Tennessee Agreement Between Fiduciary & Financial Institution

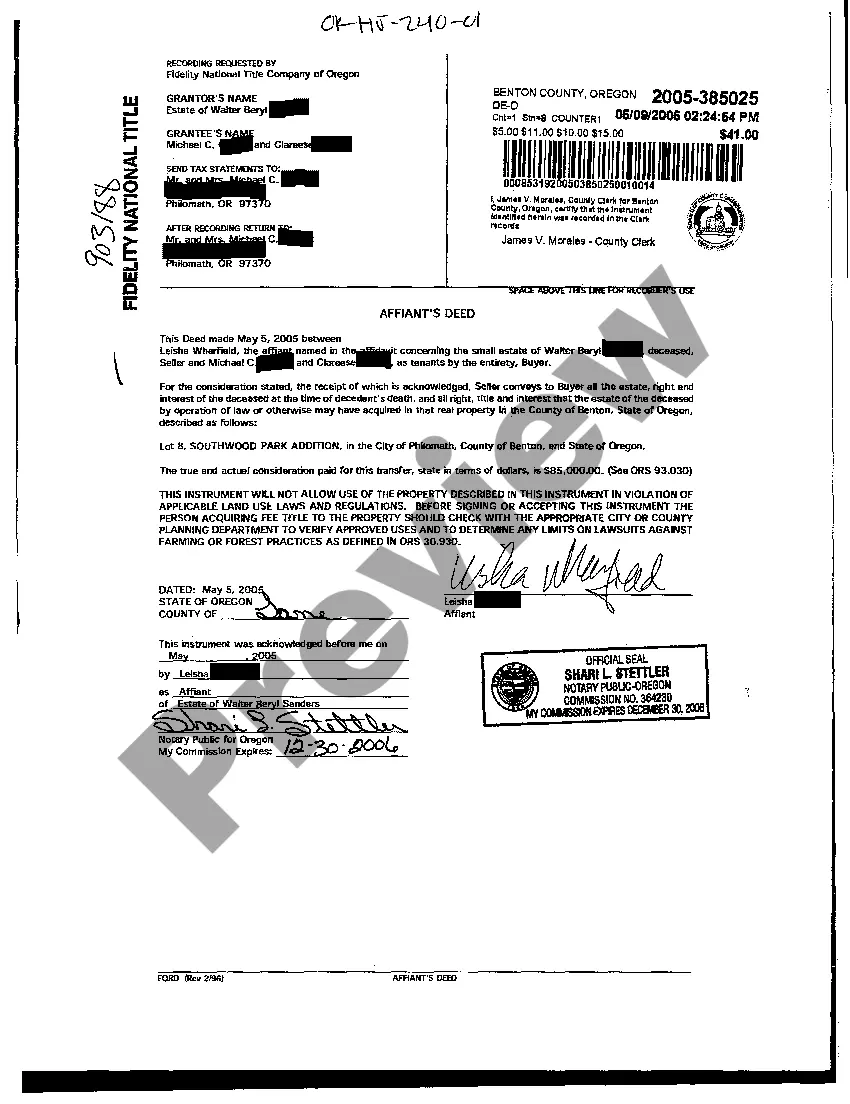

Description

How to fill out Tennessee Agreement Between Fiduciary & Financial Institution?

How much time and resources do you normally spend on drafting official documentation? There’s a greater option to get such forms than hiring legal specialists or wasting hours browsing the web for a proper blank. US Legal Forms is the premier online library that provides professionally designed and verified state-specific legal documents for any purpose, including the Tennessee Agreement Between Fiduciary & Financial Institution.

To obtain and complete an appropriate Tennessee Agreement Between Fiduciary & Financial Institution blank, adhere to these simple steps:

- Look through the form content to ensure it meets your state regulations. To do so, check the form description or use the Preview option.

- If your legal template doesn’t meet your requirements, locate a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Tennessee Agreement Between Fiduciary & Financial Institution. Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Choose the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely safe for that.

- Download your Tennessee Agreement Between Fiduciary & Financial Institution on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously purchased documents that you securely store in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as often as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most reliable web services. Sign up for us now!

Form popularity

FAQ

In a trustee/beneficiary relationship, the fiduciary (trustee) has legal ownership of the property and controls the assets held in the trust. As fiduciary, the trustee must make decisions that are in the best interest of the beneficiary as the latter holds equitable title to the property.

The Fiduciary agreement is often defined as a contract where a person transfers the ownership of one asset to another person, named the fiduciary, who will be in charge to exercise ownership rights on his behalf and re-transfer the asset to a named person at the end of the contract.

A fiduciary is legally bound to put their client's best interests ahead of their own. Fiduciary duties appear in a range of business relationships, including a trustee and a beneficiary, corporate board members and shareholders, and executors and legatees.

A fiduciary is someone who manages money or property for someone else. When you are named a fiduciary, you are required by law to manage the person's money and property for their benefit, not yours.

What is Breach of Fiduciary Duty? The person or entity in a position of responsibility for a trust or estate has a legal responsibility to act in the best interest of the other party. As the fiduciary of the estate, will, or trust, the party has certain legal duties they must meet.

A ?Fiduciary? is a person or an institution you choose to entrust with the management of your property. Included among Fiduciaries are Executors and Trustees. An Executor is a person you appoint to settle your estate and to carry out the terms of your Will after your death.

Any person who has an obligation to act in the best interest of another person or persons is considered a fiduciary. A fiduciary can be a lawyer representing a client, a trustee and a beneficiary, a corporate board and shareholders, and even employees and a company.

In order for a fiduciary duty to be legally binding, the agreement must be created under the law, by statute or contract, or by factual circumstances of the relationship, such as being based on case law.