Tennessee Alcoholic Beverage Tax Bond - Principal- Please print on legal size paper

Description

How to fill out Tennessee Alcoholic Beverage Tax Bond - Principal- Please Print On Legal Size Paper?

US Legal Forms is the most easy and profitable way to locate appropriate legal templates. It’s the most extensive web-based library of business and individual legal paperwork drafted and checked by legal professionals. Here, you can find printable and fillable templates that comply with federal and local laws - just like your Tennessee Alcoholic Beverage Tax Bond - Principal- Please print on legal size paper.

Obtaining your template takes just a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted Tennessee Alcoholic Beverage Tax Bond - Principal- Please print on legal size paper if you are using US Legal Forms for the first time:

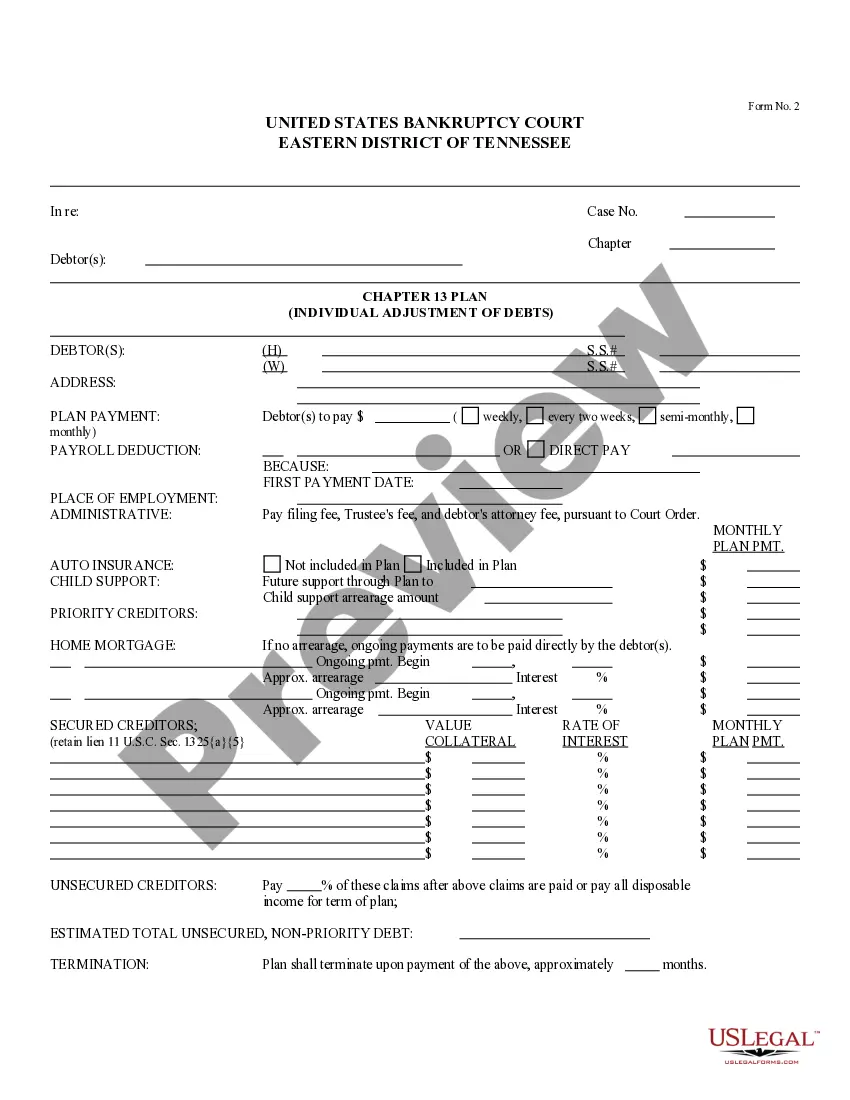

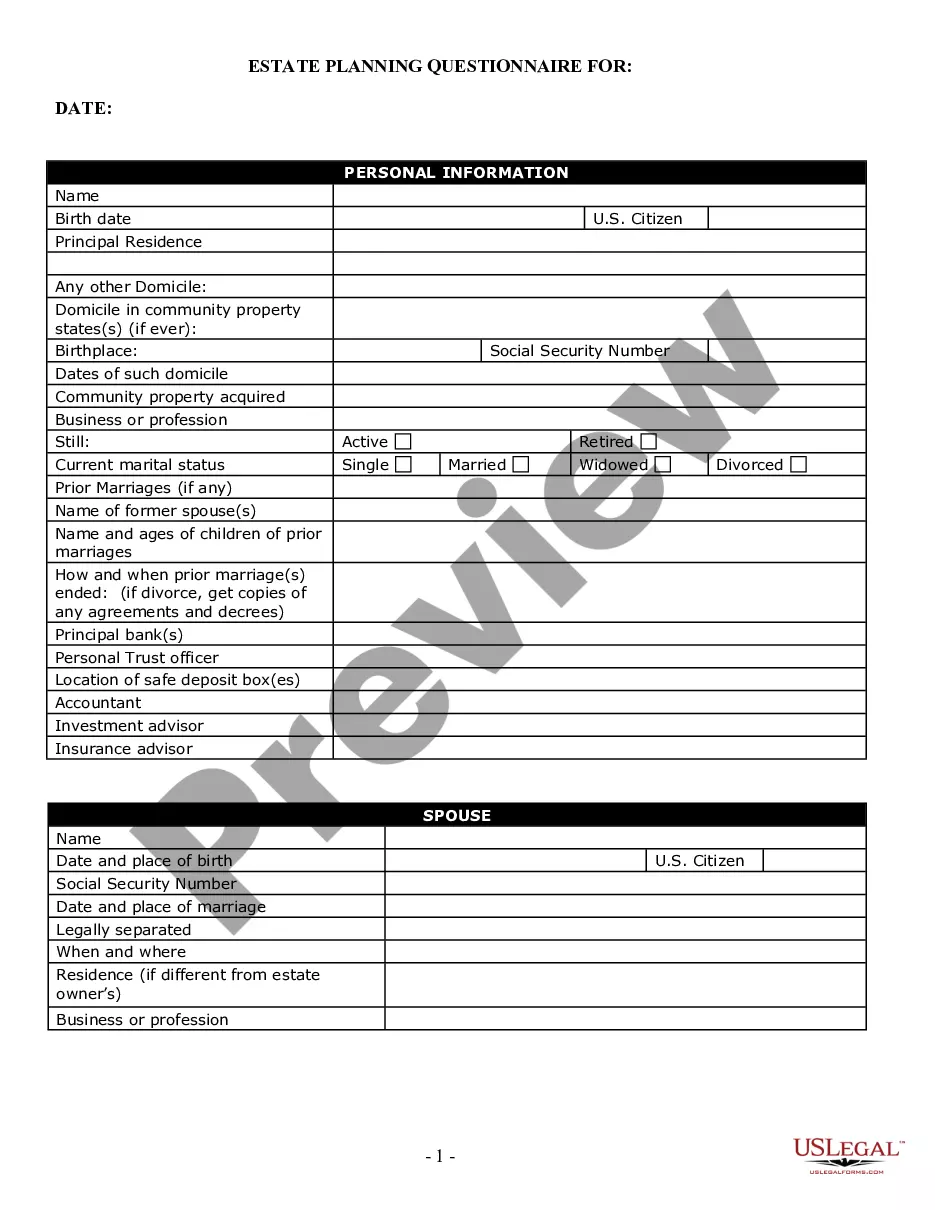

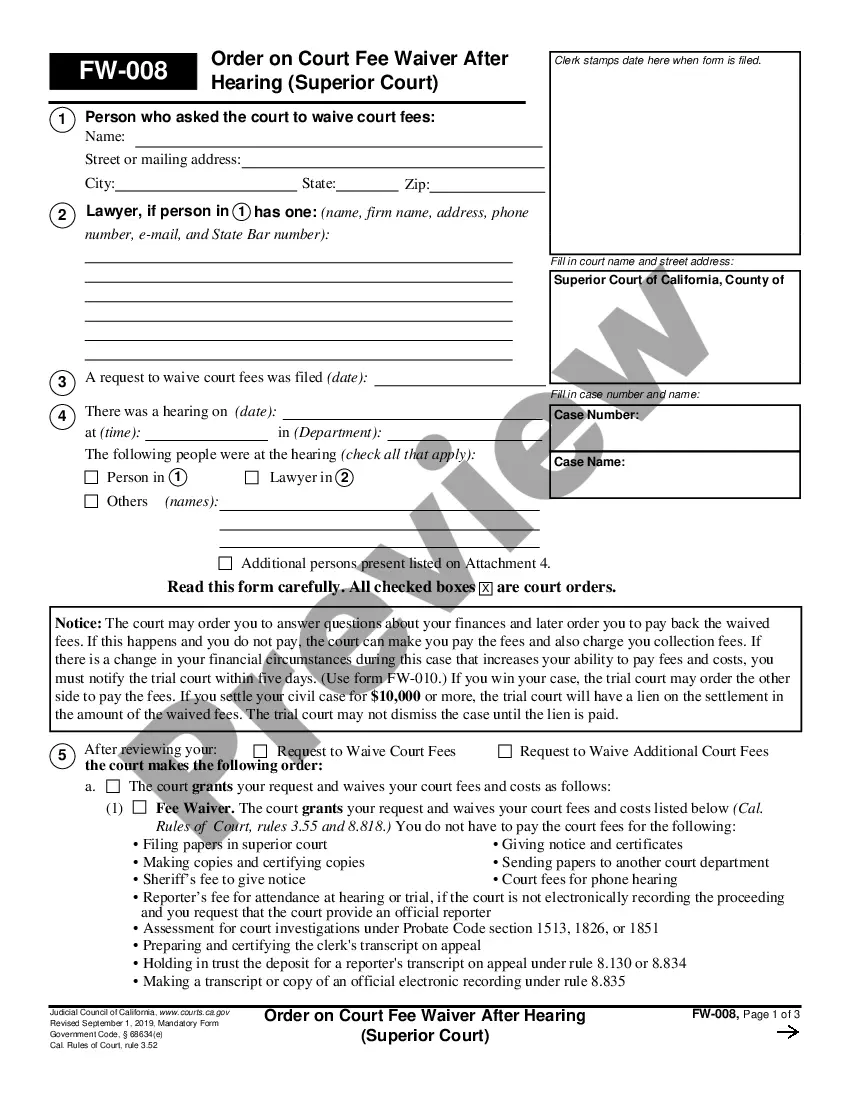

- Look at the form description or preview the document to ensure you’ve found the one corresponding to your needs, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Register for an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Tennessee Alcoholic Beverage Tax Bond - Principal- Please print on legal size paper and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more proficiently.

Benefit from US Legal Forms, your reputable assistant in obtaining the required formal documentation. Give it a try!

Form popularity

FAQ

Distilled spirits are taxed the least in Wyoming and New Hampshire. These two control states gain revenue directly from alcohol sales through government-run stores and have set prices low enough that they are comparable to buying spirits without taxes.

Mixed drinks purchased on Broadway are taxed the same throughout the county, with the 15% liquor-by-the-drink tax and the 9.25% sales tax. In addition to routine sales tax (9.25%), the liquor-by-the-dink tax is imposed on liquor, wine and high-alcohol content beer ? defined as 9% alcohol or more.

The Tennessee liquor license process typically takes between 30 and 120 days, but if there are issues that come up throughout the process, it can go up to 175 days or longer.

Liquor-by-the-drink licensees may offer drive-through, pickup, carryout, and delivery orders of alcoholic beverages for consumption off the premises until July 1, 2023. The 15% liquor-by-the-drink tax should be collected on these off premises sales.

? Tennessee's general sales tax of 7% also applies to the purchase of liquor. In Tennessee, liquor vendors are responsible for paying a state excise tax of $4.40 per gallon, plus Federal excise taxes, for all liquor sold.

There are three types of taxes that may be levied on alcoholic beverages sold at retail: Federal and state specific excise taxes (sometimes called excise taxes) State on- and/or off-premises ad valorem excise taxes.

Introduction #StateAlcohol Tax1Washington$33.222Oregon$21.953Virginia$19.894Alabama$19.1147 more rows