Tennessee Articles of Dissolution Non-Profit Corporations

Description

How to fill out Tennessee Articles Of Dissolution Non-Profit Corporations?

Dealing with official paperwork requires attention, precision, and using properly-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Tennessee Articles of Dissolution Non-Profit Corporations template from our service, you can be certain it meets federal and state regulations.

Dealing with our service is simple and fast. To get the required document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to get your Tennessee Articles of Dissolution Non-Profit Corporations within minutes:

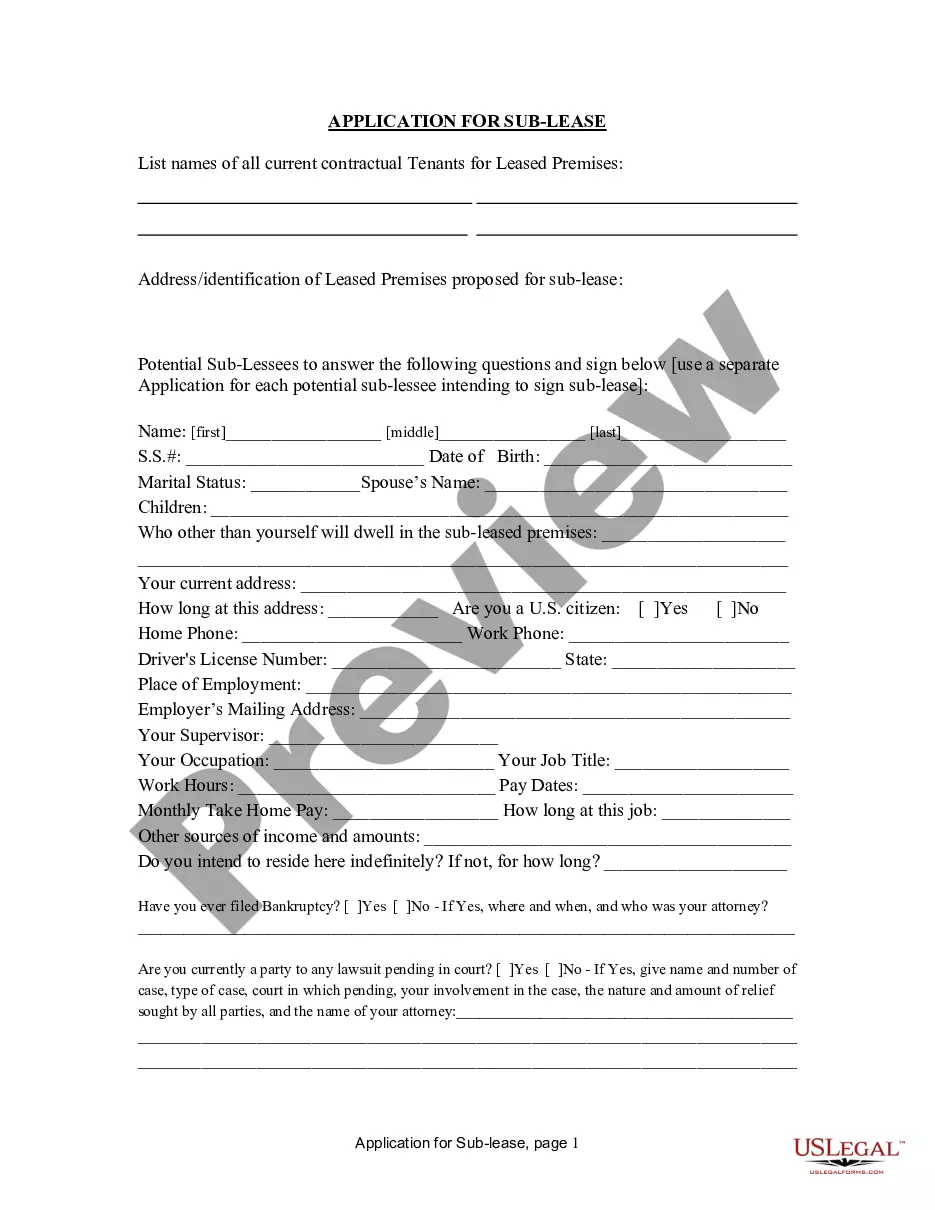

- Make sure to attentively examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another official template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Tennessee Articles of Dissolution Non-Profit Corporations in the format you prefer. If it’s your first time with our service, click Buy now to proceed.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it paper-free.

All documents are created for multi-usage, like the Tennessee Articles of Dissolution Non-Profit Corporations you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

Dissolution is a legal process that terminates a business entity's existence. If a corporation or LLC is not properly dissolved, it continues to exist as a legal entity under state law. This means that it still faces corporate or LLC filing requirements, such as annual reports and franchise taxes.

Filing dissolution documents is the first step and requires the business to wind-up its business and affairs. Once that is complete and the entity has obtained a Certificate of Tax Clearance for Termination/Withdrawal from the Tennessee Department of Revenue, the business entity may file termination documents.

This can happen in two ways. First, members can determine certain dissolution triggers (such as the death of a member) which are written into the LLC operating agreement. Second, members can cast a vote to dissolve the company at any time.

Most account changes and closures can be handled through TNTAP, or by calling us at (615) 253-0600.

A Request for Copy of Documents may be obtained using one of the following methods: Paper Submission: A blank Request for Copy of Documents form may be obtained by going to sos.tn.gov and entering SS-4461 in the search bar; by emailing the Secretary of State at TNSOS.CERT@tn.gov, or by calling (615) 741-6488.

A Statement of Dissolution of Limited Partnership form may be filed using one of the following methods: E-file: Go to and use the online tool to complete the filing and pay the filing fee by credit card, debit card or e-check.

The first step in terminating a Tennessee LLC is to file Form SS-4246, Notice of Dissolution (Limited Liability Company) with the Department of State, Division of Business Services (DBS). After you file notice of dissolution and wind up your business, you will have to file the appropriate Articles of Termination.

If the leadership of the organization decides that winding down is the best option, the organization will need a ?plan of dissolution.? A plan of dissolution is essentially a written description of how the nonprofit intends to distribute its remaining assets and address its remaining liabilities.