Tennessee Form IN-1460 (Accredited Investor Notice Form)[PDF] is a document utilized by accredited investors in Tennessee to declare their status as an accredited investor. This form is required by the Tennessee Department of Financial Institutions and must be submitted to the Tennessee Securities Division in order to be considered an accredited investor. This form is used to provide the Tennessee Department of Financial Institutions with a written statement of the investor’s qualifications to be an accredited investor. The form includes the following information: name, address, type of accredited investor, list of investments, date of submission, and a signature. It also includes an attestation that the investor has read and understands the requirements and instructions for the form. There are two types of Tennessee Form IN-1460 (Accredited Investor Notice Form)[PDF]: one for individuals and one for entities.

Tennessee Form IN-1460 (Accredited Investor Notice Form)[pdf]

Description

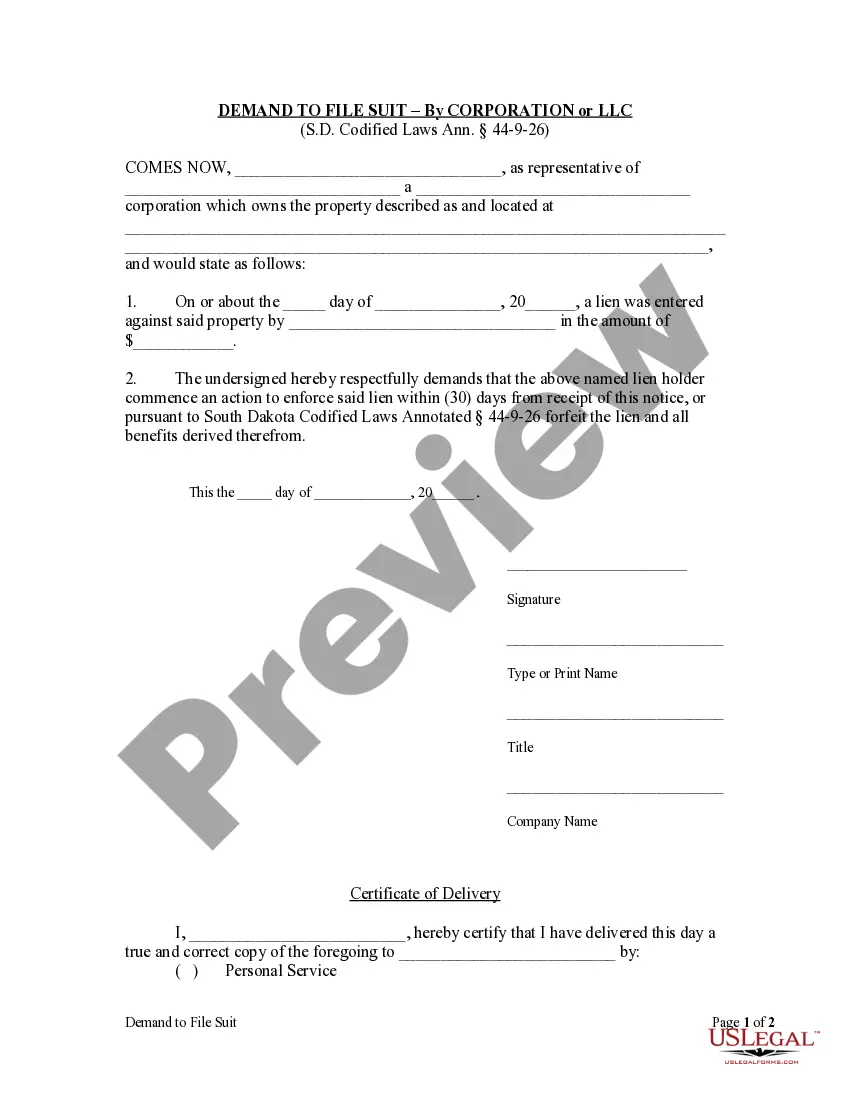

How to fill out Tennessee Form IN-1460 (Accredited Investor Notice Form)[pdf]?

US Legal Forms is the most easy and cost-effective way to find appropriate legal templates. It’s the most extensive web-based library of business and personal legal documentation drafted and checked by attorneys. Here, you can find printable and fillable blanks that comply with federal and local regulations - just like your Tennessee Form IN-1460 (Accredited Investor Notice Form)[pdf].

Getting your template takes just a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Tennessee Form IN-1460 (Accredited Investor Notice Form)[pdf] if you are using US Legal Forms for the first time:

- Read the form description or preview the document to ensure you’ve found the one meeting your demands, or find another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Create an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Select the preferred file format for your Tennessee Form IN-1460 (Accredited Investor Notice Form)[pdf] and download it on your device with the appropriate button.

After you save a template, you can reaccess it anytime - just find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more proficiently.

Benefit from US Legal Forms, your reputable assistant in obtaining the corresponding official documentation. Try it out!

Form popularity

FAQ

The SEC defines an accredited investor as either: an individual with gross income exceeding $200,000 in each of the two most recent years or joint income with a spouse or partner exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

Exempt Security - Common types of exempt securities are government securities, bank securities, high-quality debt instruments, non-profit securities, and insurance contracts.

Accredited investors are individuals or entities who are qualified by the SEC to invest in unregulated or sophisticated securities, while a qualified purchaser is an individual or entity with an investment portfolio worth over $5 million.

Summary. Exempt transactions are securities transactions that are exempt from the registration requirements of the 1933 Securities Act. Four typical examples of transaction exemptions in the United States include 1) Regulation A Offerings, 2) Regulation D Offerings, 3) Intrastate Offerings, and 4) Rule 144 Offerings.

To qualify as an accredited investor, you must have over $1 million in net worth, or more than $200,000 in earned income in the past two calendar years, with the expectation of the same earnings.

Instruments exempt from the registration requirements of the Securities Act of 1933 or the margin requirements of the SEC Act of 1934. Such securities include government bonds, agencies, munis, commercial paper, and private placements.

The Tennessee Securities Division is responsible for enforcing the Tennessee Securities Act of 1980 and protecting the investors of Tennessee by maintaining the integrity of the securities market. We accomplish this function through the regulation of the securities industry and capital markets of Tennessee.

§48-2-103(b)(6) Another Tennessee exemption applies if the aggregate amount of securities sold in Tennessee in the offering by a Tennessee issuer does not exceed $250,000 during any 12-month period, and no commission or other remuneration is paid or given directly or indirectly for soliciting any purchaser in Tennessee