Tennessee Certificate of Withdrawal

Description

How to fill out Tennessee Certificate Of Withdrawal?

How much time and resources do you typically spend on drafting formal documentation? There’s a better way to get such forms than hiring legal specialists or spending hours searching the web for a suitable blank. US Legal Forms is the premier online library that provides professionally designed and verified state-specific legal documents for any purpose, such as the Tennessee Certificate of Withdrawal.

To get and prepare an appropriate Tennessee Certificate of Withdrawal blank, follow these simple instructions:

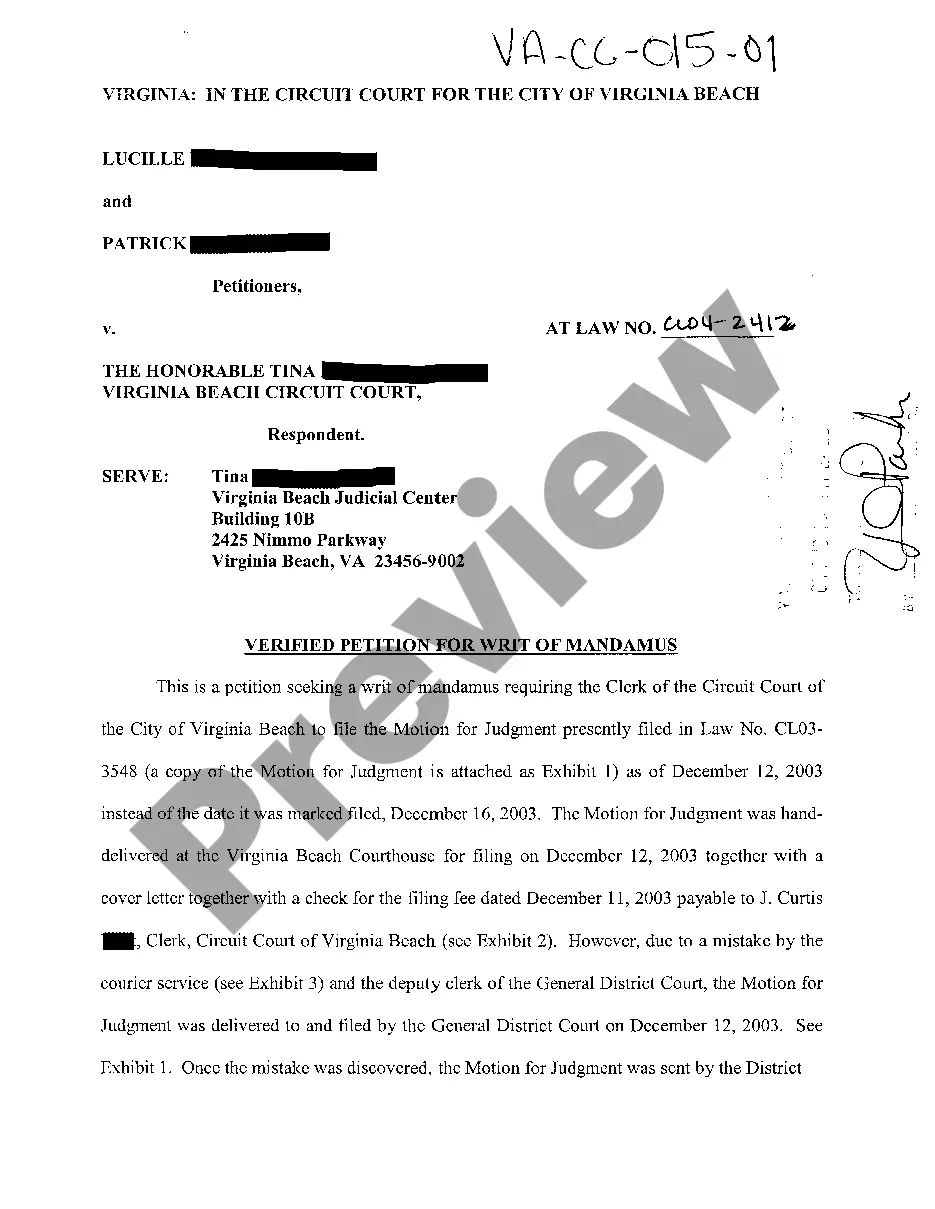

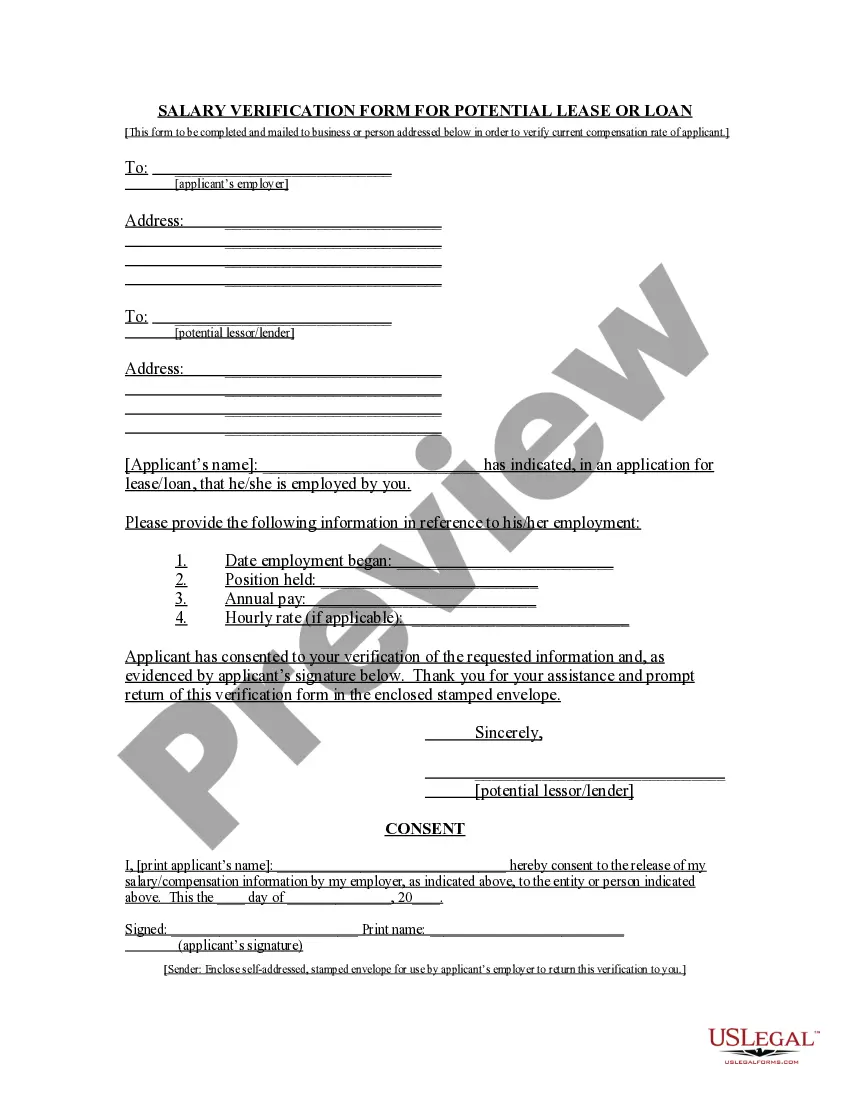

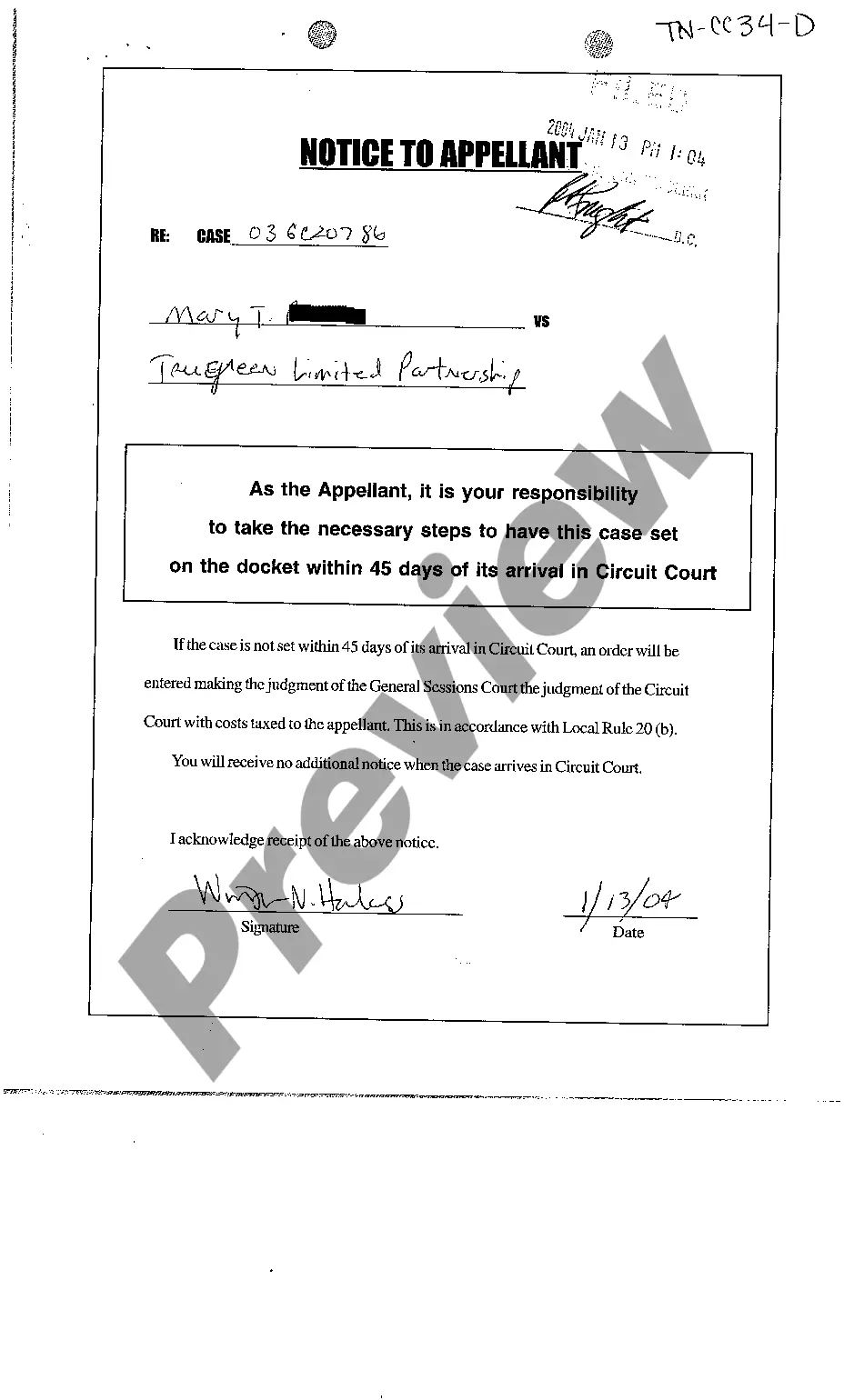

- Examine the form content to ensure it meets your state requirements. To do so, read the form description or use the Preview option.

- If your legal template doesn’t satisfy your needs, locate another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Tennessee Certificate of Withdrawal. If not, proceed to the next steps.

- Click Buy now once you find the right blank. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally secure for that.

- Download your Tennessee Certificate of Withdrawal on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously purchased documents that you securely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as frequently as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most reliable web services. Sign up for us now!

Form popularity

FAQ

The first step in terminating a Tennessee LLC is to file Form SS-4246, Notice of Dissolution (Limited Liability Company) with the Department of State, Division of Business Services (DBS). After you file notice of dissolution and wind up your business, you will have to file the appropriate Articles of Termination.

To withdraw your foreign Corporation from Tennessee, submit the completed form SS-4437, Application for Certificate of Withdrawal to the Tennessee DBS for filing. Using DBS forms is not required; you may draft your own application for withdrawal.

A certificate of existence is a document issued by our office that certifies that an entity is active and in good standing.

How to Close a Corporation in Tennessee Have a board of directors' meeting.Have a shareholders' meeting in order to approve the motion to dissolve the corporation. Submit a written Consent to Dissolution to the Tennessee Secretary of State. Submit any required annual reports to the Tennessee Secretary of State.

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.

You can find information on any corporation or business entity in Tennessee or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

To be in good standing with the Tennessee Department of Revenue means the Secretary of State has received and verified that all fees, taxes, and penalties due to the Tennessee Department of Revenue have been paid.

Tennessee businesses are not legally required to obtain a certificate of existence. However, your business may choose to get one if you decide to do business outside of Tennessee or get a business bank account.