Tennessee Tax Sale-Tax Sale Information is a process of selling tax liens and/or properties to recover unpaid taxes from delinquent taxpayers. This process is overseen by the Tennessee Trustee, the office of the county trustee, or the local county mayor. The tax sale process is conducted through either a public auction or private sale. In a public auction, the Trustee will sell a tax lien certificate or property to the highest bidder. The successful bidder will then become the lien holder or owner of the property. The lien holder is then entitled to receive the delinquent taxes, interest, and/or penalties owed on the property. In a private sale, the Trustee will negotiate directly with a prospective buyer for the sale of a tax lien certificate or property. The prospective buyer must be able to pay the delinquent taxes, interest, and/or penalties owed on the property. There are two types of Tennessee Tax Sale-Tax Sale Information: Tax Lien Certificate Sales and Property Sales. Tax Lien Certificate Sales involve the sale of a tax lien certificate to the highest bidder. The successful bidder will then become the lien holder or owner of the certificate. Property Sales involve the sale of a property to a prospective buyer who is able to pay the delinquent taxes, interest, and/or penalties owed on the property.

Tennessee TAX SALE-Tax Sale Information

Description

How to fill out Tennessee TAX SALE-Tax Sale Information?

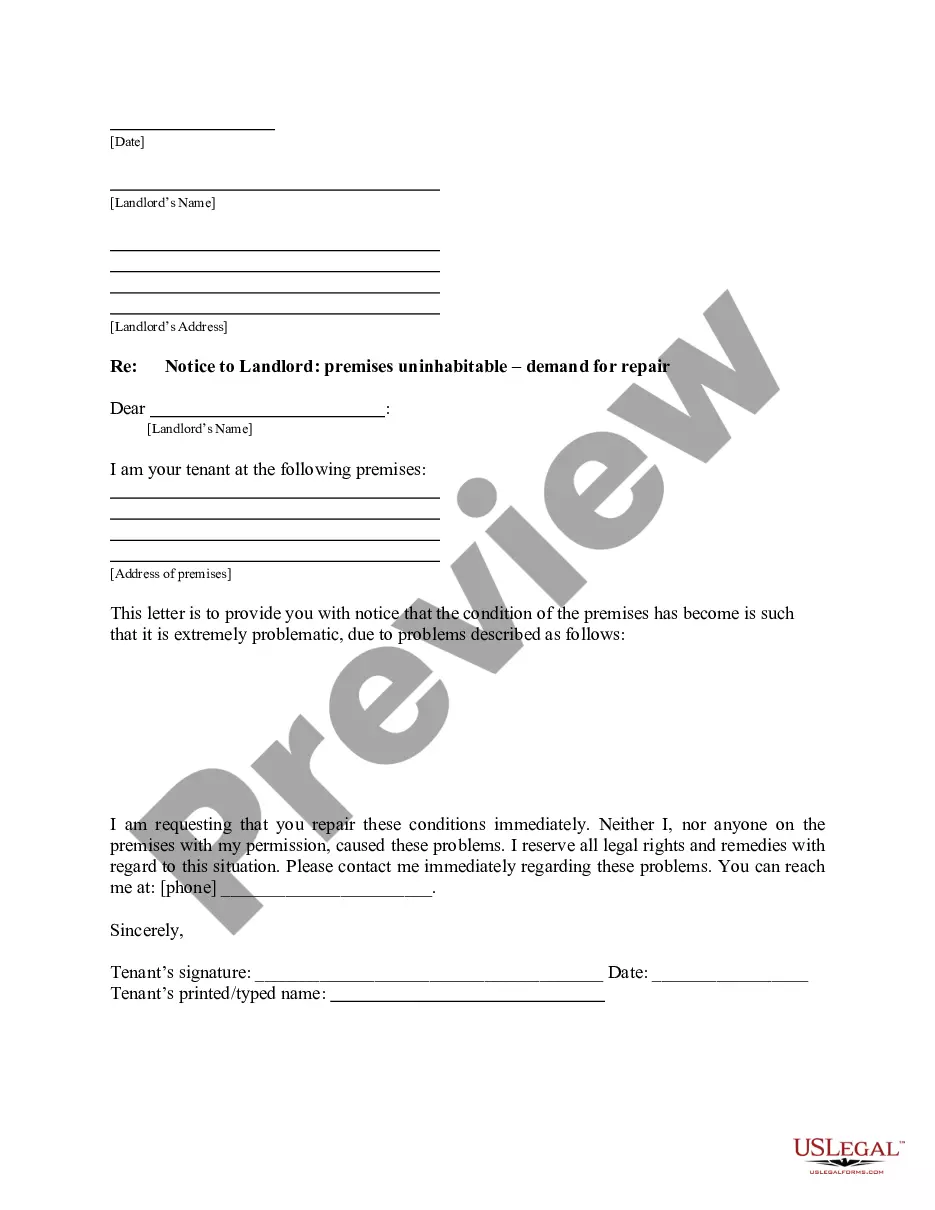

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them comply with federal and state regulations and are examined by our specialists. So if you need to fill out Tennessee TAX SALE-Tax Sale Information, our service is the best place to download it.

Obtaining your Tennessee TAX SALE-Tax Sale Information from our library is as easy as ABC. Previously registered users with a valid subscription need only log in and click the Download button once they find the proper template. Later, if they need to, users can use the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few minutes. Here’s a quick guide for you:

- Document compliance check. You should carefully review the content of the form you want and make sure whether it satisfies your needs and fulfills your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab above until you find an appropriate template, and click Buy Now when you see the one you need.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Tennessee TAX SALE-Tax Sale Information and click Download to save it on your device. Print it to fill out your paperwork manually, or use a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service today to obtain any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

Properties purchased in a tax sale may be redeemed by the previous owner, the heirs of the previous owner, or lien holders and assignees. An order confirming the tax sale is entered into the court records within 45 business days of the sale date. Once the order is complete, the property is eligible for redemption.

Delinquent tax properties are sold only by public auction and will not be sold over the counter. The Clerk & Master's Office does not issue Tax Certificates. Credit Cards are not accepted. Purchase of the properties will not be financed through the Clerk & Master's Office; payment must be made in full.

It depends, under certain circumstances a party's payment of property taxes can create a rebuttable presumption that the party has title, or ownership, to the property in question. These requirements are addressed in Tennessee Code Annotated §§ 28-2-109 & 110.

Tennessee is a redeemable deed state, which is a bit of a hybrid of a tax lien and tax deed. At a redeemable deed auction you're bidding on the deed to the property, like you would at a tax deed sale, but, as in a tax lien state, you don't get immediate possession of the property.

Properties purchased in a tax sale may be redeemed by the previous owner, the heirs of the previous owner, or lien holders and assignees. An order confirming the tax sale is entered into the court records within 45 business days of the sale date. Once the order is complete, the property is eligible for redemption.

Please contact us at Revenue.Collection@tn.gov, (615) 741-7071 or (844) 729-8689.

Delinquent tax properties are sold only by public auction and will not be sold over the counter. The Clerk & Master's Office does not issue Tax Certificates. Credit Cards are not accepted. Purchase of the properties will not be financed through the Clerk & Master's Office; payment must be made in full.