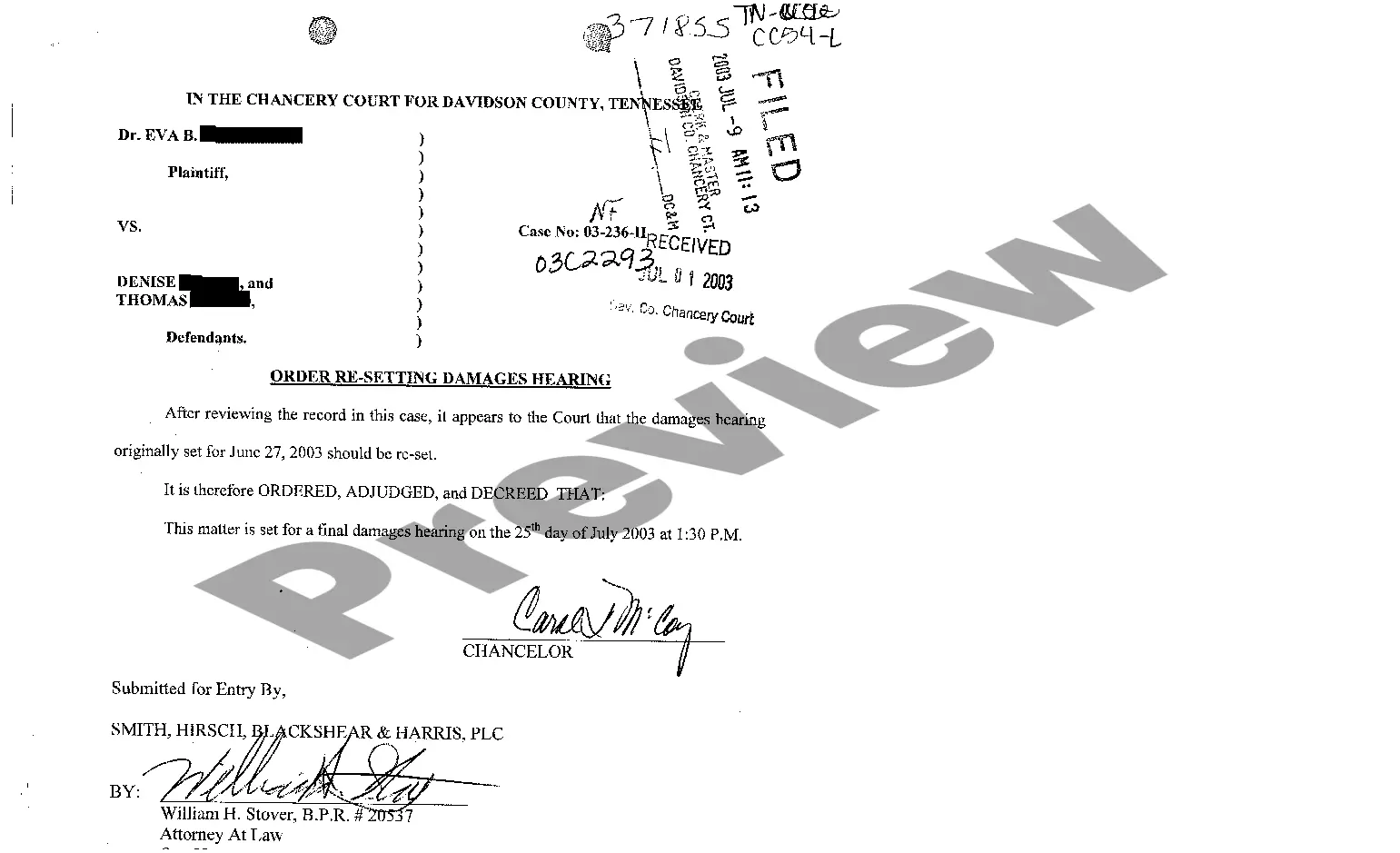

Tennessee Order Re-Taxing Court Cost is a process through which the Tennessee Supreme Court orders the repayment of court costs to individuals who have paid them in the past. This repayment is based on the court's determination that the costs were unjustly or erroneously assessed. There are two types of Tennessee Order Re-Taxing Court Cost: the Order for Re-Taxing Court Costs (ROTC) and the Order for Re-Taxing Court Costs and Attorney's Fees (ORT CAF). The ROTC is issued when the court finds that the costs were assessed in error and the ORT CAF is issued when the court finds that the costs were assessed unjustly or in violation of the law. In either case, the court orders the repayment of the costs to the individual who paid them. The repayment can be in the form of a lump-sum payment or in the form of a credit against future court costs.

Tennessee Order Re-Taxing Court Cost is a process through which the Tennessee Supreme Court orders the repayment of court costs to individuals who have paid them in the past. This repayment is based on the court's determination that the costs were unjustly or erroneously assessed. There are two types of Tennessee Order Re-Taxing Court Cost: the Order for Re-Taxing Court Costs (ROTC) and the Order for Re-Taxing Court Costs and Attorney's Fees (ORT CAF). The ROTC is issued when the court finds that the costs were assessed in error and the ORT CAF is issued when the court finds that the costs were assessed unjustly or in violation of the law. In either case, the court orders the repayment of the costs to the individual who paid them. The repayment can be in the form of a lump-sum payment or in the form of a credit against future court costs.