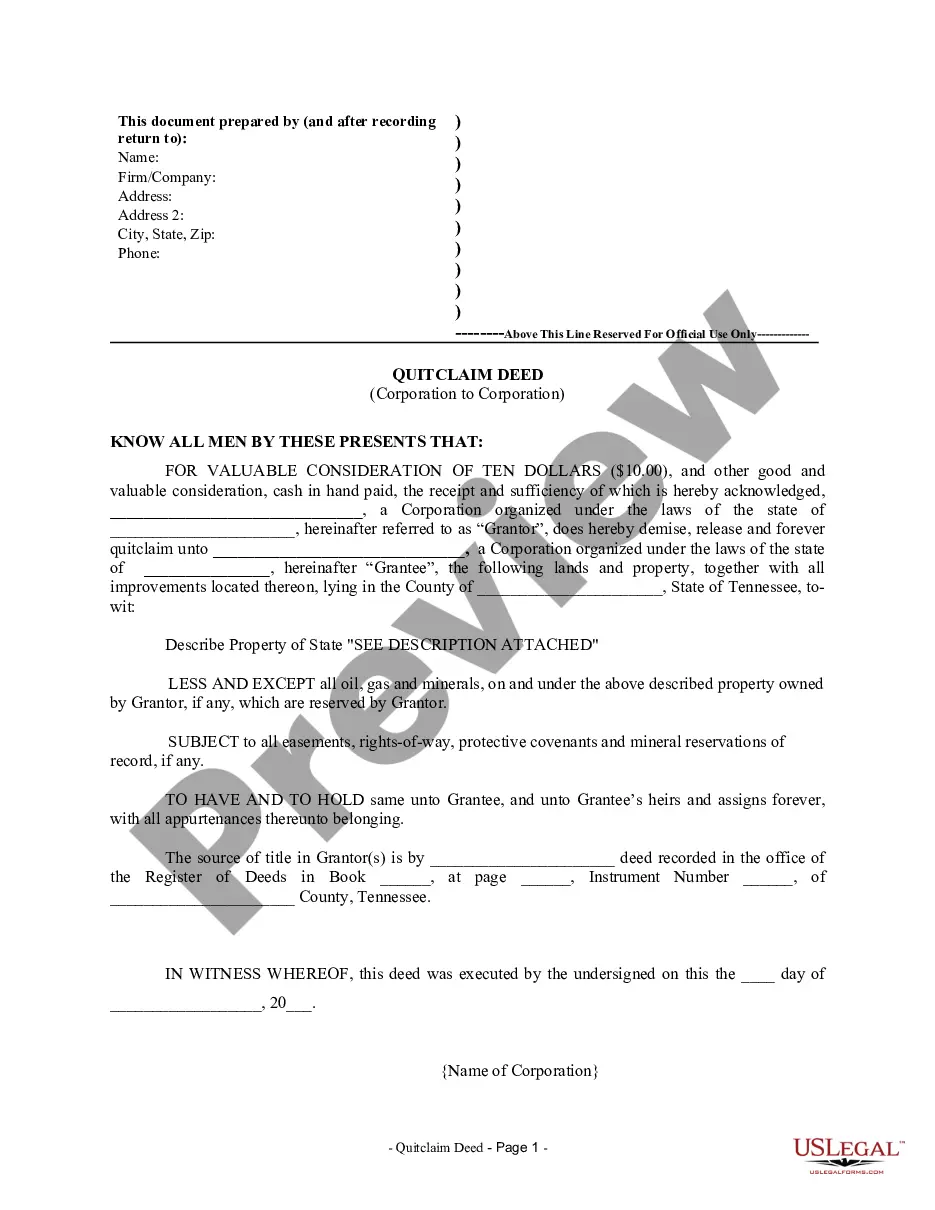

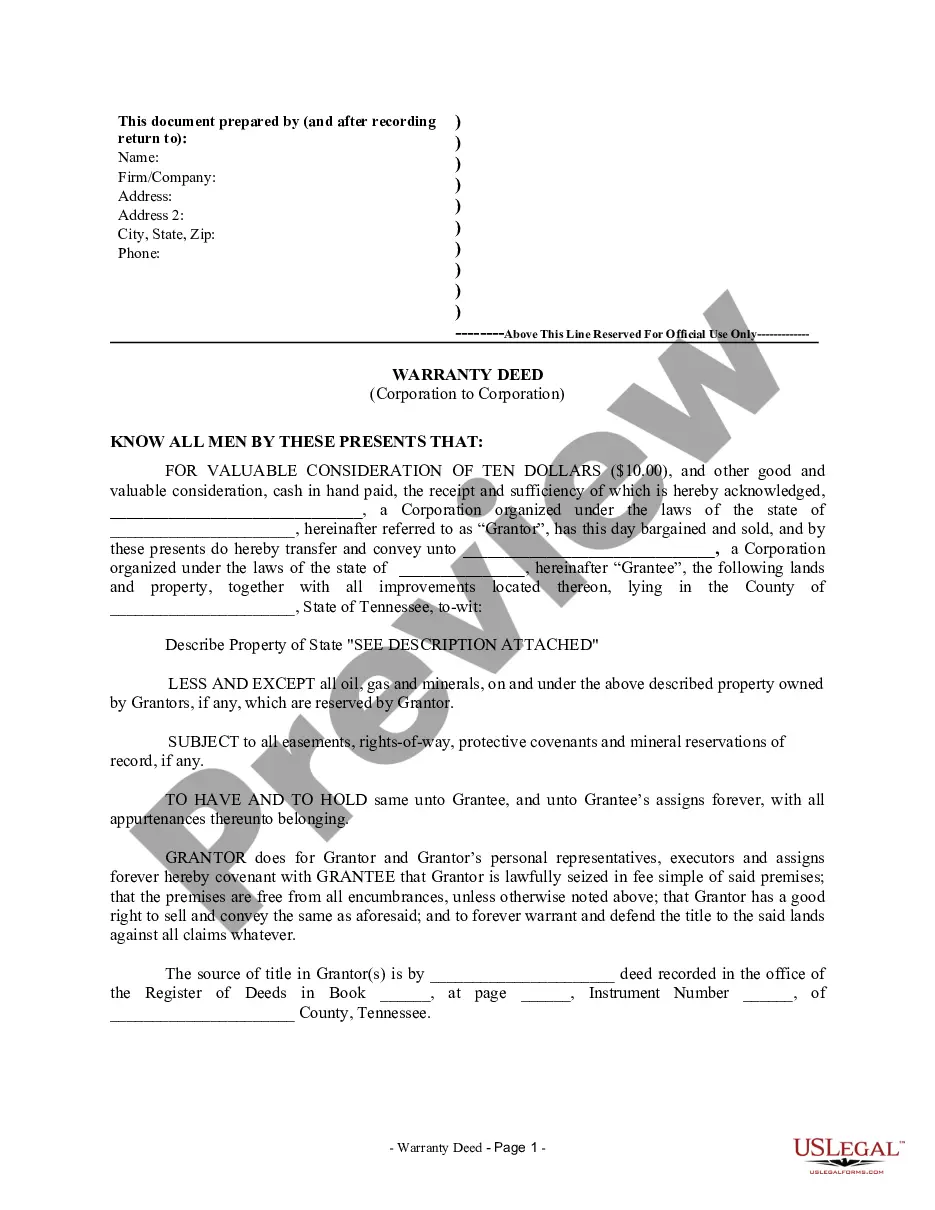

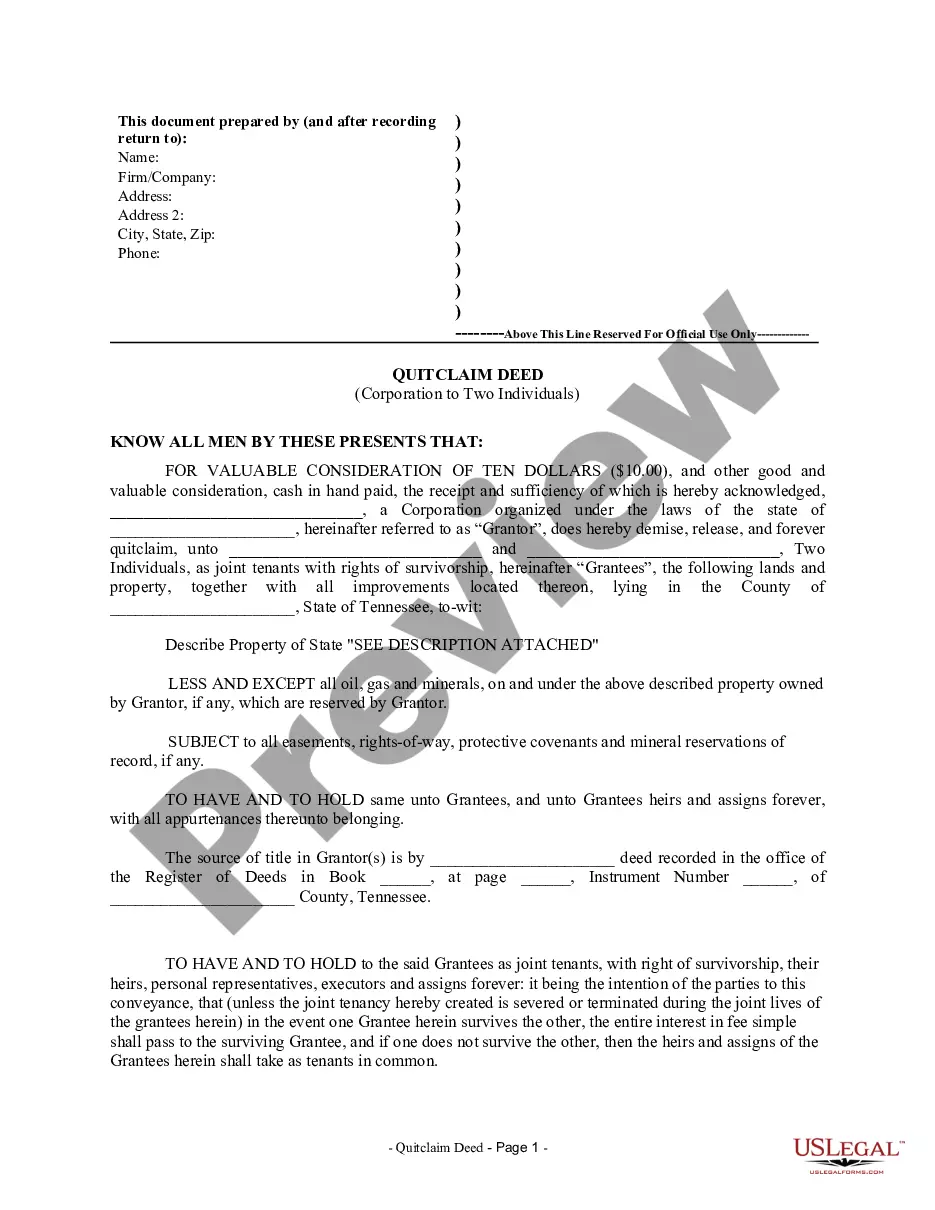

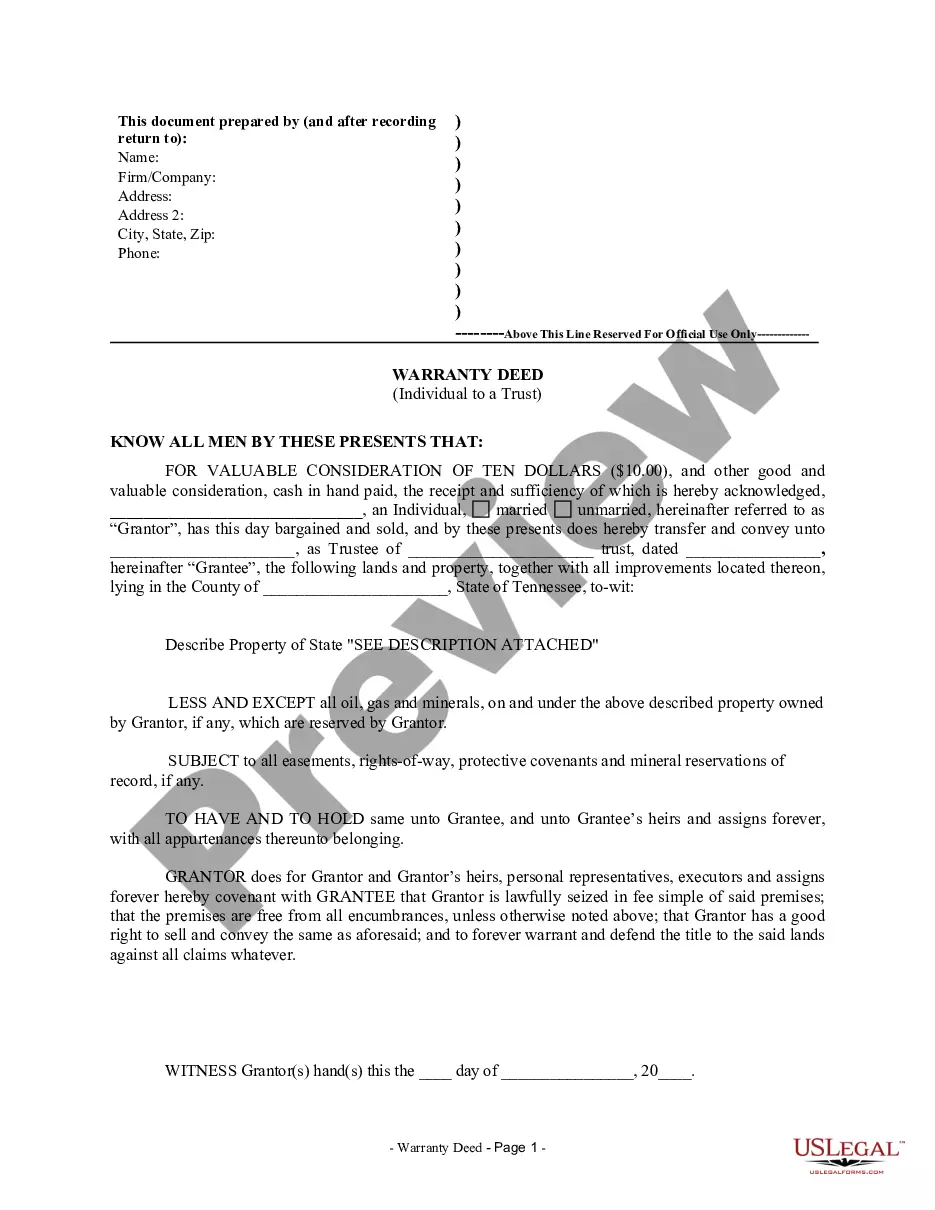

Tennessee Form SS-6075

Description

How to fill out Tennessee Form SS-6075?

If you’re searching for a way to appropriately prepare the Tennessee Form SS-6075 without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every private and business scenario. Every piece of paperwork you find on our online service is designed in accordance with federal and state regulations, so you can be certain that your documents are in order.

Follow these simple instructions on how to acquire the ready-to-use Tennessee Form SS-6075:

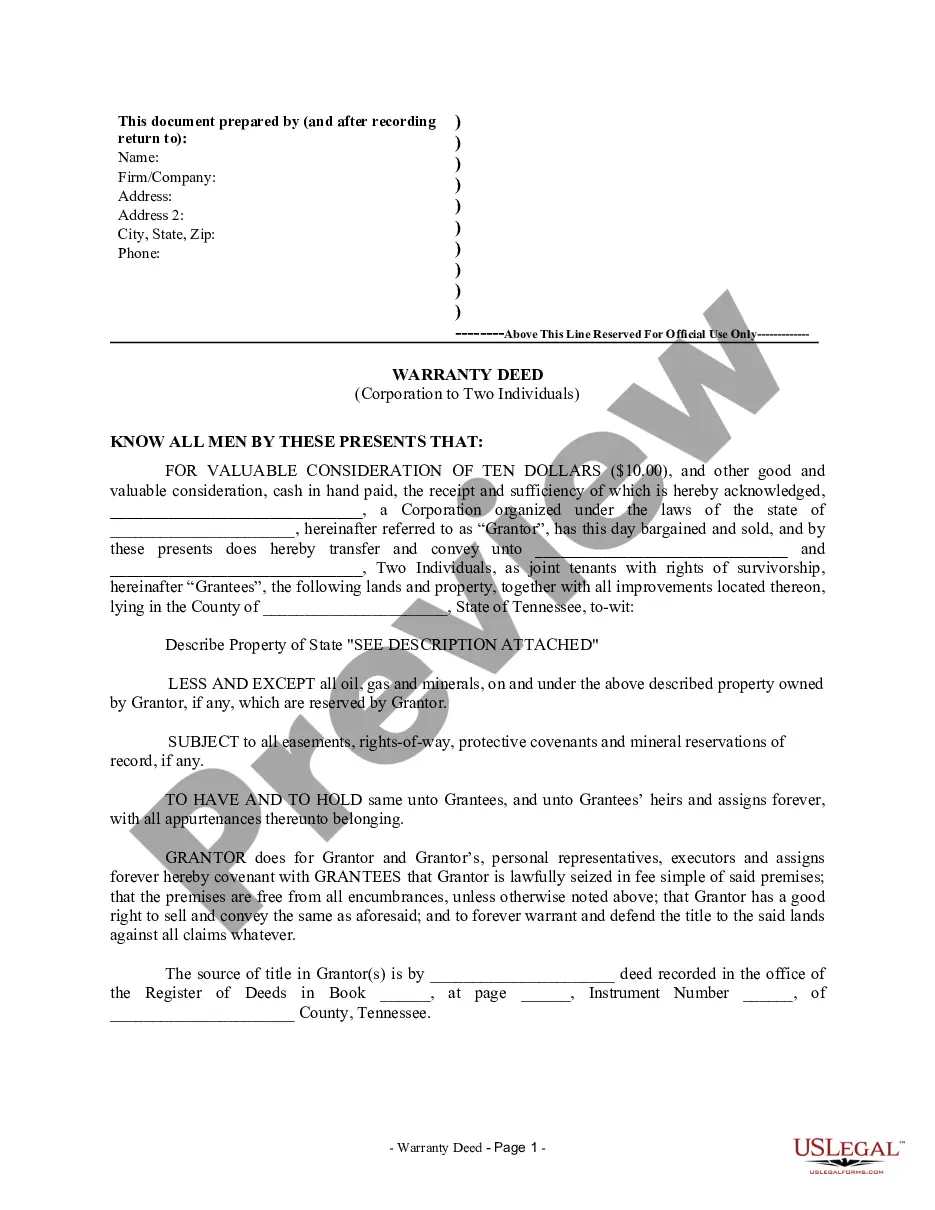

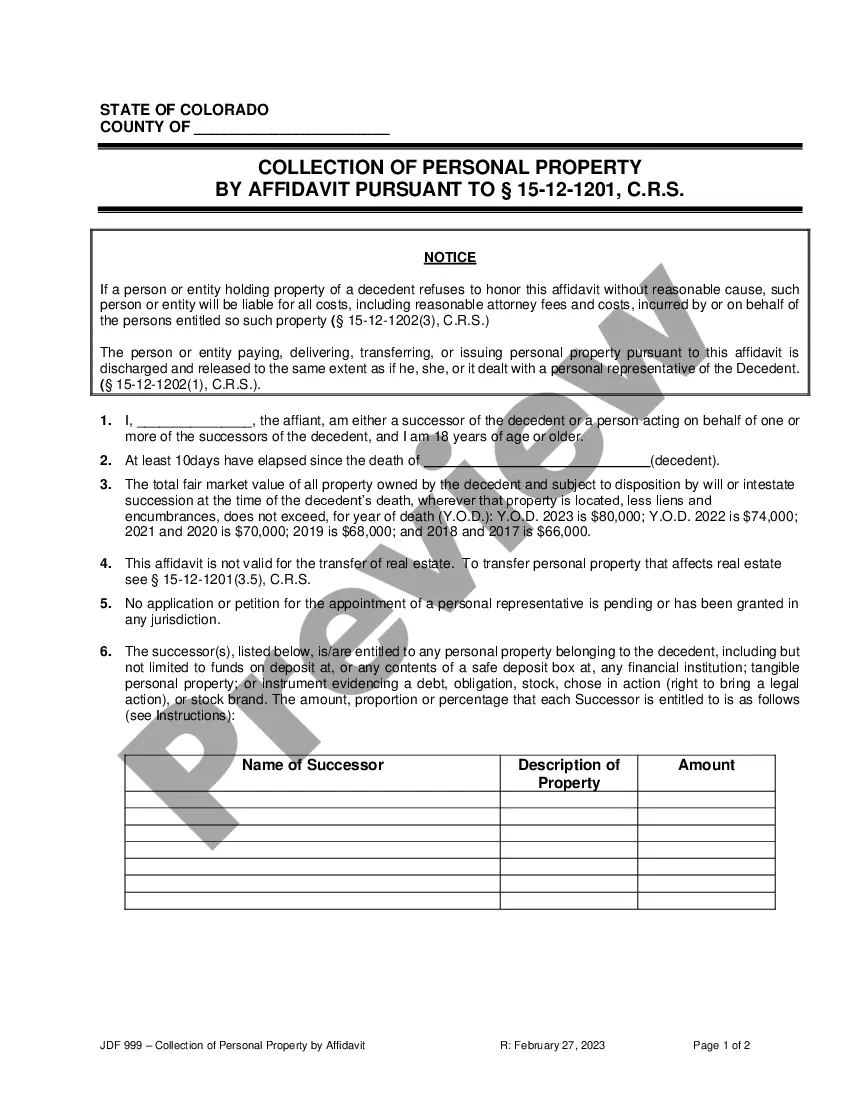

- Make sure the document you see on the page complies with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Type in the form title in the Search tab on the top of the page and choose your state from the list to locate an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Sign up for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Tennessee Form SS-6075 and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it rapidly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

The first step in terminating a Tennessee LLC is to file Form SS-4246, Notice of Dissolution (Limited Liability Company) with the Department of State, Division of Business Services (DBS). After you file notice of dissolution and wind up your business, you will have to file the appropriate Articles of Termination.

Businesses holding minimal activity licenses should contact the county clerk and city recorder's office to advise them that the business is no longer operational. If the business is sold to another entity, purchase money should be withheld to cover any taxes, interest, and penalties that the business may owe.

What You Can Do Here File an Application for Reinstatement for a business and pay the fee online. The filing fee is $70.Print and Mail the Application for Reinstement. Information will be collected through the online tool, and then printed on the correct form to be mailed to the Secretary of State with payment.

Filing dissolution documents is the first step and requires the business to wind-up its business and affairs. Once that is complete and the entity has obtained a Certificate of Tax Clearance for Termination/Withdrawal from the Tennessee Department of Revenue, the business entity may file termination documents.

The Tennessee withdrawal forms are in your online account when you sign up for registered agent service and are available on the DBS website. Deliver your corporation or LLC's original application for withdrawal and the filing fee by mail or in person.

Submit a written Consent to Dissolution to the Tennessee Secretary of State. Submit any required annual reports to the Tennessee Secretary of State. Pay off any outstanding business debts. Pay any outstanding taxes and administrative fees.

Tennessee requires LLCs to file an annual report and pay a franchise tax. The annual report is due on or before the first day of the fourth month following the close of the LLC's fiscal year.

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.