A Tennessee Consulting Agreement — Assist Company Obtain Loan is a legal document that outlines the terms and conditions between a consulting firm and a company seeking assistance in obtaining a loan in the state of Tennessee. This agreement enables the consulting firm to provide advisory services and guidance to the company throughout the loan acquisition process. The purpose of this agreement is to ensure a collaborative and transparent relationship between the consulting firm and the company, with the ultimate goal of successfully securing a loan for the company's needs. It specifies the responsibilities, obligations, and expectations of both parties involved. The consulting firm, through this agreement, agrees to provide professional advice and expertise to the company, including assessing the company's financial situation, reviewing its business plan, identifying potential lenders, preparing loan application materials, and assisting with negotiations. The consulting firm may also offer insights and strategies for improving the company's financial position and creditworthiness. The company, on the other hand, agrees to provide the consulting firm with accurate and complete information about its financial status, business operations, and any existing loans or debts. The company also agrees to cooperate with the consulting firm in the loan acquisition process by providing necessary documents, participating in meetings with lenders, and following the advice and recommendations given by the consulting firm. Important clauses included in the Tennessee Consulting Agreement — Assist Company Obtain Loan may cover the scope of services, fees and payment terms, ownership of intellectual property, confidentiality and non-disclosure provisions, termination conditions, dispute resolution mechanisms, and any applicable governing laws specific to the state of Tennessee. Different types of Tennessee Consulting Agreement — Assist Company Obtain Loan may vary based on the specific needs and requirements of the company. For example, some agreements may focus on securing traditional bank loans, while others may aim to obtain loans from private lenders or government programs. Other variations may occur depending on the industry of the company or the size of the loan being sought. It is crucial for both the consulting firm and the company to carefully review and negotiate the terms of the agreement before signing to ensure that their interests and expectations are adequately addressed and protected.

Tennessee Consulting Agreement - Assist Company Obtain Loan

Description

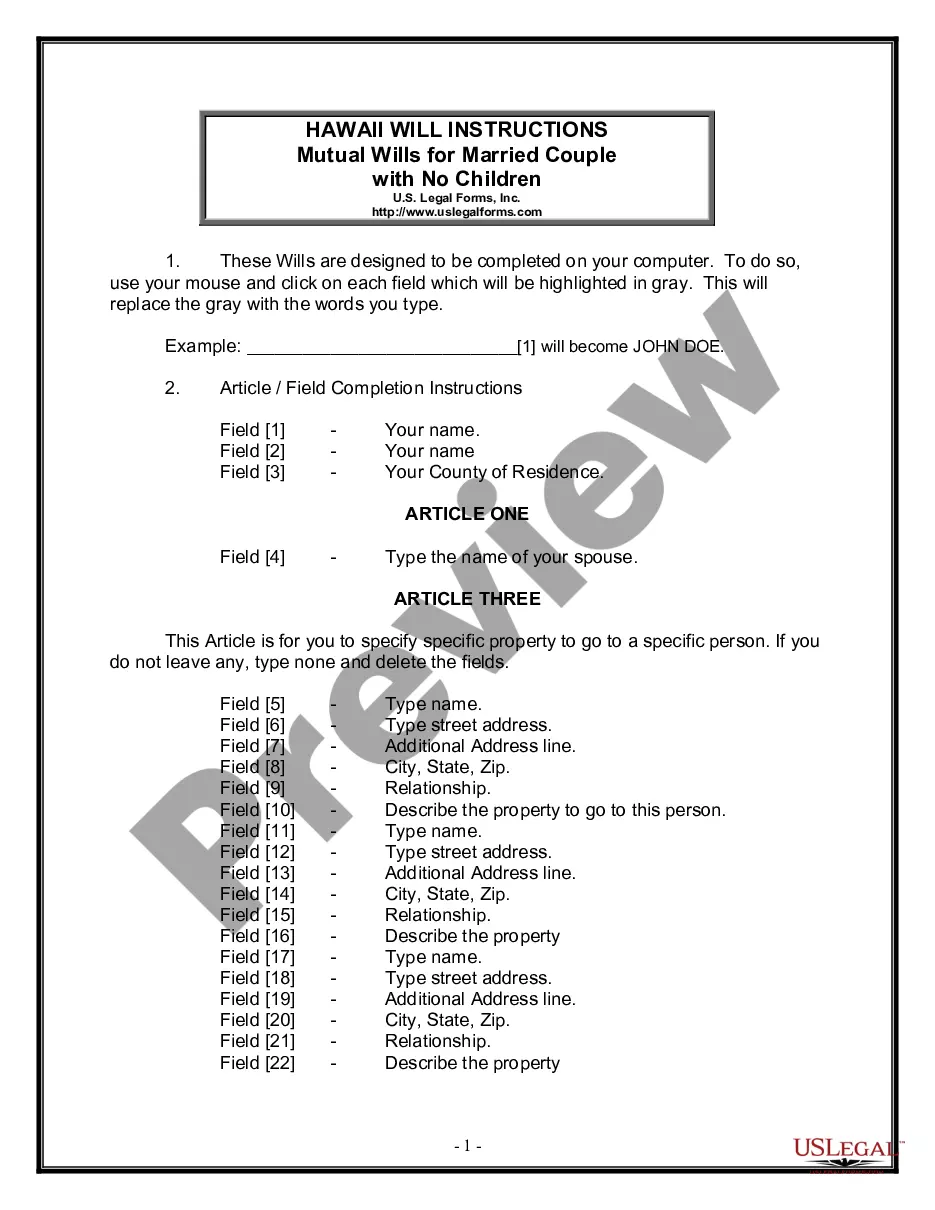

How to fill out Tennessee Consulting Agreement - Assist Company Obtain Loan?

US Legal Forms - one of the largest repositories of legal forms in the United States - offers a wide selection of legal document templates that you can download or create.

By utilizing the site, you will discover thousands of forms for commercial and personal use, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Tennessee Consulting Agreement - Assist Company Obtain Loan within moments.

If you already possess a membership, Log In and download the Tennessee Consulting Agreement - Assist Company Obtain Loan from the US Legal Forms collection. The Download button will be visible on every form you examine. You can access all previously downloaded forms in the My documents tab in your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form onto your device. Make modifications. Fill out, revise, and print and sign the downloaded Tennessee Consulting Agreement - Assist Company Obtain Loan. Every template you add to your account has no expiration date and is yours forever. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you wish to access. Obtain access to the Tennessee Consulting Agreement - Assist Company Obtain Loan with US Legal Forms, the most extensive collection of legal document templates. Utilize a vast number of professional and state-specific templates that fulfill your commercial or personal requirements.

- If you're using US Legal Forms for the first time, here are some simple steps to help you begin.

- Make sure you have selected the correct form for your location/county.

- Click the Preview button to view the details of the form.

- Review the form details to confirm that you've chosen the right form.

- If the form doesn't meet your needs, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Next, choose the pricing plan you prefer and provide your credentials to register for an account.