The Tennessee Bill of Sale of Mobile Home with or without Existing Lien is a legal document used to record the transfer of ownership of a mobile home from the seller to the buyer. It acts as evidence of the transaction and outlines the terms and conditions of the sale. This document is crucial for both parties involved, as it helps protect their interests and establishes clear rights and obligations. The Bill of Sale must include relevant details of the transaction, such as the names and contact information of the buyer and seller, a detailed description of the mobile home (including make, model, year, identification number, and any distinguishing features), the purchase price, the payment method, and the date of the sale. Additionally, it should specify the condition of the mobile home and address any existing liens or encumbrances on the property. A Bill of Sale can be categorized into two types: with existing lien and without existing lien. If the mobile home has an existing lien, the seller must disclose this information within the document. The lien holder's information, such as their name and contact details, should be included. This ensures that the buyer is aware of any outstanding debts or obligations associated with the mobile home and can make an informed decision. On the other hand, if the mobile home is being sold without an existing lien, the Bill of Sale should explicitly state that there are no outstanding liens or encumbrances on the property. This gives the buyer peace of mind, knowing that they will not be held responsible for any undisclosed debts or legal issues related to the mobile home. The Tennessee Bill of Sale of Mobile Home with or without Existing Lien serves as a legal contract between the buyer and the seller. It is recommended to consult with a legal professional or use a pre-approved template from a reputable source to ensure that all necessary information is included and the document is properly executed.

Tennessee Bill of Sale of Mobile Home with or without Existing Lien

Description

How to fill out Tennessee Bill Of Sale Of Mobile Home With Or Without Existing Lien?

It is possible to devote time on the Internet attempting to find the authorized papers web template that meets the federal and state specifications you want. US Legal Forms gives thousands of authorized types which can be evaluated by specialists. You can actually obtain or print the Tennessee Bill of Sale of Mobile Home with or without Existing Lien from our support.

If you already have a US Legal Forms profile, you are able to log in and click on the Down load switch. Afterward, you are able to comprehensive, edit, print, or signal the Tennessee Bill of Sale of Mobile Home with or without Existing Lien. Every single authorized papers web template you buy is your own for a long time. To have one more backup for any obtained develop, visit the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms web site the first time, keep to the simple instructions under:

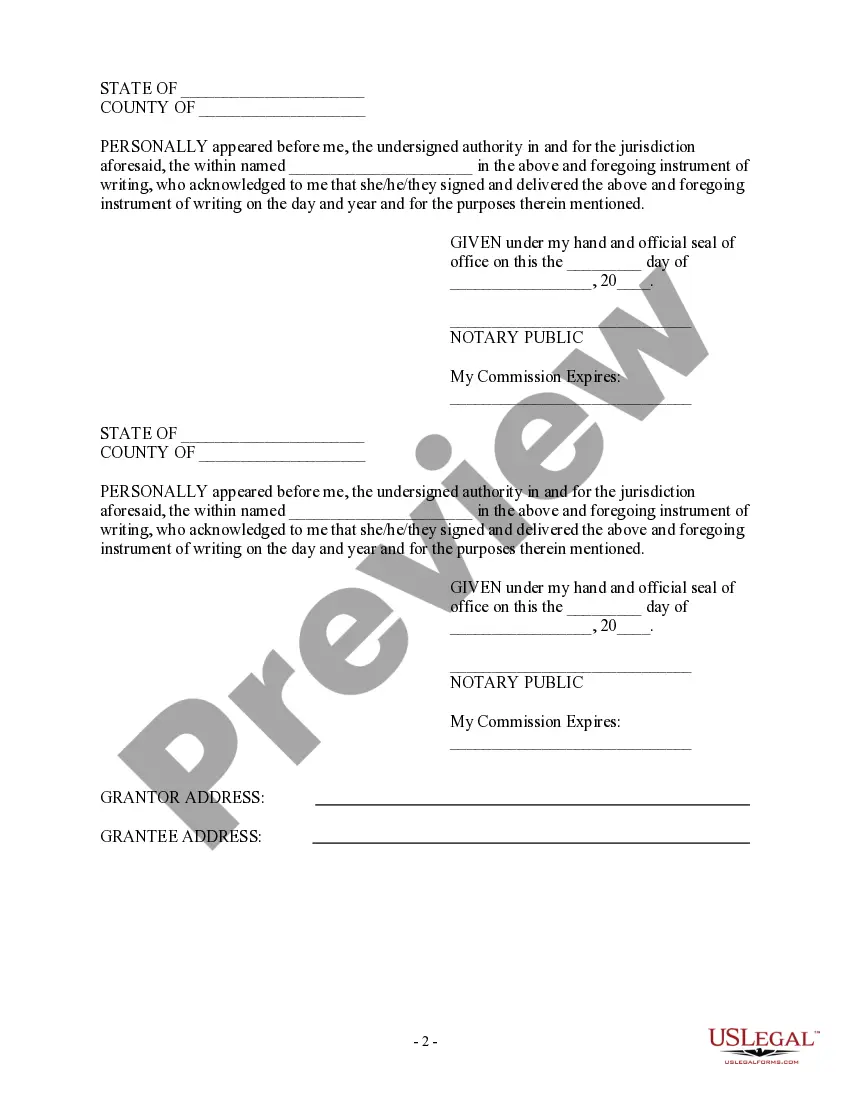

- Very first, ensure that you have selected the best papers web template to the state/town of your choice. Read the develop information to ensure you have picked out the proper develop. If offered, take advantage of the Preview switch to look from the papers web template also.

- In order to discover one more edition in the develop, take advantage of the Research industry to discover the web template that suits you and specifications.

- After you have identified the web template you would like, click on Get now to proceed.

- Select the prices strategy you would like, type in your accreditations, and register for a free account on US Legal Forms.

- Comprehensive the transaction. You can utilize your credit card or PayPal profile to fund the authorized develop.

- Select the structure in the papers and obtain it in your gadget.

- Make modifications in your papers if needed. It is possible to comprehensive, edit and signal and print Tennessee Bill of Sale of Mobile Home with or without Existing Lien.

Down load and print thousands of papers web templates making use of the US Legal Forms Internet site, which provides the largest variety of authorized types. Use expert and state-distinct web templates to tackle your organization or individual demands.