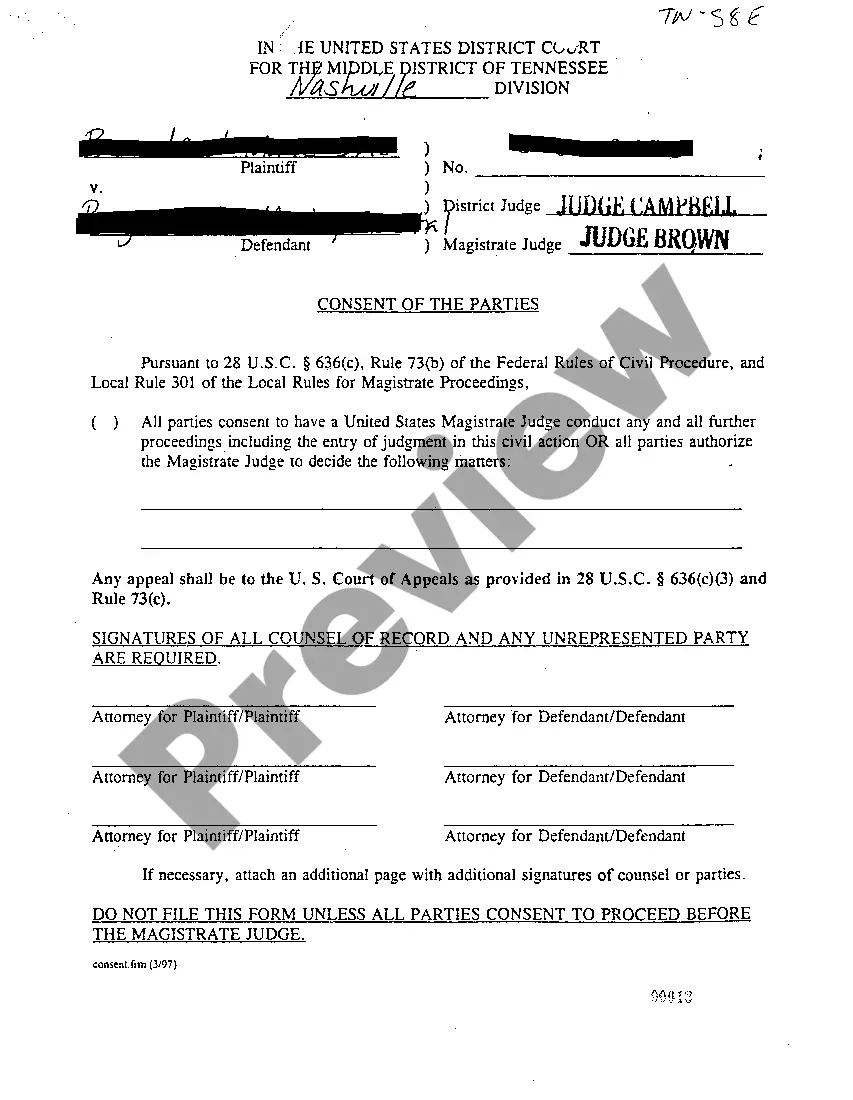

Tennessee Waiver Withdrawal Form I-13

Description Waiver Form

How to fill out Tennessee Waiver Withdrawal Form I-13?

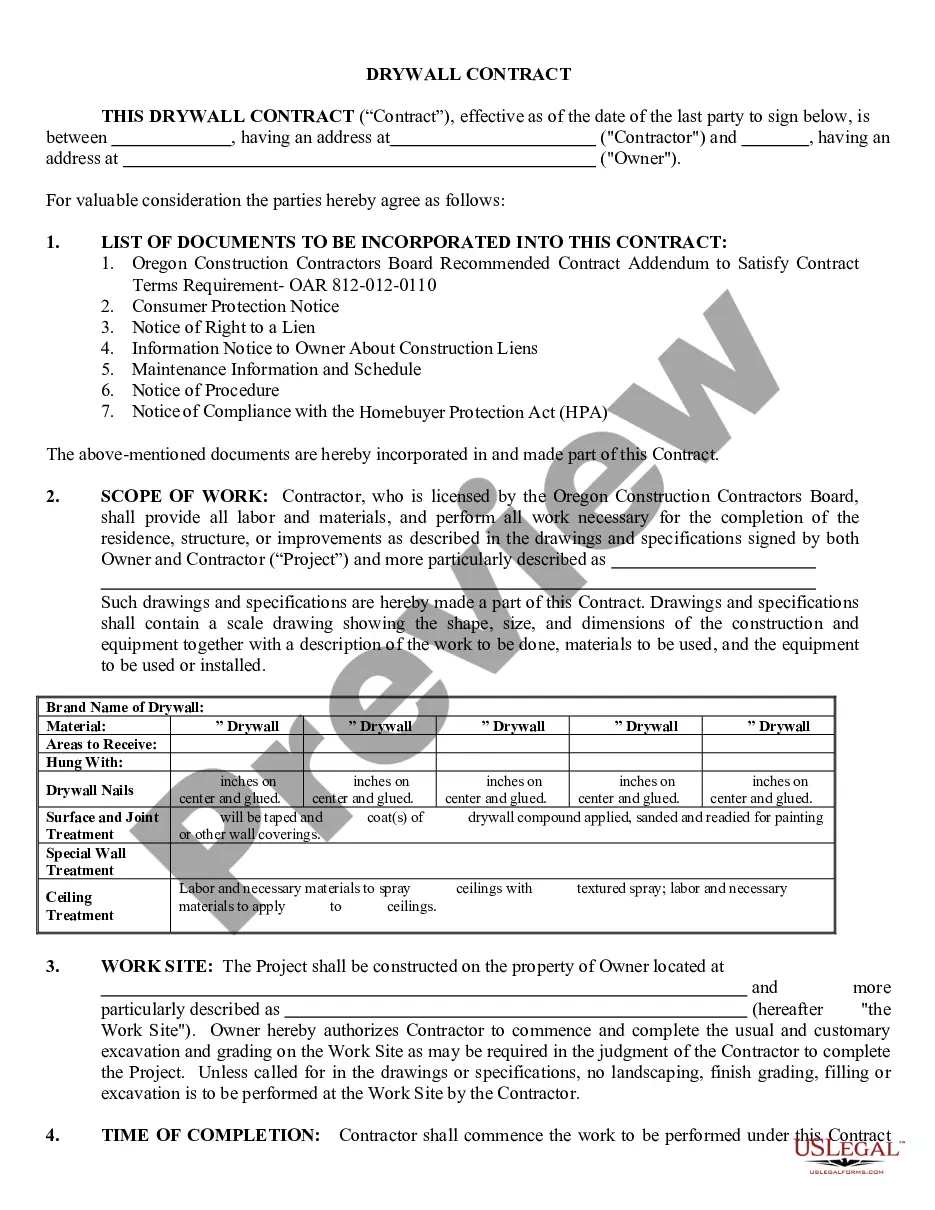

If you’re looking for a way to properly complete the Tennessee Waiver Withdrawal Form I-13 without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every private and business scenario. Every piece of documentation you find on our online service is drafted in accordance with federal and state laws, so you can be sure that your documents are in order.

Adhere to these straightforward instructions on how to acquire the ready-to-use Tennessee Waiver Withdrawal Form I-13:

- Ensure the document you see on the page meets your legal situation and state laws by checking its text description or looking through the Preview mode.

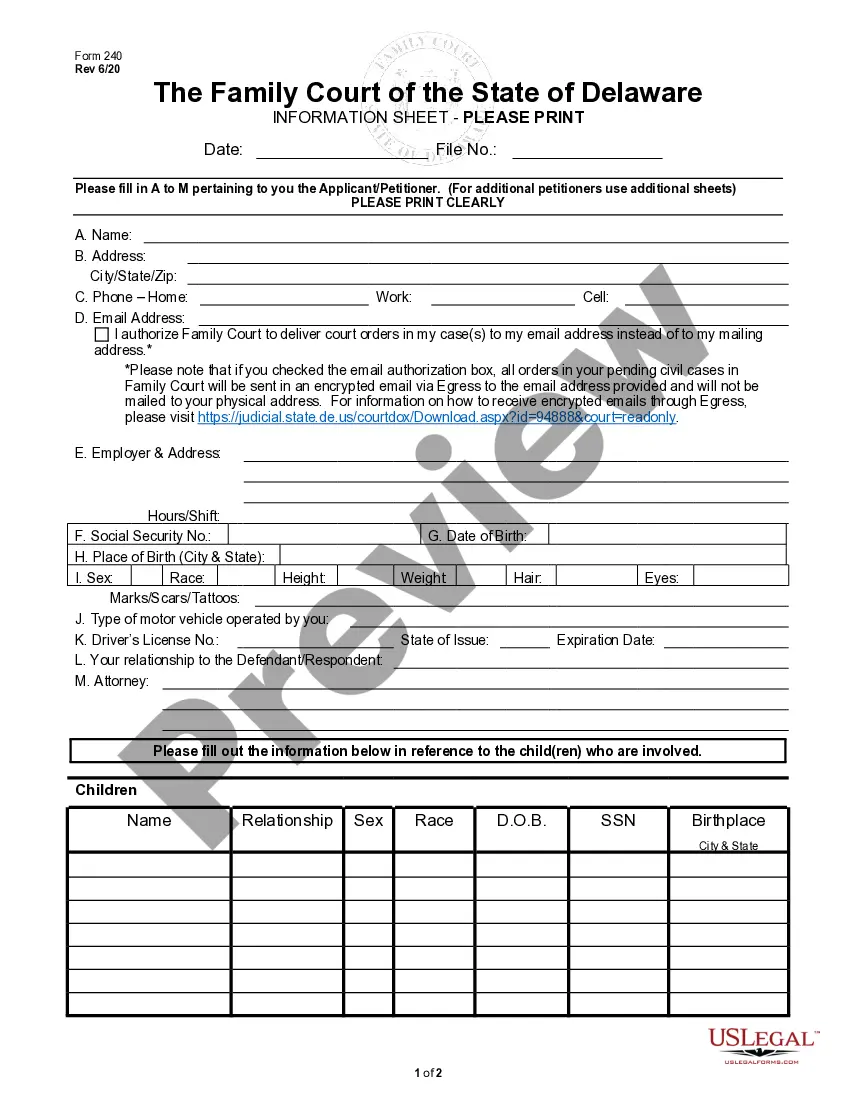

- Enter the document name in the Search tab on the top of the page and select your state from the dropdown to locate another template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Tennessee Waiver Withdrawal Form I-13 and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

How Long Does It Take to Reach a Settlement for Workers' Comp? The entire settlement process?from filing your claim to having the money in your hands?can take around 12-18 months depending on the details of your case and whether or not you have legal representation.

TPD benefits are paid at the rate of 66?% of the difference between your average weekly wage pre-injury and your average weekly-wage post-injury (subject to the state maximum). Temporary total disability (TTD) benefits apply when you're temporarily unable to work at all.

How Do You File a Workers' Compensation Claim in Tennessee? 5 steps to filing a workers' compensation claim in the Volunteer State.Step 1: Get medical treatment.Step 2: Report your injury to your employer.Step 3: Make sure your employer files the proper form.Step 4: Wait to hear if your claim is accepted or denied.

A sole proprietor who owns 100% of the assets of the business, An officer of a corporation; A member of a limited liability company with at least a 20% ownership interest, or. A partner with at least a 20% ownership interest.

Ing to the "going and coming" rule, worker's compensation benefits do not apply to injuries sustained while commuting to or from work, with exceptions.

Officers and LLC Members who are not excluded from coverage must utilize a minimum payroll of $57,200 and a maximum payroll of $234,000 in order to calculate the cost of workers' comp insurance.

Form C-41 Wage Statement. This form enables EMPLOYERS to calculate the correct compensation due to an injured employee. Please complete the form and submit to EMPLOYERS within 5 days after your knowledge of any accident that has caused your employee to be disabled for more than 7 calendar days.

In Tennessee, you need to report your work-related injury to your supervisor within 15 days of the accident (or the date when a doctor first tells you that your injury is work-related) so that the proper forms and paperwork can be completed.