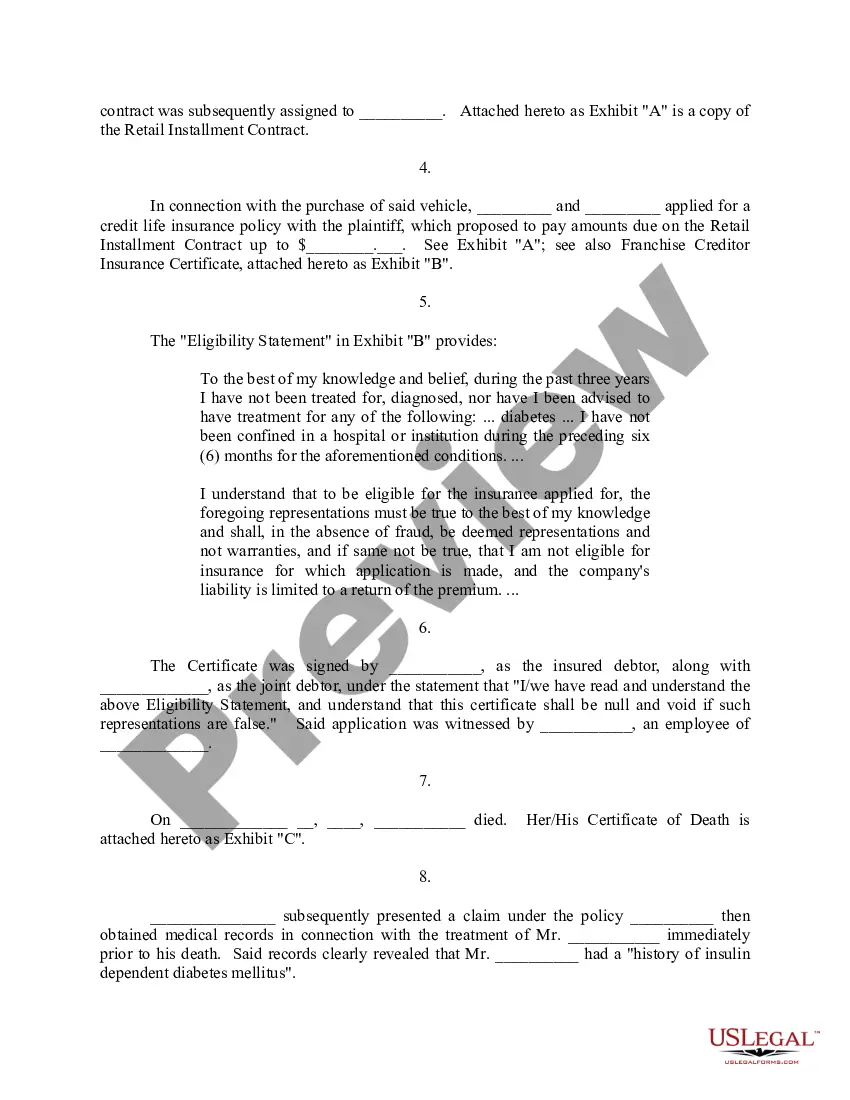

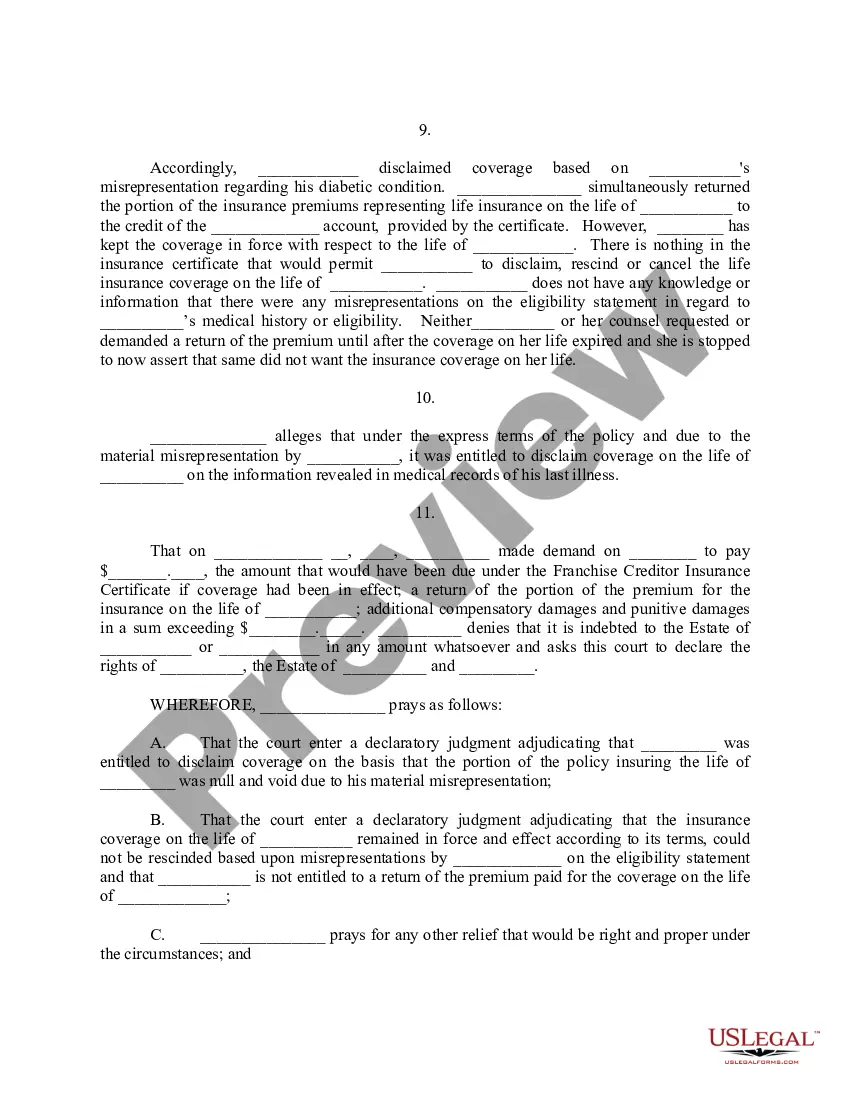

This form is a Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

A Tennessee Complaint for Declaratory Judgment to Determine Credit Life Policy Coverage is a legal document filed by an individual or entity seeking a court's interpretation and determination regarding the coverage of a credit life insurance policy. This complaint aims to resolve any disputes or uncertainty surrounding the applicability of the credit life insurance policy and clarify the rights and obligations of the involved parties. Keywords: Tennessee, complaint, declaratory judgment, determine, credit life policy coverage, legal document, interpretation, disputes, uncertainty, applicability, insurance policy, rights, obligations. Types of Tennessee Complaints for Declaratory Judgment to Determine Credit Life Policy Coverage may include: 1. Individual vs. Insurance Company: This type of complaint occurs when an individual policyholder disagrees with the insurance company's decision regarding the credit life policy coverage. The individual seeks the court's judgment to determine if the policy covers their specific circumstances, such as disability, unemployment, or death. 2. Multiple Policyholders vs. Insurance Company: In this scenario, multiple policyholders collectively file a complaint against the insurance company, questioning the scope of coverage provided by the credit life policy. They seek a declaratory judgment to ascertain if the policy adequately protects them from financial loss in case of disability, unemployment, or death. 3. Financial Institution vs. Insurance Company: This type of complaint involves a financial institution, such as a bank or credit union, which acts as the policyholder. The financial institution questions the credit life policy coverage provided by the insurance company and seeks the court's determination to clarify the extent of protection offered to borrowers in case of unexpected events affecting their ability to meet loan obligations. 4. Insurance Company vs. State Regulatory Authority: This type of complaint occurs when an insurance company challenges a decision, action, or regulation imposed by a state regulatory authority regarding credit life policy coverage in Tennessee. The insurance company seeks a declaratory judgment to determine the validity and enforceability of the regulatory measures or requirements. 5. Insurance Company vs. Insurance Company: In some cases, insurance companies can initiate complaints against other insurance companies to determine the coverage provided by a credit life policy. This could arise due to an overlap in policy coverage areas, conflicting interpretations, or disputes regarding liability. In conclusion, a Tennessee Complaint for Declaratory Judgment to Determine Credit Life Policy Coverage is a legal recourse sought by various parties to address disputes, uncertainties, or disagreements regarding the scope, applicability, and interpretation of credit life insurance policies in Tennessee.