Tennessee Order Confirming Accounting

Description

How to fill out Tennessee Order Confirming Accounting?

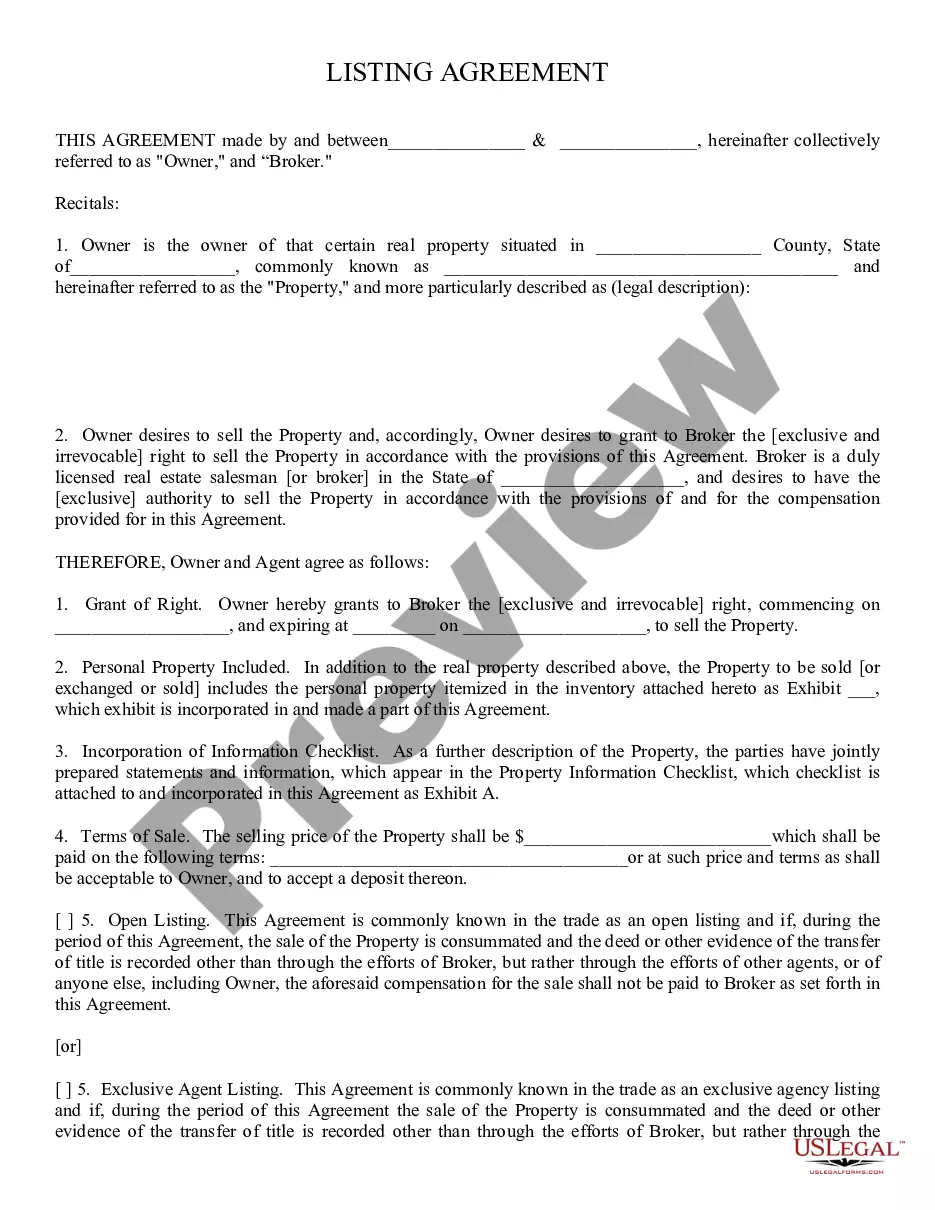

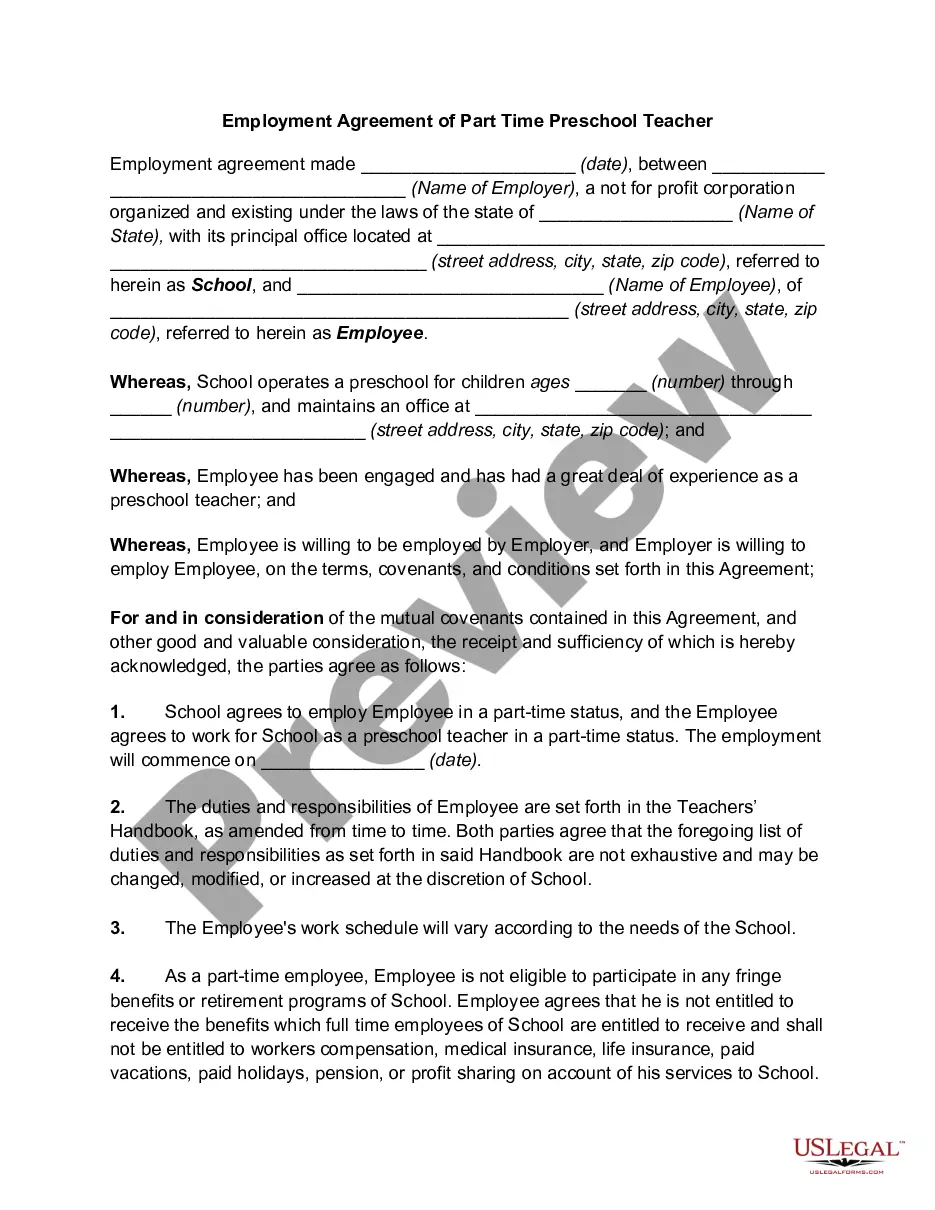

Handling legal documentation requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Tennessee Order Confirming Accounting template from our library, you can be certain it meets federal and state laws.

Dealing with our service is straightforward and fast. To get the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to obtain your Tennessee Order Confirming Accounting within minutes:

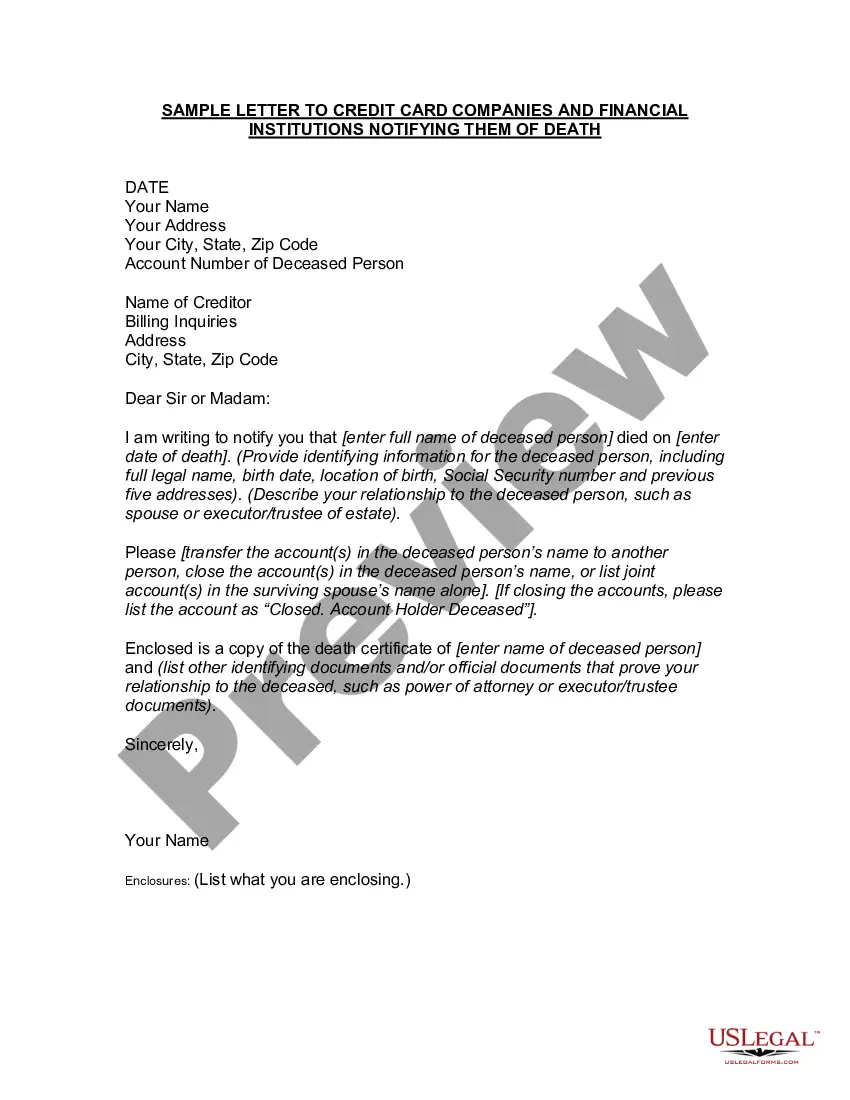

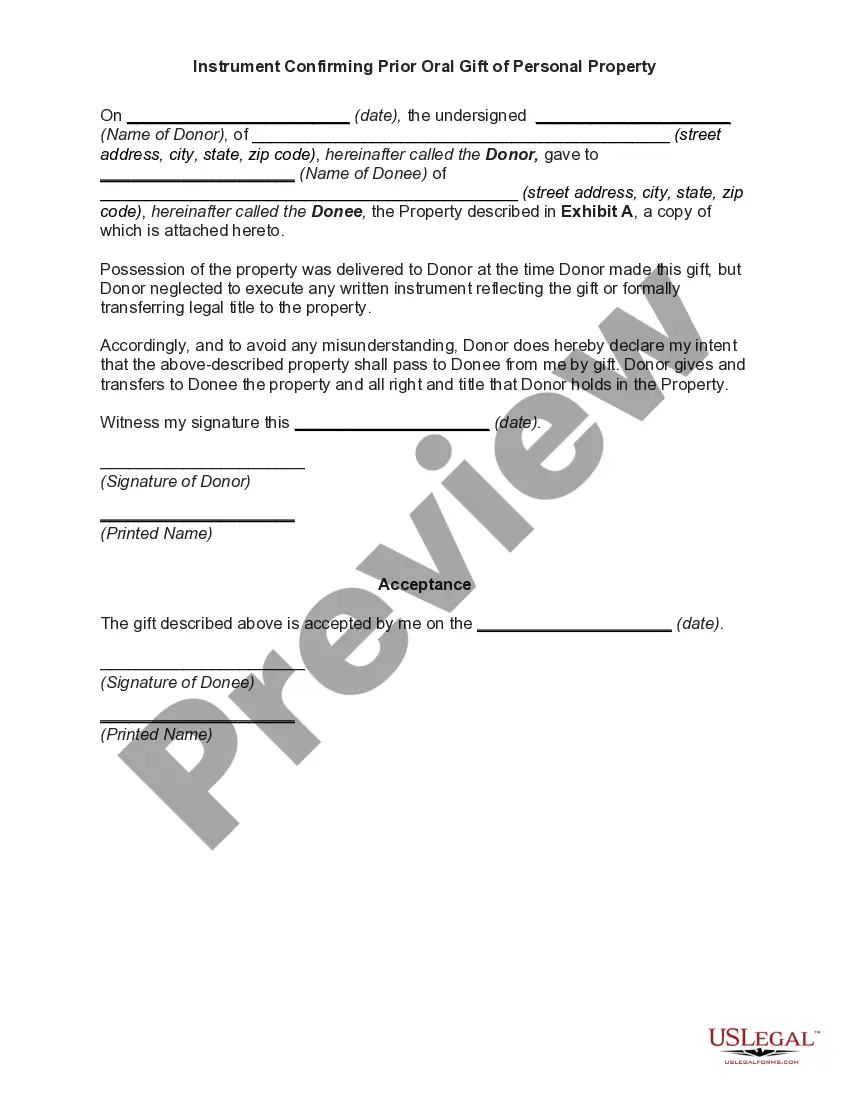

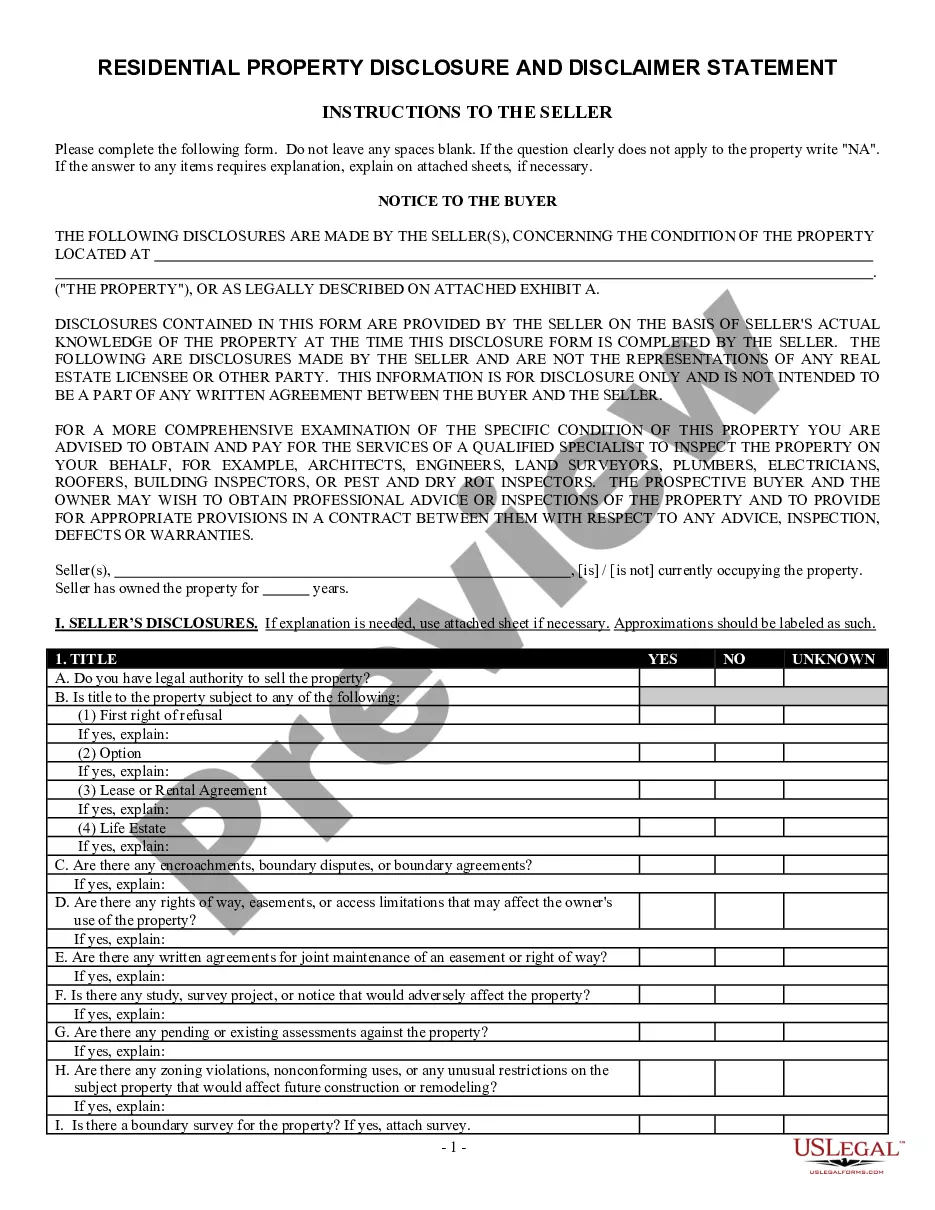

- Remember to carefully check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Tennessee Order Confirming Accounting in the format you need. If it’s your first time with our service, click Buy now to continue.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the Tennessee Order Confirming Accounting you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

Tennessee State Board of Accountancy.

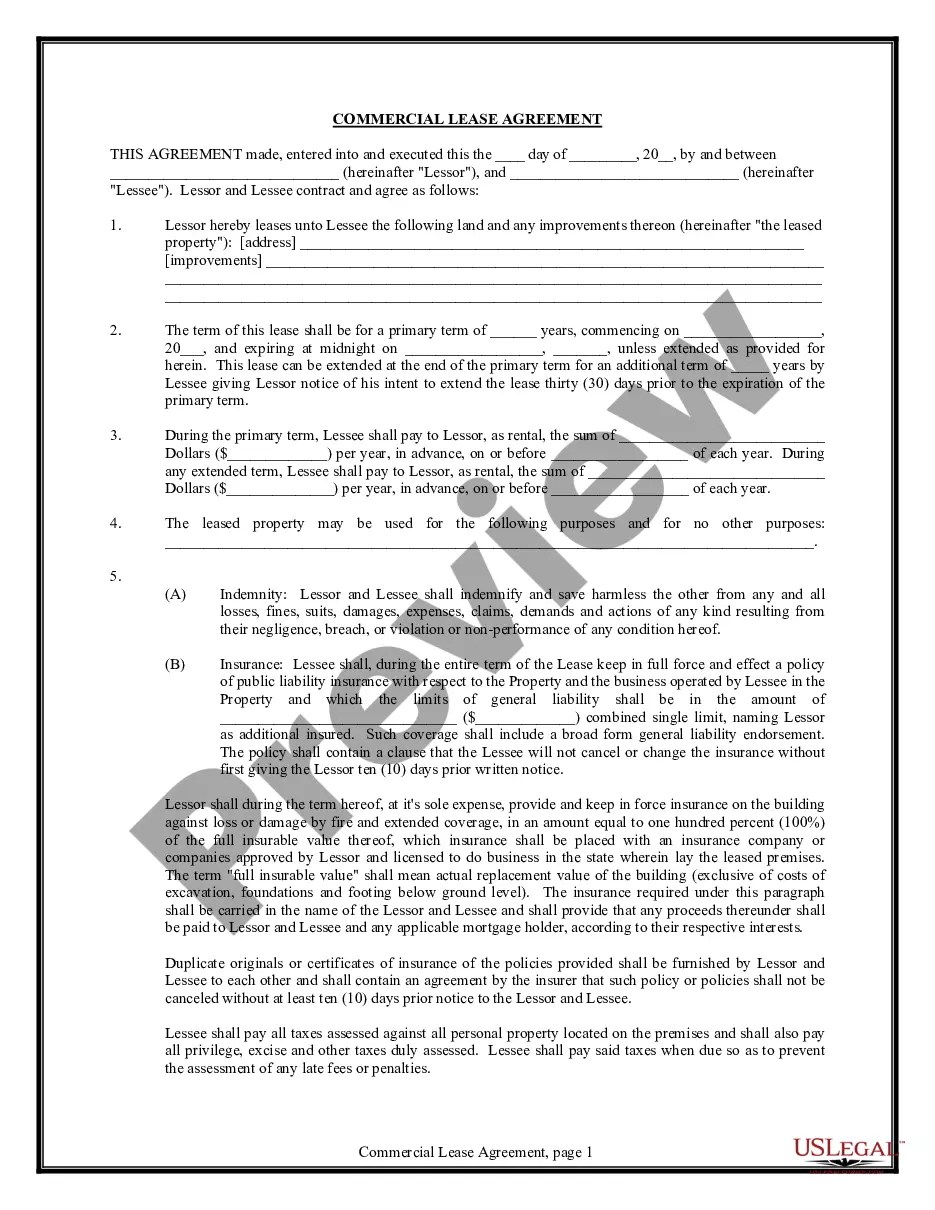

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.

Tennessee has a flat 6.50 percent corporate income tax rate and levies a gross receipts tax. Tennessee has a 7.00 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 9.55 percent.

Doing business in Tennessee means an activity purposefully engaged in within Tennessee by a person with the object of gain, benefit, or advantage consistent with the intent of the general assembly to subject such persons to the tax to the fullest extent permitted by the Constitution.

Businesses with less than $100,000 in taxable sales sourced to a county are exempt from the state business tax in that county, and businesses with less than $100,000 in taxable sales sourced to a municipality are exempt from the municipality business tax in that municipality.

Tennessee is a redeemable deed state, which is a bit of a hybrid of a tax lien and tax deed. At a redeemable deed auction you're bidding on the deed to the property, like you would at a tax deed sale, but, as in a tax lien state, you don't get immediate possession of the property.

If you are subject to the business tax, you must register to pay the tax. This application can be submitted electronically using the Tennessee Taxpayer Access Point (TNTAP). The state administered business tax is a tax based upon business gross receipts, which is due annually.

With a few exceptions, all businesses that sell goods or services must pay the state business tax. This includes businesses with a physical location in the state as well as out-of-state businesses performing certain activities in the state.