Tennessee Exemption Request

Description

How to fill out Tennessee Exemption Request?

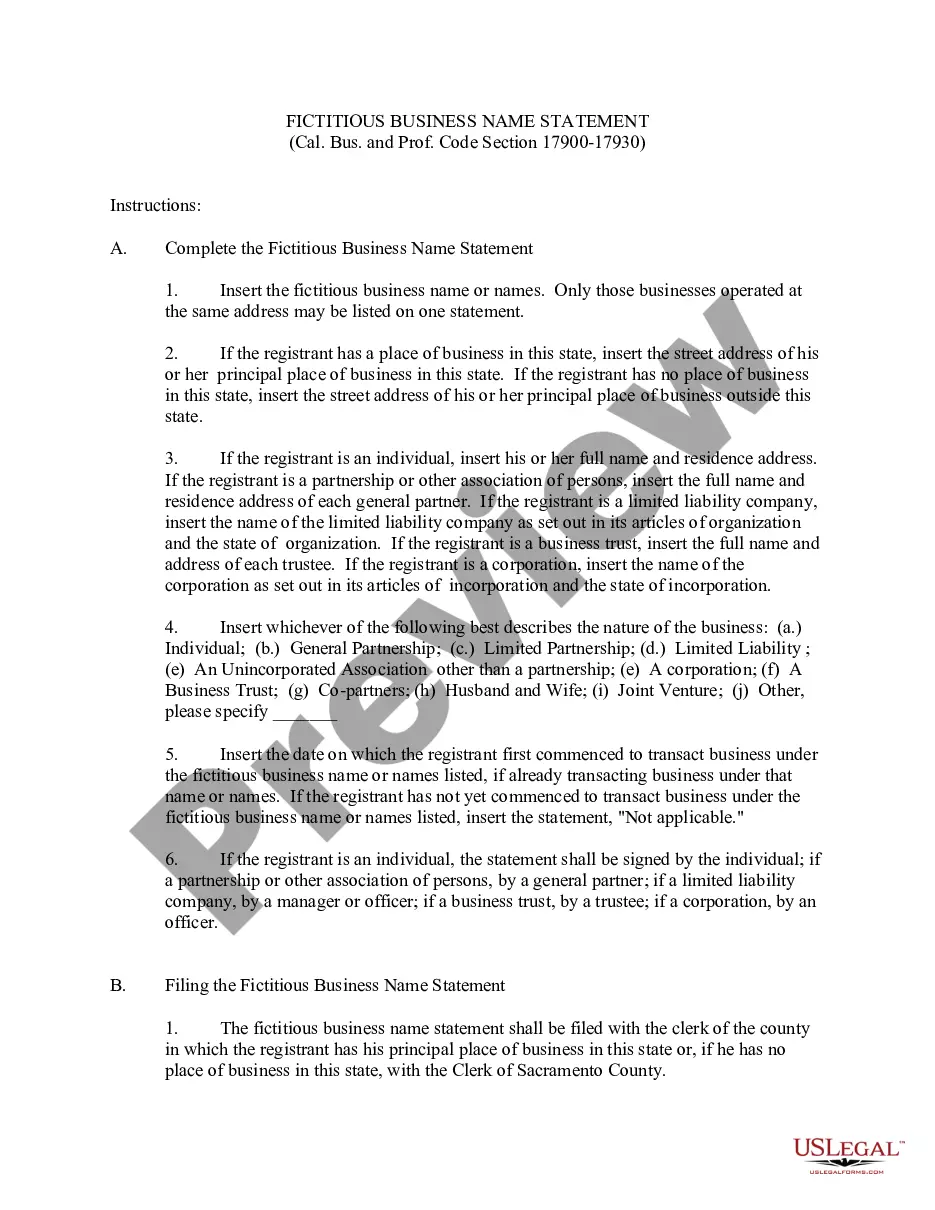

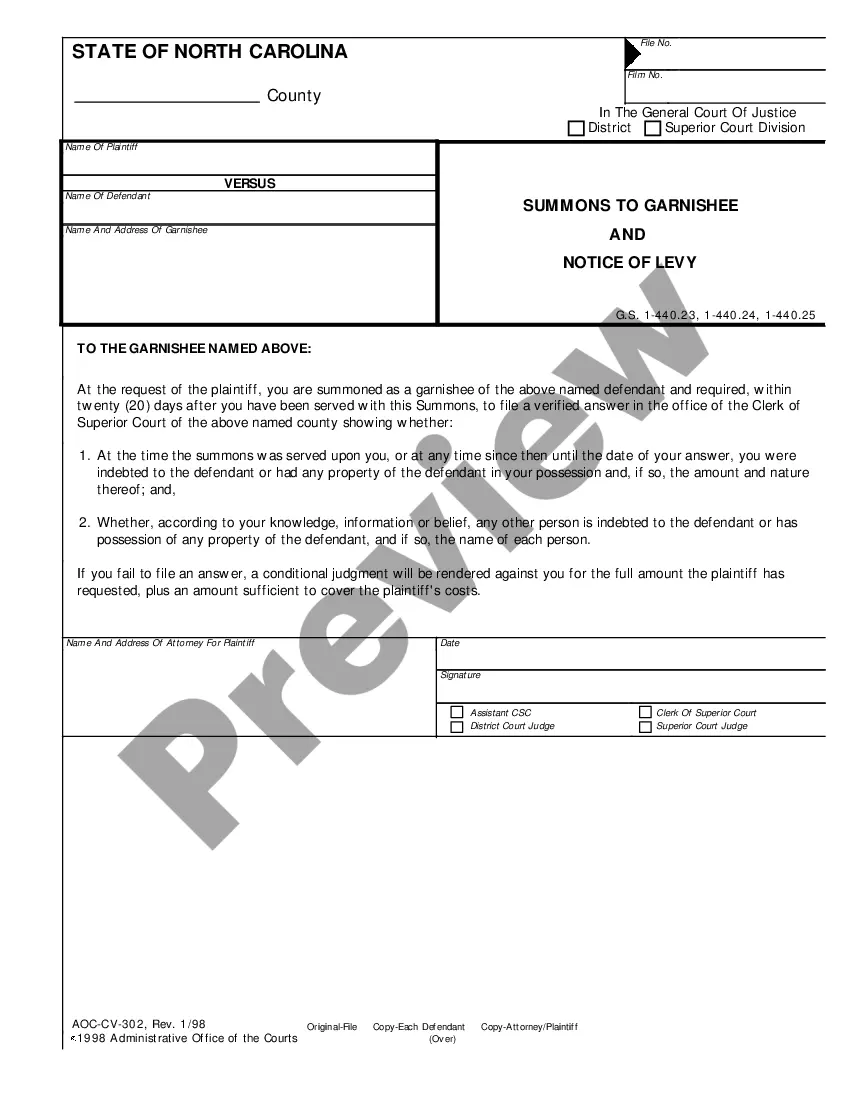

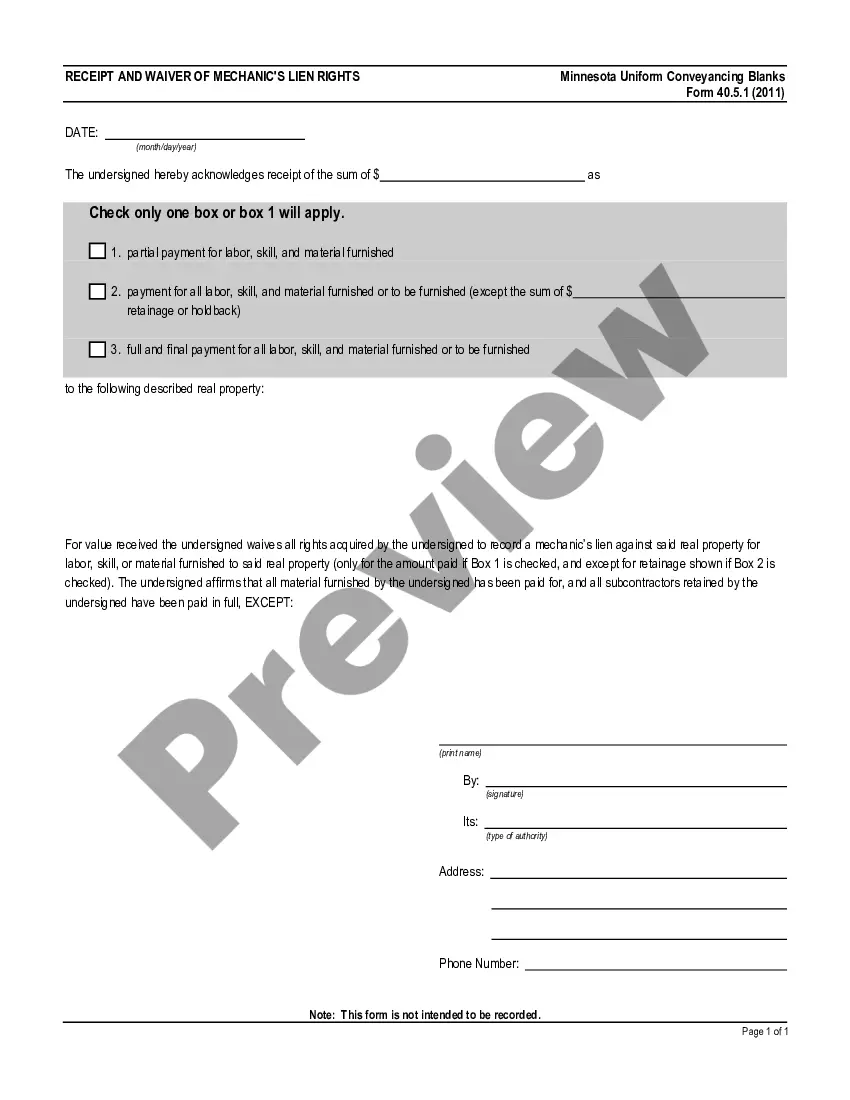

Preparing official paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them correspond with federal and state regulations and are verified by our specialists. So if you need to complete Tennessee Exemption Request, our service is the perfect place to download it.

Obtaining your Tennessee Exemption Request from our service is as easy as ABC. Previously authorized users with a valid subscription need only log in and click the Download button once they locate the correct template. Later, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a quick instruction for you:

- Document compliance check. You should carefully examine the content of the form you want and check whether it suits your needs and fulfills your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab above until you find a suitable template, and click Buy Now once you see the one you want.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Tennessee Exemption Request and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

Agricultural Exemption Tangible personal property used primarily (more than 50%) by a qualified farmer or nursery operator in agriculture operations. Equipment used primarily for harvesting timber. Gasoline or diesel used in agricultural operations. Seeds, seedlings, and plants grown from seed. Fertilizer. Pesticides.

A parcel must have at least fifteen (15) acres, including woodlands and wastelands which form a contiguous part thereof, constituting a farm unit engaged in the production or growing of crops, plants, animals, nursery, or floral products.

How do I become federally exempt? You can obtain federal tax-exempt status by applying with the IRS, by filing the detailed form 1023 and submitting it with the fee and the many required attachments. The review process will take several months and if you are successful, you will receive the Letter of Determination.

In Tennessee, the homestead exemption is automatic ? you don't have to file a homestead declaration with the recorder's office to claim the homestead exemption in bankruptcy.

Under the law, protected farms and farm operations include farmland, buildings, machinery, and activities that involve commercial agriculture production, including farm products and nursery stock such as forages, seeds, hemp, trees, vegetables, fruits, livestock, dairy, poultry, apiaries, and other products that

You'll also be required to submit the following documentation: Tax returns with income information. 1099s. Proof of land qualification under the Agricultural Forest and Open Space Land Act. Copy of your Schedule F. Copy of either Form 4835 or Schedule E. Detailed statement of why you qualify for an exemption.

An exemption or resale certificate is a form or document issued by a business to ensure sales tax is not applied to their invoice when they intend to resell their purchase. Sales tax is not used on these purchases because the applicable sales tax will be used on the final sale of the exchanged tangible property.