Tennessee Responsibility for Execution of Levy

Description

How to fill out Tennessee Responsibility For Execution Of Levy?

How much time and resources do you normally spend on composing formal documentation? There’s a greater way to get such forms than hiring legal specialists or spending hours searching the web for an appropriate template. US Legal Forms is the top online library that offers professionally drafted and verified state-specific legal documents for any purpose, such as the Tennessee Responsibility for Execution of Levy.

To obtain and prepare a suitable Tennessee Responsibility for Execution of Levy template, adhere to these simple instructions:

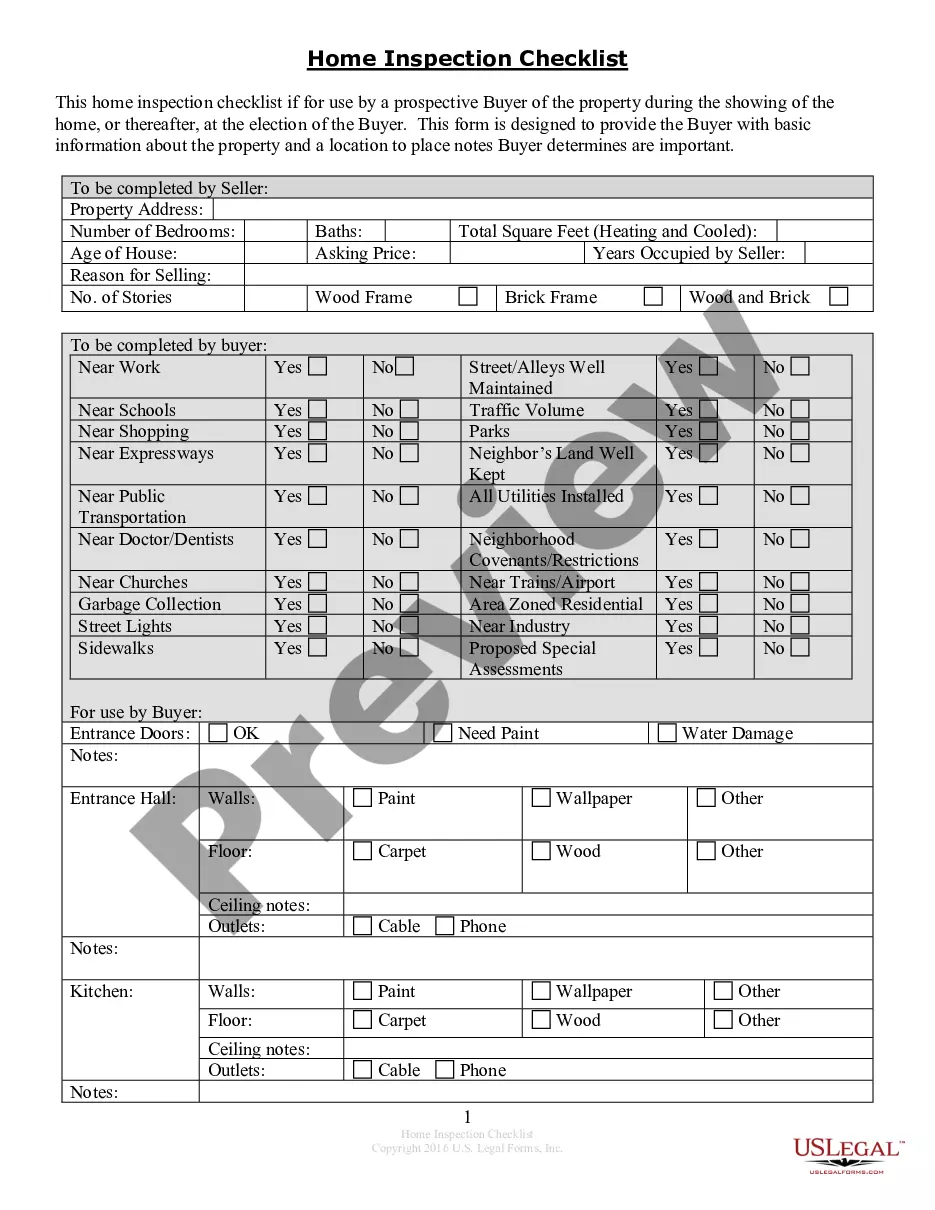

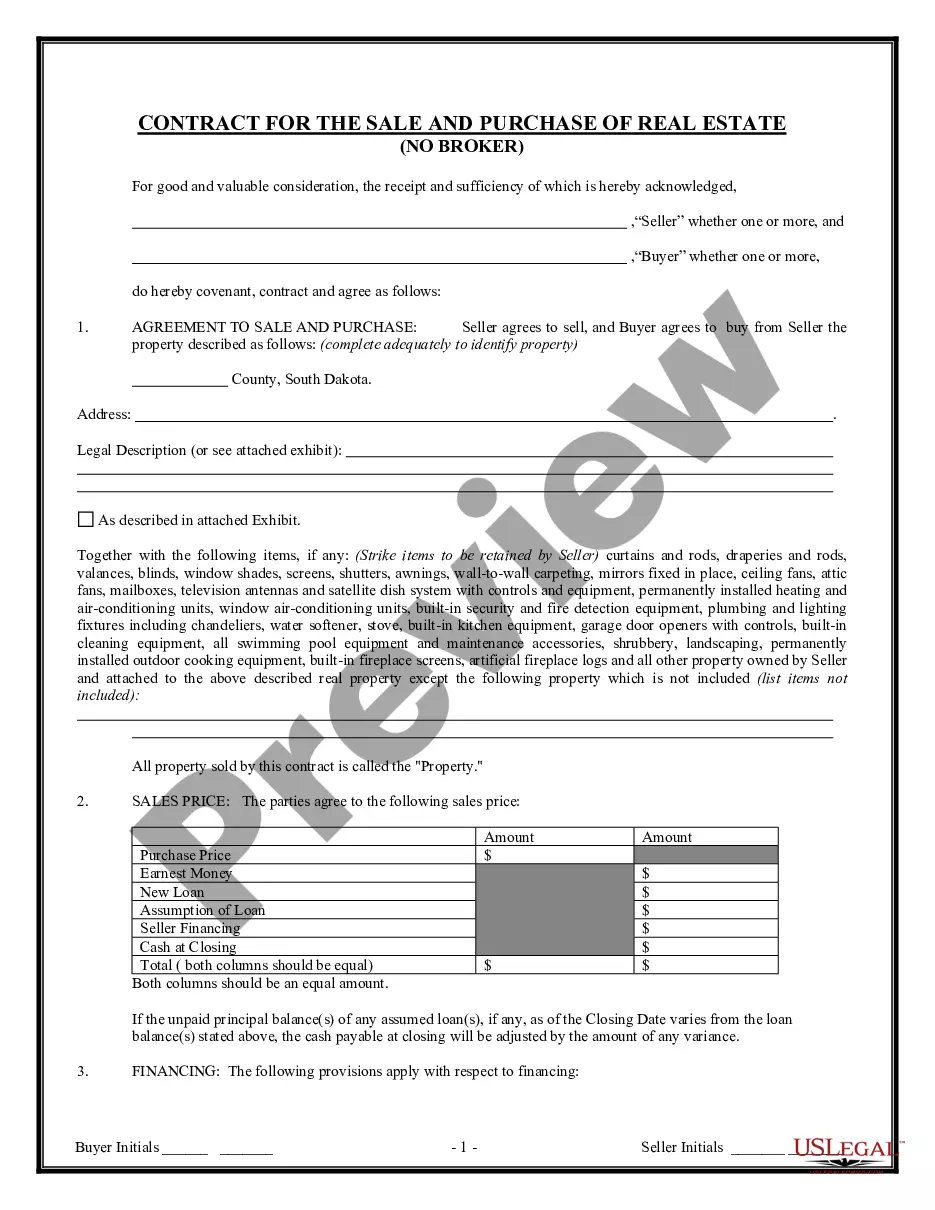

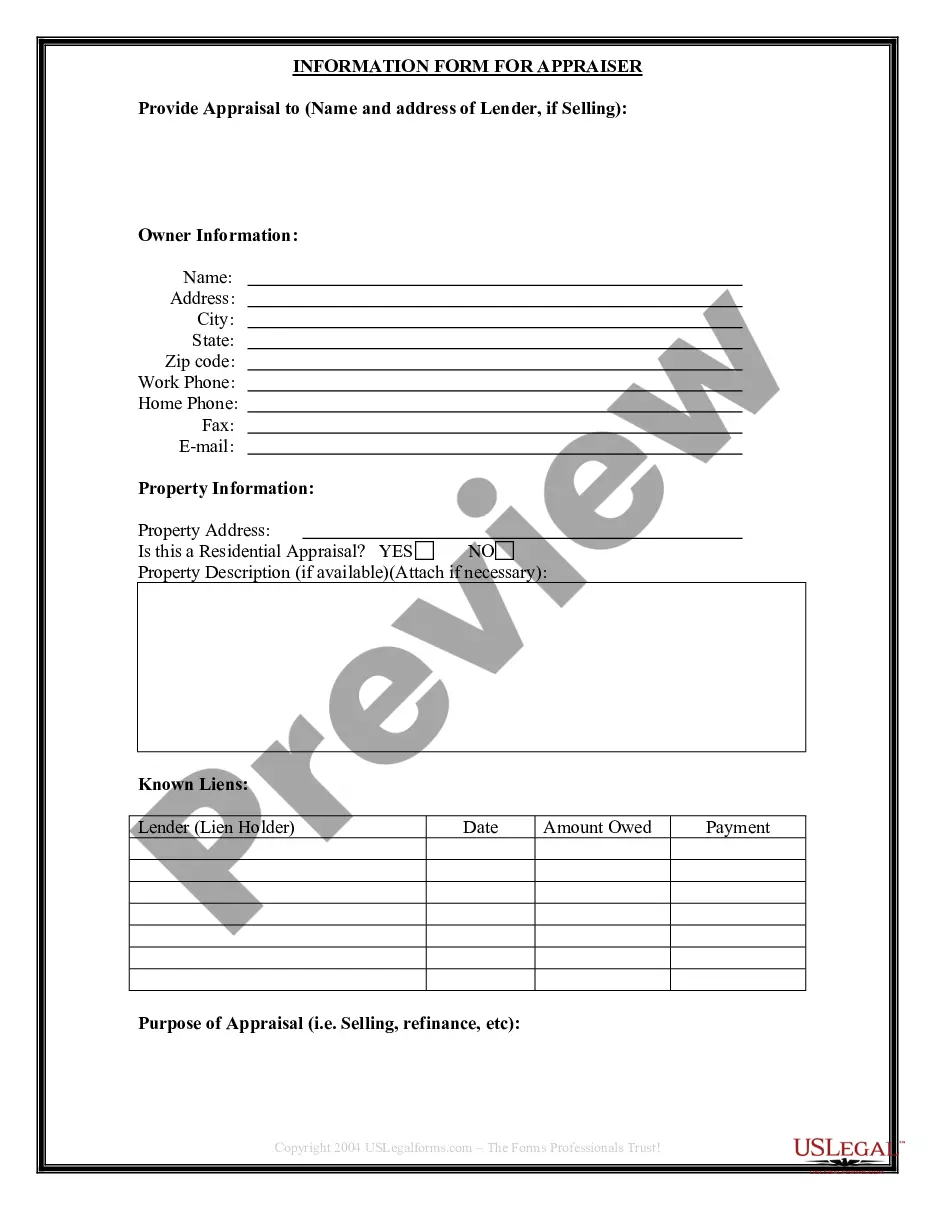

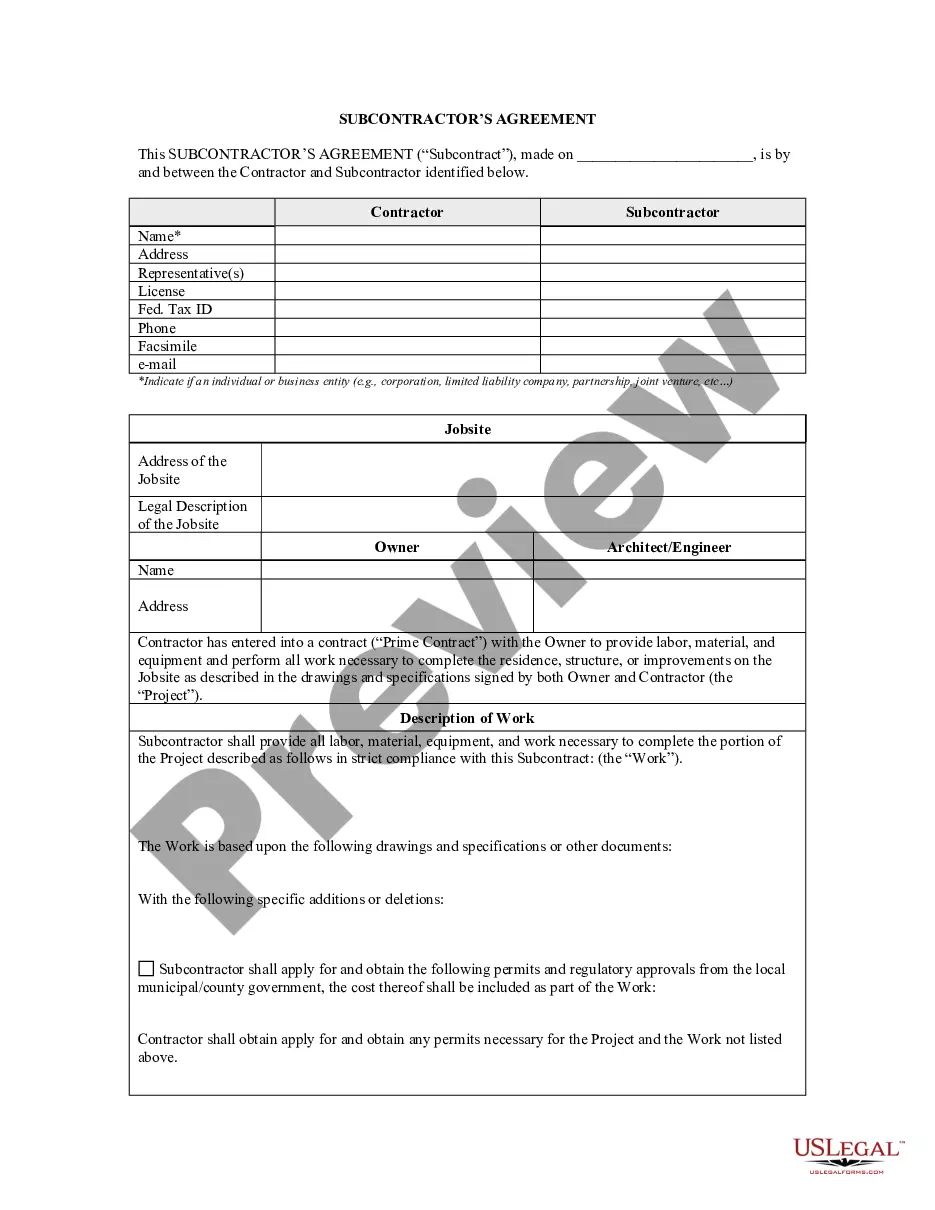

- Examine the form content to ensure it meets your state laws. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t satisfy your needs, locate another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Tennessee Responsibility for Execution of Levy. If not, proceed to the next steps.

- Click Buy now once you find the right blank. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally safe for that.

- Download your Tennessee Responsibility for Execution of Levy on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously purchased documents that you securely keep in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most trustworthy web services. Sign up for us now!

Form popularity

FAQ

How long does a judgment lien last in Tennessee? A judgment lien in Tennessee will remain attached to the debtor's property (even if the property changes hands) for ten years.

Once again, in Tennessee the statute of limitations on debt is as follows: Mortgage debt: 6 years. Medical debt: 6 years. Credit card debt: 6 years.

Execution.? every process or writ whereby the judgments and decrees of Courts are enforced.? (an Encyclopedia of Tennessee Law) says: ?An execution issues, as a matter of course, upon a judgment for a specific sum of money, without any order awarding or directing its issuance in express terms.?

(a) The abstract of the judgment or decree shall show briefly the names of the parties, plaintiff and defendant, the name of the court, and number of the case, and the amount, and date of judgment or decree, and the names of all parties against whom the judgment or decree is taken.

The statute of limitations on debt in the state of Tennessee is six years. This means that if a debt has not been repaid in six years, the lender cannot sue to collect the debt.

Lien Notation Send the completed form. Include all necessary support documentation.Include all fees. Lien notation fee: $11 per lien. County clerk fee: $8.50. State title fee: $5.50. Additional county fees may also apply.Information should be submitted to your local county clerk's office.

10-Year Lifespan for Tennessee Judgments ing to Section 28-3-110(a)(2), Tennessee Code Annotated, actions to enforce judgments must be commenced within ten years of the date the judgment was entered.