Tennessee Stay of Garnishment or Attachment

Description

How to fill out Tennessee Stay Of Garnishment Or Attachment?

How much time and resources do you often spend on composing formal documentation? There’s a better option to get such forms than hiring legal experts or spending hours browsing the web for a suitable blank. US Legal Forms is the leading online library that offers professionally designed and verified state-specific legal documents for any purpose, like the Tennessee Stay of Garnishment or Attachment.

To obtain and prepare an appropriate Tennessee Stay of Garnishment or Attachment blank, follow these easy steps:

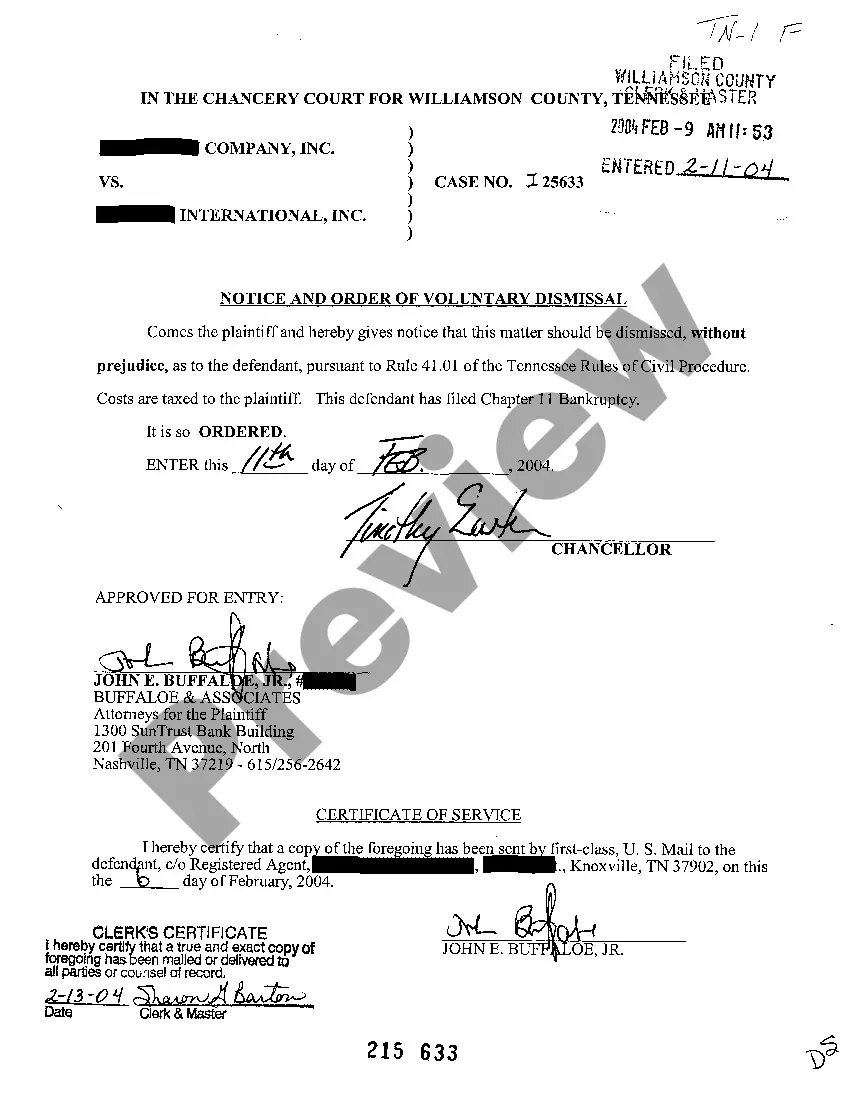

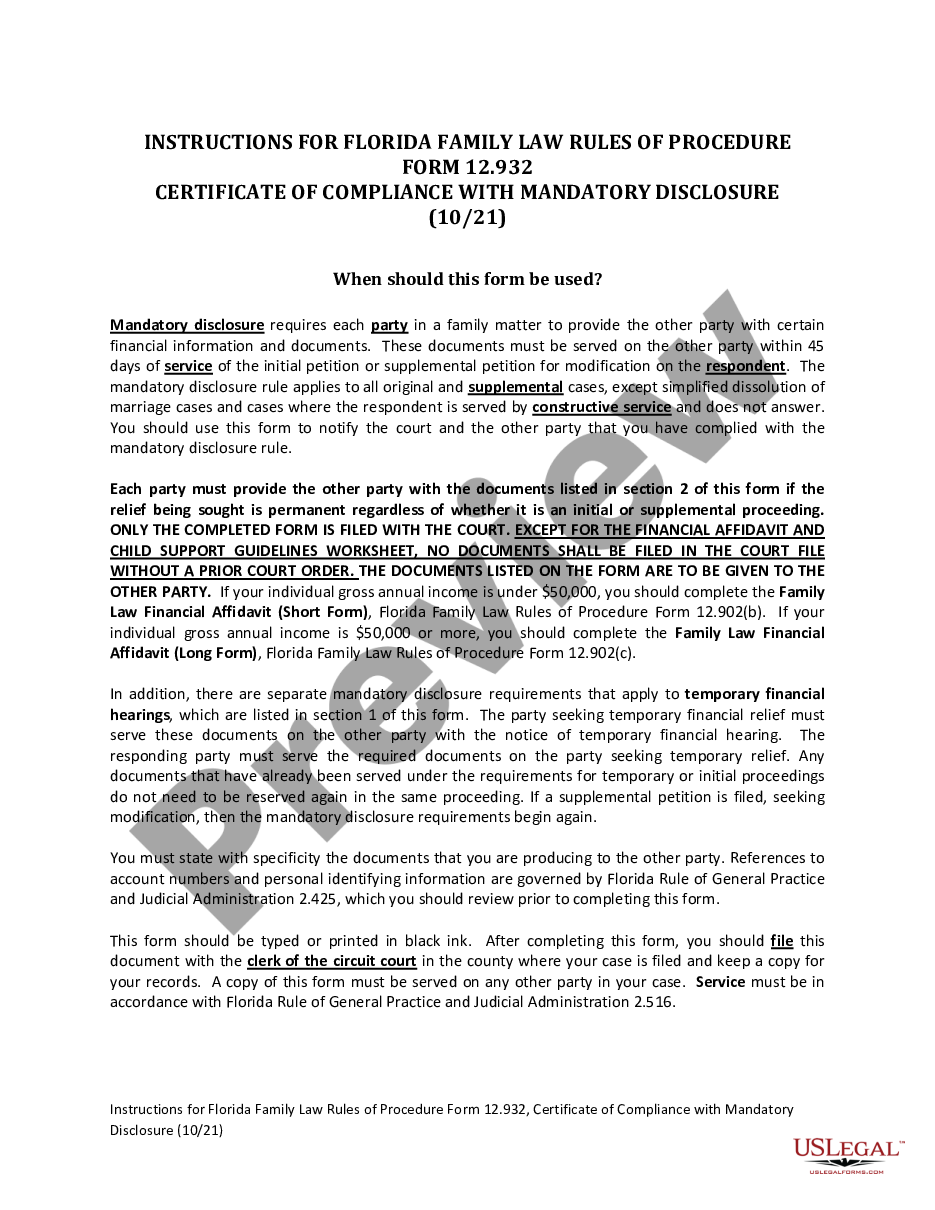

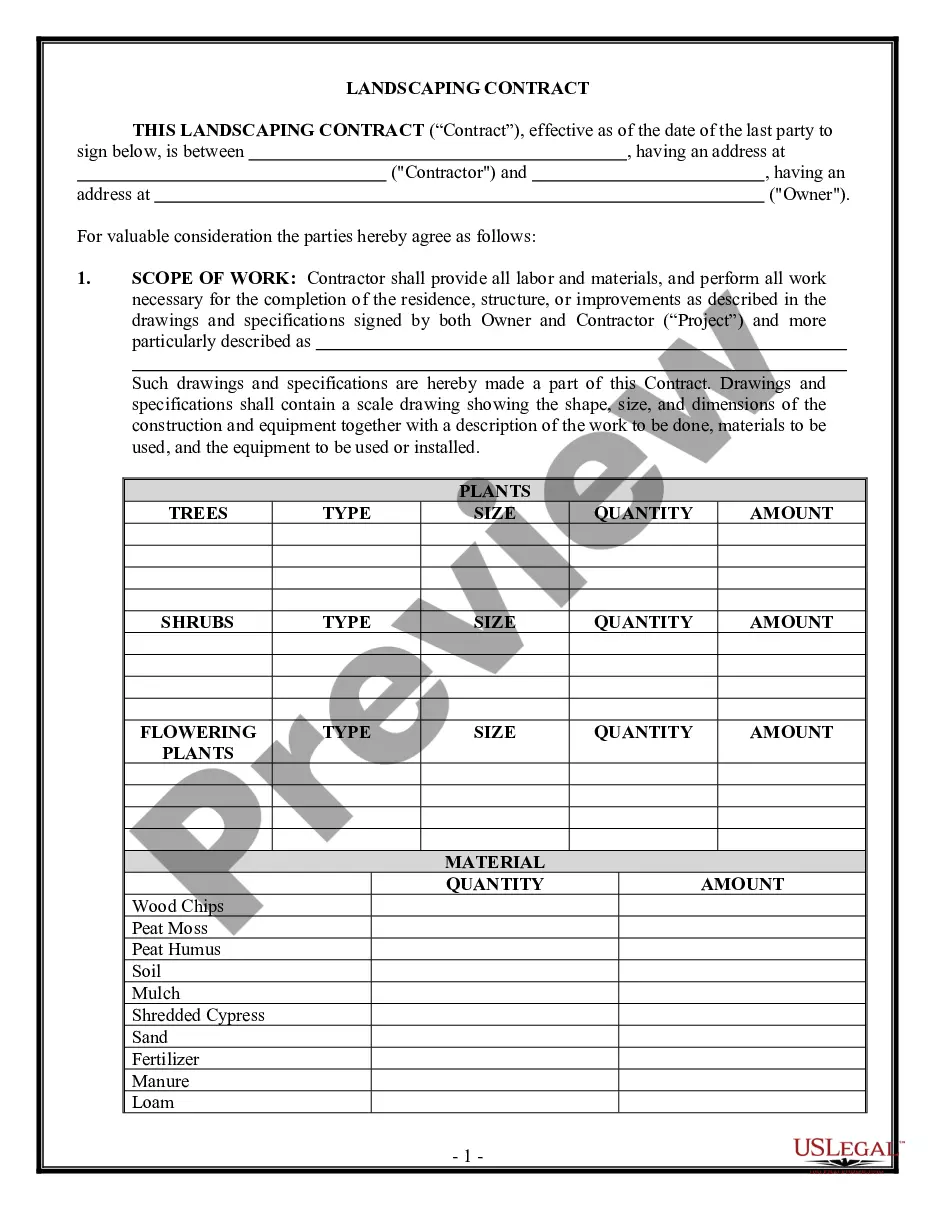

- Examine the form content to ensure it complies with your state requirements. To do so, check the form description or use the Preview option.

- In case your legal template doesn’t satisfy your needs, find another one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Tennessee Stay of Garnishment or Attachment. Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Select the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally reliable for that.

- Download your Tennessee Stay of Garnishment or Attachment on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously downloaded documents that you safely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as often as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most reliable web services. Sign up for us today!

Form popularity

FAQ

Tennessee allows employees to voluntarily assign their wages to another with the employer's written consent.

Within ten days of service, the garnishee shall file a written answer with the court accounting for any property of the judgment debtor held by the garnishee. Within thirty days of service, the garnishee shall file with the court any money or wages (minus statutory exemptions) otherwise payable to the judgment debtor.

NOTICE TO THE DEBTOR (EMPLOYEE) TCA 26-2-216(b)(2): Your earnings have been subjected to a garnishment which has been served upon your employer. The garnishment creates a lien on a portion of your earnings until the judgment is satisfied, or for six (6) months, whichever occurs first.

By filing a Chapter 7 or Chapter 13 bankruptcy, you can stop your wage garnishments. With our firm, you can stop wage garnishment with NO MONEY DOWN! File now and pay later through a repayment plan. Call 901-327-2100 to see if you qualify.

Both state and federal laws limit the amount of money that may be withheld from your weekly pay. The state and federal exemptions are nearly identical. Both Tennessee law and federal wage garnishment law limit the amount that can be garnished from a week's pay to the lesser of: 25% of your weekly disposable income.

Section 26-2-216 of the Tennessee Code establishes a process known in Tennessee as "Slow Pay." That section says that if you do not have any way to pay off a judgment against you other than your wages, you may set up an affordable payment plan through the court that issued the judgment.