Tennessee Order Granting Additional Time to File and Accounting

Description

How to fill out Tennessee Order Granting Additional Time To File And Accounting?

How much time and resources do you typically spend on drafting official documentation? There’s a greater option to get such forms than hiring legal specialists or wasting hours browsing the web for a proper blank. US Legal Forms is the leading online library that offers professionally drafted and verified state-specific legal documents for any purpose, including the Tennessee Order Granting Additional Time to File and Accounting.

To acquire and complete a suitable Tennessee Order Granting Additional Time to File and Accounting blank, follow these easy steps:

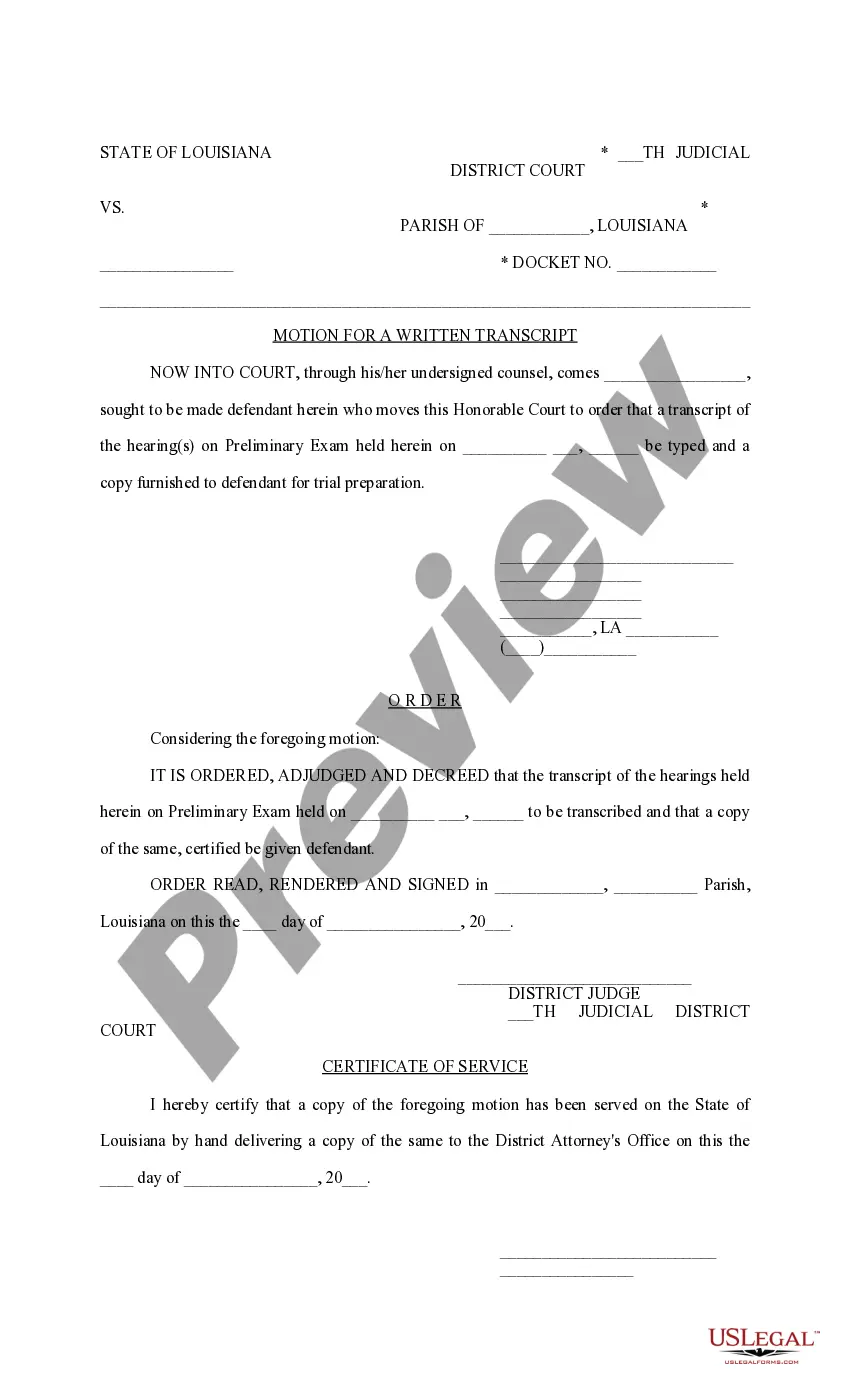

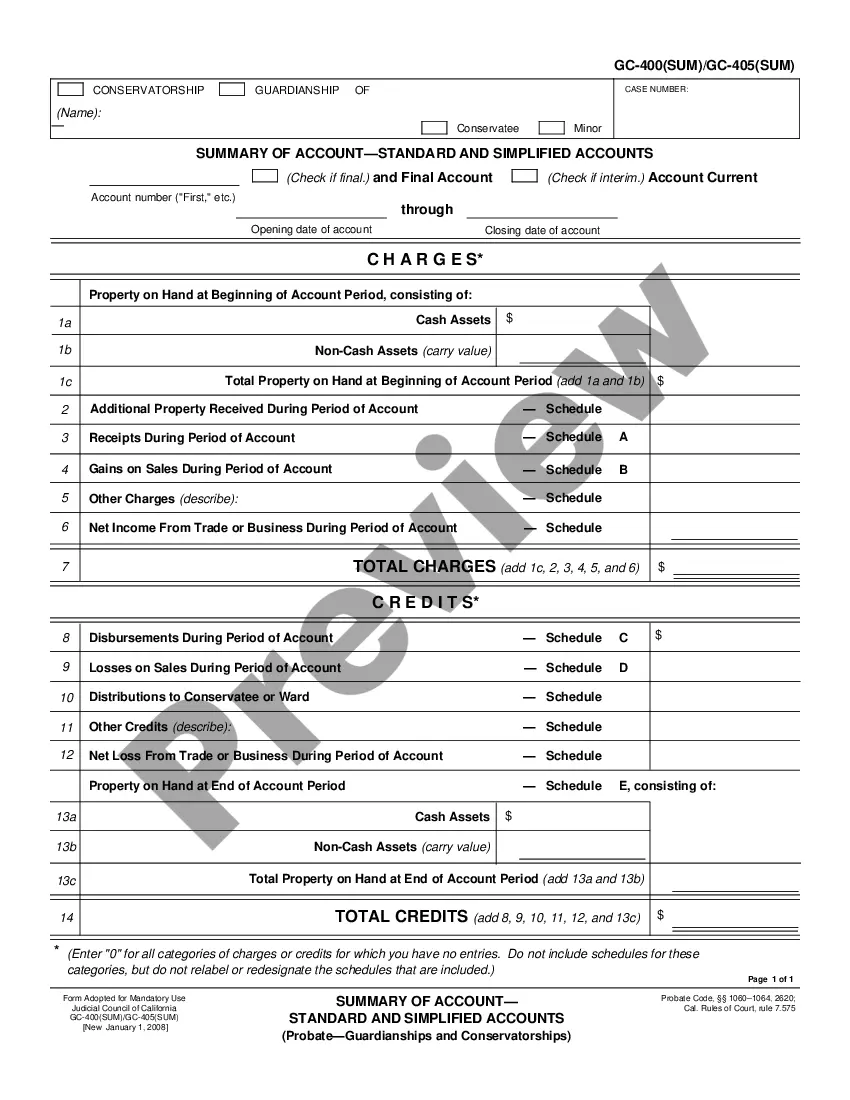

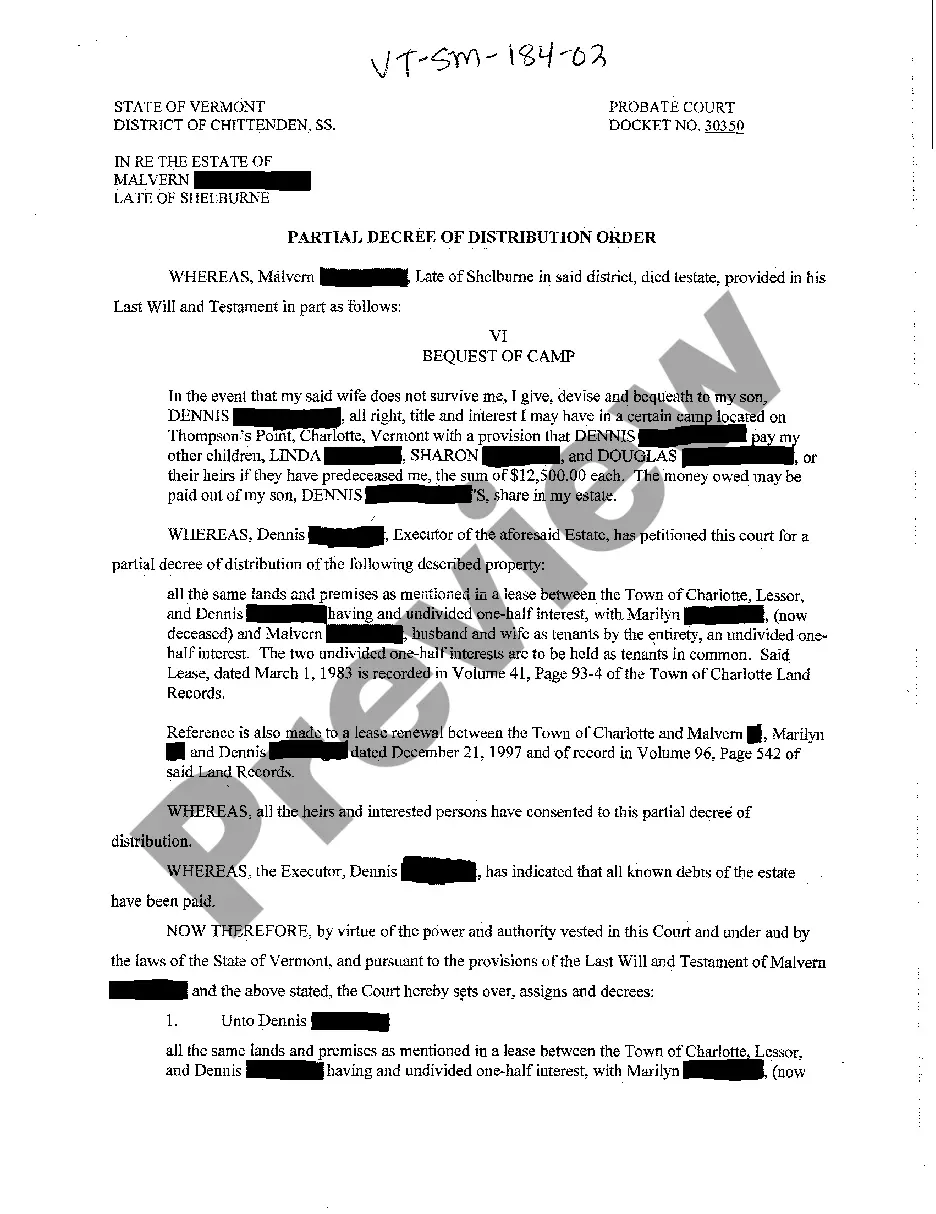

- Look through the form content to ensure it meets your state regulations. To do so, check the form description or use the Preview option.

- If your legal template doesn’t satisfy your needs, locate a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Tennessee Order Granting Additional Time to File and Accounting. Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Opt for the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally safe for that.

- Download your Tennessee Order Granting Additional Time to File and Accounting on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously purchased documents that you securely keep in your profile in the My Forms tab. Get them anytime and re-complete your paperwork as frequently as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most trusted web services. Sign up for us today!

Form popularity

FAQ

Specifically, Rule 69.04 of the Tennessee Rules of Civil Procedure provides that: Within ten years from the entry of a judgment, the creditor whose judgment remains unsatisfied may file a motion to extend the judgment for another ten years.

(1) A party is under a duty seasonably to supplement the party's response with respect to any question directly addressed to (A) the identity and location of persons having knowledge of discoverable matters; and (B) the identity of each person expected to be called as an expert witness at trial, the subject matter on

Rule 26(f) describes a conference of two parties (the plaintiff and defendant) to cooperate and set out a clear plan for the process of discovery. In terms of responsibility for arrangement, both parties are jointly responsible?and this remains true as the case progresses.

Under Tennessee Rule 26.02(4)(a)(i), a party may through interrogatories require any other party to identify experts who they expect to call at trial and to provide a summary of the facts and opinions to which the expert is expected to testify, among other things.

RULE 24. INTERVENTION. Upon timely motion any person may be permitted to intervene in an action: (1) when a statute confers a conditional right to intervene; or (2) when a movant's claim or defense and the main action have a question of law or fact in common.

Unless the court upon motion, for the convenience of parties and witnesses and in the interests of justice, orders otherwise, methods of discovery may be used in any sequence and the fact that a party is conducting discovery, whether by deposition or otherwise, shall not operate to delay any other party's discovery.

A defendant shall serve an answer within thirty (30) days after the service of the summons and complaint upon him. A party served with a pleading stating a cross-claim against such party shall serve an answer thereto within thirty (30) days after the service upon him or her.