A Tennessee Consulting Agreement — with Former Shareholder refers to a legally binding contract that outlines the terms and conditions agreed upon between a company based in Tennessee and a former shareholder who wishes to provide consulting services to the company. This agreement establishes a professional relationship between the company and the former shareholder and sets forth the rights, obligations, and expectations of both parties. The Tennessee Consulting Agreement — with Former Shareholder typically contains key elements such as the effective date of the agreement, the names and addresses of the parties involved, a clear description of the consulting services to be provided, and the specific duration of the engagement. Additionally, the agreement may outline the compensation arrangement, including details about the payment structure and the frequency of payment. It may also include provisions related to expenses, reimbursements, and any additional benefits to be provided. Confidentiality and non-disclosure clauses are often included in the agreement to protect the company's proprietary information, trade secrets, and any other confidential data shared during the consulting engagement. These clauses typically prohibit the former shareholder from using or disclosing any confidential information without the company's prior written consent. Furthermore, the agreement may address intellectual property ownership, specifying the ownership of any materials, patents, copyrights, or trademarks created during the consultancy. It may state whether the company or the former shareholder will retain the rights to such intellectual property. If more than one type of Tennessee Consulting Agreement — with Former Shareholder exists, they may be differentiated based on factors such as the industry involved (e.g., technology, finance, healthcare), the scope of the consulting services (e.g., strategic planning, financial analysis, marketing), or the specific terms related to compensation and benefits. However, without specific knowledge of the variations in the types of agreements, it would be challenging to provide more detailed information.

Tennessee Consulting Agreement - with Former Shareholder

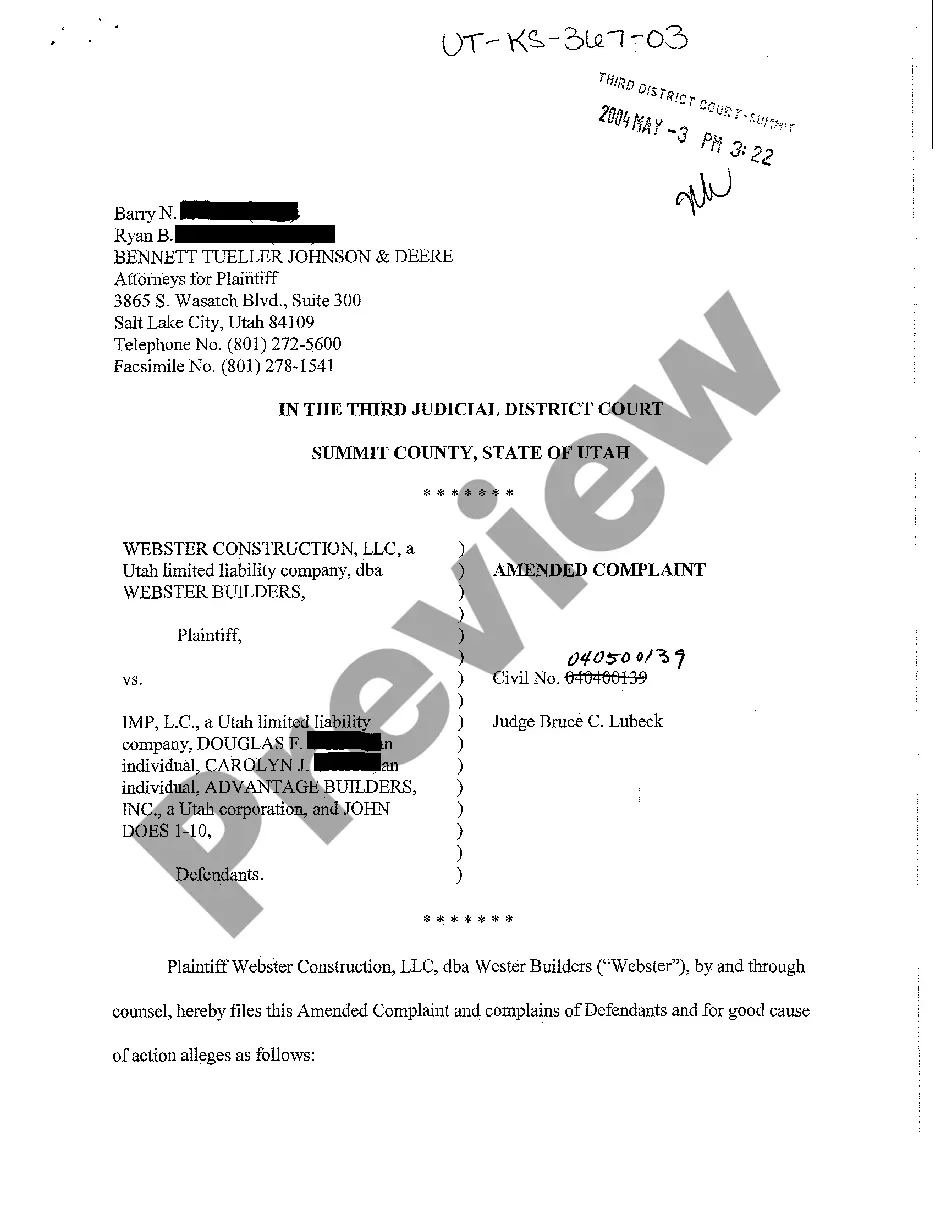

Description

How to fill out Tennessee Consulting Agreement - With Former Shareholder?

If you require extensive, obtain, or print official document templates, utilize US Legal Forms, the most extensive collection of official forms available online.

Take advantage of the site’s straightforward and user-friendly search tool to find the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and input your details to register for an account.

- Use US Legal Forms to locate the Tennessee Consulting Agreement - with Former Shareholder with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Get button to retrieve the Tennessee Consulting Agreement - with Former Shareholder.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, adhere to the following steps.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the content of the form. Remember to review the summary.

Form popularity

FAQ

Here's a short list of what should be included in every consulting contract:Full names and titles of the people with whom you're doing business. Be sure they're all spelled correctly.Project objectives.Detailed description of the project.List of responsibilities.Fees.Timeline.Page numbers.

Contracts play an essential role in the relationships that consultants have their clients. These legally binding documents tell a client what work you will perform, how long you expect the project to take, what compensation you expect, and more.

How to Package Consulting Services:Outline all of your consulting services.Evaluate your audience and the market.Determine the consulting service to package.Map out your process.Evaluate your costs and time.Determine pricing for your consulting package.Write your sales copy.Design your package landing page.

Protect yourself: Put your guidelines in writing -- and stick by them. Have a very clear discussion laying out your professional boundaries and ask your client to do the same. Come to an understanding about working hours and response times and agree on how you will schedule calls, meetings, and Skype sessions.

A consulting agreement is a legally binding document that affirms a client's request for assistance from a consultant. It's a contract detailing the terms of service between a consultant operating as an independent contractor and a client.

Parts of a Consulting AgreementStart date and end date.Services being provided.Contact information for the consultant.Contact information for the business.Ownership of intellectual property.Compensation and fees.Termination procedures.Process for handling disputes.More items...

Consultancy agreements usually contain clauses covering the following:Duration of contract.Services to be provided.Duties of the consultant.Fees and payment terms.Supply of equipment.Substitution.Tax and NICs.Liability.More items...

Consulting agreements are binding contracts that can have legal consequences. The terms of a consulting agreement often have clauses that explain what to do if a dispute occurs and what actions the offended party could take.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

The consulting agreement is an agreement between a consultant and a client who wishes to retain certain specified services of the consultant for a specified time at a specified rate of compensation. As indicated previously, the terms of the agreement can be quite simple or very complex.

Interesting Questions

More info

This FREE Brokerage Agreement Template includes: Access To Your Documents This FREE Brokerage Agreement Template includes: Access To Your Documents Free Real Estate Brokers Agreement Template Word Forms Retainer Word forms Free Brokerage Agreement Template with Retainer Word forms Access To Your Documents Deed Access To Document This FREE Brokerage Agreement Template includes: Access To Your Documents Brokerage Agreement This FREE Brokerage Agreement Template includes: Access To Your Documents Brokerage Agreement Free Real Estate Brokers Agreement Template Word Forms Retainer Word forms This FREE Brokerage Agreement Template includes: Access To Your Documents Deed Access To Document Free Brokerage Agreement Template Word Forms Retainer Word forms You have found free Brokerage Agreement Template with retainer that you can use for your brokerage agreement. We welcome your feedback and questions.