Tennessee Statement From Corporate Surety

Description

How to fill out Tennessee Statement From Corporate Surety?

US Legal Forms is the most easy and cost-effective way to find suitable formal templates. It’s the most extensive online library of business and personal legal paperwork drafted and checked by attorneys. Here, you can find printable and fillable blanks that comply with federal and local laws - just like your Tennessee Statement From Corporate Surety.

Obtaining your template requires only a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted Tennessee Statement From Corporate Surety if you are using US Legal Forms for the first time:

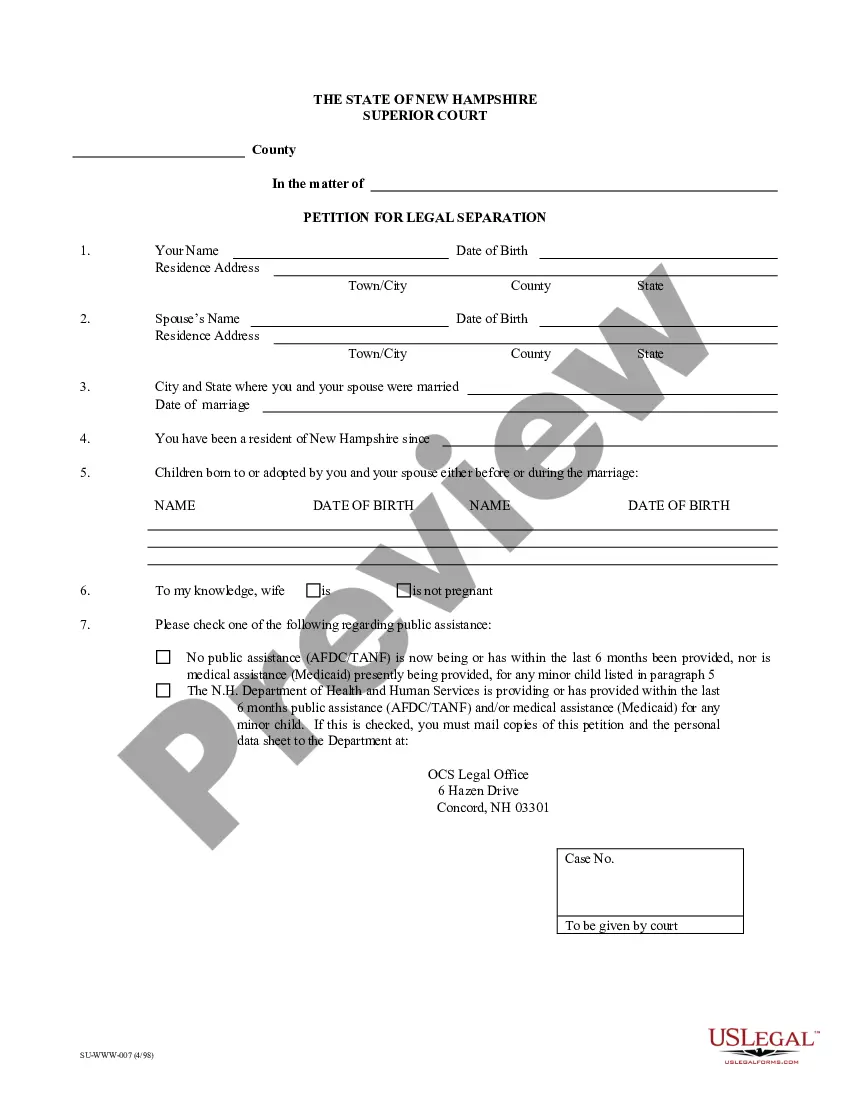

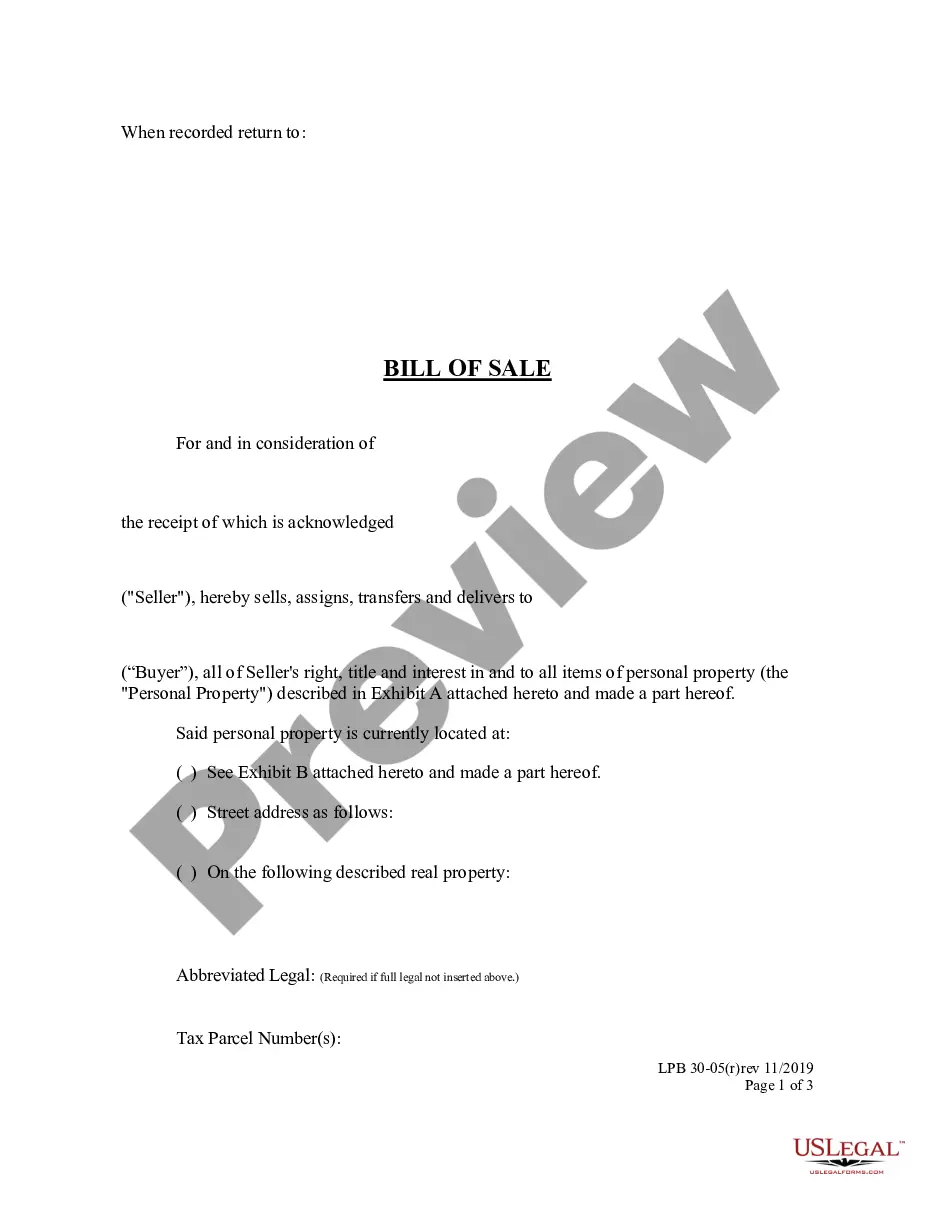

- Look at the form description or preview the document to make certain you’ve found the one corresponding to your demands, or locate another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and select the subscription plan you like most.

- Create an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your Tennessee Statement From Corporate Surety and save it on your device with the appropriate button.

Once you save a template, you can reaccess it anytime - just find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more proficiently.

Take advantage of US Legal Forms, your reputable assistant in obtaining the required formal documentation. Give it a try!

Form popularity

FAQ

Surety bond premiums (the amount you pay) are often calculated as a percentage of the total bond amount, usually between 0.5% and 5% of the bond amount for applicants with good credit, and between 5% up to as much as 20% of the bond amount for applicants with poor credit.

You can obtain a corporate surety through many insurance providers. If your insurance provider does not write corporate surety bonds, there are third-party companies available that can assist you with finding a company to write your corporate surety bond for you.

Corporate Surety Bond A corporate bond is a surety bond written or backed by a bonding or insurance company that charges a premium fee to write and back the bond for the principal. A corporate surety bond does not require the signature of two sureties but requires State of Tennessee approval.

Tennessee Surety Bonds Explained In essence, a surety bond is a contract between you or your company as the principal, and two other parties. The obligee is the entity requiring the bonding, while the surety is the one providing it.

You can obtain a corporate surety through many insurance providers. If your insurance provider does not write corporate surety bonds, there are third-party companies available that can assist you with finding a company to write your corporate surety bond for you.

How much does a Tennessee notary bond cost? Tennessee notary bonds cost $50 for the state-required 4-year term and include $10,000 of errors and omissions insurance.

Tennessee certificate of title bond costs start at $100 for the state-required 3-year term. Exact costs vary depending on the surety bond amount required by the Department of Revenue. Bond amounts less than $10,000 cost $100. Bond amounts from $10,001 to $25,000 cost $10 for every $1,000 of coverage, starting at $100.

A personal surety bond is a type of bond that is issued by an individual, rather than a surety company. In a personal surety bond, the individual who is issuing the bond acts as the surety and provides a guarantee that the executor or administrator will fulfill their duties in ance with the law.