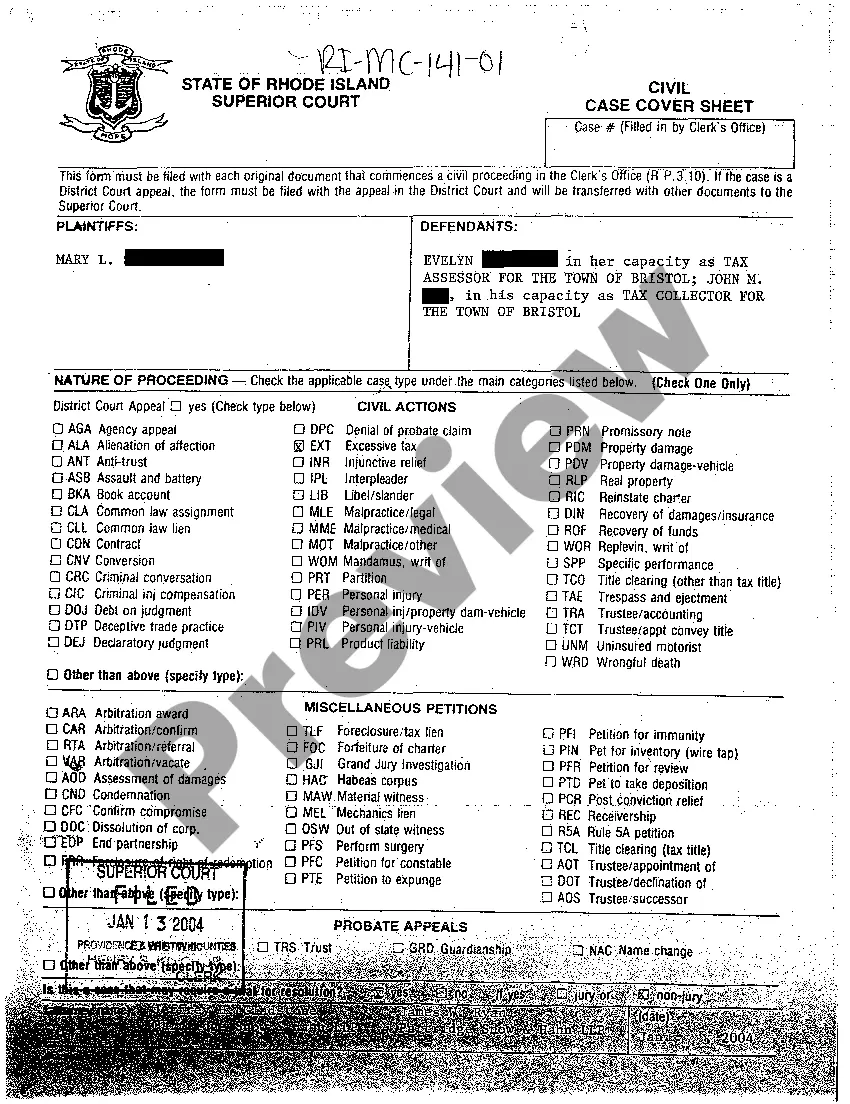

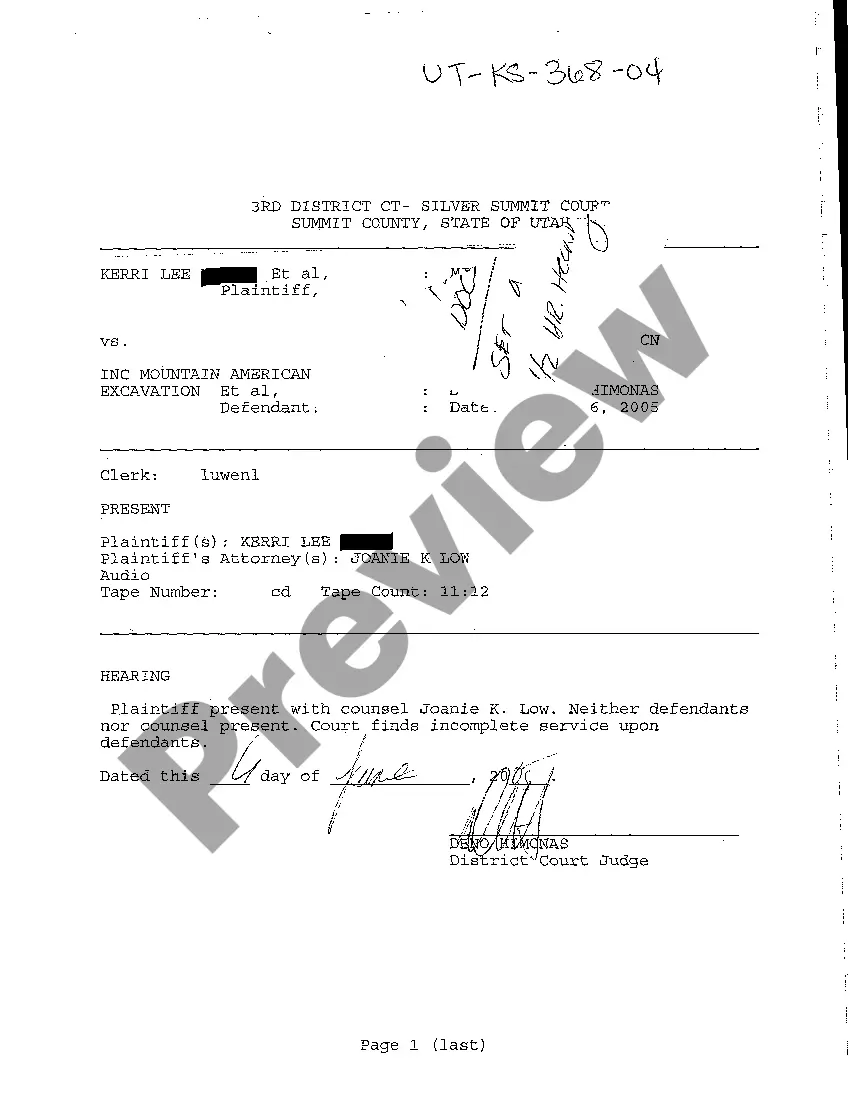

- Read the form description or preview the document to make certain you’ve found the one meeting your requirements, or find another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you like most.

- Create an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Tennessee Statistical Sheet Form and save it on your device with the appropriate button.

After you save a template, you can reaccess it anytime - just find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more proficiently.

Take advantage of US Legal Forms, your trustworthy assistant in obtaining the corresponding official paperwork. Give it a try!

Form popularity

FAQ

TTD benefits are paid at the rate of 66 ?% of your average weekly wage pre-injury (subject to the state maximum). Benefits start on the 8th day of the disability (unless the disability lasts only 14 days, in which case the benefits will be back-paid to the first day of disability).

In most industries, any employer with five or more full or part-time employees must carry workers' compensation insurance. In the construction or mining industry, however, employers must provide coverage even if there is only one employee.

Form C-41 Wage Statement. This form enables EMPLOYERS to calculate the correct compensation due to an injured employee. Please complete the form and submit to EMPLOYERS within 5 days after your knowledge of any accident that has caused your employee to be disabled for more than 7 calendar days.

Workers' Comp Exemptions in Texas Corporate officers and LLC Members who are not excluded from coverage must utilize a minimum annual payroll of $7,800 and a maximum payroll of $62,400 in order to calculate the cost of workers' comp insurance.

In Tennessee, your Workers' Compensation benefits are based on two-thirds of your Average Weekly Wage. Many claimants complain that the rate they are paid is far less than the two-thirds they are owed.

Officers and LLC Members who are not excluded from coverage must utilize a minimum payroll of $57,200 and a maximum payroll of $234,000 in order to calculate the cost of workers' comp insurance.

How Do You File a Workers' Compensation Claim in Tennessee? 5 steps to filing a workers' compensation claim in the Volunteer State.Step 1: Get medical treatment.Step 2: Report your injury to your employer.Step 3: Make sure your employer files the proper form.Step 4: Wait to hear if your claim is accepted or denied.