Tennessee Income Withholding for Support (IWO) Sample Form.pdf(114.54 KB)

Description

How to fill out Tennessee Income Withholding For Support (IWO) Sample Form.pdf(114.54 KB)?

Coping with legal paperwork requires attention, accuracy, and using properly-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Tennessee Income Withholding for Support (IWO) Sample Form.pdf(114.54 KB) template from our library, you can be certain it complies with federal and state laws.

Working with our service is easy and fast. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to obtain your Tennessee Income Withholding for Support (IWO) Sample Form.pdf(114.54 KB) within minutes:

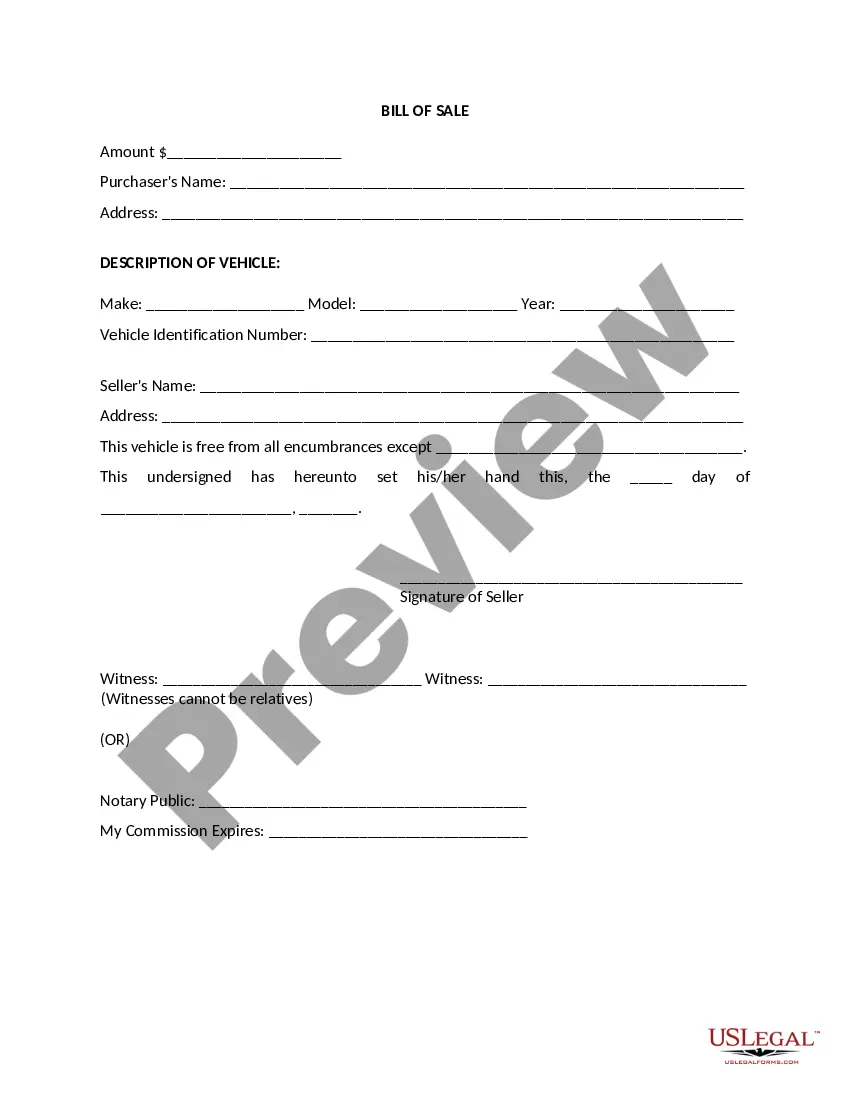

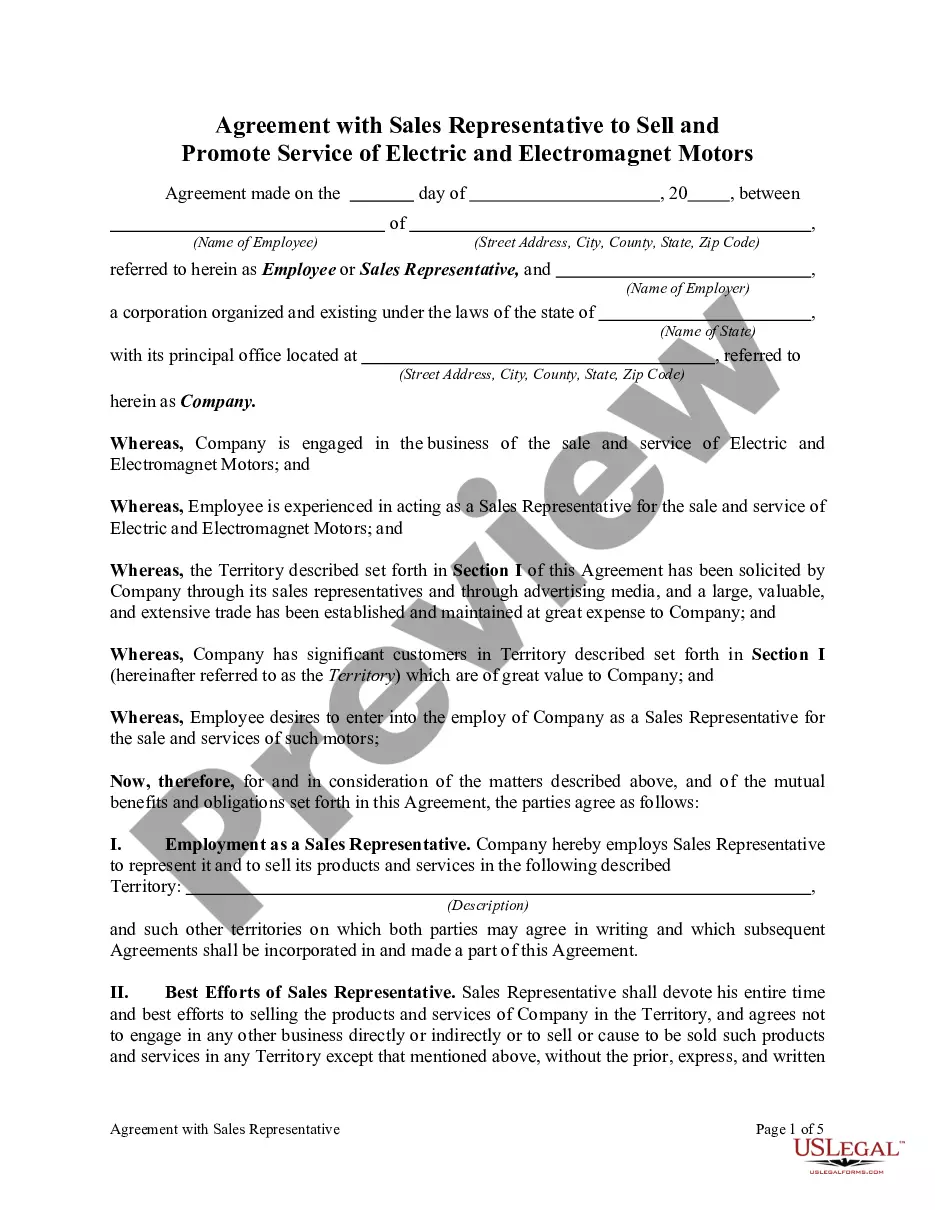

- Remember to carefully check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for an alternative formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Tennessee Income Withholding for Support (IWO) Sample Form.pdf(114.54 KB) in the format you prefer. If it’s your first experience with our service, click Buy now to continue.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the Tennessee Income Withholding for Support (IWO) Sample Form.pdf(114.54 KB) you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

Income Withholding for Support (IWO) - OMB 0970-0154.

The LCSA will handle getting an Income Withholding Order. They will have the order served within 15 days of locating your spouse's employer. Once the employer receives the Order, they have 10 days to take the money from your spouse's next paycheck.

What is an Income Withholding Order? An order directing an employer or other payor of funds to withhold a monthly amount from the income of the person obligated to pay child support, spousal maintenance, child support and spousal maintenance arrearage, and / or interest.

The Remittance ID is entered as the case identifier on the electronic funds transfer/electronic data interchange (EFT/EDI) record. NOTE TO EMPLOYER/INCOME WITHHOLDER: The employer/income withholder must use. the Remittance ID when remitting payments so the SDU or tribe can identify and apply the payment correctly.

The Remittance ID is entered as the case identifier on the electronic funds transfer/electronic data interchange (EFT/EDI) record. NOTE TO EMPLOYER/INCOME WITHHOLDER: The employer/income withholder must use. the Remittance ID when remitting payments so the SDU or tribe can identify and apply the payment correctly.

WITHHOLDING LIMIT The amount withheld for support may not exceed fifty percent (50%) of the employee's/income recipient's net wages or other income. (T.C.A. § 36-5-501(a)(1)) It is the employer's responsibility to determine when the 50% level is met.

What are withholding orders? Withholding orders are legal orders we issue to collect past due income taxes or a bill owed to local or state agencies. There are different types of withholding orders we issue: Earnings withholding order for taxes (EWOT)

The amount you are permitted to withhold from an individual's income cannot exceed 50% of their net income (the amount after FICA, withholding taxes, and a health insurance premium that covers the child/ren have been deducted).