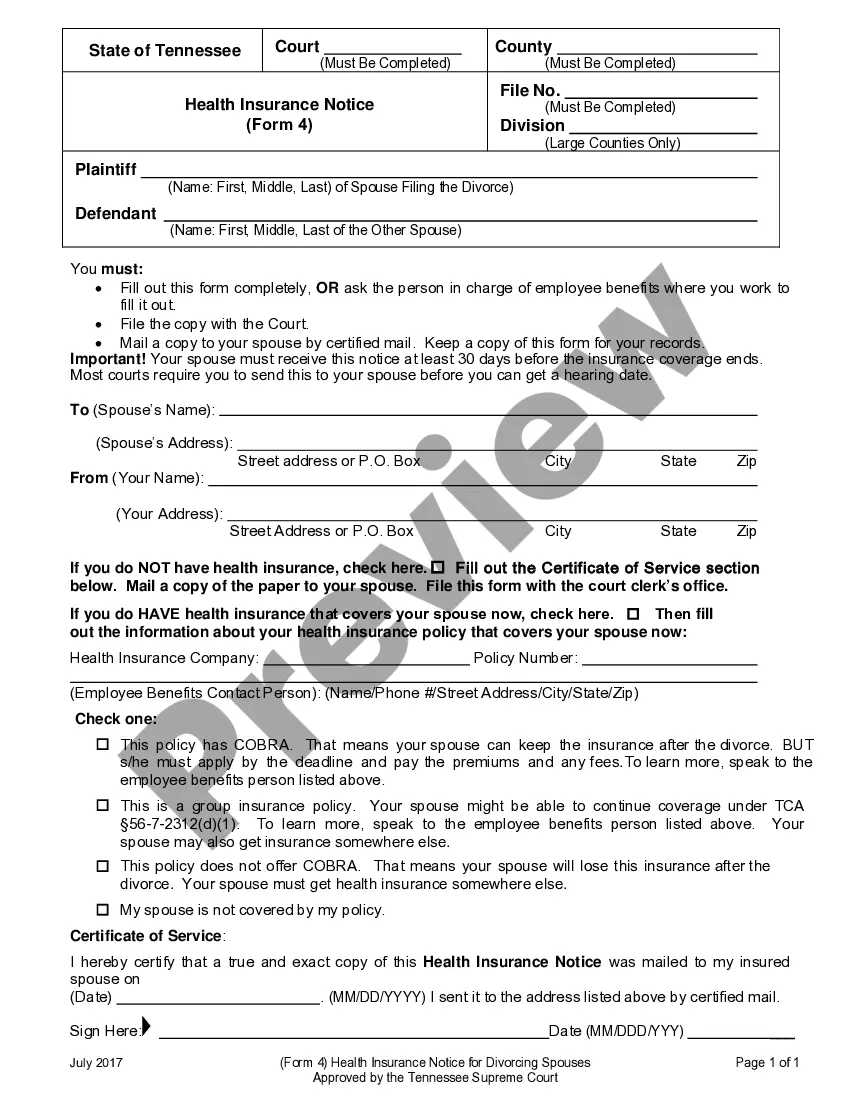

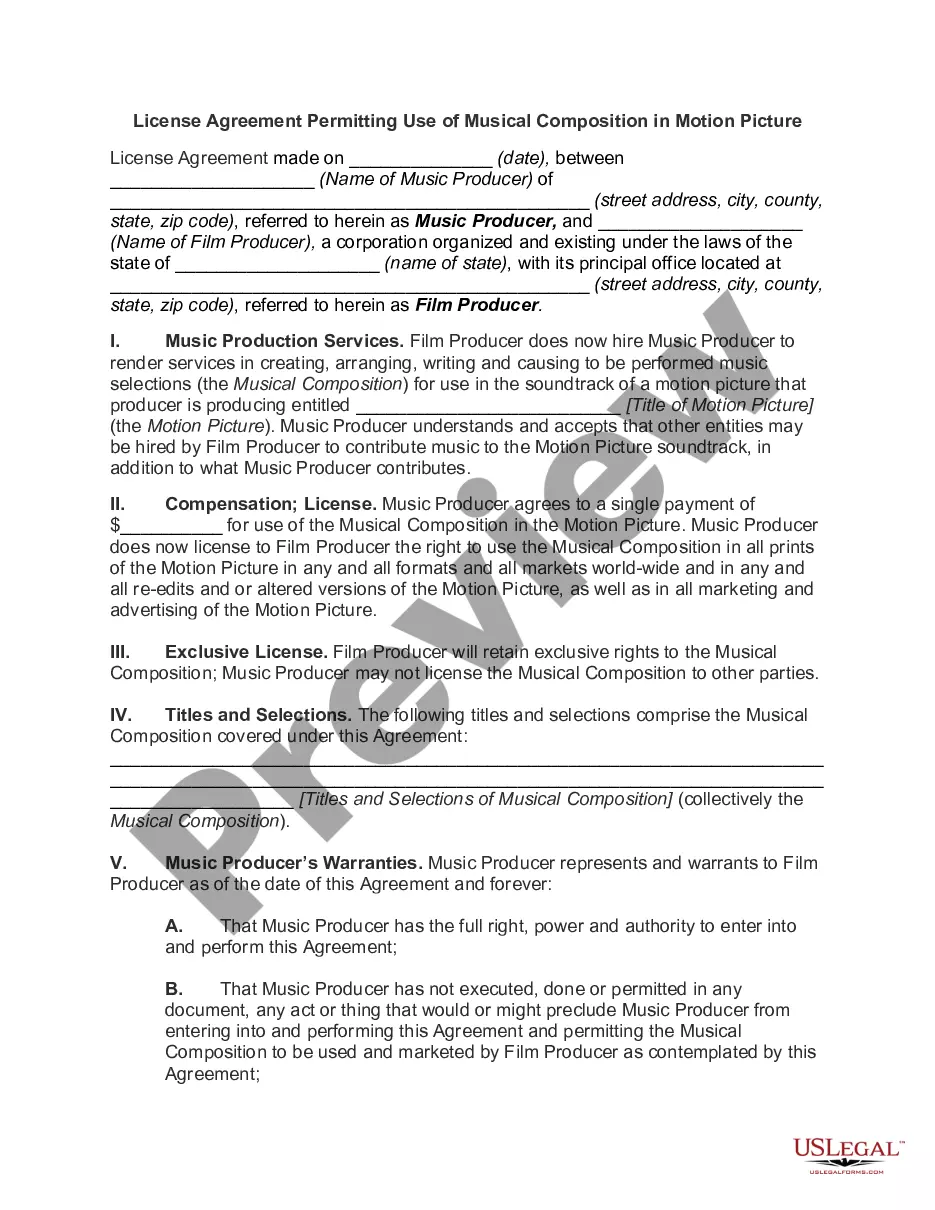

Tennessee Hamilton County

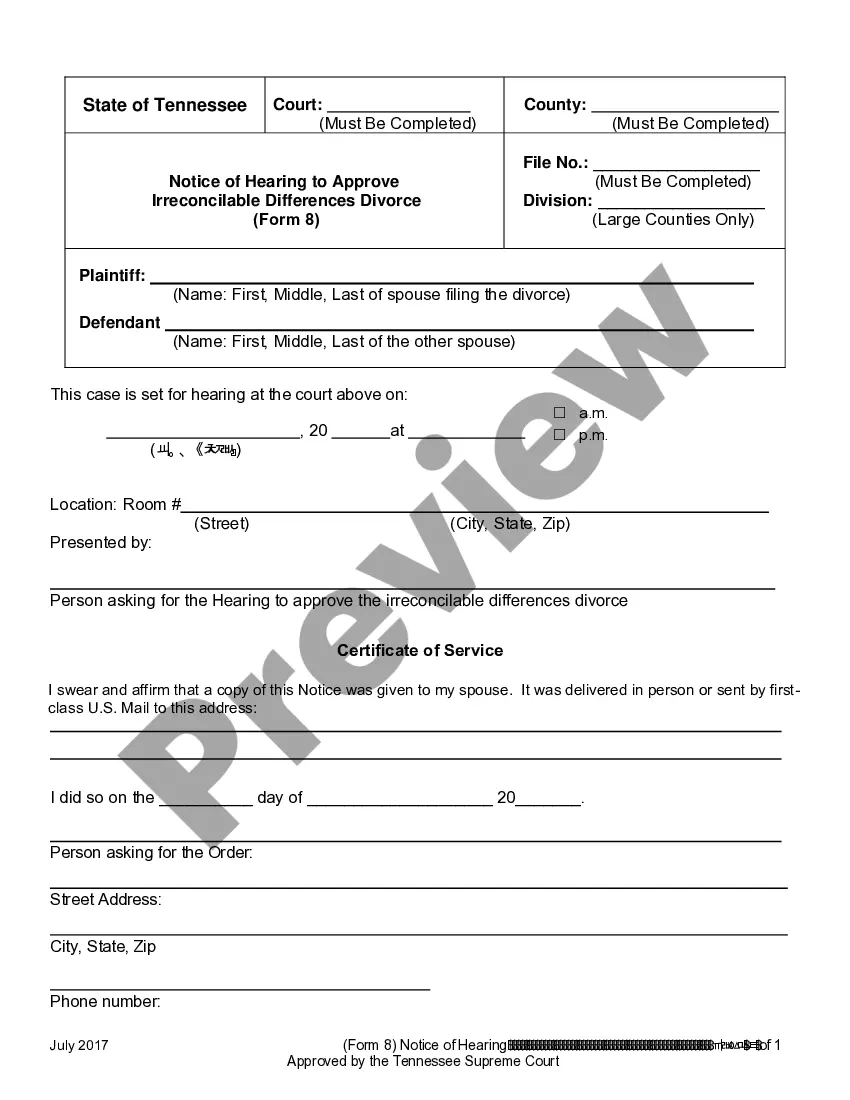

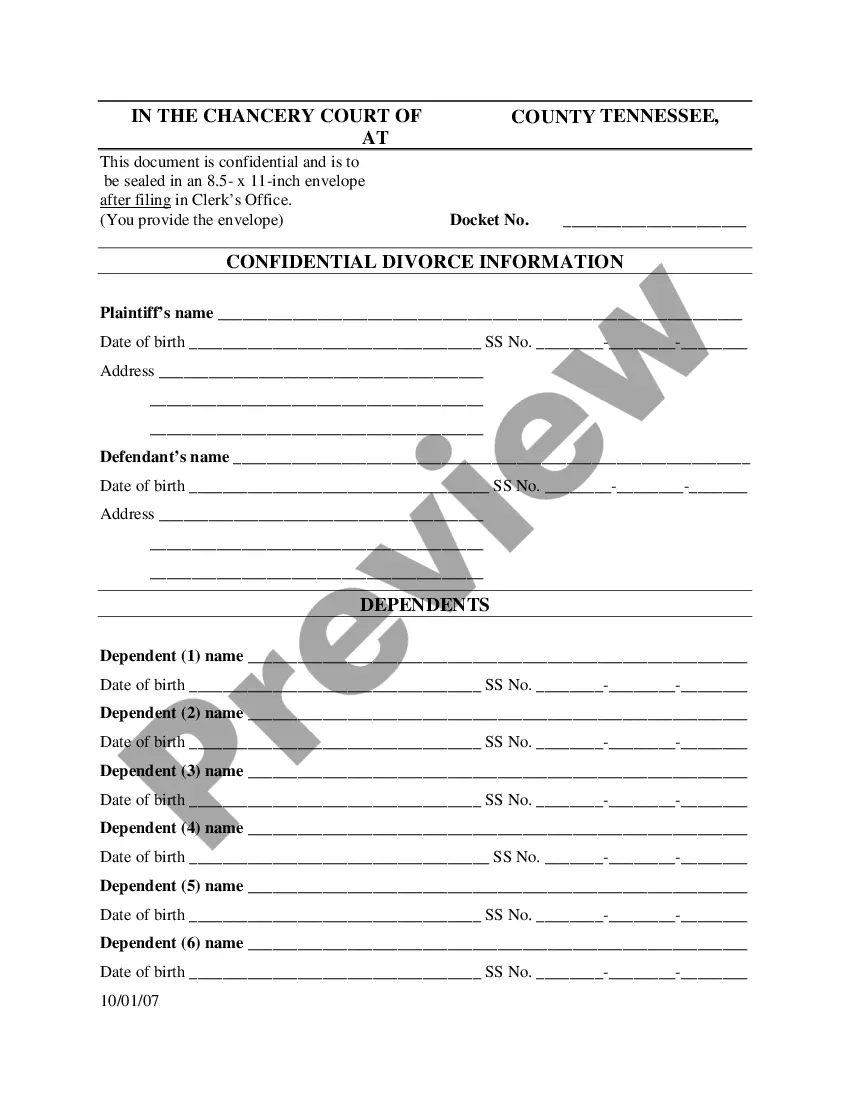

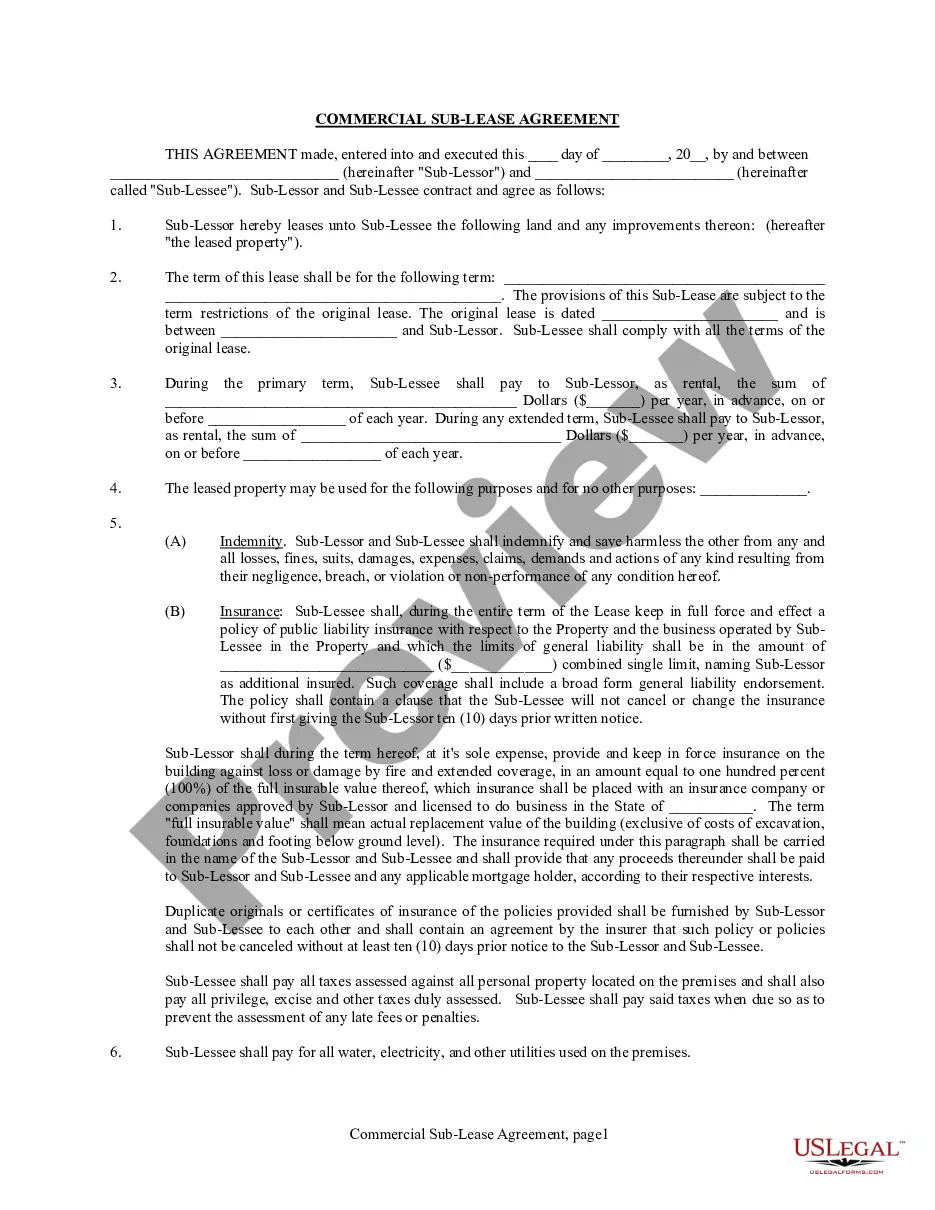

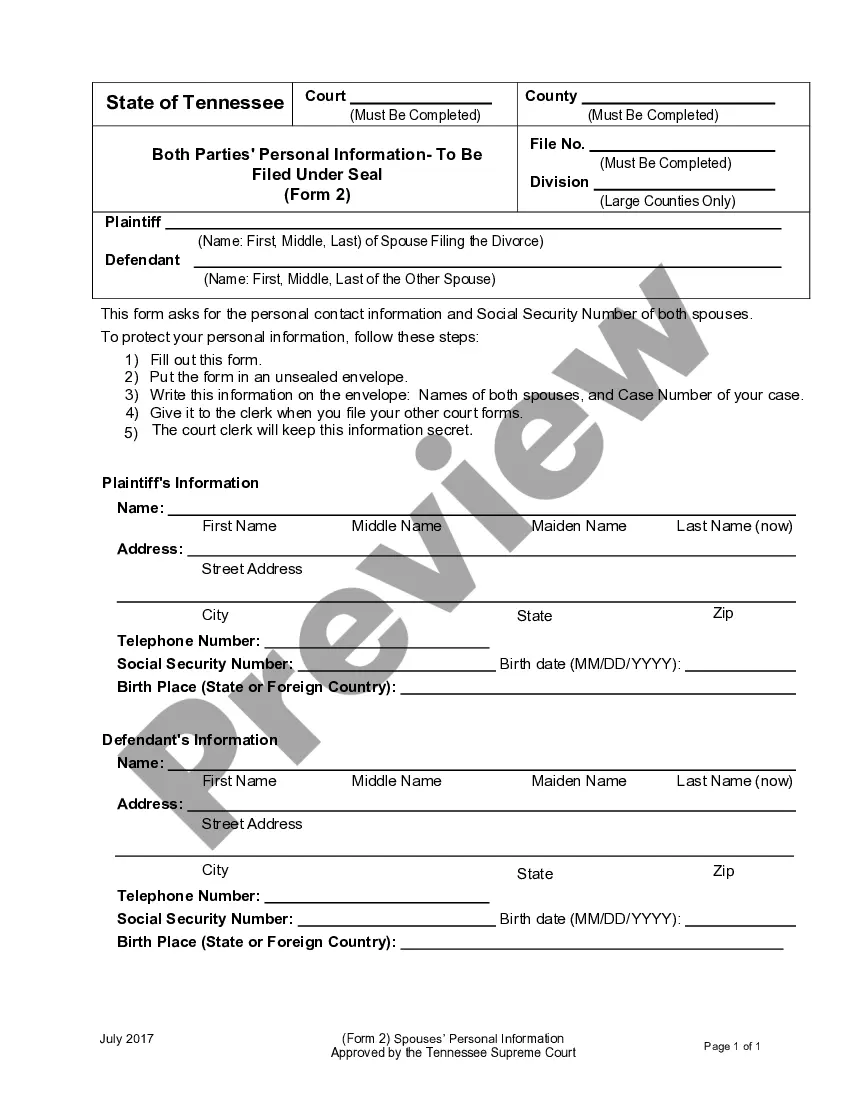

Description

How to fill out Tennessee Hamilton County?

How much time and resources do you often spend on composing formal paperwork? There’s a better opportunity to get such forms than hiring legal experts or wasting hours browsing the web for a suitable template. US Legal Forms is the leading online library that provides professionally designed and verified state-specific legal documents for any purpose, such as the Tennessee Hamilton County.

To obtain and prepare a suitable Tennessee Hamilton County template, adhere to these simple steps:

- Examine the form content to ensure it complies with your state requirements. To do so, read the form description or use the Preview option.

- If your legal template doesn’t meet your needs, locate another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Tennessee Hamilton County. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Choose the subscription plan that suits you best to access our library’s full service.

- Create an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally safe for that.

- Download your Tennessee Hamilton County on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously acquired documents that you securely store in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most trusted web services. Sign up for us now!

Form popularity

FAQ

The minimum combined 2023 sales tax rate for Chattanooga, Tennessee is 9.25%. This is the total of state, county and city sales tax rates. The Tennessee sales tax rate is currently 7%. The County sales tax rate is 2.25%.

Hamilton County, Tennessee; Chattanooga city, Tennessee.

The Chattanooga, TN-GA metropolitan statistical area, as defined by the United States Office of Management and Budget, is an area consisting of six counties ? three in southeast Tennessee (Hamilton, Marion, and Sequatchie) and three in northwest Georgia (Catoosa, Dade, and Walker) ? anchored by the city of Chattanooga.

Hamilton County is located in Tennessee with a population of 363,790. Hamilton County is one of the best places to live in Tennessee. In Hamilton County, most residents own their homes. In Hamilton County there are a lot of restaurants, coffee shops, and parks.

What is the sales tax rate in Hamilton County? The minimum combined 2023 sales tax rate for Hamilton County, Tennessee is 9.25%. This is the total of state and county sales tax rates. The Tennessee state sales tax rate is currently 7%.

wide sales tax rate of 2.25% is applicable to localities in Hamilton County, in addition to the 7% Tennessee sales tax.

What is the property tax rate in Chattanooga, TN? The City of Chattanooga property tax rate is $2.250 per $100 assessed value for 2021. This is in addition to the Hamilton County tax rate ($2.2373) for a combined tax rate of $4.4873 per $100 assessed value (25% of market value).

0.25% Residents of Hamilton County pay a flat county income tax of 1.00% on earned income, in addition to the Indiana income tax and the Federal income tax.